The National Treasury is projecting that Kenya’s economy will grow by 5.3% this year, slightly lower than Central Bank of Kenya’s December 2024 prediction of growth by 5.5%.

- On December 5, the apex bank projected the economy to grow at 5.5 per cent in 2025 and 5.1 per cent in 2024 mainly supported by resilience of key service sectors and agriculture, as well as improved exports.

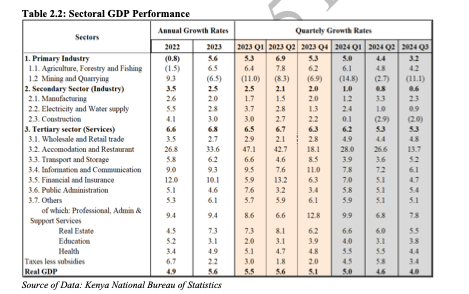

- In the draft 2025 Budget Policy Statement, National Treasury notes that the performance of the Kenyan economy slowed down in the first half of 2024, with real GDP growth averaging 4.8% compared to 5.5% in the first half of 2023.

- It expanded by 4% in the third quarter of 2024, a slowdown from 6% recorded in the same period in 2023 and the slowest in four years, dragged by notable contractions in key sectors such as construction, mining, and quarrying.

“Economic growth is estimated to have slowed down to 4.6 percent in 2024 from a growth of 5.6 percent in 2023 reflecting deceleration of economic activities in the first three quarters of 2024 and the slowdown in private sector credit growth to key sectors of the economy,” says Treasury Cabinet Secretary John Mbadi.

“Growth is expected to pick up to 5.3 percent in 2025 and retain the same momentum over the medium term largely driven by: enhanced agricultural productivity; resilient services sector, and ongoing implementation of priorities under BETA,” he added.

In 2021, Kenya recorded the highest growth rate of 7.6% in 2021 from a low of 0.3% in 2020 due to the effects of Covid-19. The country’s economy grew at 5.1%, 4.9% and 5.6% in 2019, 2022 and 2023 respectively. In late 2024, the International Monetary Fund (IMF) lowered its predictions of Real GDP growth for the country from 5.0% in 2024 and 2025. This made Kenya the only middle-income country in Africa that the Bretton Woods institution did not predict would recover in 2025.

The Big Picture

Growth in the advanced economies is projected to remain stable at 1.8% in 2024 and 2025 from 1.7% in 2023. In the United States, growth is projected at 2.8% in 2024 on account of stronger outturns in consumption and non-residential investment and demand factors in the labour market. Growth is anticipated to slow to 2.2% in 2025 as fiscal policy is gradually tightened and a cooling labor market slows consumption.

Growth in the euro area is expected to recover as a result of better export performance, in particular of goods, stronger domestic demand, rising real wages which are expected to boost consumption, and a gradual loosening of monetary policy which is expected to support investment. However, growth in Japan in expected to slowdown reflecting temporary supply disruptions and fading of one-off factors that boosted activity in 2023, such as the surge in tourism.