The government is worried about deteriorating financial health of many Kenyans despite positive economic fundamentals, Treasury and Economic Planning Cabinet Secretary (CS) John Mbadi has said.

- According to the CS, despite healthy reserves, stable shilling, low inflation, exports looking positive and an average economic growth projected this year, many Kenyans still don’t have money to spend.

- CS Mbadi said to avail money to businesses, the government is also working on releasing monies owed to the private sector.

- He noted that the middle class is also choking from deductions taking away a huge chunk of money from their income, something the government is working on through PAYE amendments.

“We are no longer going to turn deaf on popular word on the street that Kenyans are starved of disposable income,” CS Mbadi said during the launch of the 2024 FinAccess Household Survey Topline Findings Report.

“We need to know the appropriateness of our policies, products and services and innovations vis a vis needs of our people. We will let Central Bank to engage financial service providers in lowering borrowing rates to make loans affordable,” he added, “CBK has lowered base lending rates, let our banks respond accordingly. I want to challenge our lenders that if this economy chokes you will be worst hit than all of us.”

Lenders have been pushing for more rate cuts ahead the last Monetary Policy Committee meeting of the year on December 5th. Commercial banks have been opting for investments in less risky assets such as government securities amid the elevated non performing loans ratio on private sector loans which stands at 16.5%.

“A further cut in the Central Bank Rate to provide a stronger signal to the market for lending rates to decline,” the industry lobby group said in a recent research note.

Kenya’s Financial Inclusion Landscape

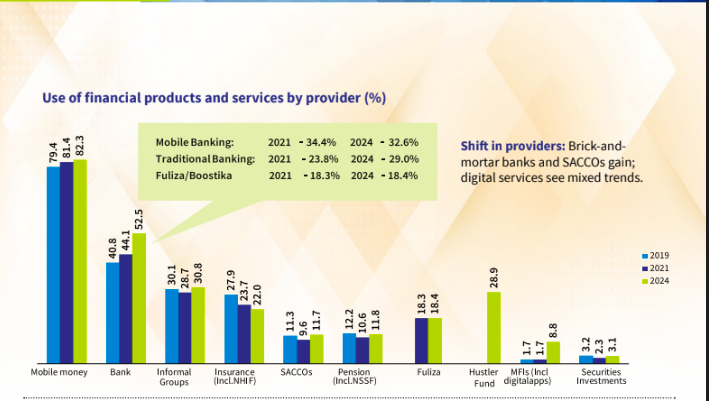

Results of the topline findings indicate that the financial inclusion landscape was impacted by the various reforms instituted in the last three years and especially the regulatory environment governing digital credit providers.

Overall, financial access has improved from 83.7% in 2021 to 84.8% in 2024. Similarly, the adult population that reported being completely excluded from accessing any form of financial services or products in the last 12 months has declined from 11.6% in 2021 to 9.9% in 2024.

“Notably, access to informal-only financial services increased to 5.2% in 2024 from 4.7% in 2021,” notes the survey conducted by Central Bank of Kenya (CBK), the Kenya National Bureau of Statistics (KNBS), and Financial Sector Deepening Trust (FSD) Kenya .