The Organisation of Petroleum Exporting Countries (OPEC) projects that global oil demand will reach 120.1 million barrels per day by 2050 from about 103mn barrels per day today, concurrent with a 24% rise in energy demand.

- Refinery runs are set to start slowing down in Canada, Europe, the US, and parts of Asia-Pacific from 2030 onwards, slowing down growth as transition policies take effect.

- But regions seeking a just transition energy policy are expected to fill the gap, with almost 90% of new refining capacity set to be located in Africa, the Middle East, and the Asia-Pacific.

- Most of Africa’s oil exports are expected to end up in Europe and Asia Pacific for the next 35 years, although the proportions for exports to the former will progressively slow towards 2050.

“Demand will be fueled by a world economy that is expected to more than double in size to more than $360 trillion by 2050. Driving this economic growth is the rapidly expanding world population, expected to reach 9.7 billion from the current 8 billion,” Haitham Al Ghais, OPEC Secretary General, said in a keynote speech at the African Energy Week.

While exports to the US & Canada are projected to increase in the next five years, OPEC estimates that they will slow down and ultimately plateau as exports from the Middle East dominate until 1940, and then Latin America’s exports grow in the decade after.

“For oil alone, we see demand reaching over 120 million barrels a day by 2050, with the potential for it to be higher. There is no peak oil demand on the horizon,” Al Ghais, said in the forward of the latest World Oil Outlook by OPEC.

The global population is projected to rise from 9.7 billion people by 2050, adding an additional 1.7 billion people over the next two and a half decades. Most of this demographic surge will come from developing nations, which have the right factors for the ongoing rapid urbanisation to intensify.

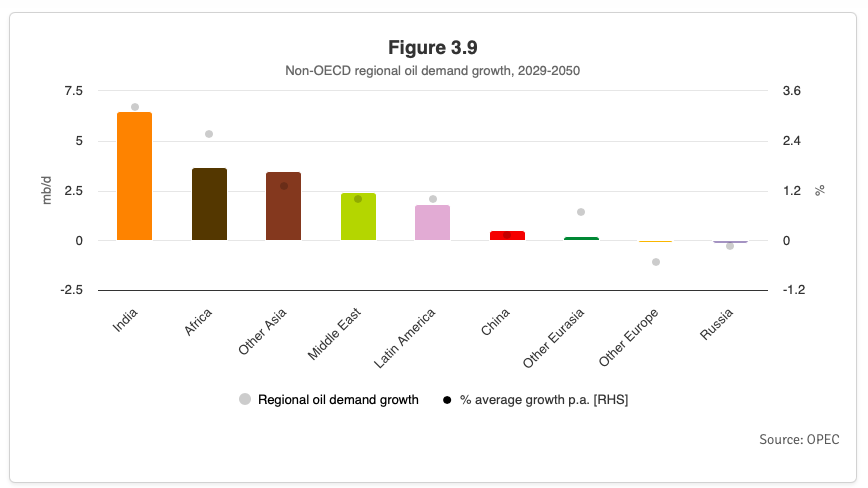

Although OPEC expects dwindling demand from demographic shifts and transition policies in developed nations, it projects that this will be more than compensated for by growth in developing nations. The net effect is that oil will remain the highest in the energy matrix at 29.3%, with oil and gas having a combined share above 53 percent. But it also projects across the board for all primary fuels, especially wind, solar, and natural gas, with the exception of coal.

The net result, according to some projections, is that the global economy will double in size in absolute terms. This rapid growth in population will fuel the growth in primary energy demand, estimated at 24% and driven by the mainstays of the demographic surge, about 30% of which will be from India.

OPEC has cut its outlooks in recent times, and at least three consecutive times in 2024. In October, it reduced its projections for 2024 from 2.03 million barrels per day to 1.93 million barrels per day, mainly due to shifting demand patterns in China.

The International Energy Agency (IEA), has more moderate estimates.”World oil demand is on track to expand by just shy of 900,000 barrels per day in 2024 and close to 1 million barrels per day in 2025, marking a sharp slowdown on the roughly 2 mb/d seen over the 2022-2023 post-pandemic period,” the IEA said in its October outlook, “China underpins the deceleration in growth, accounting for around 20% of global gains both this year and next year, compared to almost 70% in 2023.”