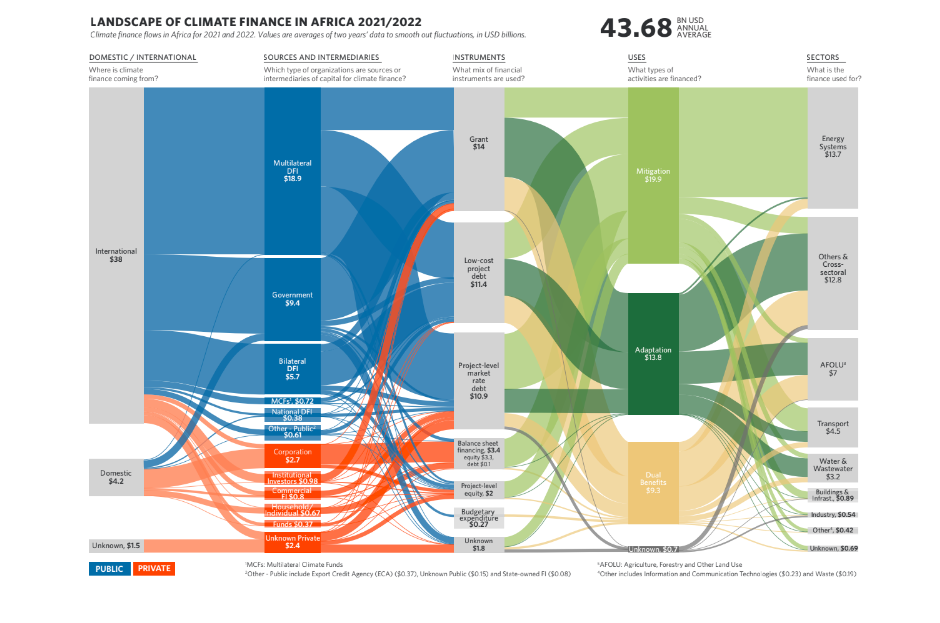

A recent report shows that climate finance flows to Africa saw a 48% increase, reaching USD 44 billion in 2021/2022, up from USD 30 billion in 2019/2020.

- According to the study by the Climate Policy Initiative (CPI), the increase was led by public finance, but the private sector also played a significant role, with its contribution doubling to USD 8 billion.

- While the private sector’s share of finance reached USD 8 billion, funding from African governments remains critically low. In fact, government contributions dropped from USD 1.6 billion in 2019/2020 to just USD 1 billion in 2021/2022.

- Overall, domestic actors accounted for only 10% of Africa’s total climate finance, with 75% of this coming from private finance.

READ; How Financial Institutions Can Help Mitigate Climate Risks

International sources continue to dominate, providing 87% of Africa’s climate finance, even though the continent boasts an estimated USD 2.4 trillion in assets under management from domestic banks, insurance companies, and pension funds. This presents a significant opportunity for increasing domestic investments in climate-positive initiatives.

In this article

Regional Imbalances and Climate Vulnerability

The CPI report highlights significant regional imbalances in the flow of climate finance. The top ten countries, including South Africa, Egypt, and Nigeria, received 46% of total climate funding, while the bottom 30 countries shared just 10%. Notably, private finance flows were also highly concentrated, with South Africa, Egypt, and Nigeria alone accounting for half of all private climate finance.

This disparity is particularly stark when comparing climate finance distribution with vulnerability to climate change. Of the ten most climate-vulnerable African countries, which include Somalia, Chad, Niger, and Liberia, only Uganda made the list of top recipients. These highly vulnerable nations received just 11% of the total climate finance, leaving them severely underfunded and ill-equipped to manage the adverse impacts of climate change.

Public Finance and Debt

Public finance continues to be the dominant source of climate funding, comprising 82% of Africa’s total flows. Multilateral development finance institutions (DFIs) were the largest providers, contributing 43% (USD 19 billion) of total flows and 53% of public finance. These DFIs have increased both grant and concessional lending across the continent.

However, debt remains a significant component of Africa’s climate finance landscape. According to the report, 51% of climate finance comes in the form of debt, split equally between low-cost and market-rate debt. This raises concerns, particularly for countries already facing debt distress, as debt makes up between 36% and 43% of their climate finance despite the availability of grants.

Adaptation, Mitigation, and Project Sizes

In terms of allocation, adaptation solutions received 32% of Africa’s total climate finance in 2021/2022, a much higher share compared to other regions, where adaptation finance typically ranged between 1% and 14%.

Additionally, the average climate project size in Africa remains small, at under USD 2 million—significantly lower than in other regions, where projects average USD 24 million in East Asia and the Pacific, USD 5 million in South Asia, and USD 4.6 million in Latin America and the Caribbean.

Growth of African Carbon Markets

One bright spot in Africa’s climate finance landscape is the rapid growth of the African carbon markets, driven by political and regulatory efforts like the Africa Carbon Markets Initiative (ACMI). While demand for carbon credits stagnated or declined globally, Africa saw an 11% increase in demand for its credits. The continent’s share of the global carbon market also grew, with the value of African carbon projects rising from 10% of the global market in 2021 to 26% in 2023.

Bond Market Participation

Africa’s participation in the global bond market remains low. Between 2019 and 2022, Africa accounted for just 0.5% of the global bond market, averaging approximately USD 2.2 billion per year. South Africa led the continent in green bond issuances, followed by Mauritius, Ivory Coast, and Nigeria. Corporate issuances dominated the African green bond market, with financial institutions also playing a key role. Only Nigeria and Egypt have issued sovereign green bonds, though South Africa is currently in the process of developing one.

RELATED; CIB Group Roots for Equity Financing in Fight against Climate Change