The Competition Authority of Kenya (CAK) has raised concerns about employment in the ongoing regulatory review of the acquisition of KCB Group’s National Bank of Kenya (NBK) by Nigerian lender Access Bank.

- In March, KCB Group CEO Paul Russo confirmed that the bank was in the process of selling NBK at 1.25* its book value, to Access Bank.

- Access Bank, which has been on a mergers and acquisitions streak across the continent, already has a presence in Kenya after it acquired Transnational Bank in 2019.

- The Nigerian lender originally wanted to acquire Sidian Bank from Centum Investments, but the deal fell through in 2023.

On 13th August 2023, COMESA’s Competition Commission approved the parts of the KCB-Access deal in other markets other than Kenya, and referred the part of the transaction related to the Kenyan market to CAK.

In its submission to the regional competition regulator, CAK had expressed concerns that the horizontal merger would lead to the loss of employment opportunities. The commission reviewed the request made by CAK as well as the submissions by the merging parties and resolved that the referral request was justifiable having regard to the significant operations of the merging parties in Kenya.

“The NBK-Access Bank deal is not likely to substantially prevent or lessen competition in the Common Market or substantial part of it, nor will it be contrary to public interest. The deal is unlikely to negatively affect trade between Comesa member states,” said Commissioner Mahmoud Momtaz, Chairperson Comesa Competition Commission.

“The above approval does not apply to the Kenyan market. In accordance with referral granted by the Commission, the Competition Authority of Kenya shall issue its decision in relation to aspects of the merger relating to the Kenyan market,” he said.

The Deal

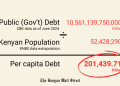

By a share purchase agreement entered on 20 March 2024, Access Bank agreed to purchase 100 per cent of the issued share capital of NBK from KCB. Access will also acquire indirect control of of NBK Bancassurance upon completion of the proposed transaction.

Access Bank is a full-service commercial bank in Nigeria with subsidiaries in Sub-saharan Africa and the United Kingdom, a branch in Dubai, UAE and representative offices in China, Lebanon and India.

To position itself strategically in Africa, the bank is currently in the process of acquiring 80.89 per cent of the issued capital of Finance Trust Bank, a commercial bank based in Uganda which Comesa Competition Commission approved on 4 May 2024.

Estimated market share of Access Bank in DRC, Kenya, Rwanda and Zambia is at 3.33 per cent, 0.20 per cent, 3.53 per cent and 8.49 per cent respectively. NBK estimated market share in Kenya is 2.09 per cent.