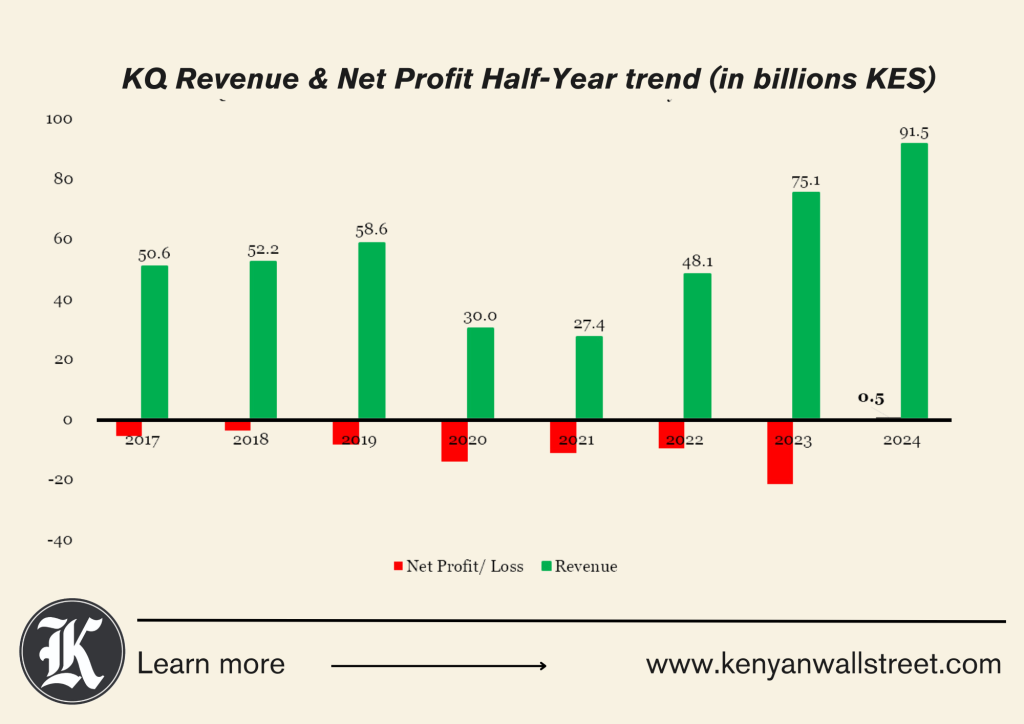

National carrier Kenya Airways is out of the red line for the first time in 10 years after announcing Sh513 million net profit in the first half of 2024.

- After 2013 when the airline recorded Sh384 million, it has been on the red with losses running into billions. The largest loss it reported was in 2020 having sank into Sh14.3 billion loss.

- During the 2023 half year period, the airline reported a loss of about Sh22 billion.

- Total income reported in the first half of 2024 are up 22 per cent to Sh91.49 billion while operating profit jumped 30 per cent toSh1.30 billion, due to a decrease in total operating costs by 22 per cent to Sh90.20 billion.

“We are not there yet, but this is a significant milestone that indicates our intention to continue transforming this organisation into a fully stable and sustainable airline, so this something we want to celebrate,” Chief Executive Officer Allan Kilavuka said.

Kenya Airways Chairman, Michael Joseph said the airline remains focused on completing its capital restructuring plan to reduce financial leverage and enhance liquidity, thus ensuring a strong foundation for long-term growth and stability.

“Kenya Airways is committed to maintaining this positive momentum, building on the success of the first half of 2024 as we continue to strive for excellence in the aviation industry,” he said.

During the period under review, Kenya Airways experienced a 10 per cent increase in passenger numbers, totaling 2.54 million, total revenue grew by 22 per cent to Kshs 91 billion, driven by higher passenger numbers.

- Kenya Airways share trading at Nairobi Securities Exchange was suspended in July 2020, when MPs began a review of the law to allow the state to take over the airline. In 2019, lawmakers approved the Treasury’s plan to nationalize KQ.

In 2023, Kenya Airways (KQ) share trading was frozen from the Nairobi bourse for a further 12 months to enable the firm to complete operational and restructure process.

The suspension was approved and issued by the Capital Markets Authority (CMA) pursuant to section 11(3)(w) of the Capital Markets Act and regulation 22 of the Capital Markets (Securities) (Public Offers, Listings and Disclosures) Regulations, 2002.