Recently IATA announced that Africa’s airlines are expected to earn a collective net profit in 2024 for the second year in a row, reflecting the sector’s resilience in its post-COVID recovery.

- African airlines are projected to achieve a net post-tax profit of US$ 100 million, the second year of profits following the COVID crisis.

- The expected US$ 100 million profit, however, translates into just 90 cents per passenger—well below the global average of US$ 6.14.

- Profit per passenger is expected to reach US$ 0.9, nearly doubling the 2023 figure of $0.5, reflecting improved operational efficiency and increased demand.

Profit margins are anticipated to be 0.6% of revenue, up from 0.4% in 2023. This remains significantly lower than the global net profit margin of 3.1%.

According to the IATA report, Revenue Passenger Kilometers growth is forecasted at 8.5%, indicating continued strong passenger demand across the region. This does, however, lag behind the expected growth in capacity of 9.1%.

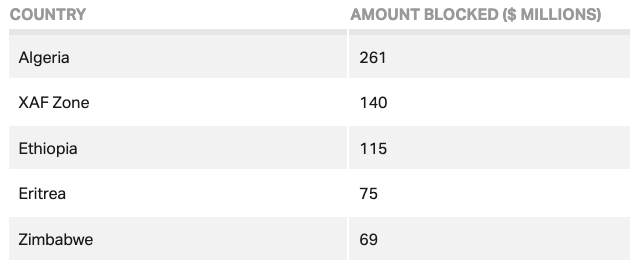

The amount of blocked funds in African countries in June 2024 stood at $880 million, just over 52% of the $1.68 billion in blocked funds globally. This is an improvement following Nigeria clearing 98% of the total funds blocked ($831 million).

The top five countries in Africa with blocked funds are as shown in the table below:

Despite being home to over one billion people and nearly a fifth of the world’s population, Africa has a very limited presence in the aviation industry, and accounts for just 2% of air global passengers.

See Also:

Commercial Passenger Traffic in Kenya Hits 12.2 Million in 2023