LeapFrog Investments, the profit-with-purpose investor in emerging markets, has made an investment of USD 180m in Ghana’s financial services market leader, Enterprise Group Limited (Enterprise Group). The transaction draws from a USD 350m separately managed account, LeapFrog Strategic African Investments (LSAI), which was established in 2016 to access high growth markets in Africa.

The Enterprise Group commitment represents LeapFrog’s largest investment to-date and marks the first investment of LSAI, a fund in which Prudential Financial, Inc. (PFI) (NYSE: PRU) is the primary investor. LSAI will manage the EGL investment, applying decades of operational expertise in emerging markets financial services to the Enterprise Group business, increasing efficiencies, offering product development opportunities and helping expand the business in Ghana and other growth markets in the region. The transaction is subject to customary closing conditions, including regulatory approvals.

Enterprise Group financial services include insurance, life cover, and pensions for emerging consumers. Enterprise Group’s life insurance arm, Enterprise Life, is Ghana’s leading provider of life insurance, controlling gross premiums of over USD 50m. The Company has reported a market-leading compound annual growth rate (CAGR) of 26 per cent in premiums between 2013 and 2015.

“Enterprise Group is a pioneer in delivering vital financial services to emerging consumers in Ghana. Its leading position in financial services, as well as dominance in insurance with over 28 per cent of the market, is a testament to the quality of the financial services it provides,” said Doug Lacey who co-led the transaction with Norm Kelly on behalf of LSAI.

“We are extremely pleased to enter into this strategic relationship with Enterprise Group,” said Norm Kelly of LeapFrog Investments. “Enterprise Group’s management team has built a robust platform for growth in West Africa. With the capital and expertise of our team behind the business, we are confident that it will scale to provide millions more people with access to essential financial services.”

With the new investment, Sanlam Emerging Markets Proprietary Ltd will exit its holding in three of Enterprise Group’s subsidiaries companies; namely Enterprise Life, Enterprise Insurance and Enterprise Trustees for USD 130 million. A further USD 50 million will be invested to fund Enterprise Group’s future growth.

Keli Gadzekpo, Group CEO of Enterprise said “We at Enterprise are delighted to welcome LeapFrog Investments into the Enterprise Family. They bring an incredible network of global insurance contacts and experience, and also the capacity to provide growth capital towards the realisation of our very ambitious strategic objectives. We are pleased they have chosen to partner with us.”

The rapid expansion of the Ghanaian economy, projected at 8.7 per cent in 2017, is creating substantial demand for financial services among emerging consumers in the country. The investment positions Enterprise Group to further seize that vast market opportunity.

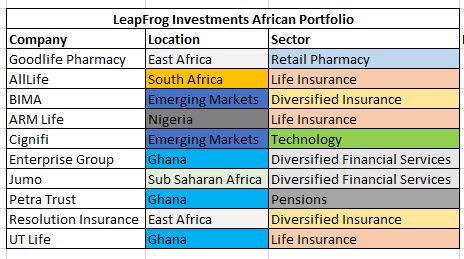

The company has also invested across Africa with investments in East Africa (Goodlife Pharmacy, Resolution Insurance), South Africa (AllLife), Nigeria (ARM Life) among others.

Notable exits the investment company has made are in East Africa’s Apollo Insurance which it sold to Swiss Re in 2014 and in Nigeria’s Express Life Insurance Company to Prudential PLC in 2014.

Notable exits the investment company has made are in East Africa’s Apollo Insurance which it sold to Swiss Re in 2014 and in Nigeria’s Express Life Insurance Company to Prudential PLC in 2014.

Related: Leapfrog Acquires majority stake in Kenya’s Goodlife Pharmacy for Sh 2.2 Billion

Source: LeapFrog Investments