The government has earmarked 35 state owned enterprises for outright sale or offering to the public through the Nairobi Securities Exchange.

Speaking during African Securities Exchange Association (ASEA) conference in Nairobi, the President noted that despite the reforms, macroeconomic environment has weighed on the growth of the markets making contribution of security exchanges marginal to economic development.

“We noted that majority of stock exchanges across the continent and in Kenya face structural hurdles, struggling with liquidity and minimal participation by retail investors,” he said.

- Without disclosing the enterprises and the timeline when the transaction will occur, President William Ruto noted that the initiative will end IPO drought at the exchange and also inject the much-needed capital into the struggling entities.

- He said the government has identified the first 35 companies to be offered to the private sector and it has another close to 100 that it is working with financial advisors on the next step.

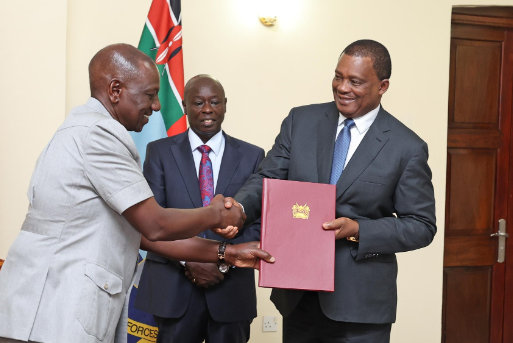

- In October, the president signed in law the privatization bill knocking down bureaucracy that previously stood in between the sale of the enterprises.

“The new law heralds a shift in executing privatization by infusing international best practices, cuts down bureaucracy which almost made privatization grind to a halt,” President Ruto added.

Despite having potential to have at least five listings per day, securities exchange platforms in Africa struggle to meet the target. Reforms such as interest rates liberalization, removal of debt ceiling, enhancement of regulatory environment as well as restructuring and privitiZation of state corporations have acted as a catalyst that have seen growth in some markets over the last decades.

At the same event, Cabinet Secretary Ministry of Finance and Planning Prof Njuguna Ndungu challenged the leadership of Africa securities exchange to rethink structure and align with the digital age.

“Majority of African stock exchanges face structural hurdles to growth, struggling with liquidity, and minimal participation by retail investors. We have to rethink structure given the digital age and we need to think about that in terms of how we are going to contain the process,” said Prof Ndung’u.

“IPO landscape in the continent indicates that the challenges are quite immense, it is against this that we need to rethink legacy and emerging challenges facing the stock markets,” he added.

President Ruto Approves Privatisation of Loss-Making Government Entities – Kenyan Wallstreet