KCB Group’s Q32023 net earnings rose marginally, by 0.3%, for the first nine months of 2023 as the regional lender increased its loan provisions by 118.1% in Kenya due to the rapid depreciation of the Shilling against major foreign currencies.

The lender made KSh 30.7 billion in Q3 2023 compared to KSh 30.6 billion in Q3 2022. The lender’s bad book now stands at KSh 187.0 billion with KSh 10.0 billion attributed to the impact of integrating Trust Merchant Bank(TMB), based in the DRC, into the business, and KSh 20.0 billion due to a depreciating Kenya Shilling exchange rate against the greenback.

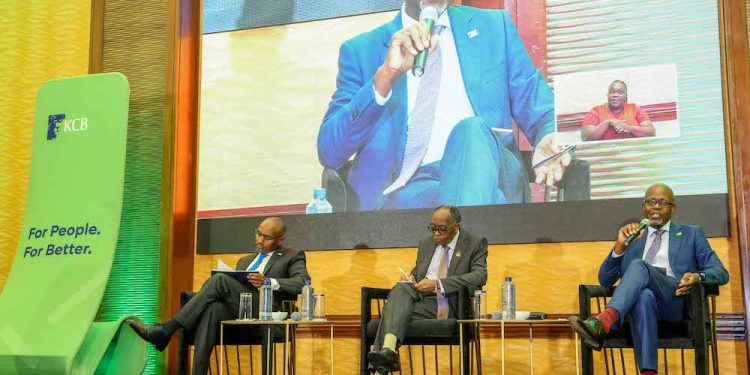

“We have had a rather difficult nine months due to a tough operating environment that has negatively affected our customers,” KCB Group CEO Paul Russo said, “Our focus has been on speedy and sustainable resolution of our customer’s pain points and ringfencing the business to guarantee long-term growth”.

- This improved performance in Q3 more than offset the drop posted in H1 which was 16% below that of the previous year.

- The Group owns KCB Bank Kenya, National Bank of Kenya, and regional subsidiaries.

- It also owns a Bancassurance business, an Investment Bank, an Asset Management business, KCB Foundation, and other associate companies.

The lender now has an asset base of KSh 2.1 trillion, the largest branch network in the region with 605 branches, 1,315 ATMs, 30, 153 POS/Merchants, and agents offering banking services round the clock in East Africa. In its latest results, the Group posted a 43% growth in its balance sheet size beyond KSh 2 trillion while net loans grew 38% to KSh 1.048 trillion and customer deposits were up 80% to KSh 1.048 trillion, the first in the region.

These regional record-breaking numbers were further bolstered by a 33% increase in contributions from subsidiaries. This growth from subsidiaries has compensated for the KSh 3 billion net loss in the National Bank of Kenya (NBK)

- The Kenyan subsidiary delivered net earnings of KSh 10 billion in Q3 2023 compared to KSh 9.8 billion in Q3 2022.

- Uganda was up 63.0% to KSh 3.3 billion, Tanzania was up 56.0% to KSh 4.5 billion, South Sudan was up 41.0% to KSh 1.9 billion, Burundi up 16.0% to KSh 1.2 billion, Rwanda up 12.0% to KSh 6.8 billion,

- National Bank of Kenya still in loss territory “due to legal awards as well as increased costs of borrowings and provisions.”

Fuliza fuels Mobile Loans

The value of mobile loans disbursed grew to KSh 245 billion, a growth of 77% driven by Fuliza, the introduction of term loans on KCB Mobi, and new mobile lending products for small businesses.

- Fuliza personal loans increased 69% year on year to KSh 150.3 billion,

- The lender also disbursed loans worth KSH 33.8 billion through KCB MPESA, KSh 24.8 billion through KCB Mobi loan, Business loans through digital overdraft and KSh 23 billion through retailer financing and Fuliza business KSh 13.3 billion.

- Total non-funded income from digital channels increased to KSh 9.9 billion: KSh 7.1 billion from mobile banking, KSh 2 billion from agent and merchant point of sell channels, KSh 561 million from internet banking, and KSh232 million from ATMs.

“Inflation across the region is easing as domestic food price inflation falls on the back of improved agricultural production. We are optimistic that the various governments in the region will keep up with robust fiscal and monetary interventions to support sustained economic growth,” Board chair Dr. Joseph Kinyua said.

ALSO READ: KCB Group Records 17.9% Decline Net Profit in First-Half of 2023