Uganda has increased the number of bank accounts to 24 million from 6 million bank accounts six years ago as it strives to improve financial inclusion.

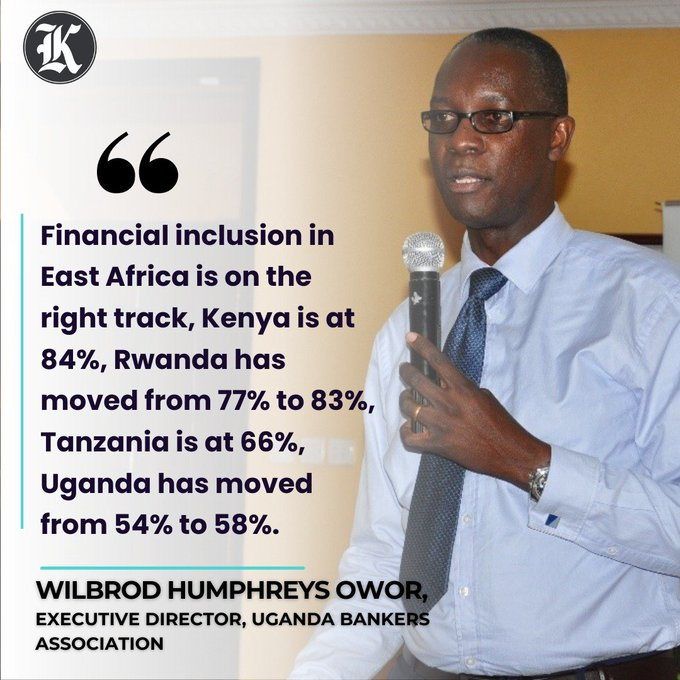

Speaking during the October regional #CEOChat, Wibrod Humphreys Owor, Executive Director, Uganda Bankers Association (UBA) said Uganda still deals with cultural and religious perceptions that exist at the micro-level, and this impacts on the country’s financial and digital literacy levels.

CEO Chat is a social media event presented by a leading financial sector advocacy group — Kenya Bankers Association (KBA). The session is meant to facilitate discussions on current financial sector trends. In the sessions, CEOs share information and receive feedback on various aspects of banking.

Under the theme: “Promoting Sustainable Financial Inclusion in the EAC Region’’ the October session features East African Community Region Bankers Associations CEOs who engaged the public on ways of deepening Financial Inclusion in the region.

The four-week engagement will feature four Associations CEOs: Dr. Habil Olaka, CEO- Kenya Bankers Association; Ms. Tusekelege Joune, Executive Director- Tanzania Bankers Association; Mr. Tony Francis Ntore, CEO- Rwanda Bankers Association; Mr. Wilbrod Humphreys Owor, CEO- Uganda Bankers Association.

In East Africa, different countries are at different levels of achieving financial inclusion. In Uganda, the country has crafted a national financial inclusion strategy for 2017-2022. The plan has several pillars including building the infrastructure, digital assets as well as critical credit infrastructure, and empowering the masses through digital literacy initiatives.

Uganda has done well and opened up new channels and eased the national identity process. It has also formulated the national payments system regulations. The country is now in the second phase and aims to increase more products, strengthen consumer protection, deal with gender and youth issues, and develop the green finance market.

“We have under 1,000 branches, today we have over 30,000 bank agents and 472,000 agents around the world.” noted Owor.

He added that while Uganda has been conservative in this public borrowing. “If Eurobonds are not well managed, countries can find themselves in big problems. Uganda is conservative when it comes to government borrowing.”

He said there is a role for everybody to play including public sector bodies, the private sector, and fintech to achieve Financial inclusion, which is a development index and there is a lot to be done.

“Fintechs have broken barriers, they have enabled institutions to deliver services 24/7,” said Dr Owor.

ALSO READ: Uganda Maintains Key Interest Rate in a Bid to Ease Inflation