CYNK, a Nairobi-based platform, has announced it has successfully facilitated the trading of over two million carbon credits derived from the Tamuwa renewable biomass project. Tamuwa, one of Kenya’s prominent biomass companies, specializes in producing briquettes and pellets from agricultural waste and sugarcane bagasse, offering an eco-friendly alternative to unsustainable energy sources like charcoal.

This landmark transaction marks the second of its kind in just three months, following a significant milestone on June 14, 2023. During the June auction, Kenya’s carbon market achieved a remarkable feat by selling 2.2 million tonnes of carbon credits at the Nairobi Auction to heavyweight entities like Saudi Airlines, Saudi Electric, Dubai Islamic Bank, and Saudi Aramco, resulting in a substantial $25 million revenue.

Kenya’s carbon credits market continues to flourish, with ambitions to become Africa’s primary carbon credits exporter. The Capital Markets Authority is actively working on regulatory frameworks to support this burgeoning market. At present, Kenya boasts the largest share of the carbon credits market in Africa, holding over 24%.

ALSO READ; Kenya’s Strategy for Carbon Market Dominance

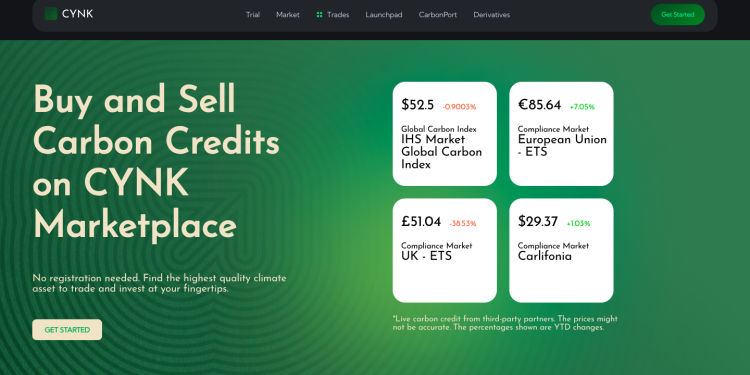

Tamuwa, the company behind CYNK, specializes in producing biomass briquettes using bagasse waste from Kenya’s sugar milling operations. Nils Razmilovic, Tamuwa’s CEO noted, “Our landmark trade illustrates the value of carbon credits as an asset class. They can create climate action and benefits for local communities.”

ALSO READ; Kenya Sells Record 2.2m Tonnes of Carbon Credits to Saudi Firms

Each carbon credit represents one ton of climate-warming carbon dioxide or its equivalent, either removed from the atmosphere or prevented from entering it. These credits are sought after by greenhouse gas emitters seeking to offset their polluting activities. The global carbon credits trade, currently valued at $2 billion annually, has the potential to grow to an astonishing $1 trillion within the next 15 years, according to Bloomberg forecasts.

As companies worldwide strive to meet net-zero emissions goals, the demand for carbon offsets generated through various projects, such as tree planting and cleaner cooking fuel, is expected to soar. The voluntary carbon market plays a pivotal role in assisting companies to reach their environmental targets by allowing investments in projects that sequester climate-warming emissions, which cannot be eliminated from their operations.

RELATED;

CMA to Support Creation of Kenya’s Carbon Credit Markets

Carbon Trading: Kenya Private Sector Pushes for Predictable Regulatory Framework