First Published on February 27th, 2023 by Samuel Smith for SureDividend

Banks in the US are generally well regarded when it comes to income investing. They tend to pay decent yields, and the best-run banks offer relative dividend security, as well as the potential for dividend growth. Internationally, banks have proven riskier due to a variety of factors, including geopolitical risk, localized economic weakness, currency risk, and others.

Itaú Unibanco (ITUB) is a Brazilian bank that pays a relatively small dividend to shareholders but one that is quite secure. In addition, it pays its dividend monthly instead of quarterly, allowing for faster wealth compounding and current income.

Itaú Unibanco is one of the stocks we cover that makes monthly dividend payments. You can download our full list of 84 monthly dividend stocks (along with price-to-earnings ratios, dividend yields, and payout ratios) by clicking on the link below:

Despite the payout ratio being extremely low, and therefore implying high levels of dividend safety, we see many growth challenges ahead for Itaú Unibanco. With the earnings outlook quite murky, and Brazil’s economic growth in doubt, we have concerns about the bank’s near-term future.

Given this, we are cautious on Itaú Unibanco’s prospects as an investment at this time, despite its attractive monthly payout schedule.

In this article

Business Overview

Itaú Unibanco is a very large bank that is headquartered in Brazil. ITUB is a large cap stock with a market capitalization above $44 billion.

Itaú Unibanco conducts business in more than a dozen countries around the world, but the core of its business is in Brazil. It has significant operations in other Latin American countries and select businesses in Europe and the US.

Its scale is huge in relation to other Latin American banks. Itaú is the largest financial conglomerate in the Southern Hemisphere, the world’s 10th–largest bank by market value, and the largest Latin American bank by assets and market capitalization.

The bank offers its customers an impressive list of services, running the entire spectrum of financial products. This huge list of offerings has helped Itaú Unibanco grow to its current size while diversifying its revenue streams.

Its business has two main segments – Retail Banking and Wholesale Banking. Retail Banking serves smaller consumer accounts, while Wholesale Banking serves larger, mostly business accounts. The retail business produces about two-thirds of the company’s total net income, with the wholesale business making up the balance.

Both are critically important to the bank’s profit outlook, but like many other large banks, Itaú Unibanco’s business is heavily dependent upon consumers.

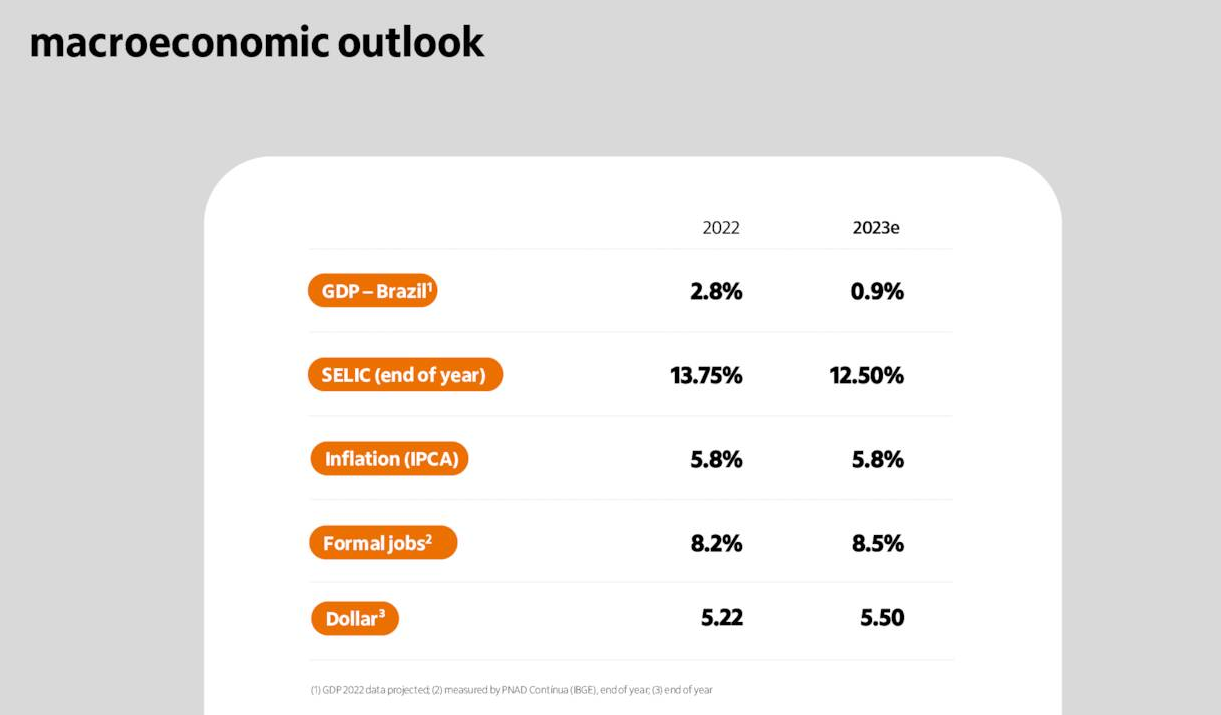

Given Itaú Unibanco’s reliance upon Brazil and other South American countries for its earnings, we have significant concerns about its ability to grow.

Growth Prospects

Itaú Unibanco’s strategy of trying to be everything to every consumer and business isn’t unusual in the world of banking. The major US banks have adopted a similar strategy over time, providing core banking services like deposits and loans, but also insurance products, equity investing, and a host of other products to help attract customers.

However, what sets Itaú Unibanco apart is its exposure to emerging economies rather than established ones in Europe or the US.

Indeed, Brazil’s economy has struggled for many years, and many of the other countries Itaú Unibanco operates in similar, if not worse, situations.

This is a primary concern for us regarding the company’s ability to grow because the business model of a bank requires broad economic growth for its own expansion. Without this growth, Itaú Unibanco will have a difficult time producing profit expansion.

In the fourth quarter of 2022, the recurring managerial result was R$7.7 billion, a decrease of 5.1% compared to the previous quarter. The recurring managerial return on equity remained the same at 19.3%, which is the level determined for operations in Brazil. Excluding this effect, the recurring managerial result would have been R$8.4 billion, and the recurring managerial return on equity would have been 21.0% in the fourth quarter.

The loan portfolio grew by 2.0% in Brazil and 2.7% on a consolidated basis, while the individual loan portfolio in Brazil grew by 3.7% in the quarter. The credit card portfolio, which is seasonally higher at the end of the year, grew by 4.9%, a lower growth rate than the end of 2021 due to the challenging economic scenario and the slowdown in card issuing activities throughout the year. Mortgage loans grew by 5.2%, but at a slower pace due to the increase in the basic interest rate. Loans to very small, small, and middle-market companies increased by 2.4%.

The margin with clients grew by 3.6% to reach R$24.2 billion in the quarter, primarily driven by the increase in the average portfolio. Margin with clients was also helped by the increase in liabilities’ margin, driven by the higher interest rate and higher average deposits’ balance, and the increase in the margin in Latin America.

The cost of credit increased to R$9.8 billion, primarily due to higher expenses in the wholesale business segment in Brazil. The growth was due to a subsequent event related to a specific case in the corporate segment, which had an impact of R$1.3 billion in the quarter on the cost of credit.

Commissions and fees remained stable in the quarter, as higher revenues from cards and asset management were offset by lower revenues from investment banking and current account services. The result from insurance operations increased by 11.4%, driven by the increase in earned premiums and higher revenues from private pension.

Non-interest expenses increased by 4.5% from the previous quarter, primarily due to higher personnel and administrative expenses. The consolidated efficiency ratio was 41.4%, down 1.6 p.p. on a year-on-year basis.

Dividend Analysis

Itaú Unibanco has a conservative approach to paying its dividend. The bank pays out dividends to shareholders based on its projected earnings and losses, with the goal being the ability to continue to pay the dividend under various economic conditions.

Along with providing its recent quarterly results, the company also slightly increased its monthly dividend from $0.0033 per share to $0.0034 per share. Still, the yield is quite low at 0.83%.

Thus, Itaú Unibanco isn’t a pure income stock by any means, as its yield is simply too small to be attractive to most income investors.

On the plus side, the very small yield affords the bank better dividend coverage as the payout ratio is in the teens. We, therefore, do not see any risk of a negative change in the dividend policy today, but we are also cautious about future growth given the uncertain outlook for Brazil’s economy.

Thus, we do not believe income investors should be interested in Itaú Unibanco stock, due to its fairly low yield and the number of elevated geopolitical and macroeconomic risk factors.

Final Thoughts

We see a difficult road ahead for Itaú Unibanco. With low projected earnings growth under normalized conditions and a diminutive dividend yield, we don’t view this stock as attractive.

Furthermore, buying international stocks carries multiple unique risk factors, including geopolitical and currency risks. Itaú stock provides geographic diversification for investors particularly interested in investing outside the United States.

However, the risks seem to outweigh the potential rewards for this stock. Given all of the above factors, we recommend investors avoid Itaú Unibanco, despite its monthly dividends.

Related:

Top 10 Cheapest Monthly Dividend Stocks Now

Top 10 Safest Monthly Dividend Stocks Now