First Published on January 24th, 2023 by Aristofanis Papadatos for SureDividend

Each year, we publish an in-depth look at each of the Dividend Aristocrats, an exclusive list of stocks in the S&P 500 Index with 25+ years of consecutive dividend increases. There are just 65 Dividend Aristocrats in the entire S&P 500 Index, indicating difficulty in reaching 25 consecutive annual dividend increases.

To join the Dividend Aristocrats list, a company must have competitive advantages and the ability to increase its dividend each year, even during recessions. As a result, Dividend Aristocrats are an excellent source of dividend growth stocks.

With this in mind, we created a list of all 65 Dividend Aristocrats, with important metrics such as dividend yields and price-to-earnings ratios. You can see the full list of all 65 Dividend Aristocrats by clicking on the link below:

Up next in our annual Dividend Aristocrats In Focus series is S&P Global Inc. (SPGI).

S&P Global has a very impressive dividend track record. It has paid a dividend every year since 1937 and has raised its dividend for 49 years in a row. According to the company, it is one of fewer than 25 companies in the S&P 500 that has raised its dividend for at least 46 consecutive years.

This article will look closely at S&P Global and what makes it such a high-quality dividend growth stock.

In this article

Business Overview

S&P Global traces its roots back to 1917 when McGraw Publishing Company and the Hill Publishing Company came together. The company was first named McGraw Hill Financial. In 1957, McGraw Hill introduced the S&P 500, the most widely-recognized index of all large-cap U.S. stocks.

S&P Global offers financial services to the global capital and commodity markets, including credit ratings, benchmarks, analytics, and data. It derives revenue from four operating segments: Ratings, Market Intelligence, Platt’s, and S&P Dow Jones Indices. S&P Global has a highly profitable business model. It is the industry leader in credit ratings and stock market indexes, providing high-profit margins and growth opportunities.

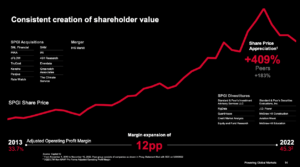

S&P Global has a very strong business model. The company has generated impressive growth rates over the past several years.

Source: Investor Presentation

Today, the S&P 500 is arguably the world’s most widely-known stock market index. The company generates more than $10 billion in annual revenue, with 20,000 employees, and has a current market cap of $120 billion.

S&P Global benefits from a strong secular trend, namely the steadily growing amount of global debt. This trend has markedly accelerated in the last three years, as nearly all the countries have issued unprecedented amounts of debt in response to the pandemic. In addition, numerous companies have come under pressure, and thus they have issued appreciable amounts of debt. This is a strong tailwind for the business of S&P Global, which has enjoyed a steep increase in its number of debt ratings.

The strength of the business model of S&P Global has been on full display in recent years. While many companies saw their earnings collapse in 2020 due to the pandemic, S&P Global grew its earnings per share by 23% in 2020, to a new all-time high, and by another 17% in 2021.

As the global issuance of new debt decelerated in 2022, the rating company took a breather last year. It is expected to report an approximate 19% decrease in its earnings per share for 2022. Nevertheless, its earnings per share in 2022 are still more than triple its earnings per share in 2013.

Growth Prospects

S&P Global has exhibited an impressive performance record. It had grown its earnings per share every year for more than a decade, except for 2022, when the company took a breather due to blowout earnings in previous years. Overall, since 2013, S&P Global has grown its earnings per share at a 14.3% average annual rate. The exceptional growth rate combined with the consistent performance are testaments to the strength of the business model of S&P Global and its reliable growth trajectory.

Indeed, there are strong secular trends behind the impressive growth record of S&P Global. Even better, these trends are intact. Most countries issue hefty amounts of debt year after year in order to keep their citizens satisfied. In addition, numerous companies resort to the issuance of new debt in order to fund their investments, pay their dividends, and repurchase their shares. This means more rating business for S&P Global.

In addition, investors are becoming increasingly sophisticated, and thus the demand for sophisticated financial analysis is steadily increasing. Overall, S&P Global should continue to experience growing demand for financial analysis and debt ratings.

Moreover, S&P Global does not rest on its laurels. Instead, it is doing its best to continuously innovate and thus expand its reach.

Source: Investor Presentation

Thanks to its proven ability to innovate and enhance its offerings to its customers, S&P Global is likely to remain on its growth trajectory for the next several years.

As mentioned above, S&P Global is expected to report a 19% decrease in its earnings per share for 2022. This is natural due to the blowout performance in each of the previous two years. However, the company’s growth prospects remain promising thanks to its leading business position and the secular tailwinds. Overall, we expect average annual growth of earnings per share of 10% through 2028.

Competitive Advantages & Recession Performance

S&P Global enjoys multiple competitive advantages. First, it operates in a highly concentrated industry. It is one of only three major credit rating agencies in the U.S., along with Moody’s (MCO) and Fitch Ratings.

Put together, these three companies control over 90% of the global financial debt rating industry, with S&P Global on top. Moreover, there are high barriers to entry in this industry. Specifically, becoming an accepted rating agency would require a great deal of trust from the financial industry and government that is hard to build quickly, if at all.

Clients pay S&P Global hefty sums for investment research, as S&P Global has built a strong reputation over its many decades of business. These competitive advantages helped the company remain consistently profitable throughout the Great Recession:

- 2007 earnings-per-share of $2.94

- 2008 earnings-per-share of $2.51 (15% decline)

- 2009 earnings-per-share of $2.33 (7% decline)

- 2010 earnings-per-share of $2.65 (14% increase)

S&P Global’s earnings declined in 2008 and 2009, as investors should expect during recessions. A global recession will naturally result in lower demand for financial services as investors exit the markets. With that said, S&P Global quickly bounced back after the recession ended. By 2011, earnings-per-share had hit a new post-recession high.

Valuation & Expected Returns

Based on the expected earnings per share of $11.10 for 2022, the stock has a price-to-earnings ratio of 33.4. S&P Global’s 5-year average price-to-earnings ratio is 23, but we’re assuming a fair price-to-earnings ratio of 26 times given the sustained, outstanding performance the company has produced.

Still, shares appear slightly overvalued. If shares were to retreat to a price-to-earnings ratio of 26 over the next five years, investors would see a reduction in annual returns of 4.9%. The stock also has a current dividend yield of 0.9%. The dividend is highly secure, with a payout ratio of only 31%, but it is too low for income-oriented investors.

A potential bull-case breakdown of future returns is as follows:

- 10% earnings-per-share growth

- 9% dividend yield

- -4.9% valuation headwind

In this scenario, S&P Global will generate a total return of 5.7% per year through 2028. This is a decent rate of return, but it does not meet our typical threshold of 10% for a buy rating. Thanks to its exceptional performance record and its consistent performance, S&P Global has almost always traded with a premium valuation. Its current valuation is not an exception.

Final Thoughts

S&P Global is a strong business with a long growth runway ahead. There will always be a need for financial rating services while future growth potential is strong in new areas as well, such as data and financial technology. S&P Global will accelerate its growth in these segments via acquisitions.

The dividend yield of 0.9% might not be attractive to income investors, as it trails the S&P 500 current yield of 1.6%, but dividend growth investors should view the stock more favorably. The company has grown its dividend by 10% per year on average since 1974. It has also grown its dividend by 12.5% per year on average over the last decade and by 15.2% per year over the last five years.

With that said, shares are somewhat expensive relative to the historical average; hence, S&P Global receives a hold recommendation at the current price.

This article was first published by Aristofanis Papadatos for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

Warren Buffett Stocks: Citigroup Inc.

Do Dividend Stocks or Annuities Make The Better Investment?