First Published on April 12th, 2023 by Nathan Parsh for SureDividend

It isn’t surprising that we favor stocks that pay dividends as studies have shown that owning income producing securities is an excellent way to build wealth while also protecting to the downside.

In bull markets, dividends can add to the gains from the stock while also purchasing additional shares. When prices decline, dividends can reduce the losses while being used to acquire more shares at a now lower price.

Most companies distribute dividends on a quarterly payment schedule, but there are some that pay dividends monthly.

However, the number of companies that distribute monthly dividends are limited in quantity. In fact, there are just 84 companies that currently offer a monthly dividend payment. You can see all 84 monthly dividend paying names here.

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter, like dividend yield and payout ratio) by clicking on the link below:

The monthly compounding of dividends provides several benefits to the investors. First, monthly dividend paying stocks can help provide consistent cash flow year round. With most companies paying dividends every three months, investors needing regular payments would need to create a portfolio from a wide variety of stocks to meet their needs. Identifying high-quality monthly dividend paying stocks can help create regular cash flows.

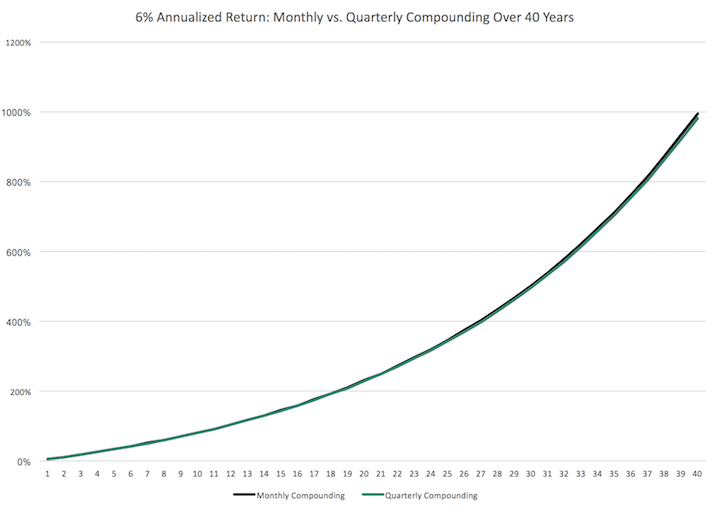

Second, monthly compounding of dividends can be a signfnincat contributor to wealth building. All else being equal, monthly dividend compounding can, over time, outpace quarterly dividend compounding by a solid amount.

That being said, there are less than 90 names that provide monthly dividends, which means a limited number of investment options. And all monthly dividend paying companies are not created equal.

In fact, there are just three names that have raised distributions for at least 10 consecutive years in our database of monthly dividend paying companies.

We believe that a decade of dividend growth is the bare minimum for a stock to be considered a “hold forever” position. This means that the underlying company has a solid enough business model that can support continued dividend growth.

In this article

Table of Contents

- Hold Forever Stock #3: Agree Realty Corp. (ADC)

- Hold Forever Stock #2: STAG Industrial Inc. (STAG)

- Hold Forever Stock #1: Realty Income (O)

Hold Forever Stock #3: Agree Realty Corp. (ADC)

Agree Realty is a retail real estate investment trust, or REIT, that specializes in owning, acquiring, and developing properties for rent. The trust was founded in 1971 and has developed more than 40 community shopping centers throughout the Midwest and southeastern U.S.

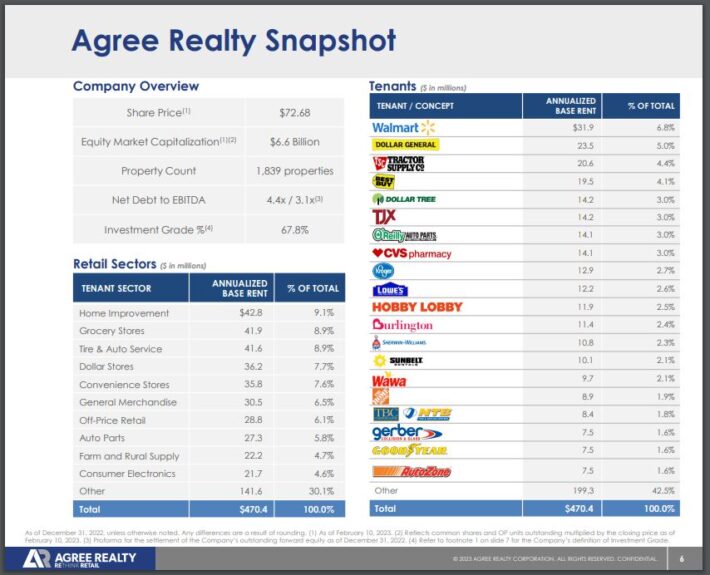

As of the end of 2022, Agree Realty owned and operated more than 1,800 properties in 48 states with approximately 38.1 million square feet of gross leasable space. Nearly 68% of the trust’s portfolio has an investment grade rating, meaning that the bulk of annualized base rents come from stable tenants.

Source: Investor Presentation

Retail has been a challenging landscape to navigate, given the rise of e-commerce and the impact that social distancing related to the Covid-19 pandemic had on the sector. But Agree Realty’s portfolio contains some of the most well-known retailers, including Walmart Inc. (WMT), Dollar General Corp. (DG), Home Depot Inc. (HD), and CVS Health Corp (CVS). In a difficult sector, Agree Realty often partners with high-quality tenants.

The trust’s portfolio is very balanced and diversified, with all tenant sectors contributing less than 10% of annualized base rents. Only two tenants, Walmart and Dollar General, account for more than 5% of annualized base rents. This means that Agree Realty isn’t overly dependent on a single sector or tenant for the bulk of its rents. This offers some protection in case of a downturn in an area or individual tenant.

Agree Realty has worked to reduce its exposure to weaker areas of retail, such as movie theaters, health clubs, and fitness centers. In total, just 3% of the trust’s annualized base rents come from these sectors.

The trust has also invested heavily in order to acquire strategically located properties. Last year, Agree Realty spent $1.7 billion on acquisitions and developments. The trust’s acquisitions and development investment has totaled more than $5 billion since 2015. Management has stated that it’s acquisitions budget is $1.1 to $1.3 billion for the current year, so the trust is indeed continuing to grow aggressively.

Agree Realty does have some tenants that receive a sub-investment grade rating, including Burlington Stores Inc. (BURL) and Goodyear Tire & Rubber Co. (GT), which could mean that these tenants are at risk for missing their rent payments or could even enter bankruptcy. This is an area that investors will want to monitor, but Agree Realty has done an excellent job of making sure its properties are leased. As of the most recent quarter, 99.7% of the portfolio was leased. The average weighted lease term is in great shape at almost 9 years.

Due to its solid business model, Agree Realty has raised its dividend for 11 consecutive years. Growth has been on the low end, including a 2.6% increase for the October 2022 payment. This is less than half of the average increase of 6.1% for the 2013 to 2022 period.

While dividend growth has slowed recently, we believe that the current yield of 4.3%, which is 2.5 times the average 1.7% yield for the S&P 500 Index, is relatively safe. The projected payout ratio for 2023 is 75%, which isn’t especially high for a REIT and matches the 10-year average payout ratio of 75%.

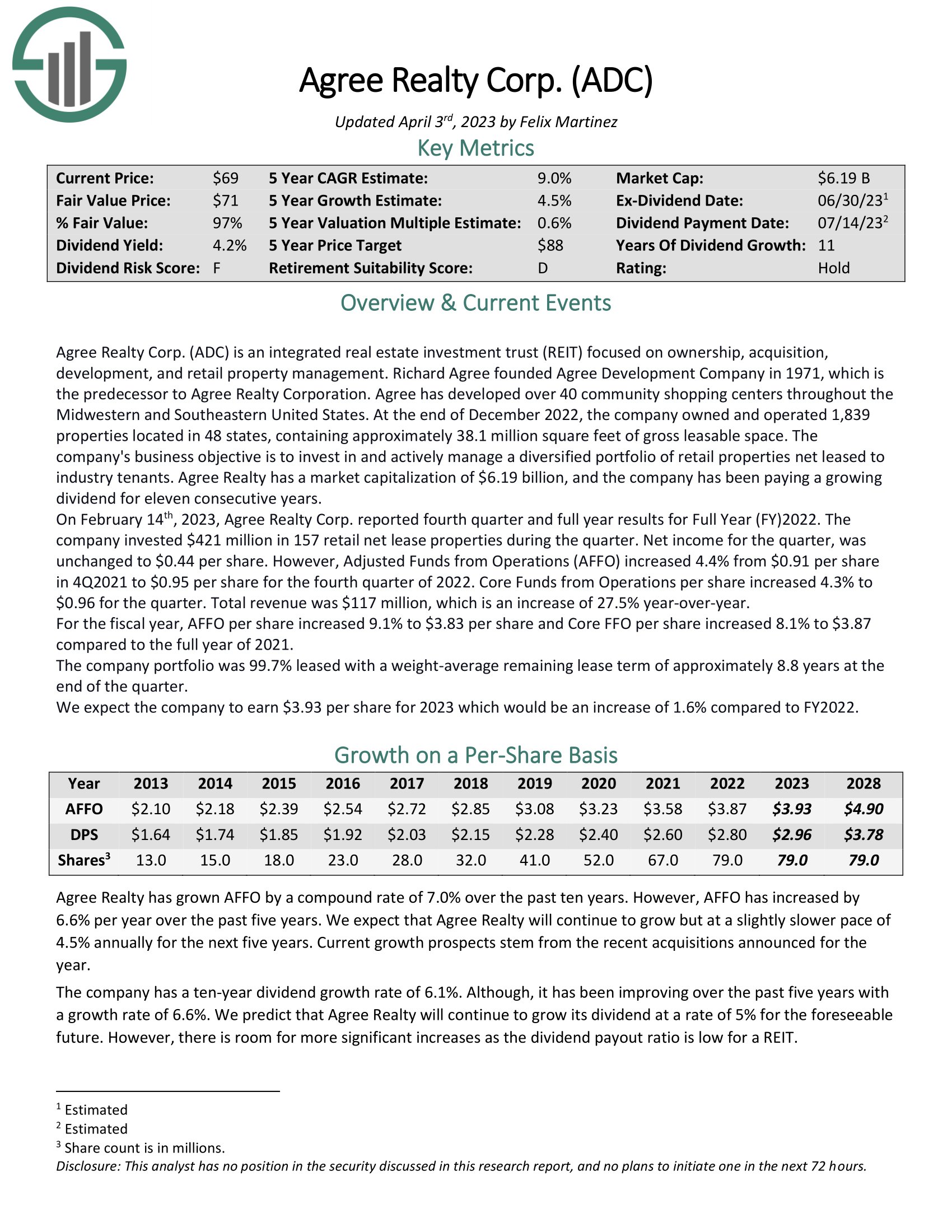

Click here to download our most recent Sure Analysis report on Agree Realty Corp. (ADC) (preview of page 1 of 3 shown below):

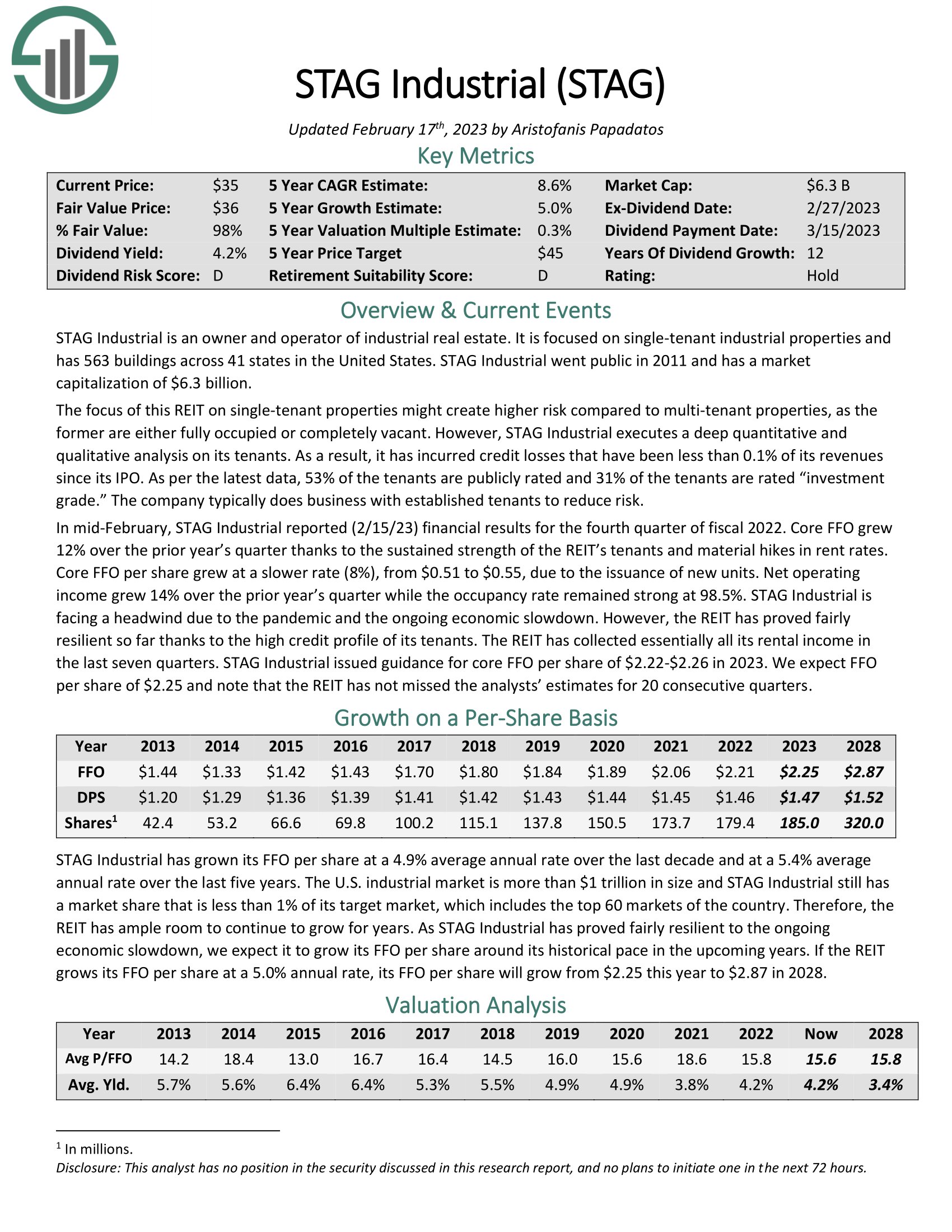

Hold Forever Stock #2: STAG Industrial Inc. (STAG)

STAG Industrial owns and operates industrial real estate. The trust’s portfolio consists of single-tenant industrial properties and has approximately 560 facilities across 40 U.S. states.

In general, single-tenant properties carry more risk to the owner and operator as these properties are either occupied or vacant. An unleased property is a headwind and too many such properties can significantly impact the business.

STAG Industrial, on the other hand, has done an excellent job of partnering with quality tenants. A very in-depth quantitative and qualitative assessment of tenants has led to credit losses of less than 0.1% of revenues since the trust’s IPO in 2011.

One benefit of single-tenant properties is that they can be severely mispriced, which allows STAG Industrial to acquire properties at very reasonable valuations. The total addressable market for the trust is estimated at more than $1 trillion, affording STAG Industrial the ability to be patient and selective when adding new properties to its portfolio. The market is also highly fragmented, which benefits a REIT of STAG Industrial’s size.

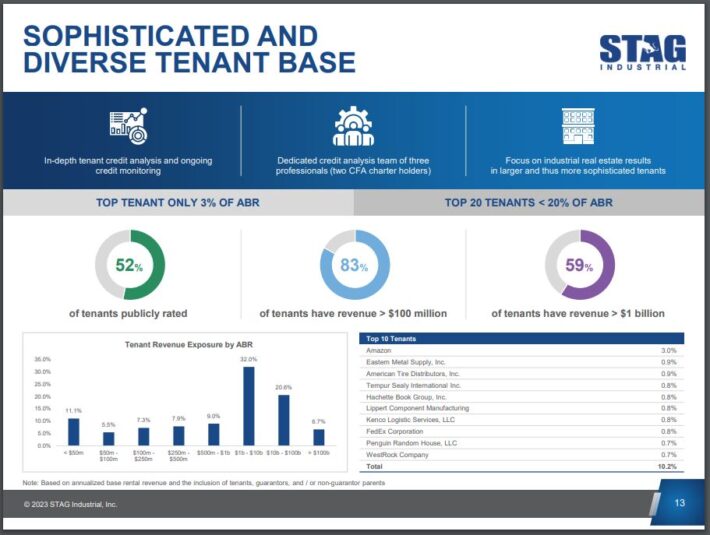

Another point in the trust’s favor is STAG Industrial’s highly diversified portfolio.

Source: Investor Presentation

STAG Industrial has done an excellent job of making sure it isn’t highly exposed to just a handful of tenants. Amazon.com Inc. (AMZN) contributes 3% of base rents, but the next largest tenant accounts for just 0.9% of the total. Moreover, the top 10 tenants contribute just over 10% of annualized base rents, meaning that STAG Industrial’s portfolio is very protected from weakness in a certain tenant. The average remaining lease is 4.9 years, which is lower than the other names discussed in this article.

Looking closer at the portfolio, we see that the diversification has been a focus point of the trust. STAG Industrial’s tenants range from very small to very large. The vast majority have annual revenue in excess of $100 million. Of these, 59% have at least $1 billion in annual sales. More than half of tenants are publicly rated as well, which is lower than the other names discussed here, but still provides a solid level of safety. The trust collected 100% of base rents in 2022, showing that its ability to identify good tenants is working.

STAG Industrial has paid a monthly dividend since 2013 and has raised its dividend for 12 consecutive years. Dividend growth has also been slow for the trust, with the average increase at just over 2% over the last decade. The dividend was increased 0.7% for the February payment earlier this year, which has been the typical raise recently. STAG Industrial makes up for the low growth with a generous yield of 4.5%. The very reasonable expected payout ratio for 2023 of 65%, below the 10-year average of 83%, means that the growth streak is likely to continue.

Click here to download our most recent Sure Analysis report on STAG Industrial Inc. (STAG) (preview of page 1 of 3 shown below):

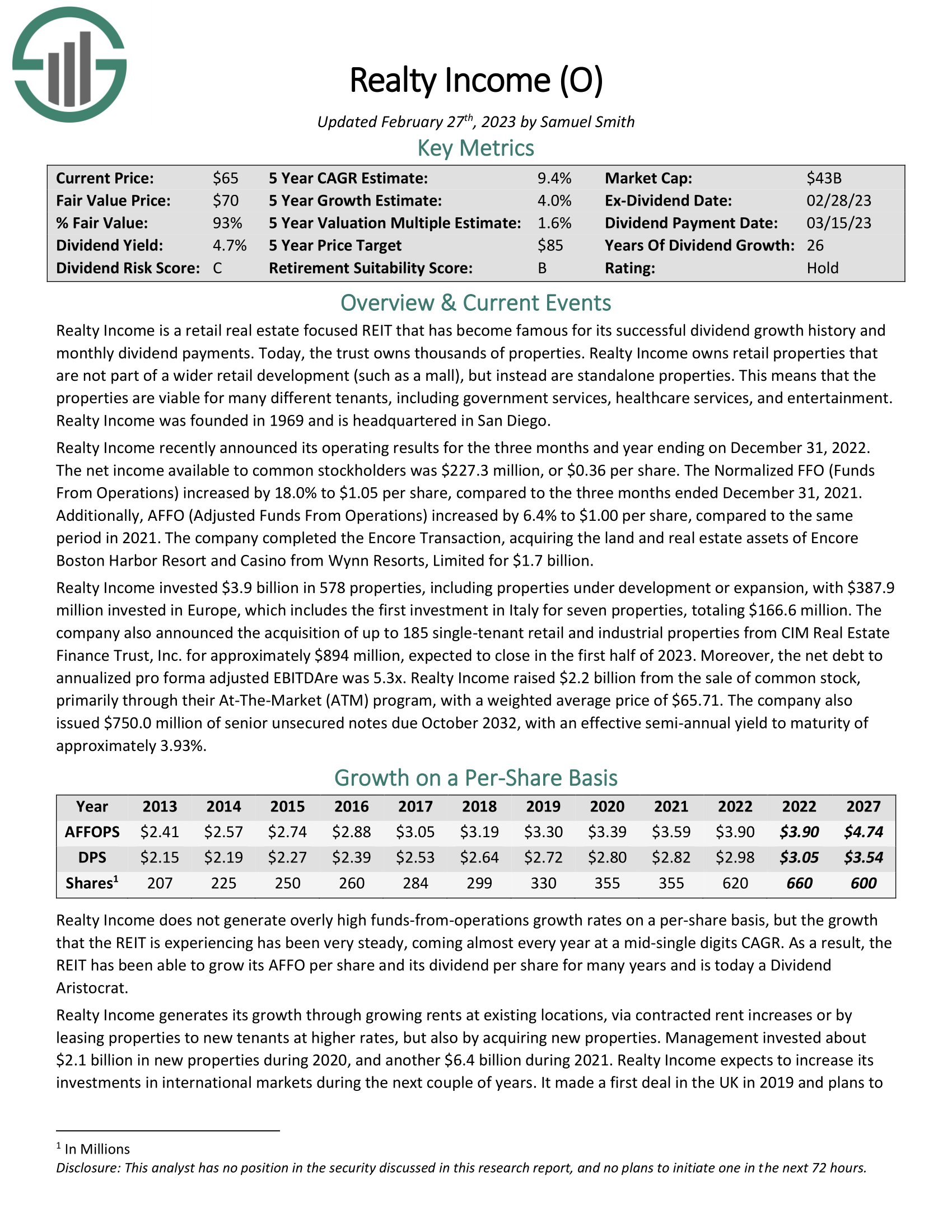

Hold Forever Stock #1: Realty Income (O)

Our final stock for consideration is Realty Income, which is perhaps the most famous monthly dividend paying stock. The trust prioritizes standalone properties that are not part of a wider retail development, such as a malls. Realty Income is one of the largest REITs in the market as it has a market capitalization of almost $41 billion.

Realty Income’s portfolio is one of the largest in the REIT sector.

Source: Investor Presentation

The sheer size of the portfolio is impressive as the trust has more than 12,000 properties spread out over every state in the U.S. as well as Europe. Realty Income has roughly 1,240 tenants from more than 80 industries. More than half of rents comes from investment-grade tenants while more than 90% of the tenants are non-discretionary, offer low price points, and/or operate in service-oriented retail. This makes these properties resistant to recessionary environments.

With a portfolio of this size, it might seem difficult to lease each individual property, but this has not been the case. Realty Income ended 2022 with a leased portfolio of 99%, its second highest figure in the last 20 years. The trust has never seen its occupancy portfolio dip below 96.9%, which is an excellent performance considering this includes several recessionary periods and a pandemic.

The top three industries are grocery stores, convenience stores, and dollar stores, which account for 10%, 8.6%, and 7.4%, respectively, of annualized rents. Dollar General is the largest tenant, but contributes just 4% of rents.

This diversification protects against potential weakness in several areas or several tenants. The trust’s remaining average lease term is 10 years, giving Realty Income plenty of clarity on where its rents will be coming from over the next decade.

This proved beneficial during 2020 when the Covid-19 pandemic was at its worst. The trust was able to still collect the vast majority of its rents.

Following this period, management undertook several strategic improvements to the core business. First, the trust merged with VEREIT, which held 4,000 single-tenant properties at the time, in November of 2021. This acquisition made Realty Income one of the largest property managers in the U.K. and Spain almost overnight. Previously, the trust had limited exposure to Europe. Now, the U.K. is the second largest region for Realty Income and accounts for nearly 8% of the total portfolio.

Just a few weeks later, Realty Income completed its spinoff of office property business, which were the weakest portions of the business during the worst of the pandemic, into Orion Office REIT Inc. (ONL). These two events improved the quality of the portfolio while expanding the trust’s areas of operation, leaving Realty Income in a much stronger position.

Realty Income has earned the title of “The Monthly Dividend Company”. The trust’s business model has enabled the trust to raise its dividend for 26 consecutive years, which is one of the longest dividend growth streaks in the REIT sector. This also qualifies the trust as a Dividend Aristocrat. The trust often raises its dividend several times per year. Most recently, the trust declared a monthly dividend that was 3.2% higher than the previous year.

Shares of Realty Income yield almost 5%. The forecasted payout ratio for 2023 is 78%, which would be the second lowest in the last decade for the trust. Therefore, we believe that Realty Income has a very safe and secure dividend.

Click here to download our most recent Sure Analysis report on Realty Income (O) (preview of page 1 of 3 shown below):

Final Thoughts

There are multiple benefits to owning stocks that pay monthly dividends, with regular distributions chief among them. However, there are a limited number of stocks that provide monthly income, limiting the investor’s choices. Further complicating matters is that not all companies that pay monthly dividends can be considered hold forever type of investments.

We believe that Agree Realty, STAG Industrial, and Realty Income are three exceptions to this as each has a sound business model that has supported dividend increases for at least a decade. These three names could be the most reliable of the monthly dividend payers, making them a possible investment for those looking for stocks to hold forever.

Related:

The Top 5 High Dividend ETFs Now

The 3 Critical Times To Sell A Dividend Stock