Africa is emerging as a vital destination for blockchain-based startup investment, as blockchain venture funding continues to rise globally. According to CV VC’s second African Blockchain Report 2022, African blockchain funding achieved a record 15% share of all sector-agnostic venture funds raised by the continent, more than double the global average.

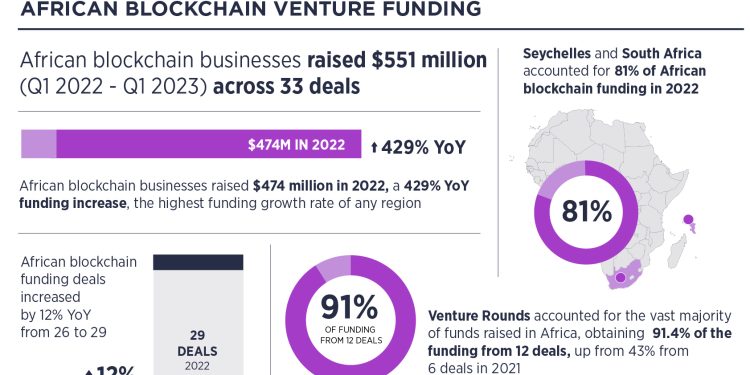

In 2022, African venture funding grew by 34% to $3.14 billion while global funding fell 35% to $415 billion. However, blockchain deals were an exception, with $26.8 billion raised globally, up 4%, and $474 million raised in Africa across blockchain deals, up 429%. This far outpaced the growth seen in general African venture funding (429% vs. 34%) showing over 12.5 times the level of growth on a year-on-year basis. Africa now represents 1.8% of all global blockchain funding, up from 0.3%. The Custody & Exchanges category was the highest-funded in Africa with a 52% share.

African Blockchain Funding By Nation

Africa is the only global region to have experienced increased venture funding and an explosion in blockchain-specific funding. The number of African blockchain deals grew by 12%, with significant interest in the areas of infrastructure, personal identification, record-keeping, and access to financial independence.

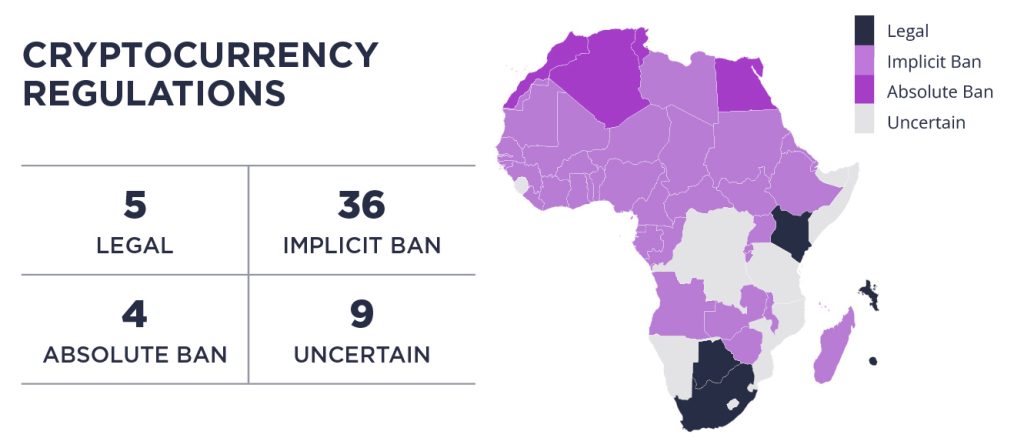

Nigeria leads the number of blockchain startups funded, followed by South Africa, Seychelles, and Kenya. The Custody & Exchanges category was the highest-funded in Africa with a 52% share, followed by Fintech (24%) and Infrastructure & Development (15%).

Despite economic and socio-political challenges, the global blockchain industry broke records yet again in 2022, with a total of 1,828 deals, representing an almost 30% increase from the previous year. Among global regions, Africa emerged as the most vigorous, with blockchain companies achieving the highest funding growth rate of the report’s globally assessed regions.