First Published on January 31st, 2023 by Aristofanis Papadatos for SureDividend

Chevron Corporation (CVX) is one of the largest and most well-known oil stocks in the world. It is also one of the most stable, having grown its dividend for 36 consecutive years with the most recent increase of 6%.

As a result, Chevron is a member of the exclusive Dividend Aristocrats – a group of 68 elite dividend stocks with 25+ years of consecutive dividend increases.

We believe the Dividend Aristocrats are some of the highest-quality dividend stocks in the entire stock market. With this in mind, we created a full list of all 68 Dividend Aristocrats, along with important financial metrics such as dividend yields and P/E ratios.

You can download a copy of our full Dividend Aristocrats list by clicking on the link below:

Due to the industry’s reliance on high commodity prices for profitability, there are just two energy stocks on the list of Dividend Aristocrats – Chevron and Exxon Mobil (XOM). Chevron’s dividend consistency and stability help it stand out in the otherwise-volatile energy industry.

This article will analyze the intermediate-term investment prospects of Chevron.

In this article

Business Overview

Chevron is one of 6 oil and gas supermajors, along with:

- BP (BP)

- Eni SpA (E)

- TotalEnergies (TTE)

- Exxon Mobil (XOM)

- Shell (SHEL)

Chevron is one of only two oil and gas supermajors to be headquartered in the United States, along with fellow Dividend Aristocrat Exxon Mobil.

Like the other integrated supermajors, Chevron engages in upstream oil and gas production, as well as downstream refining businesses. In 2019, 2021 and 2022, Chevron generated 78%, 84% and 79%, respectively, of its earnings from its upstream segment. It is thus highly sensitive to the prices of oil and gas, especially the price of oil.

All the oil producers were severely hurt by the coronavirus crisis in 2020 due to the unprecedented lockdowns and the resultant collapse of global oil consumption. Chevron was not an exception and thus it incurred an adjusted loss per share of -$0.20 in that year.

Fortunately, thanks to the massive distribution of vaccines worldwide, global oil consumption began to recover in 2021. In addition, oil producers have greatly benefited from the invasion of Russia in Ukraine and the resultant sanctions of the U.S. and Europe on Russia. Before the sanctions, Russia was producing about 10% of global oil output and one-third of natural gas consumed in Europe. Due to the sanctions, the global oil and gas markets became extremely tight last year and thus the prices of oil and gas skyrocketed to 13-year highs.

The benefit from these exceptionally favorable conditions was evident in the performance of Chevron in 2022. The oil major more than doubled its earnings per share, from $8.13 in 2021 to an all-time high of $18.83 in 2022.

The prices of oil and gas have moderated off their peak but remain above historical average levels. As a result, Chevron is expected to post earnings per share of about $15.00 this year. This level is lower than the blowout level in 2022 but it will mark the second-best performance in the history of the company if it materializes.

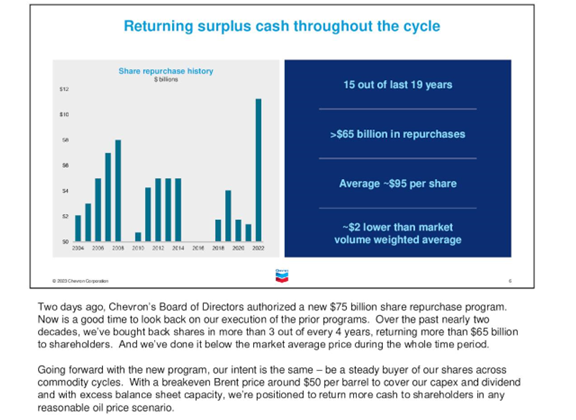

Thanks to its bright short-term outlook, Chevron announced a massive share repurchase program of $75 billion for the next few years. This amount is sufficient to reduce the share count by 22% at the current stock price. We are cautious of this unprecedented share repurchase program near the peak of the cycle of the oil industry.

On the other hand, Chevron boasts of having repurchased shares efficiently throughout its history.

Source: Investor Presentation

The oil major has spent more than $65 billion on share repurchases over the last 20 years, at an average stock price of $95. As the current stock price is nearly double this price, management feels vindicated for its execution. Nevertheless, we expect oil and gas prices to deflate in the upcoming years and thus we believe that share repurchases will enhance shareholder value much more at lower oil and gas prices, which will probably be accompanied by a lower stock price.

Growth Prospects

Chevron is one of the largest publicly traded energy corporations in the world and stands to benefit tremendously from elevated prices of oil and gas.

Chevron invested heavily in growth projects for years but failed to grow its output for an entire decade, as oil projects take several years to start bearing fruit. However, Chevron is now in the positive phase of its investing cycle.

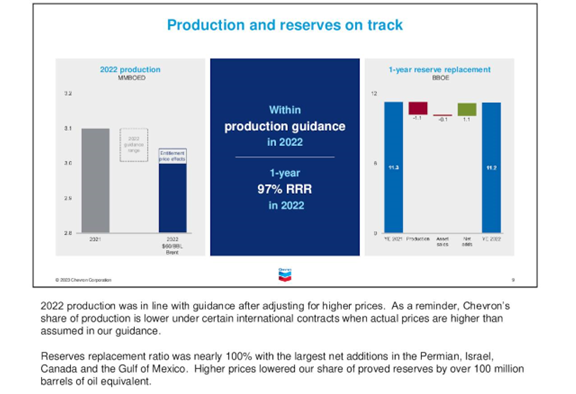

Chevron grew its output by 5% in 2017, 7% in 2018, 4% in 2019, 1% in 2020 and 0.5% in 2021. Its output dipped 3% in 2022 due to depressed investment during the pandemic but Chevron is likely to return to growth mode this year thanks to its sustained growth in the Permian Basin and in Australia. The company has more than doubled the value of its assets in the Permian in the last four years thanks to new discoveries and technological advances.

Chevron replaced 97% of its reserves in 2022. While this number is uninspiring from a long-term perspective, investors should be aware of the depressed investment levels of all the oil producers over the last three years due to the pandemic.

Source: Investor Presentation

Chevron has begun to boost its investment in growth projects and thus it is likely to return to growth mode this year. Management recently provided guidance for 0%-3% growth of production in 2023.

Chevron also learned its lesson from the previous downturn and now invests most of its funds on projects that begin delivering cash flows within two years.

However, we expect oil and gas prices to deflate in the upcoming years, primarily due to the record number of renewable energy projects that are being developed right now as a result of the energy crisis caused by the war in Ukraine. As a result, we expect the earnings per share of Chevron to decrease by 9% per year on average over the next five years.

On the other hand, the dividend should continue to grow, as the company continues its 30+ year streak of higher payouts. This does not necessarily mean that investors will receive a dividend boost each and every four quarters. There have been numerous instances when Chevron held the dividend steady for more than four quarters – with 2020-2021 being a prime example – and eventually increased it so that the year-over-year comparison showed improvement.

The important thing to note is that Chevron is committed to a growing dividend in all environments.

Competitive Advantages & Recession Performance

Chevron’s competitive advantage in the highly cyclical energy sector comes primarily from its size and financial strength. The company’s operational expertise allowed it to successfully navigate the 2020 coronavirus pandemic.

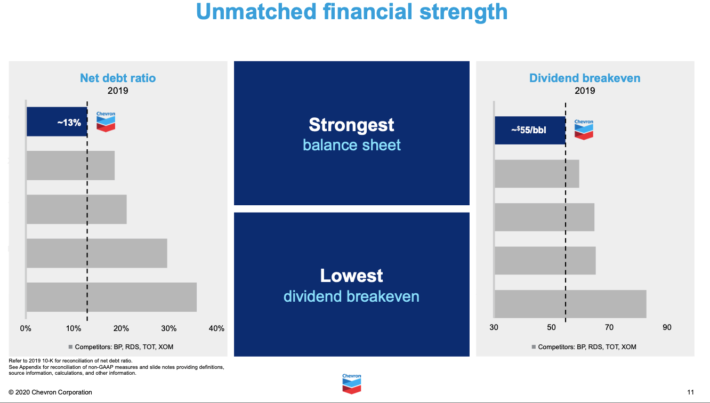

As a commodity producer, Chevron is vulnerable to any downturn in the price of oil, particularly given that it is the most leveraged oil major to the oil price. However, thanks to its strong balance sheet, the company is likely to endure the next downturn, just like it has done in all the previous downturns.

Chevron’s aggressive cost-cutting efforts have helped the company become more efficient. Chevron has continued to reduce drilling costs, significantly reducing its break-even expense.

In fact, today Chevron claims to be the best-positioned for commodity price uncertainty, as it boasts one of the lowest cash flow break-even prices among its major oil counterparts.

Source: Chevron 2020 Security Analyst Meeting

Chevron stacks up well among its peers in the energy sector. However, the company is certainly not the most recession-resistant Dividend Aristocrat, as evidenced by its performance during the 2007-2009 financial crisis:

- 2007 adjusted earnings-per-share: $8.77

- 2008 adjusted earnings-per-share: $11.67 (33% increase)

- 2009 adjusted earnings-per-share: $5.24 (-55% decline)

- 2010 adjusted earnings-per-share: $9.48 (81% increase)

Chevron’s adjusted earnings per share declined by more than -50% during the 2007-2009 financial crisis, but the company did manage to remain profitable during a bear market that drove many of its competitors out of business. This allowed Chevron to continue raising its dividend payment throughout the Great Recession. Chevron’s dividend safety is far above the average company in the energy industry.

Valuation & Expected Total Returns

Chevron’s expected total returns are more difficult to assess than many other companies. This is primarily due to the highly volatile results of the company, which result from the dramatic swings of the prices of oil and gas.

With a share price near $174, the price-to-earnings ratio presently sits at 11.6 times based on 2023 expected earnings of $15.00 per share. If the stock were to revert to our fair value estimate of 14 times earnings, this would imply a 3.8% annualized valuation tailwind.

Moreover, the stock is offering a 3.5% dividend yield. However, the valuation tailwind and the dividend are likely to be offset by the expected 9% average annual decline of earnings per share. Overall, the stock can be reasonably expected to offer a -1.4% average annual return over the next five years off its nearly all-time high current stock price.

Final Thoughts

Chevron is one of the rare oil and gas companies that was able to navigate through the Great Recession of 2007-2009, the oil downturn of 2014-2016, and the COVID-19 pandemic without cutting its dividend.

It has even managed to grow its dividend lately, including a 6.3% increase in 2019, an 8.4% increase in 2020 and a 6.0% increase in each of the last three years, including 2023. As a result of Chevron’s lower cost structure, it can now handle a much lower average price of oil. Furthermore, new projects in the U.S. and international markets will help the company continue to grow. Nevertheless, as we are near the peak of the cycle of the oil industry, which is infamous for its dramatic swings, Chevron should probably be avoided around its current stock price.

This article was first published by Aristofanis Papadatos for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

Top 20 Highest-Yielding Small Cap Dividend Stocks Now

10 Regional Banks To Buy After The Collapse Of Silicon Valley Bank