Verto, London-based and authorised by the UK FCA as an Electronic Money Institution, has launched 100% Safeguarded USD accounts that see funds deposited held in protected accounts.

Following the recent Bankruptcy of Silicon Valley Bank (SVB), startups and tech enterprises across the globe have been scrambling to find Bank accounts that can provide them with assurances their assets remain protected in the event of a financial shock. Several Y-Combinator backed fintechs have stepped up their support, including Brex and Mercury in the US that have increased their provision to protect up to $2.25M and $3M of deposited funds respectively.

However, Verto has taken an unprecedented step to support startups and enterprises in the African ecosystem by offering Safeguarded USD accounts with up to 100% protection. These funds are ring fenced and are forbidden from being lent out, which is in contrast to the practice of traditional banks.

This enhancement offers levels of protection not seen before for African startups, enterprises and VCs that hold international currencies and ensures that their finances are always safe, secure and accessible, despite the wider financial environment.

“The collapse of Silicon Valley Bank (SVB) is unprecedented and we’ve been overwhelmed by businesses and VCs reaching out to ask how we can support them. In times like these we believe an unprecedented response is necessary. We’re proud to support global giants including Maersk, MTN and Interswitch. However, believe Africa’s unicorns of tomorrow deserve protection as well.

Making 100% Safeguarded USD accounts available for African startups and enterprises was not easy, but our team has worked tirelessly over the past few days to make it happen. We would also like to thank our global tier-1 partner banks for responding to our calls to support the African ecosystem.” said Verto Co-founder and CTO Anthony Oduu

Verto services half of Africa’s tech unicorns and this is another conscious step from the business towards ensuring that African startups are given World-class protection and tools to succeed.

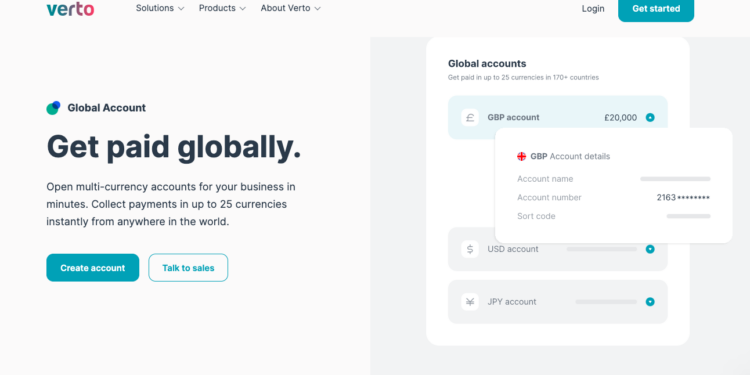

In addition to its enhanced safeguarding capabilities, Verto gives businesses the ability to receive and hold 50 local currencies including USD, GBP, NGN and KES alongside access to market leading Foreign Exchange rates (<1% mark ups), making it cheaper for companies to manage their currencies.

With instant cross-border payment settlement times with their wallet product and the ability to open an account online from anywhere in the world, Verto is on a forward charge towards making banking accessible and easy for all global African businesses, with its suite of products used by MTN, Jumia, Maersk and Interswitch.

Verto Co-founder and CEO Ola Oyetayo adds “As CEOs, it is our responsibility to ensure that our companies are well-positioned to navigate any potential financial crisis that may arise. In times of increased volatility, speculation, and uncertainty, prioritising safeguarding and protective measures for our business is more important than ever.”

To fast track your application visit www.vertofx.com/Local-Account/USD/VertoSVB or for additional information reach out to Co-founder Anthony on [email protected].

ALSO READ; What is a venture holding company? Revolutionizing the landscape of venture investment in Africa