Rwanda’s central bank raised interest rates to the highest level since 2014 as it sees inflation remaining in double digits in the first half of the year.

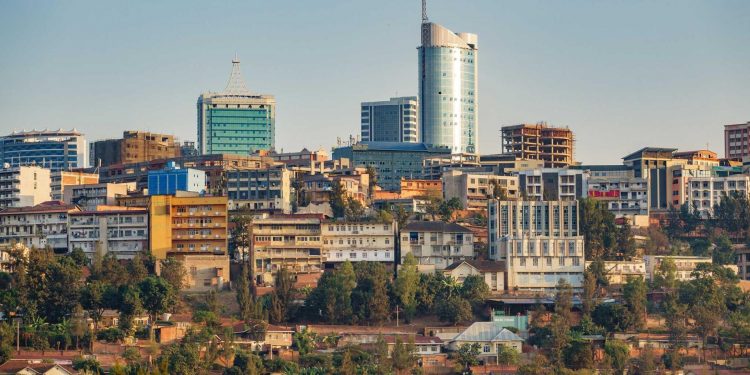

The monetary policy committee lifted the key rate to 7% from 6.5% because of prevailing economic conditions and to continue the fight against inflationary pressures that are affecting consumers’ purchasing power, Governor John Rwangombwa said in the capital, Kigali, on Thursday.

Annual urban inflation in Rwanda slowed for a second straight month to 20.7% in January and has been at more than double the 8% ceiling of the central bank’s target range since September.

While the MPC sees the inflation curve turning, the rate is only expected to converge below the ceiling by the fourth quarter, according to Rwangombwa.

Price pressures in the East African nation have been fueled by adverse weather affecting agricultural production, high farm input costs, more expensive imports due to Russia’s invasion of Ukraine and a stronger dollar.

The Rwandan franc has weakened almost 2% this year against the greenback.

Read also; Rwanda Central Bank Raises Lending Rate to 6.5%.