First Published on January 5th, 2023 by Nathan Parsh for SureDividend.

At Sure Dividend, we believe that purchasing shares in high-quality companies is the best way to amass wealth.

The term “quality” can mean different things to different people, but to us, it means dividend-paying stocks with long histories of rewarding shareholders with rising distributions. Companies with long histories of dividend growth have enduring business models that can provide for dividend increases even when economic conditions are difficult.

This is why we believe so strongly that investors should consider owning shares of the companies that make up the Dividend Aristocrats, which are those companies that have raised their dividends for at least 25 consecutive years.

Membership in this group is so exclusive that just 65 companies qualify as a Dividend Aristocrat. You can see all of the Dividend Aristocrats here:

While much discussion that takes place here is based on why investors should consider a specific stock, there are other important factors to consider when investing. Every investor has or should have, criteria when evaluating a stock for purchase. This includes the underlying company’s business model or its ability to thrive in a recession.

One such question that we feel should also be considered when making an investment is, “does the stock offer a good dividend yield?” Because many dividend growth investors plan to use the income produced by their portfolio to at least partially pay for retirement expenses, we believe that this is a very important question that should be answered before investing in the stock.

This article will explore this question in further detail.

In this article

What is a Good Yield?

The short answer is that a good yield depends on several factors. While the actual yield is an important consideration, a lot more goes into assessing if the yield is good. A high yield that is in danger of being cut isn’t a good yield, far from it. On the other hand, a low yield that is well-covered and safe from being cut could be considered reasonable.

Several other factors will help determine a good yield for each investor. This includes items such as income needs, time horizon, and dividend growth rates.

Investors picking individual stocks probably would prefer to have their portfolio have an average yield that at least matches the S&P 500 Index; otherwise, indexing investing is a solid alternative.

Currently, the index has an average yield of 1.7%. So, an average portfolio yield of at least 2% is tenable. Lower-yielding stocks tend to have higher growth rates as well.

For example, Microsoft Corporation (MSFT) yields 1.1% even after shares fell almost 29% last year, but the company’s dividend has a compound annual growth rate of more than 13% over the last decade. While high growth rates eventually tend to subside as the base dividend grows, Microsoft is still raising its dividend at a high rate as it announced a 9.7% increase for the December 8th, 2022 payment date.

At the same time, you should be mindful of incredibly high yields, as this can indicate issues with the business model. Deteriorating fundamentals can result in a dividend cut.

To be on the safe side, selecting stocks that average between 2% to 6% allow investors to construct a portfolio of stocks providing more income than the market index. Stocks having too high of a yield might signal that the dividend is in danger of being cut or eliminated.

Examples of Good Yields for Different Types of Investors

Younger investors likely have more years until retirement and can, therefore, be more selective in the names that they include in their portfolios. Not needing just high-yielding stocks allows them to invest in companies that dominate their respective industries and have solid fundamentals but provide lower immediate income.

One name matching this criteria would be Visa Inc. (V), which is the global leader in digital payments, but yields just 0.9%. At this stage, Visa is much more of a growth name than an income name and is primarily owned by investors for its capital gains. The dividend, in this case, is a small part of the total return.

Lower-yielding but higher dividend growth stocks can help compound income growth faster if done over a long period. A portfolio averaging a 2% yield and 10% dividend growth will provide more income than a 4% yielding portfolio growing dividends at a rate of 5.0% within 15 years. For investors just entering the workforce, 15 years is likely less than half of their career. They can afford to wait for the disparity in income to change as they might be more inclined to invest in higher-growth companies.

Income might not be the top priority in the early stages of retirement planning, as younger investors may have a preference for total returns. For these investors, stocks with lower yields can be appealing if they have the potential for capital gains and dividend growth.

On the other hand, an investor nearing retirement or one that is starting to save at a more advanced age may require higher-yielding securities. In this scenario, the investor doesn’t have the luxury of time and has a greater need for stocks offering higher yields at the present time. Typically, higher-yielding securities come with lower dividend growth rates.

Take Verizon Communications (VZ). The telecommunications company is one of the largest wireless carriers in the marketplace. The stock yields a generous 6.3%, but the dividend has compounded at approximately just 2% over the last decade.

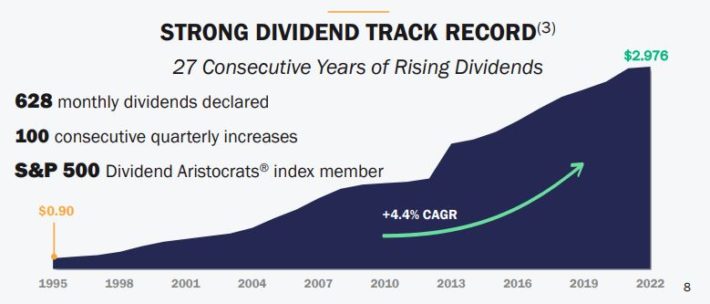

Lower growth rates can still be effective in creating wealth. Realty Income Corporation (O) is often referred to as the Monthly Dividend Company because it has made monthly dividend payments to shareholders since its initial public offering in 1994. The trust’s dividend has a compound annual growth rate of just over 5% over the last decade and 4.4% since the IPO.

That said, the dividend growth over the long term has been impressive.

Source: Investor Presentation

Investors looking to split the difference and find a stock offering a market-beating yield and double-digit dividend growth can also find names to invest in.

A good example of this would be The Home Depot, Inc. (HD), which operates more than 2,300 home improvement stores in the U.S., Canada, and Mexico. Shares of the company yield 2.4%, solidly ahead of what the S&P 500 Index offers. In addition, the dividend has a compound annual growth rate of more than 17% over the last five years. In November, the company continued its streak of aggressive dividend raises, increasing its payment by more than 15%.

What a Stock’s Yield Can Tell Investors

A stock’s yield can provide clues to the investor on the state of the company, as a stock offering a higher-than-usual dividend yield can reveal some issues with the company’s business model.

Perhaps the most obvious recent instance of this is AT&T Inc. (T). Up until recently, AT&T had been a darling of the income investor circles as the company had increased its dividend for 36 years. Yearly dividend increases were very low, often a penny per quarter per year, but that didn’t matter much when the stock had a high yield.

The past few years had seen the dividend climb higher than it had been over the long term, including averaging a yield of 7.4% for 2021. This compares to the average yield of 5.6% for the prior decade.

AT&T held the dividend constant for nine quarters even as free cash flow generation had remained fairly strong. Then, the company announced on February 25th, 2021, that it was merging its media assets with Discovery to form Time Warner Discovery (WBD). Because these assets provided significant free cash flow, the dividend in its current form was no longer viable.

As a result, shareholders saw their dividend cut nearly in half in early 2022. The ensuing decline since the dividend cut has meant that shares of AT&T still yield a robust 6%. The higher-than-usual yield, coupled with the dividend payment held constant for nine consecutive quarters, was a sign for investors concerned with total returns to exit their position in AT&T.

At the same time, dividend yields can also help identify undervalued stocks, which could allow the investor to capture income and capital gains from buying a name at a much lower price.

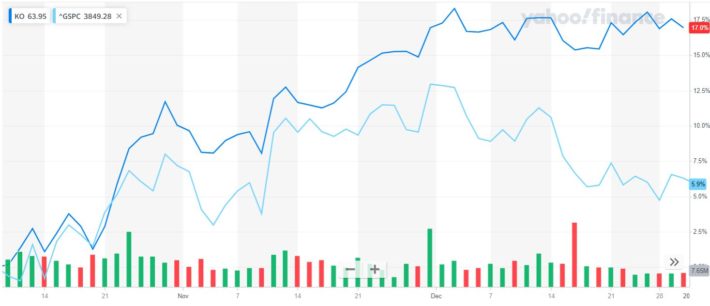

The Coca-Cola Company (KO) is an excellent example of this. The stock has averaged a yield just above 3% over the last decade. Purchasing shares of the company when the yield was at or above this level has made for a smart investment decision several times during this time period.

Most recently, Coca-Cola hit a 52-week low of $54.02 on October 10th, 2022, when the stock yielded 3.3%. Nothing specific with the company had occurred to cause the decline as the low was likely induced by market-wide factors such as the Federal Reserve raising interest rates and inflationary pressures. However, Coca-Cola would report revenue and earnings-per-share that topped expectations just two weeks later, showing that the company’s business was performing at a high level.

Had you bought the stock at the low, you would’ve seen impressive returns in a short period of time.

Source: Yahoo Finance

Buying Coca-Cola at the low and holding through the end of 2022 would have provided a capital gain of nearly 18% through the end of the year. For context, the S&P 500 Index was up less than 6% during this time.

In the case of Coca-Cola, the company’s business fundamentals hadn’t changed and were, in fact, quite strong. Investors had been presented with an opportunity to take advantage of the market’s mood, lock in a higher-than-usual yield, and see strong returns over the last few months of 2022.

Final Thoughts

A good dividend yield means different things to different investors. Each investor needs to determine their own situation. Would they prefer higher levels of income now, do they want to own higher growth dividend names, or is a combination of income and growth their preferred investment strategy.

Most investors prefer a safe dividend, first and foremost, regardless of the investment philosophy. Higher than usual yields can show that the company is facing a major headwind in its business. Higher yields can also be a sign of an undervalued stock. If nothing has changed with the company, the yield could mean the stock is trading near its low.

Therefore, a “good yield” is determined by your personal situation and investment strategy.

This article was first published by Nathan Parish for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

7 Best Water Stocks Buys Now | 2023 List Of All 56 | Profit From Clean Water

Top 20 Highest Yielding Monthly Dividend Stocks Now | Yields Up To 21.7%

All 43 Agriculture Stocks List For 2023 | The Best 7 Buys Now