Largest Insurance company by market capitalization on the Nairobi Securities Exchange, Jubilee Holdings, released their full year earnings for the period ending 31 December 2016. Here is a brief analysis of the same:

Revenues

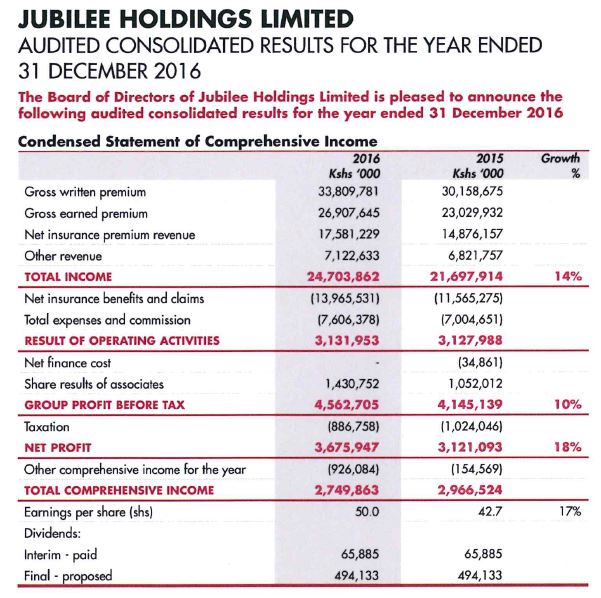

Jubilee’s total income shot up by 14% to Ksh 24.7 billion in 2016 compared to Ksh 21.7 billion recorded in the previous financial year. This increase in revenues were boosted up by an impressive 59% increase in the group’s life business, a 36% increase in individual life business and a 16% increase in the medical insurance business.

Operating Expenses

Net insurance benefits and claims went up by 20.75% to Ksh 13.96 billion in 2016 compared to Ksh 11.57 billion recorded in 2015.

Other expenses and commissions were up by 8.6% to Ksh 7.6 billion in 2016 compared to Ksh 7.0 billion in 2015.

Profits

The insurance company’s profit before tax was up by 10% to Ksh 4.56 billion in 2016 compared to Ksh 4.14 billion in 2015. Net profits went up by 18% to Ksh 3.67 billion in 2016 compared to Ksh 3.12 billion in 2015 aided by a lower taxation pay in 2016.

Dividends

The directors of Jubilee holdings recommended a final dividend of Ksh 7.50 per share effectively making it to a total dividend of Ksh 8.50 per share paid out in 2016. Dividend payment will be made on 11 July 2017 and the shares register will be closed on 22 May 2017.

Bonus Issue

The company further recommended a bonus issue of 1 additional share for every 10 shares held subject to approval by the company’s shareholders on 22 May 2017.

Share Price

Jubilee last traded price on the NSE was Ksh 473.00 per share.

Shareholders

Jubilee’s largest shareholder is The Aga Khan Fund for Economic Development SA holding a 37.98% stake.

Some notable institutional shareholders in Jubilee are:

- Evli Fund Management Co. Ltd. (ranked the best institutional fund manager in Finland in 2016 by SFR i.e Scandinavian Financial Research Ltd) – 100k shares (as at 28 Feb 2017)

- Blakeney LLP – 68.94k shares (as at 30 June 2016)

- Driehaus Capital Management LLC – 30.3k shares (as at 31 Jan 2017)

- Stanlib Asset Management – 3.7k shares (as at 31 Mar 2016)

Sources: (Jubilee Insurance, Kenyan Wall Street, FT, NSE)