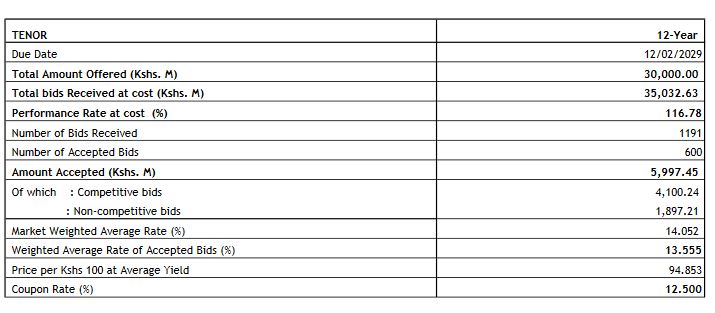

The Central Bank of Kenya on 28th Feb 2017 offered a Ksh 24 billion Tap Sale on the twelve year amortized infrastructure bond. This came after the initial sale where the bank only accepted Ksh 5.997 billion from the Ksh 30 billion on offer, interestingly bids came in at Ksh 35 billion with a weighted market average of 14.052 percent of which the majority bids were rejected by the bank possibly due to bidding of higher yields from investors.

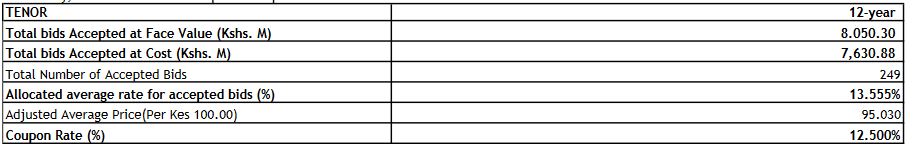

The results of the extended bond sale which closed on 2 March 2017 came in and the bank was able to accept Ksh 8.050 billion at face value and Ksh 7.630 billion at cost. This brings the amount raised in the tap sale to Ksh 15.681 billion. The average rate for accepted bids came in at 13.555 percent.

Effectively the total amount raised from the bond auction comes in at Ksh 21.679 billion missing the target by roughly 27 percent. The funds are to be used for infrastructure projects in the roads, energy and water sectors. The bond has a coupon of 12.5 percent and is Tax Free.

Source: (Central Bank of Kenya, Kenyan Wall Street)