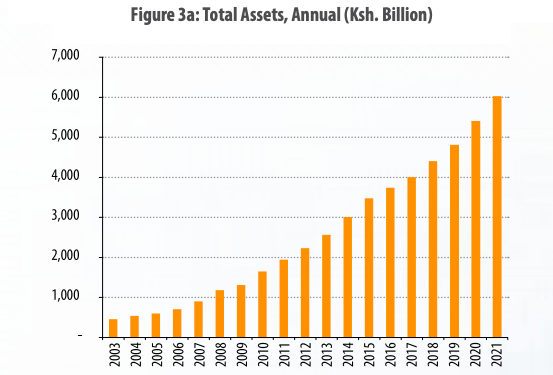

Kenya’s banking industry total assets grew in 2021 by 11.4% to Ksh 6.0 Trillion from Ksh 5.4 trillion in 2020, driven mainly by growth in investments in government securities and private sector gross loans that together account for 78.3% of the total assets.

According to the Kenya Bankers Association’s (KBA) State of the Banking Industry (SBI) Report 2022, the industry’s overall profitability recovered, as average return on assets and return on equity went up to 3.3% and 22.1%, from 2.0% and 13.3% in 2020, respectively.

The lobby said the improved profitability reflected recovery of the economy from the depressing effects of the pandemic.

KBA Chief Executive Officer, Dr. Habil Olaka noted that banking sector has adequate liquidity and sufficient capital positions that allowed banks to support other sectors with loan restructures and continued loan extension.

Banking Industry Ratios and Deposits

The report further showed that the banking industry’s total and core capital adequacy ratio were strong at 19.5% and 16.5% in 2021 compared to 19.0% and 16.6% in 2020; both above the statutory minimum requirements of 14.5% and 10.5% respectively.

Total deposits grew by 12.2% to Ksh 4.6 trillion in 2021 while asset quality improved slightly, with the ratio of gross Non-Performing Loans (NPLs) to gross loans declining to 14.1% from 14.5% at end 2020. Non Performing Loans grew to Ksh. 460 billion up from Kshs. 436 billion as at end 2020.