Updated on April 28th, 2022 by Bob Ciura for SureDividend

We invest to compound our wealth over time. Unfortunately, too many people are in a big hurry to multiply their investments. Over-ambition leads to excessive risk – and counter-productively – lower returns.

The ‘secret’ that many of the world’s best investors know is that investing for quick returns tends to lead to poor long-term performance. Focusing on long-term investing frames investments in a way that makes wealth compounding much more likely.

“The single greatest edge an investor can have is a long-term orientation.”

– Seth Klarman

When Seth Klarman – one of the world’s best investors and self-made billionaire – says that the single greatest edge you can have as an investor is a long-term orientation, I pay attention.

We recommend that investors looking for the best long-term investments start with the Dividend Aristocrats, a group of 66 stocks in the S&P 500 Index, with 25+ consecutive years of dividend increases.

You can download the full list of all 66 Dividend Aristocrats below:

Click here to download your Dividend Aristocrats Excel Spreadsheet List now.

So what exactly is long-term investing?

Long-term investing is the process of buying and holding investment securities you believe will compound investor wealth indefinitely into the future. Long-term investing requires a patient, disciplined mindset.

“Long-term investing is about character, about depth of vision and the cultivation of patience, about who you are and who you’ve made yourself to be”

– Lowell Miller, The Single Best Investment, page 149

This guide covers why and how long-term investing works to compound your wealth over time.

In this article

Table of Contents & Video Analysis

You can skip to a particular section of this article using the links below. Alternatively, scroll past the table of contents to watch a detailed video analysis on long-term investing.

- Why Be A Long-Term Investor?

- Long-Term Investing Quotes From The World’s Best Investors

- The Simple 4 Step Long-Term Investing Strategy

- Long-Term Investing Calculator

- Slow Changing Industries For Long-Term Investors

- Critical Tips For Long-Term Investors

- Final Thoughts

Why Be A Long-Term Investor?

There are 3 primary reasons to become a long-term investor:

- It is highly effective, and very likely to result in meaningful wealth creation.

- It requires less of your time, freeing you of constantly watching the markets.

- It reduces taxes and fees, keeping more money in your account to compound.

On The Effectiveness of Long-Term Investing

Long-term investing is successful because it puts your focus on what mattersfor the success of a business. If you invest for the long-run you will focus on businesses with strong and durable competitive advantages.

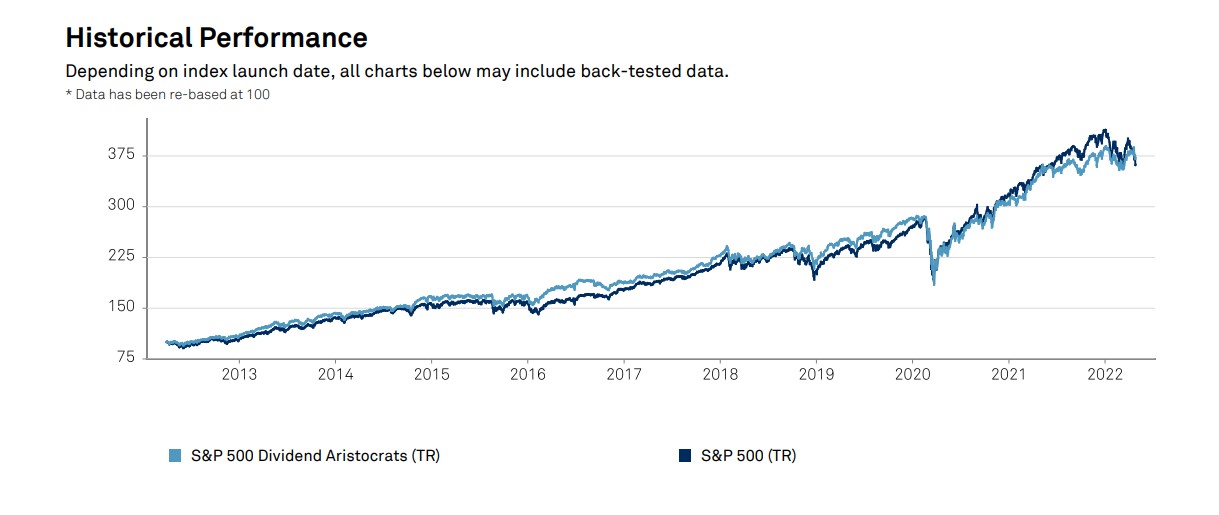

Importantly, dividend paying businesses with strong competitive advantages have historically outperformed the market over time. The Dividend Aristocrats are an excellent example…

The Dividend Aristocrats Index is made up exclusively of S&P 500 stocks with 25+ years of rising dividends that meet certain minimum size and liquidity requirements. There are currently just 66 Dividend Aristocrats.

The Dividend Aristocrats have generated annualized total returns of over 14.1% per year over the last decade. The S&P 500 has generated annualized total returns of 14.6% over the same time period.

However, the Dividend Aristocrats have exhibited lower risk than the benchmark, as measured by standard deviation. This has led to much closer risk-adjusted returns for the Dividend Aristocrats relative to the broader market in the past 10 years.

Source: S&P Fact Sheet

Investing with a long-term mindset focuses you on what really matters for long-term investing success. An additional benefit of long-term investing is a reduction in both taxes and fees versus higher turnover strategies.

On Reducing Taxes & Fees

Every time you buy or sell a stock you incur transaction costs. Buying and holding indefinitely reduces fees. Brokerage fees and slippage add up to reduce your returns over time. Every dollar taken out of your account is a dollar not building long-term wealth for you.

Having fewer transactions is especially important in taxable accounts due to capital gains taxes. When you hold a stock that has appreciated you have capital gains that are ‘built up’.

Selling triggers a taxable event; a portion of your built up capital gains must be paid to the government. By not selling the money you would’ve paid in capital gains taxes is left to compound in your account, working for you instead of going to the government.

The compounding of money that would’ve been paid out as capital gains tax has a powerful effect on your investments over time.

Time matters with investing; the more time your investments have to compound, the better. At the same time, all other things being equal, the less time you spend focusing on investing the better (assuming you like spending your time and energy on more than the stock market).

On Requiring Less Time

Time is money. The purpose of life is not to manage your investments…

Long-term investing requires less of your time. Your work is done when you buy a high quality stock you believe will maintain its competitive advantage indefinitely.

All you have to do is periodically check in on the company to make sure it is performing reasonably well.

How often do you need to check in? Quarterly is more than enough in most cases.

You don’t have to find other quality investments tomorrow, next week, or even next year… The money you’ve invested is safely compounding away. That’s powerful.

Long-term investing also insulates you from caring what the market does today, tomorrow, next week, or next month. With a long-term perspective, short-term fluctuations don’t matter. This goes a long way in helping you to stop paying so much attention to your stocks.

Many of the world’s best investors are advocates for long-term investing. The 7 long-term investing quotes below give more perspective on what successful investors think about long-term investing.

7 Long-Term Investing Quotes

The quotes below will give you peace of mind knowing that many of the greatest investors in history endorse long-term investing.

Seth Klarman is founder of the Baupost Group hedge fund. His current net worth is around $1.5 billion. Klarman is not the only person to discuss the advantages of long-term investing.

Philip Fisher is the pioneer of growth investing and author of Common Stocks and Uncommon Profits.

Warren Buffett is the founder of Berkshire Hathaway (BRK.A). His current net worth is around $120 billion.

Warren Buffett is the most well-known advocate of long-term investing. He has amassed a portfolio of dividend stocks with strong competitive advantages.

This quote quickly conveys Warren Buffett’s investment horizon. He is not a short-term investor, far from it.

Buffett does not constantly check in on his securities. Instead, he lets them work for him by accruing the benefits of growth over time.

Jesse Livermore was one of the most successful stock traders of all time. While he did not practice true long-term investing, the quote above shows his adherence to the idea of letting winners compound.

Peter Lynch is one of the most successful institutional investors of all time. He managed the Magellan Fund at Fidelity between 1977 and 1990 and generated compound returns of 29.2% a year.

The Simple 4 Step Long-Term Investing Strategy

The strategy long-term investors follow is straight-forward:

- Identify companies with strong competitive advantages

- Be sure these companies’ competitive advantages will last

- Invest in these companies when trading at fair or better prices

- Hold these for the long-run

This 4 step-process greatly reduces the field of stocks that investors have to choose from.

There are a few ‘shortcuts’ to quickly find businesses with strong and durable competitive advantages. One place to find these stocks is the previously mentioned list of all 66 Dividend Aristocrat stocks.

Another place to find high quality businesses suitable for long-term investing is the Dividend Kings List. The Dividend Kings list is comprised exclusively of businesses with 50+ years of consecutive dividend increases. There are only 44 Dividend Kings.

You can download a free list of all 44 Dividend Kings (along with important financial ratios such as dividend yields and P/E ratios) by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

Parts 1 and 2 of this strategy are typically satisfied by investing in Dividend Aristocrats or Dividend Kings. It is important to do our due diligence after finding an Aristocrat or King to verify the company is likely to keep its competitive advantage going forward.

Step 3 of this strategy is to invest in these businesses only when they are trading at fair or better prices.

To find if a company is trading at ‘fair or better prices’, a few financial ratios and metrics are important.

The first is the company’s price-to-earnings ratio.

If the company is trading below:

- The market price-to-earnings ratio

- Its peer’s price-to-earnings ratio

- And its 10 year historical average price-to-earnings ratio

It is likely undervalued. These 3 relative price-to-earnings ratios will help to paint a picture of if a stock is ‘in favor’ or ‘out of favor’.

As a general rule, it’s best to buy great businesses at a discount – when they are out of favor.

You can see the current and long-term S&P 500 average price-to-earnings ratio on Multpl.com. You will note that the market is currently historically overvalued. The value of the market as a whole does not say anything about the value of a single specific stock. There are still high quality businesses trading at a discount today.

Finviz provides peer price-to-earnings ratios for thousands of stocks for free. It’s a great tool for a quick check of the price-to-earnings ratio or other valuation tools. With that said, it’s important to dig beyond Finviz and verify the data. Most screeners (including Finviz) use GAAP earnings, which can be prone to certain one time fluctuations that don’t accurately show the true earnings power of a business.

Value Line is Sure Dividend’s preferred data provider for single company analysis. Value Line’s 1 page analysis sheets show long-term historical price-to-earnings ratios for individual stocks.

Tip: If you are in the United States, ask your public library how to access Value Line for free.

Another good metric to look at for determining value is a company’s expected payback period.

Payback period is calculated using an expected growth rate and a stock’s current dividend yield. The higher the dividend yield and expected growth rate, the lower the payback period. The payback period is the number of years it will take an investment to pay you back. Obviously, the lower the payback period, the better.

Long-Term Investing Calculator

The power of long-term investing comes from the compounding of wealth over time.

Each year your gains from previous years will compound along with your principal. Over time this results in phenomenal capital growth.

Just how much will your investment account grow?

Obviously predicting the future is impossible. You can however estimatefuture wealth growth using just a few assumptions.

To calculate the long-term value of an investment, use the quick and easy Excel spreadsheet calculator below.

Click Here to Download the Long Term Investing Calculator

The calculator uses dividend yield and expected growth rate to calculate the long-term total returns of an investment.

Slow Changing Industries for Long-Term Investors

The biggest risk in investing is that the business you invest in goes bankrupt. This is a 100% loss of your investment.

Progress inevitably leads toward changes in the market. Old business models fail, and new models succeed.

Not all industries are created equally, however. There are some industries that change much slower than others. These industries are best suited for long-term investing.

The entire consumer staples sector is ripe for long-term investing. Food and beverage companies in particular are able to maintain their competitive advantages almost indefinitely.

People will always need to eat and drink.

8 out of the 66 Dividend Aristocrats are in the food and beverage industry.

- Sysco (SYY)

- PepsiCo (PEP)

- Coca-Cola (KO)

- McDonald’s (MCD)

- Hormel Foods (HRL)

- Brown-Forman (BF.B)

- McCormick & Co. (MKC)

- Archer-Daniels-Midland (ADM)

Interestingly, six of the eight (ADM and SYY are the exception) make their money from branded consumer food and beverages products. If you are looking for a slow changing businesses that grow year after year, branded food companies are a good place to search.

What happens when you eat too much unhealthy branded food and beverage products?

You need health care.

The health care industry will continue to grow as global populations rise and age. Growing prosperity means more income can (and will) be spent on health.

The following companies are Dividend Aristocrats whose revenue is generates primarily in the health care sector:

- AbbVie (ABBV)

- Medtronic (MDT)

- Walgreens (WBA)

- Cardinal Health (CAH)

- Becton Dickinson (BDX)

- Johnson & Johnson (JNJ)

- Abbott Laboratories (ABT)

- West Pharmaceutical Services (WST)

Not to be outdone by the food and beverage industry (or perhaps due to negative health effects from the food and beverage industry) the health care sector counts 8 Dividend Aristocrats in its ranks.

They operate in more diverse lines of business than the food companies.

Cardinal Health distributes pharmaceuticals and other medical supplies.

Medtronic and Becton Dickinson manufacture and distribute health care devices and supplies.

Abbott Laboratories and Johnson & Johnson are well diversified health care businesses.

AbbVie was recently spun-off from Abbott Laboratories (notice the vaguely similar names), and is a pharmaceutical company.

West Pharmaceutical Services manufactures and sells medical packaging and medical components. Products include automatic medication delivery systems and medicine injection solutions, among others

There has been much debate about the role of insurance in health care in the United States over the last decade.

The insurance industry is among the slowest changing of any industry.

Big data and cheap information has not reduced the earnings power of insurance companies.

Technology enhances insurance, as it allows actuaries to more precisely determine risks. The following companies are in the insurance industry and are Dividend Aristocrats:

- Cincinnati Financial (CINF)

- AFLAC (AFL)

- Brown & Brown (BRO)

- Chubb (CB)

The reason there are only 4 insurance companies that are Dividend Aristocrats is not because the insurance industry has gone through tremendous changes.

Rather, the insurance industry is highly competitive. It takes an exceptionally well run business to outmaneuver its competitors in the insurance industry. The four companies above have done just that for more than 25 years.

The advantage of investing in businesses from slow changing industries is that you can sit back and watch your investment grow over time. You do not have to constantly check and make sure the business in which you have invested has not faltered.

Great businesses in slow changing industries can compound wealth at above market rates for decades at a time. Great businesses in mediocre industries will eventually succumb to the competitive forces and poor economics of their respective fields.

Poor businesses in great industries are pushed out of business by great businesses. Finally, poor businesses in poor industries make generally terrible long-term investments.

Identifying which industries offer the best chance of long-term outperformance can increase your odds of generating above average stock returns.

6 Critical Tips for Long-Term Investors

This section covers several tips to increase your odds of long-term investing success.

Tip #1: Long-Term Investing is Simple But Not Easy

Please don’t get the wrong idea – long-term investing is not easy.

It is psychologically difficult to hold a stock when its price is declining.

Holding through price declines takes real conviction.

The nearly infinite liquidity of the stock market combined with the ease of trading makes selling stocks something you can do on a whim.

But just because you can, doesn’t mean you should.

The constant stream of stock ticker price movements also coerces individual investors into trading unnecessarily.

Does it really matter that a stock is up 1% today, or down 0.3% this hour? Have the long-term prospects of the business really changed? Probably not.

Tip #2: Stock Prices Lie, Dividends Tell The Truth

Stock prices lie…

They signal a business is in steep decline when it isn’t.

They say a company is worth 3x as much as it was 3 years ago while the underlying business has only grown 50%.

Stock prices only represent the perception of other investors. They do not and cannot show the real total returns an investment will generate.

Instead of watching stock prices, avoid them completely. Look at dividend income instead.

Dividend do not lie.

A business simply cannot pay rising dividends for any long period of time without the underlying business growing as well.

Dividends are much less volatile than stock prices. Dividends reflect the real earnings power of the business.

Don’t you care what your investment pays you more than what people think about your investment? If the answer to this question is ‘yes’, then you should track dividends, not stock prices.

Tip #3: Long-Term Investing Is Not Buy & Pray Investing

There is a stark difference between buy and hold (sometimes called buy and pray) investing and long-term investing.

Buy and hold investing typically means buying and holding no matter what. That’s not what long-term investing is about.

Sometimes there is a very good reason to sell a stock. It just happens much less frequently than most people believe.

Stocks should be sold for two reasons:

- If it cuts or eliminates its dividend payments

- If it becomes extremely overvalued

If you invest in a business to provide you steadily rising income, and instead it reduces or eliminates its dividend, that business has violated your reason for investment.

Cutting or eliminating a dividend is really a symptom of a cause. The true cause of most dividend cuts is an erosion in the earnings power and competitive advantage of the business.

The second reason to sell is in the case of an extreme overvaluation.

I’m not talking about when a stock moves from a price-to-earnings ratio of 15 to 25…

I’m talking about when a stock is trading for a ridiculous price-to-earnings ratio – say 40+. An important caveat is to always use adjusted earnings for this calculation.

If a cyclical stock’s earnings temporarily fall from $5.00 per share to $1.00 per share, and the price-to-earnings ratio jumps from 15 to 75, don’t sell. In this instance, the price-to-earnings ratio is artificially inflated because it is not reflecting the true earnings power of the business.

Selling due to extreme valuations should only occur very rarely, during extreme bouts of irrational market exuberance.

Tip 4: Know What You Own

Only invest in businesses you understand…

Coca-Cola (KO) makes a good example. Coca-Cola is an extremely easy business to understand. That hot new biotech start-up, not as much.

When you know the business plan of a particular stock you own, you will have confidence not to sell it during bear markets.

If Coca-Cola share price dips 10%, you can have confidence knowing that sodas (and juices, and waters.) are still going to be sold regardless of what the stock price does.

“The worst thing you can do is invest in companies you know nothing about. Unfortunately, buying stocks on ignorance is still a popular American pastime.”

– Peter Lynch

Tip 5: Don’t Sell Because of Small Gains

No one ever went broke taking a profit…

While this is true, it is also true that it is much harder to get wealthy by taking small profits.

Invest in businesses that you believe will double, triple, or more over several decades.

A business does not have to be growing quickly to multiply your money over several decades. Businesses that repurchase shares, pay dividends, and make efficiency gains will not have to expand much at all to create serious shareholder gains.

“I had made what I believe was one of the more valuable decisions of my business life. This was to confine all efforts solely to making major gains in the long-run.”

– Philip Fisher

Tip 6: Overreaction is Harmful to Your Wealth

The world is constantly changing.

One day, European Union central banks adopt negative interest rates…

Another day, a war will break out or the US will impose economic sanctions on a country.

In less macro news, a business may report quarterly earnings 5% below analyst expectations, or a patent will expire.

All of these things don’t matter very much to long-term investors. What matters is that the businesses you hold still have a strong competitive advantage.

If they do, there is no reason to sell based on temporary uncertainty.

“In the 20th century, the United States endured two world wars and other traumatic and expensive military conflicts; the Depression; a dozen or so recessions and financial panics; oil shocks; a flu epidemic; and the resignation of a disgraced president. Yet the Dow rose from 66 to 11,497.”

– Warren Buffett

Final Thoughts

The amazing success records of investors who believe a long-term outlook is critical for favorable investment returns lends credibility to the idea of long-term investing.

When you approach stock purchases as if you were never going to sell, it forces you to be very selective in which businesses you will invest. Long-Term investing puts the spotlight on what really matters – the long-term prospects and competitive advantage of the business.

Related: The Coffee Can Portfolio | Dividend King Stocks For The Long-Run

The financial media does not typically discuss the merits of long-term investing because it does not generate fees for the financial industry. Long-term investing does not lend itself to flashy headlines or catchy sound bites.

I personally invest in high quality dividend growth stocks for the long-run.

I believe that high quality dividend growths stocks with strong competitive advantages offer individual investors the best available mix of current income, growth, and stability.

Long-term investing requires conviction, perseverance, and the ability to do nothing when others are being very active with their portfolios.

At Sure Dividend, we often advocate for investing in companies with a high probability of increasing their dividends each and every year.

If that strategy appeals to you, it may be useful to browse through the following databases of dividend growth stocks:

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

2022 Dividend Kings List | Updated Daily | All 44 Analysed

These 2 Dividend Stocks Will Work During Inflation Or Recession

Bill Gates Portfolio List | All 18 Stock Investments Now

2022 Best Monthly Dividend Stocks List | See All 49 Now | Yields Up To 19.0%