Updated on June 10th, 2022 by Aristofanis Papadatos for SureDividend

Airline stocks used to be avoided by value and income investors, and for good reason. Airlines are highly vulnerable during recessions. They are also vulnerable to industry-specific forces that can erase profits for several years, or even drive some airlines out of business.

That’s why legendary value investor Warren Buffett had, for many years, avoided airlines and advised investors to do the same.

However, thanks to a series of bankruptcies and mergers, the airline industry has consolidated. As a result, the four major U.S. airlines–American Airlines (AAL), Delta Air Lines (DAL), United Airlines Holdings (UAL) and Southwest Airlines (LUV)–now have 80% market share.

Industry consolidation led Buffett to change his stance and purchase significant stakes in the four major U.S. airlines in 2016. All four airlines were among Buffett’s top 20 stock holdings in 2016.

However, the airline industry went through an unprecedented downturn due to the coronavirus crisis in 2020-2021. As a result, the Oracle of Omaha sold all his shares of airline stocks in 2020.

You can see the entire list of Buffett’s biggest stock holdings here.

With all this in mind, we created a downloadable list of airline stocks. You can download an Excel spreadsheet of all airline stocks (with metrics that matter like dividend yields and price-to-earnings ratios) by clicking the link below:

Click here to download your Airline Stocks Excel Spreadsheet List now.

This article will discuss our top 6-ranked airline stocks, according to the Sure Analysis Research Database. The stocks are ranked according to expected total returns over the next five years, listed in order of lowest to highest.

In this article

Table Of Contents

- Industry Overview

- Delta Airlines (DAL)

- Alaska Air Group (ALK)

- Hawaiian Holdings (HA)

- Southwest Airlines (LUV)

- American Airlines Group (AAL)

- United Airlines Holdings (UAL)

Industry Overview

Thanks to the industry consolidation, many airlines enjoyed strong profit margins in 2015-2019.

However, airlines are now going through one of the fiercest downturns in their history due to the coronavirus crisis. Due to the measures taken by the U.S. government in an effort to limit the expansion of the virus, the air traffic plunged approximately 80% in 2020.

Even in 2021, the total number of air travelers around the world was only 47% of the pre-pandemic level. Consequently, all the airlines burnt cash at a record pace in 2020-2021 and remained solvent solely thanks to the immense fiscal stimulus packages offered by the government.

Fortunately, thanks to the massive distribution of vaccines worldwide, the pandemic has begun to subside and the airline industry has begun to recover from this crisis. According to the latest forecast of IATA, the total number of passengers is expected to reach 4.0 billion by 2024 and thus it will exceed the pre-pandemic level (in 2019) by 3% in that year.

The airlines are also facing another headwind, namely the surge of inflation to a 40-year high this year. Fuel costs have skyrocketed due to the rally of the oil price to a 13-year high, which has resulted from the sanctions of western countries on Russia for its invasion in Ukraine. However, thanks to pent-up demand for flights, airlines are trying to pass their incremental costs to their customers.

Investors should be aware that all the airlines of this article have suspended their dividends since early 2020 due to the impact of the pandemic on their business.

In this article, we will compare the expected 5-year returns of the six major U.S. airlines. Stocks are ranked in terms of 5-year expected total returns, from lowest to highest.

Best Airline Stock #6: Delta Air Lines (DAL)

Delta Air Lines is one of the largest international airlines, serving 275 destinations in 52 countries. Delta bought a refinery in 2012 in order to limit its risk of high jet fuel prices. However, a single refinery is not sufficient to eliminate this risk entirely. It limits the effect of an increase in the spread between the prices of jet fuel and crude oil but does not provide any protection against an increase in the price of crude oil.

In addition, Delta has proved incapable of hedging its fuel cost. It was hedging its fuel cost before the downturn of the oil market in 2014-2016. Consequently, it incurred heavy losses from those hedges when the price of jet fuel collapsed. Then, due to that traumatic experience, it stopped hedging its fuel cost so it was exposed to rising jet fuel prices in the oil price recovery of 2016-2018.

Delta incurred excessive losses in 2020-2021 due to the collapse of global air traffic amid the pandemic. It was also caught with a high debt load in this crisis and thus it survived mostly thanks to the immense financial aid of the government.

Fortunately, the pandemic has begun to subside and thus Delta is poised to become profitable again this year. In the first quarter, its revenue was 79% of its pre-pandemic revenue and the company posted a loss per share of -$1.23. However, it exceeded the analysts’ consensus by $0.04.

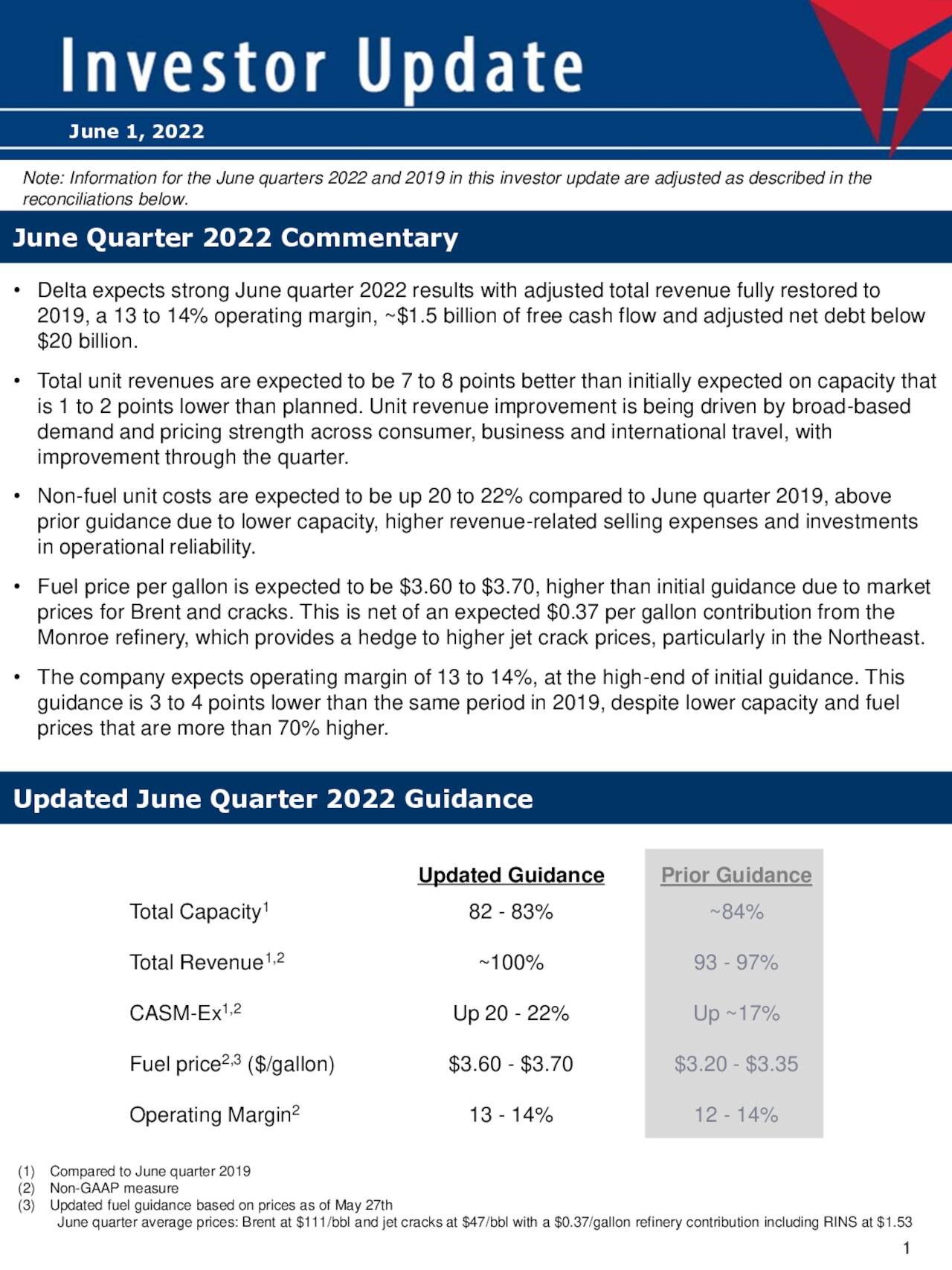

Even better, business momentum has accelerated in the second quarter. Delta expects its revenue to return to its pre-pandemic level in this quarter and its operating margin to rebound to 13%-14%.

Source: Investor Presentation

Moreover, Delta expects its refinery to reduce fuel costs by $0.37 per gallon, though it still expects high fuel costs ($3.60-$3.70 per gallon), thus confirming that its refinery can do little to mitigate fuel costs. Nevertheless, the essence is that Delta enjoys accelerated consumer demand and hence it is on track for a strong recovery this year. We expect the airline to become profitable this year after two years of losses, with earnings per share around $2.95.

Given the recovery of Delta off a low comparison base, we expect 18% average annual growth of earnings per share over the next five years. On the other hand, Delta is currently trading at a price-to-earnings ratio of 12.5, which is higher than the historical average price-to-earnings ratio of 8.3 of the stock.

If the stock reverts to its average valuation level in five years, it will incur a -7.9% annualized contraction of its earnings multiple. As a result, we believe the stock can offer an 8.6% average annual return over the next five years.

Best Airline Stock #5: Alaska Air Group (ALK)

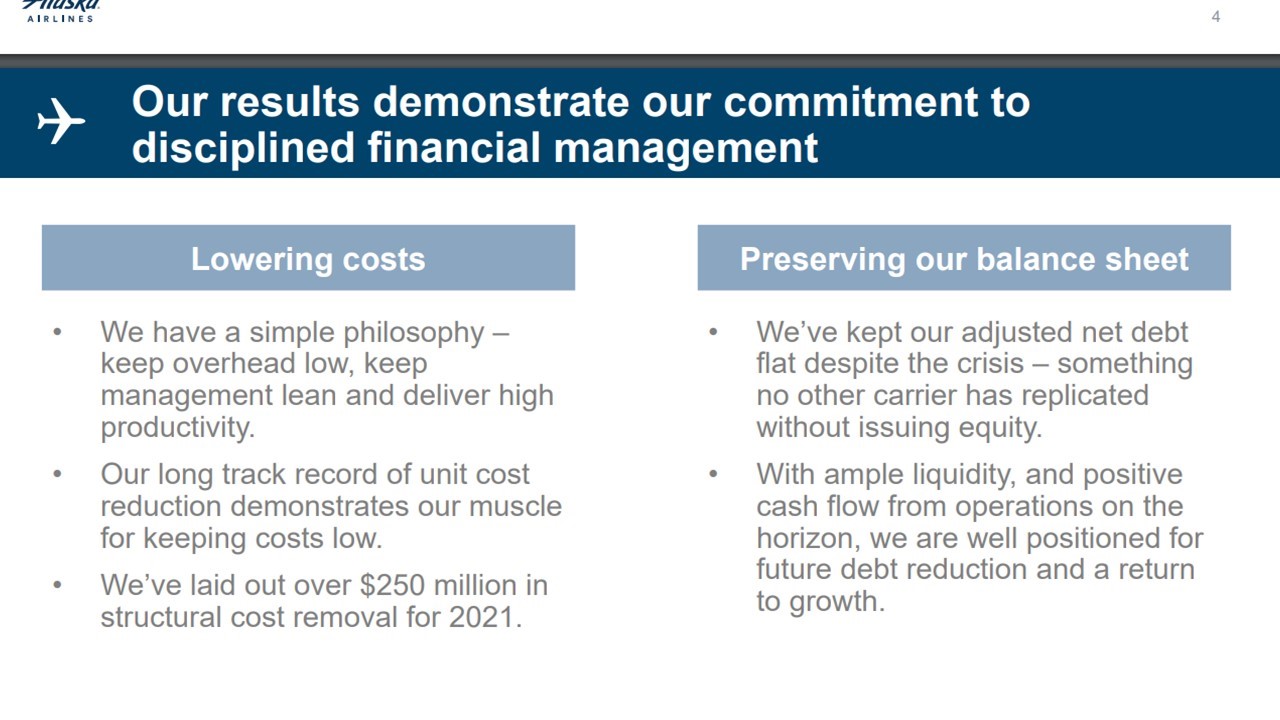

Alaska Air Group serves more than 115 destinations in the U.S., Mexico, Costa Rica and Canada. The company operates with a low-cost business model in order to secure a significant competitive advantage over its peers.

Source: Investor Presentation

Thanks to its low-cost model and its decent balance sheet, Alaska Air has endured the coronavirus crisis much more readily than other airlines, which are highly leveraged. Alaska Air has net debt of $7.0 billion, which is higher than its market capitalization of $6.1 billion but not extreme.

Moreover, the airline is recovering strongly from the pandemic right now. It recently provided positive guidance for the second quarter, expecting a load factor of 87%-88% and revenue growth of 12%-14% compared to the pre-pandemic level. We thus expect Alaska Air to post a strong profit per share around $4.40 this year.

Given the ongoing recovery of Alaska Air, we expect 9% average annual growth of earnings per share over the next five years. Moreover, the stock is currently trading at a forward price-to-earnings ratio of 10.5, which is slightly lower than its historical average price-to-earnings ratio of 11.0.

If the stock trades at its average valuation level in five years, it will enjoy a 1.0% annualized expansion of its earnings multiple. As a result, we believe the stock can offer a 10.1% average annual return over the next five years.

Best Airline Stock #4: Hawaiian Holdings (HA)

Hawaiian Holdings is the largest air carrier in Hawaii, transferring about 12 million passengers per year under normal business conditions. It has a market capitalization of $0.9 billion, the lowest among the airlines discussed in this article.

Hawaiian hedges its fuel costs but this is much easier said than done. To be sure, in the years 2012-2014, when the price of oil was trading around $100 per barrel, the airline posted poor earnings.

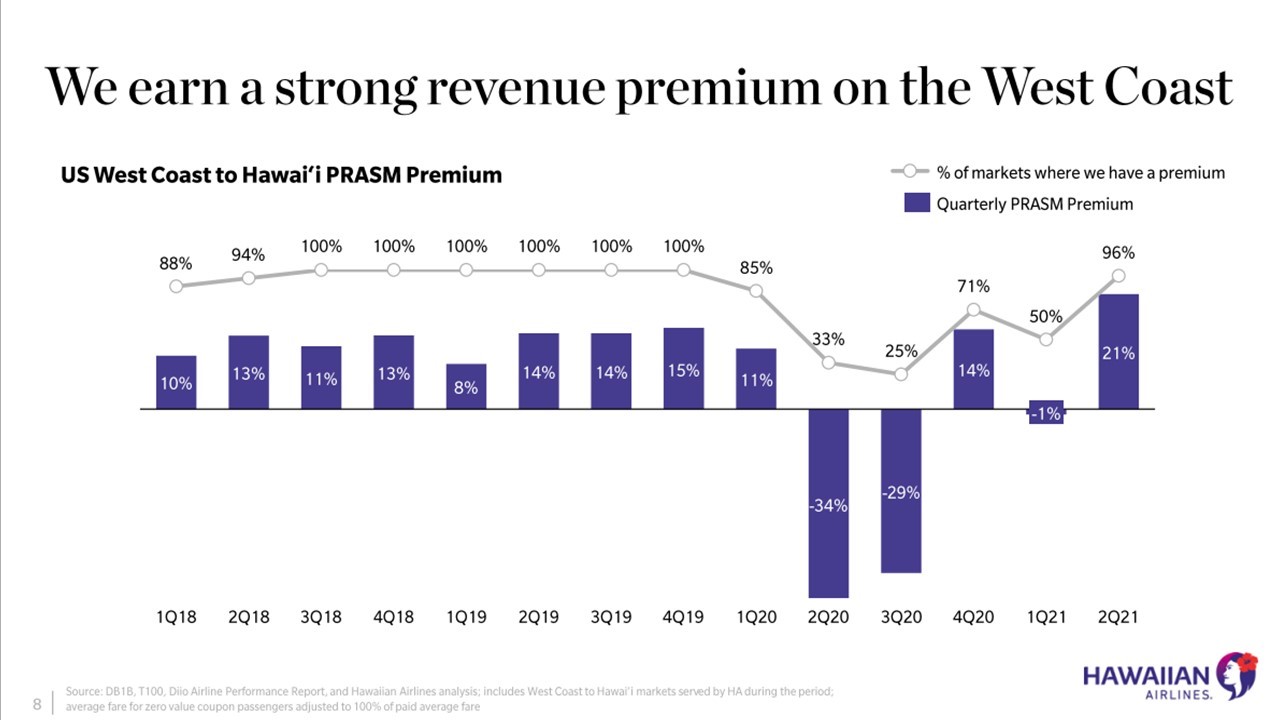

Hawaiian enjoys a meaningful competitive advantage, namely its dominant position in Hawaii. Thanks to this advantage, the airline has enjoyed premium fares compared to the fares of the West Coast.

Source: Investor Presentation

However, Hawaiian has been severely hurt by the coronavirus crisis. The airline is somewhat more vulnerable to downturns than its peers due to its lack of diversification and its tie to tourist traffic. This helps explain the excessive aggregate losses per share of -$19.51 in 2020-2021.

These losses exceed the current market capitalization of the stock and hence they raise a red flag. Given also the high net debt of $2.3 billion, which is nearly triple the market capitalization of the stock, Hawaiian will be highly vulnerable in the event of a prolonged downturn.

Moreover, Hawaiian has much weaker business momentum than most of its peers this year. While Southwest, Delta, United Airlines and Alaska Air are poised to become profitable this year, Hawaiian is expected to post a material loss for a third consecutive year. The company does not expect its capacity to return to pre-pandemic levels anytime soon while it has not provided guidance for the full year due to high uncertainty.

Due to the challenges facing Hawaiian, we assume a fair price-to-earnings ratio of 7.0 for the stock. In addition, we expect the company to earn approximately $4.00 per share by 2027. As a result, we expect the stock to trade around $28 by 2027 and thus offer a 12.6% average annual return over the next five years.

Overall, while Hawaiian is recovering much more slowly than its peers, the stock appears to have been punished to the extreme by the market.

Best Airline Stock #3: Southwest Airlines (LUV)

Southwest Airlines is the second-largest U.S. carrier based on market capitalization and serves 121 destinations in 42 states and 10 near-international countries. Southwest stands out among its peers for its exceptional consistency.

While its peers exhibit highly cyclical performance and tend to post losses during recessions, Southwest remained profitable for 47 consecutive years, until the onset of the pandemic.

Source: Investor Presentation

Southwest also stands out in its sector for two more reasons, namely its strong free cash flows and its low debt level. It is the only airline that posted positive free cash flows in every single year in the decade leading to the pandemic. It also has by far the lowest debt-to-assets ratio. Its net debt is just $9.4 billion, which is only 35% of its market capitalization.

Thanks to its strong balance sheet, Southwest enjoys by far the greatest rating from the three major credit rating firms in its peer group. Its superior balance sheet is of paramount importance, as it gives the company resilience during downturns. This helps explain its above mentioned consistency, which is unique in its sector.

The market obviously appreciates the unique consistency and the superior balance sheet of Southwest with a higher valuation multiple. The stock has held an average price-to-earnings ratio of 16.8 during the last decade, compared with single-digit ratios across the industry. As Southwest has by far the strongest balance sheet in its peer group, it is the most resilient airline during the ongoing coronavirus crisis.

Moreover, Southwest has begun to recover strongly from the pandemic. In its latest business update, the company stated that it expects 12%-15% revenue growth in the second quarter thanks to strong load factors and accelerated demand for summer travel. We expect the airline to become profitable this year after two years of losses, with earnings per share around $2.70.

Given the strong recovery of Southwest off a low comparison base, we expect 18% average annual growth of earnings per share over the next five years. On the other hand, Southwest is currently trading at a price-to-earnings ratio of 15.9, which is higher than our fair value estimate of 13. If the stock reaches our fair valuation level in five years, it will incur a -4.0% annualized contraction of its earnings multiple. As a result, we believe the stock can offer a 13.3% average annual return over the next five years.

Best Airline Stock #2: American Airlines (AAL)

American Airlines is the world’s largest airline in revenue and fleet size, with thousands of daily flights to more than 365 destinations in 61 countries. The company emerged from Chapter 11 bankruptcy in December 2013.

American Airlines has a more volatile performance record than its peers, primarily due to its high sensitivity to fuel costs, as the company does not hedge its fuel cost. The price of jet fuel has jumped to a 13-year high this year due to the ongoing war in Ukraine and thus it provides a strong headwind to American Airlines.

Moreover, American Airlines has been caught in the ongoing coronavirus crisis off-guard, with an excessive debt pile. The debt-to-assets ratio has climbed from 100% before the pandemic to 114% while its net debt has climbed from $54.4 billion to $62.3 billion. This amount is nearly 6 times the market capitalization of the stock and hence it is undoubtedly excessive.

Moreover, the annual interest expense of American Airlines has nearly doubled during the pandemic, from $1.1 billion to $1.9 billion. The company has posted negative free cash flows in each of the last five years, partly due to its high capital expenses.

All these factors render the stock by far the riskiest in its peer group in the ongoing downturn of the aviation industry. This is also evident from the fact that American Airlines is expected to incur a loss for a third consecutive year in 2022, in sharp contrast to Southwest, Delta, United Airlines and Alaska Air, which are expected to return to profitability this year.

On the other hand, leverage is a double-edged sword. This means that American Airlines is an ideal stock for those who are confident in a sustained, multi-year recovery of the aviation industry. American Airlines has provided a highly optimistic outlook.

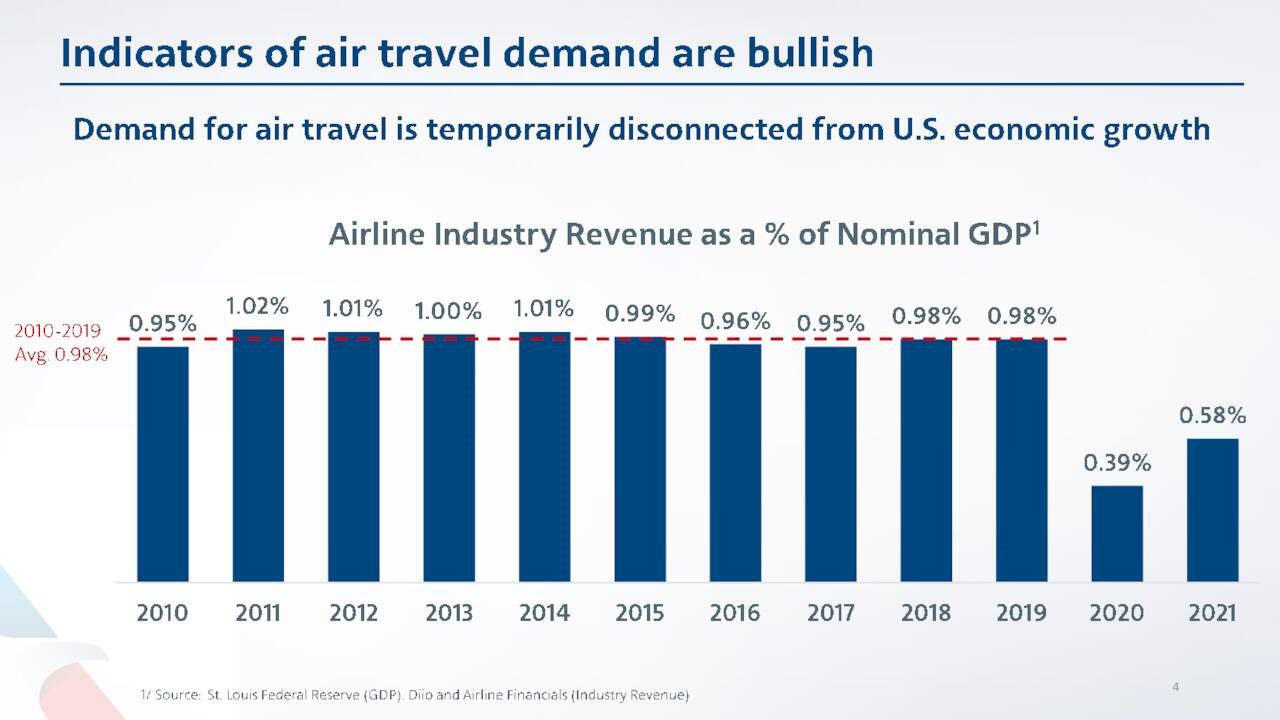

Source: Investor Presentation

As shown in the above chart, total airline industry revenue has always moved in tandem with economic growth. This relationship has been temporarily disrupted due to the pandemic but it is reasonable to expect the revenue of the airline industry to rebound strongly in the upcoming years to catch up with global GDP. Such a rebound will provide a strong tailwind to the business of American Airlines.

As we expect American Airlines to post a loss this year, we have used a mid-cycle level of earnings per share of $3.50 for our calculations. Given the expected recovery of American Airlines but also its excessive debt pile, we expect 7% average annual growth of earnings per share over the next five years off its mid-cycle level. Moreover, the stock is currently trading at 4.4 times its mid-cycle earnings.

Given the high debt load of the company, we assume a fair price-to-earnings ratio of 6.0. If the stock trades at its fair valuation level in five years, it will enjoy a 6.3% annualized expansion of its earnings multiple. As a result, we believe the stock can offer a 13.7% average annual return over the next five years but we note that such a high return will materialize only in the absence of another downturn.

Best Airline Stock #1: United Airlines Holdings (UAL)

United Airlines Holdings owns United Airlines and Continental Airlines and operates thousands of flights every day to numerous domestic and international destinations.

United introduced 93 new routes in 2018, more than any other U.S. airline. Thanks to its strategy, United generates a much higher portion of its revenues from international flights than its peers. Due to its international exposure, the company is somewhat more exposed than its peers, as international flights have been hit harder than domestic flights so far. Notably, United reduced its international flights by 95% in the first stage of the pandemic due to a collapse in demand.

In the first quarter of 2022, its revenue was 19% lower than the pre-pandemic level and thus the company incurred a loss per share of -$4.24. However, United has provided remarkably positive guidance for the second quarter. Management stated that it currently observes the greatest recovery in demand in the last 30 years and thus it expects a strong profit in the second quarter, with total revenue per available seat mile 17% higher than the pre-pandemic level.

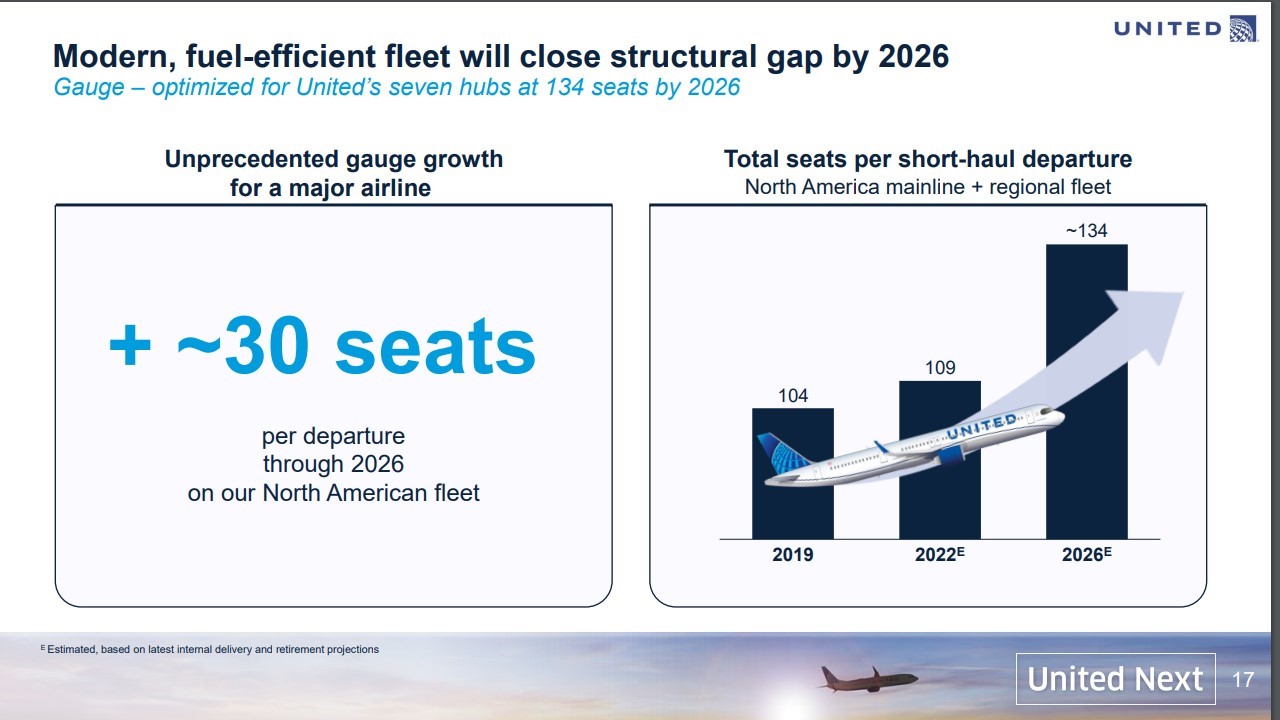

Moreover, United is doing its best to increase the number of seats of its fleet in an effort to improve its efficiency.

Source: Investor Presentation

The company has set a goal to increase the total seats per short-haul flight from 104 in 2019 to 134 by 2026.

Unfortunately, United has a high debt load, with net debt of $44.7 billion, which is more than triple the market capitalization of the stock. If the airline enjoys a sustained recovery from the pandemic, it will easily service its debt. On the other hand, it will be vulnerable if it faces another downturn in the near future.

Due to the high debt load of United, we assume a fair price-to-earnings ratio of 7.0 for the stock. In addition, we expect the company to earn approximately $12.00 per share by 2027. As a result, we expect the stock to trade around $84 by 2027 and thus offer a 14.3% average annual return over the next five years.

Final Thoughts

Airline stocks are basically leveraged proxies for underlying U.S. and global economic growth. As long as the economy grows, the airlines thrive but in the current downturn they are all going through great pressure due to their leveraged balance sheets.

Fortunately, the aviation industry has begun to recover from the pandemic, as people are claiming back their normal lifestyle, after two years of social distancing. As long as global air traffic continues to recover, all the above airlines are likely to highly reward those who purchase them around their current stock prices.

United currently offers the highest 5-year expected return of the airline stocks. However, due to its high debt load and its exposure to international flights, the stock carries a significant amount of risk, albeit with a high potential return as well.

Southwest offers the third-highest expected return of the airline stocks, but we believe that it offers by far the highest risk-adjusted annual return over the next five years thanks to its lower risk profile.

Southwest posted a profit for 47 consecutive years until 2020, whereas its peers have incurred heavy losses during past recessions. Southwest also has by far the strongest balance sheet in its group. As the resilience in this downturn is of paramount importance, we believe that Southwest is the best choice right now for risk-averse investors.

Other Dividend Lists

The following lists contain many more high-quality dividend stocks:

- The Dividend Aristocrats List is comprised of 65 stocks in the S&P 500 Index with 25+ years of consecutive dividend increases.

- The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 38 stocks with 50+ years of consecutive dividend increases.

- The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- The Dividend Challengers List: 5-9 consecutive years of dividend increases.

Related:

5 Rules For Building a Dividend Portfolio You Can Live On

5 Steps To Saving Money in The Right Way

2022 Dividend Kings List | Updated Daily | All 44 Analysed