Published on July 19th, 2022 by Bob Ciura for SureDividend.

Spreadsheet data updated daily; Top 10 list is updated when the article is updated

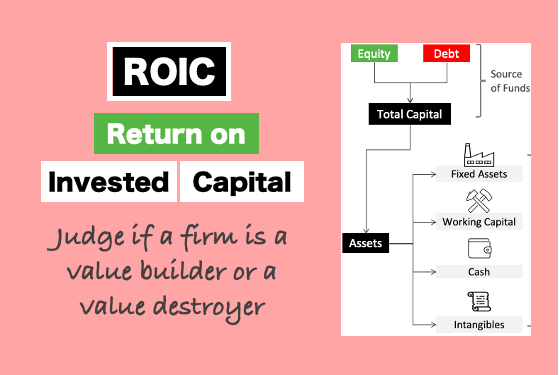

Return on invested capital, or ROIC, is a valuable financial ratio that investors can add to their research process. Understanding ROIC and using it to screen for high ROIC stocks is a good way to focus on the highest-quality businesses. With this in mind, we ran a stock screen to focus on the highest ROIC stocks in the S&P 500.

You can download a free copy of the top 100 stocks with the highest ROIC (along with important financial metrics like dividend yields and price-to-earnings ratio) by clicking on the link below:

Click here to download my High ROIC Stocks Excel Spreadsheet now. Keep reading this article to learn more.

Using ROIC allows investors to filter out the highest-quality businesses that are effectively generating a return on capital.

This article will explain ROIC and its usefulness for investors. It will also list the top 10 highest ROIC stocks right now.

In this article

Table Of Contents

You can use the links below to instantly jump to an individual section of the article:

What Is ROIC?

Put simply, return on invested capital (ROIC) is a financial ratio that shows a company’s ability to allocate capital. The common formula to calculate ROIC is to divide a company’s after-tax net operating profit, by the sum of its debt and equity capital.

Once the ROIC is calculated, it is evaluated against a company’s weighted average cost of capital, commonly referred to as WACC. If a company’s WACC is not immediately available, it can be calculated by taking a weighted average of the cost of a company’s debt and equity.

Cost of debt is calculated by averaging the yield to maturity for a company’s outstanding debt. This is fairly easy to find, as a publicly-traded company must report its debt obligations.

Cost of equity is typically calculated by using the capital asset pricing model, otherwise known as CAPM.

Once the WACC is calculated, it can be compared with the ROIC. Investors want to see a company’s ROIC exceed its WACC. This indicates the underlying business is successfully investing its capital to generate a profitable return. In this way, the company is creating economic value.

Generally, stocks generating the highest ROIC are doing the best job of allocating their investors’ capital. With this in mind, the following section ranks the 10 stocks with the highest ROIC.

The Top 10 Highest ROIC Stocks

The following 10 stocks have the highest ROIC. Stocks are listed in order from lowest to highest.

High ROIC Stock #10: Fortinet, Inc. (FTNT)

- Return on invested capital: 46.6%

Fortinet is a technology company that provides automated cybersecurity solutions worldwide. It offers FortiGate hardware and software licenses that provide various security and networking functions, including firewall, intrusion prevention, anti-malware, virtual private network, application control, web filtering, anti-spam, and wide area network acceleration.

The company also provides the FortiSwitch product family that offers secure switching solutions. Fortinet stock has a market capitalization of approximately $50 billion.

High ROIC Stock #9: Apple, Inc. (AAPL)

- Return on invested capital: 49.0%

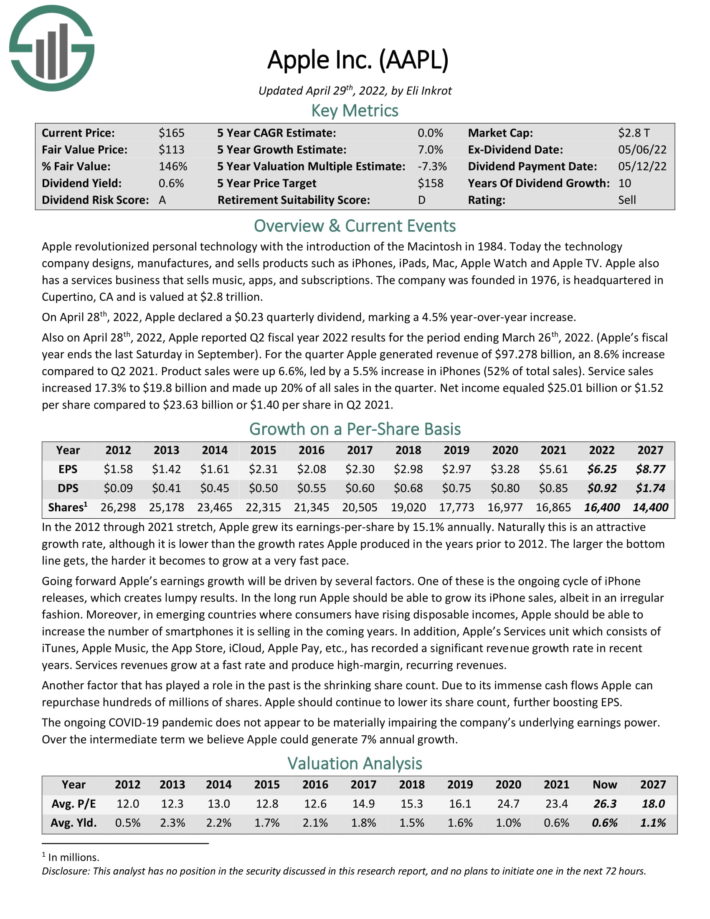

Apple revolutionized personal technology with the introduction of the Macintosh in 1984. Today the technology company designs, manufactures and sells products such as iPhones, iPads, Mac, Apple Watch and Apple TV.Apple also has a services business that sells music, apps, and subscriptions.

On April 28th, 2022, Apple declared a $0.23 quarterly dividend, marking a 4.5% year-over-year increase. Also on April 28th, 2022, Apple reported Q2 fiscal year 2022 results for the period ending March 26th, 2022. (Apple’s fiscal year ends the last Saturday in September).

For the quarter Apple generated revenue of $97.278 billion, an 8.6% increase compared to Q2 2021. Product sales were up 6.6%, led by a 5.5% increase in iPhones (52% of total sales). Service sales increased 17.3% to $19.8 billion and made up 20% of all sales in the quarter. Net income equaled $25.01 billion or $1.52 per share compared to $23.63 billion or $1.40 per share in Q2 2021.

Apple is the #1 holding of Berkshire Hathaway (BRK.B), making the technology giant one of the top Warren Buffett stocks.

Click here to download our most recent Sure Analysis report on AAPL (preview of page 1 of 3 shown below):

High ROIC Stock #8: Moderna Inc. (MRNA)

- Return on invested capital: 49.1%

Moderna is a biotechnology company. It develops therapeutics and vaccines based on messenger RNA for the treatment of infectious diseases, immuno-oncology, rare diseases, cardiovascular diseases, and auto-immune diseases.

The company has over 40 development programs, which includes 26 in clinical trials across seven modalities comprising prophylactic vaccines, systemic secreted and cell surface therapeutics, cancer vaccines, intratumoral immuno-oncology, localized regenerative therapeutics, systemic intracellular therapeutics, and inhaled pulmonary therapeutics.

High ROIC Stock #7: Advanced Micro Devices (AMD)

- Return on invested capital: 49.7%

Advanced Micro Devices was founded in 1959 and in the decades since it has become a sizable player in the chip market.

AMD is heavy in gaming chips, competing with others like NVIDIA for the lucrative, but competitive market. It operates in two segments, Computing and Graphics; and Enterprise, Embedded and Semi-Custom. Its products include x86 microprocessors, chipsets, discrete and integrated graphics processing units (GPUs), and server and embedded processors. The company also provides processors for desktop and notebook personal computers.

As a volatile tech stock, AMD is one of the high beta stocks.

High ROIC Stock #6: AutoZone Inc. (AZO)

- Return on invested capital: 69.1%

After opening its first store on July 4th, 1979, AutoZone has grown into the leading retailer and distributor of automotive replacement parts and accessories with more than 6,000 stores in the U.S., Puerto Rico, Mexico and Brazil. AutoZone carries new and re-manufactured parts, maintenance items and accessories for cars, SUVs, vans and light trucks.

AutoZone has proven to be recession–resistant thanks to the nature of its business. During rough economic periods, the sales of new cars fall significantly, causing the average age of cars to increase. This favors AutoZone’s business. In the Great Recession, when most companies saw their earnings plunge, AutoZone grew its EPS by 18% in 2008 and another 17% in 2009.

Due to its impressive growth, AutoZone is one of the top car part stocks.

Click here to download our most recent Sure Analysis report on AZO.

High ROIC Stock #5: Otis Worldwide (OTIS)

- Return on invested capital: 89.5%

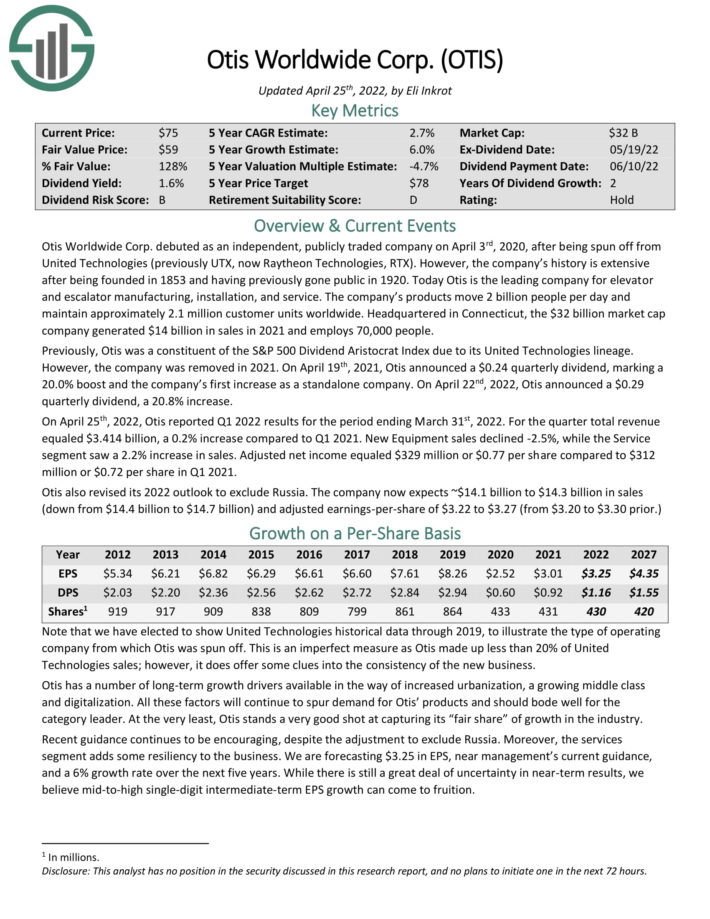

Otis Worldwide Corp. debuted as an independent, publicly traded company on April 3rd, 2020, after being spun off from United Technologies (previously UTX, now Raytheon Technologies, RTX). However, the company’s history is extensive after being founded in 1853 and having previously gone public in 1920.

Today Otis is the leading company for elevator and escalator manufacturing, installation, and service. The company’s products move 2 billion people per day and maintain approximately 2.1 million customer units worldwide.

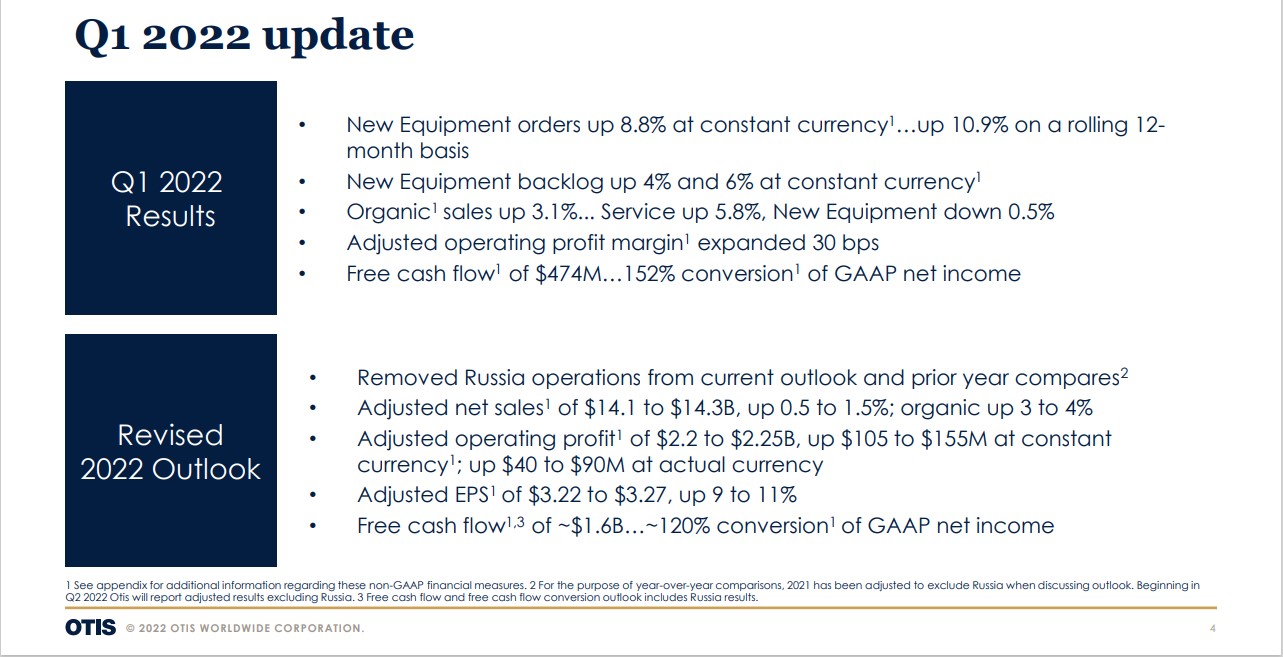

On April 22nd, 2022, Otis announced a $0.29 quarterly dividend, a 20.8% increase. On April 25th, 2022, Otis reported Q1 2022 results for the period ending March 31st, 2022.

Source: Investor Presentation

For the quarter total revenue equaled $3.414 billion, a 0.2% increase compared to Q1 2021. New Equipment sales declined -2.5%, while the Service segment saw a 2.2% increase in sales. Adjusted net income equaled $329 million or $0.77 per share compared to $312 million or $0.72 per share in Q1 2021.

Otis also revised its 2022 outlook to exclude Russia. The company now expects ~$14.1 billion to $14.3 billion in sales (down from $14.4 billion to $14.7 billion) and adjusted earnings-per-share of $3.22 to $3.27 (from $3.20 to $3.30 prior.)

Click here to download our most recent Sure Analysis report on OTIS (preview of page 1 of 3 shown below):

High ROIC Stock #4: O’Reilly Automotive (ORLY)

- Return on invested capital: 90.4%

O’Reilly Automotive was founded in 1957 by the O’Reilly family and is nowone of the largest specialty retailers of automotive parts and accessories in the U.S., serving both the do–it–yourself and professional service provider markets. The company operates more than 5,400 stores in 47 states and about 21 stores in Mexico.

Click here to download our most recent Sure Analysis report on ORLY.

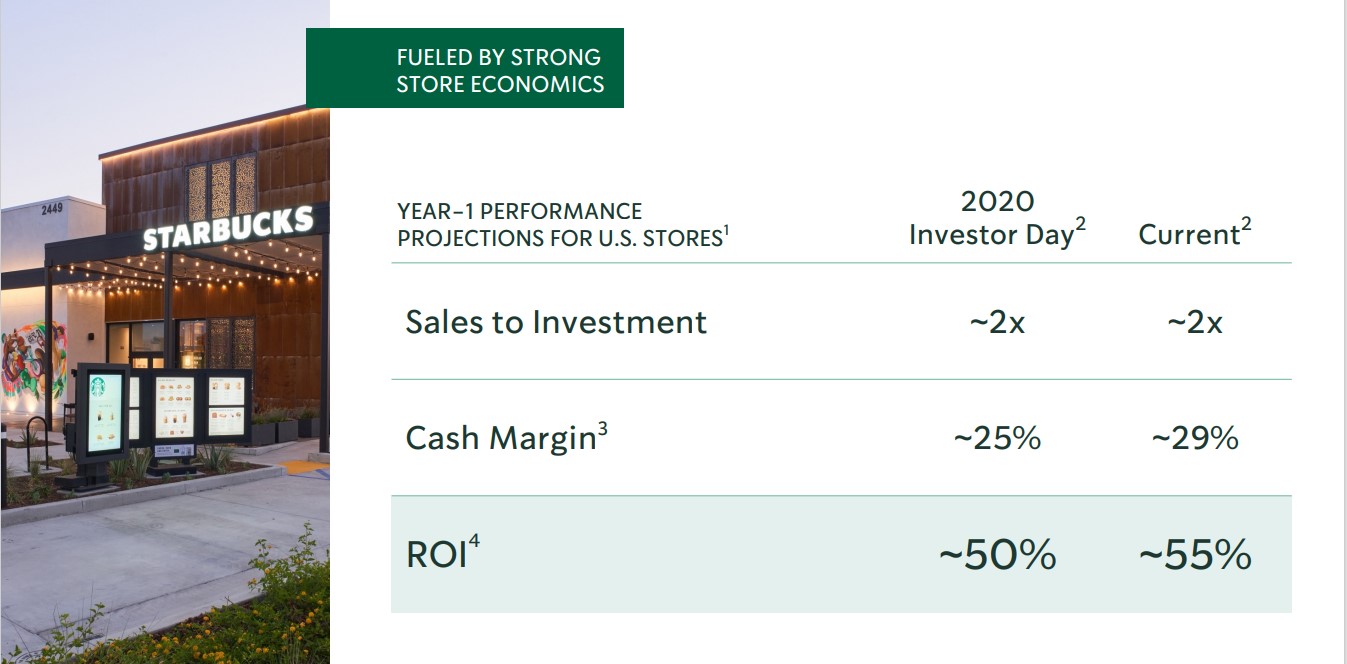

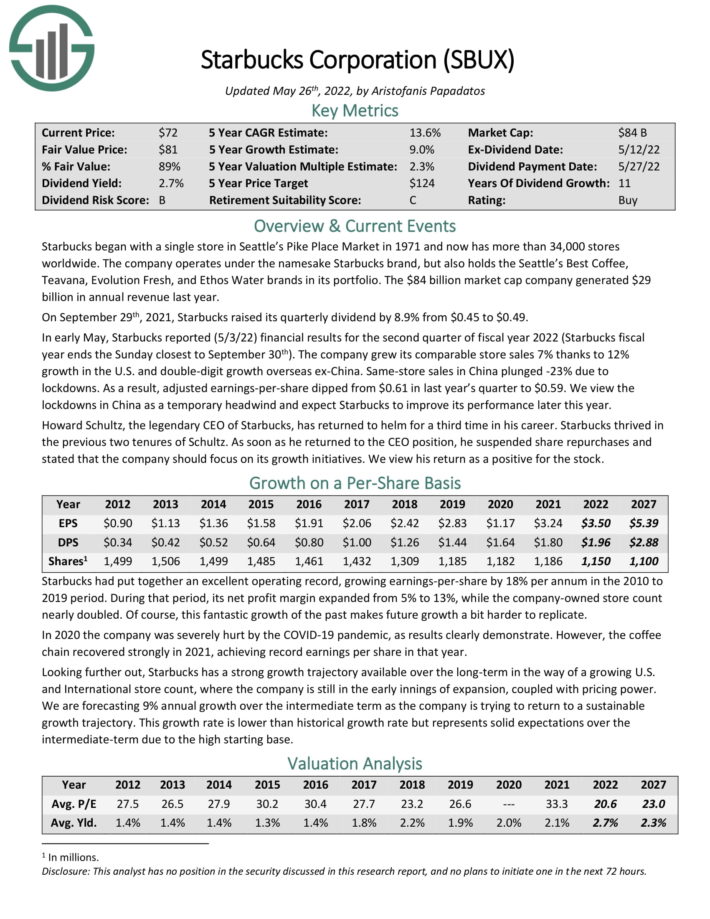

High ROIC Stock #3: Starbucks Corp. (SBUX)

- Return on invested capital: 141.0%

Starbucks has more than 34,000 stores worldwide. The company operates under the namesake Starbucks brand, but also holds the Seattle’s Best Coffee,Teavana, Evolution Fresh, and Ethos Water brands in its portfolio. Thecompany generated $29 billion in annual revenue last year.

Starbucks is one of the high ROIC stocks, due in large part to its favorable store economics.

Source: Investor Presentation

In early May, Starbucks reported (5/3/22) financial results for the second quarter of fiscal year 2022 (Starbucks fiscal year ends the Sunday closest to September 30th). The company grew its comparable store sales 7% thanks to 12% growth in the U.S. and double-digit growth overseas ex-China. Same-store sales in China plunged -23% due to lockdowns.

As a result, adjusted earnings-per-share dipped from $0.61 in last year’s quarter to $0.59. We view the lockdowns in China as a temporary headwind and expect Starbucks to improve its performance later this year.

Howard Schultz, the legendary CEO of Starbucks, has returned to helm for a third time in his career. Starbucks thrived in the previous two tenures of Schultz. As soon as he returned to the CEO position, he suspended share repurchases and stated that the company should focus on its growth initiatives.

Click here to download our most recent Sure Analysis report on SBUX (preview of page 1 of 3 shown below):

High ROIC Stock #2: NortonLifeLock Inc. (NLOK)

- Return on invested capital: 170.5%

NortonLifeLock is a technology company that provides security solutions for consumers around the world. It offers Norton 360, an integrated platform providing security with a subscription model for personal computers and mobile devices.

It also offers Norton and LifeLock identity theft protection solution that offers monitoring, alerts, and restoration services to its customers. The company also provides Norton Secure VPN solutions.

NLOK stock has a market capitalization above $13 billion. Shares have a current dividend yield of 2.1%.

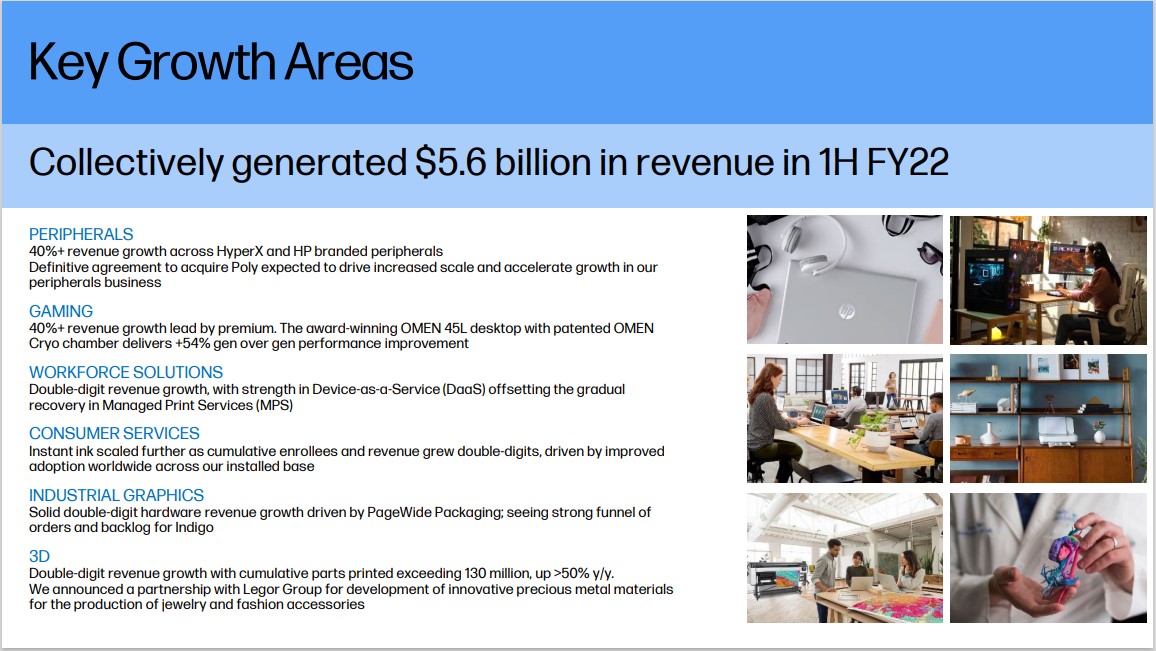

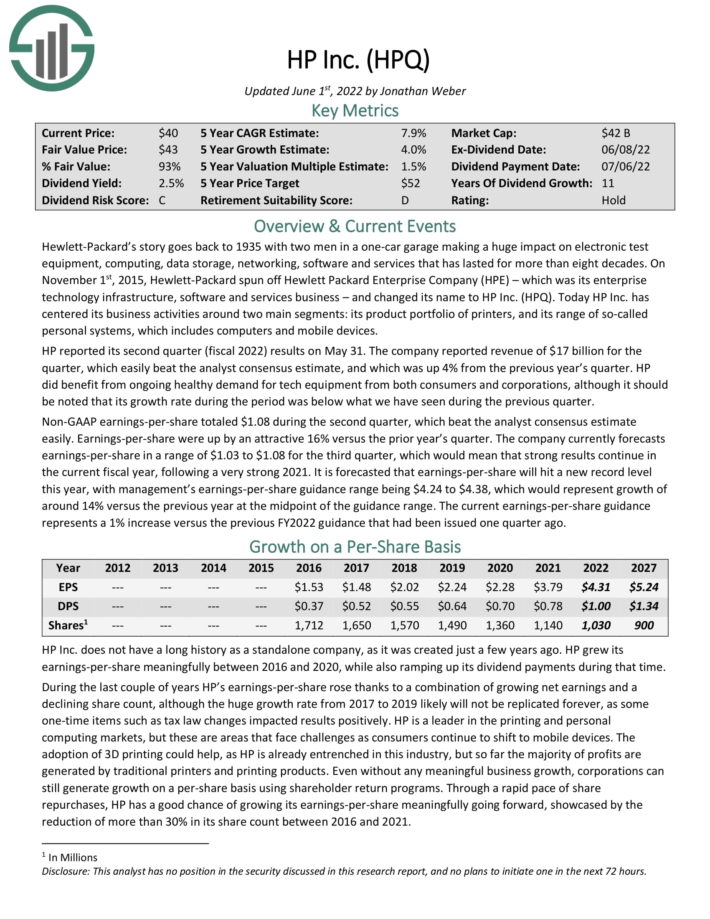

High ROIC Stock #1: HP Inc. (HPQ)

- Return on invested capital: 168%

HP Inc. has centered its business activities around two main segments: itsproduct portfolio of printers, and its range of so–called personal systems, which includes computers and mobile devices.

HP reported its second quarter (fiscal 2022) results on May 31. The company reported revenue of $17 billion for the quarter, which easily beat the analyst consensus estimate, and which was up 4% from the previous year’s quarter. HP benefited from ongoing healthy demand for tech equipment from both consumers and corporations.

Non-GAAP earnings-per-share totaled $1.08 during the second quarter, which beat the analyst consensus estimate easily. Earnings-per-share were up by 16% versus the prior year’s quarter.

Source: Investor Presentation

The company currently forecasts earnings-per-share in a range of $1.03 to $1.08 for the third quarter, which would mean that strong results continue in the current fiscal year, following a very strong 2021. It is forecasted that earnings-per-share will hit a new record level this year, with management’s earnings-per-share guidance range being $4.24 to $4.38, which would represent growth of around 14% versus the previous year at the midpoint.

The current earnings-per-share guidance represents a 1% increase versus the previous FY2022 guidance that had been issued one quarter ago.

Click here to download our most recent Sure Analysis report on HPQ (preview of page 1 of 3 shown below):

Final Thoughts

There are many different ways for investors to value stocks. One popular valuation method is to calculate a company’s return on invested capital. By doing so, investors can get a better gauge of companies that do the best job investing their capital.

ROIC is by no means the only metric that investors should use to buy stocks. There are many other worthwhile valuation methods that investors should consider. That said, the top 10 ROIC stocks on this list have proven the ability to create economic value for shareholders.

This article was first published by Bob Ciura for Sure Dividend.

Sure Dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

Investing 101: What’s the Minimum Amount Needed to Invest

What to Invest in: Using Your Money to Make Money

Investing 101: Answering the Question: Why Should I Invest?