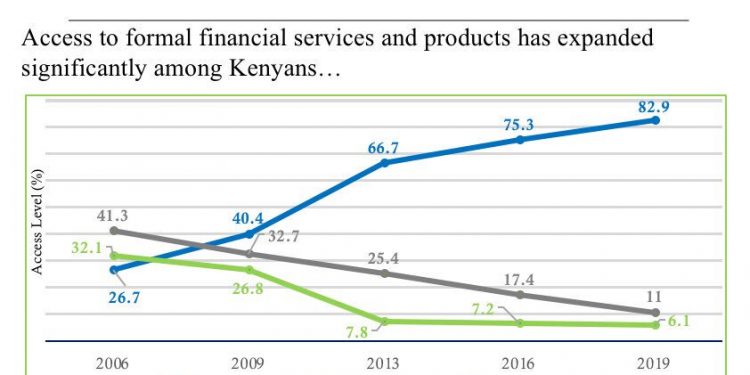

About 83 percent of Kenyan adults have access to formal financial services while only 11percent are excluded from such services. These details emerged from the 2019 FinAccess household survey conducted by FSD Kenya in partnership with CBK and KNBS.

The report ranked Kenya as the third most financially inclusive country in Africa behind Seychelles and South Africa.

According to the survey, Nairobi and Mombasa are the most financially inclusive regions with inclusion rates of 96 and 94 percent respectively. Other regions such as Nyanza, Central, Western, Coastal, North Eastern, Mid Eastern, and Lower Eastern all have inclusion rates above 70 percent. Strikingly, financial inclusion in the North Eastern area increased by 60 percent between 2016 and 2019 to reach 84 percent. North Rift Valley region had the lowest rate of access to financial services at 57 percent.

The Central Bank Governor Dr. Patrick Njoroge lauded mobile money services for transforming the financial sector in Kenya. Speaking at the launch of the FinAccess survey, the governor said, “Kenyans take the mobile money services lightly, yet it has transformed the financial sector. Other countries wish to apply the same technology in their economies “

Some of the challenges mobile money users in Kenya face are; fraud, lack of transparency in transaction charges, and system failures.

Related;

CMA unveils panel of Financial Markets experts

Kenya’s Active Mobile Money Subscribers hits 31.6 Million