Kenya’s financial landscape is undergoing a structural shift — one defined not just by access, but by behavior.

- •According to the FinAccess 2024 report, 68% of Kenyan adults now save or deposit money, a modest decline from the 74% recorded in 2021.

Yet beneath this headline figure lies a deeper transformation: formal savings channels, particularly banks, have become the dominant vehicle of choice, while informal options like chamas and home safes continue to decline. - •As usage patterns evolve across gender, location, and purpose, the data paints a compelling portrait of a population moving toward more secure, regulated financial practices — even amid economic headwinds.

Kenyans now overwhelmingly prefer formal savings. Bank usage has surged from 12.4% in 2006 to 60.2% in 2024, while mobile money has plateaued at around 36%. Informal options such as chamas and home safes have steadily declined — the latter from 55.7% in 2009 to just 16.2%.

The FinAccess data also reveals encouraging progress in both gender and geographic inclusion. As of 2021, 75% of men and 73% of women reported using savings tools — a near convergence that highlights growing gender parity in financial behavior.

At the same time, Kenya’s rural-urban divide is narrowing with rural savings usage rising from 63.5% in 2021 to 71.8% in 2024 while urban rates remained steady at 77.7%. This reduced the urban-rural gap to just 5.9 percentage points — the smallest in 15 years.

| Year | Bank | Mobile Money | SACCO | Secret Place | Group/Chama | Family/Friends |

|---|---|---|---|---|---|---|

| 2006 | 12.4 | – | 12.8 | 27.9 | 34.7 | 16.6 |

| 2009 | 12.4 | – | 8.9 | 55.7 | 37.1 | 11.6 |

| 2013 | 9.8 | 27.0 | 10.6 | 31.7 | 26.8 | 19.2 |

| 2016 | 24.0 | 43.3 | 12.6 | 35.8 | 39.2 | 15.4 |

| 2019 | 25.4 | 53.6 | 9.4 | 23.6 | 30.1 | 11.8 |

| 2021 | 58.0 | 33.3 | 5.0 | 28.1 | 21.2 | 2.4 |

| 2024 | 60.2 | 35.9 | 8.7 | 16.2 | 19.7 | 3.6 |

Why Kenyans Save: A Shift in Motives

Numbers also reveals a shift in why Kenyan adults save — from immediate needs like daily expenses and emergencies, toward long-term goals such as retirement and business expansion.

Saving for education saw the steepest drop (−22 points), while retirement saving rose slightly.

| Purpose | 2021 (%) | 2024 (%) | Change |

| Day-to-day needs | 43 | 36 | -7 |

| Emergencies | 35 | 28 | -7 |

| Education (self/children) | 32 | 10 | -22 |

| Retirement | 10 | 13 | +3 |

| Business expansion | 6 | 8 | +2 |

| Land/House/Personal Use | 4 | 4 | 0 |

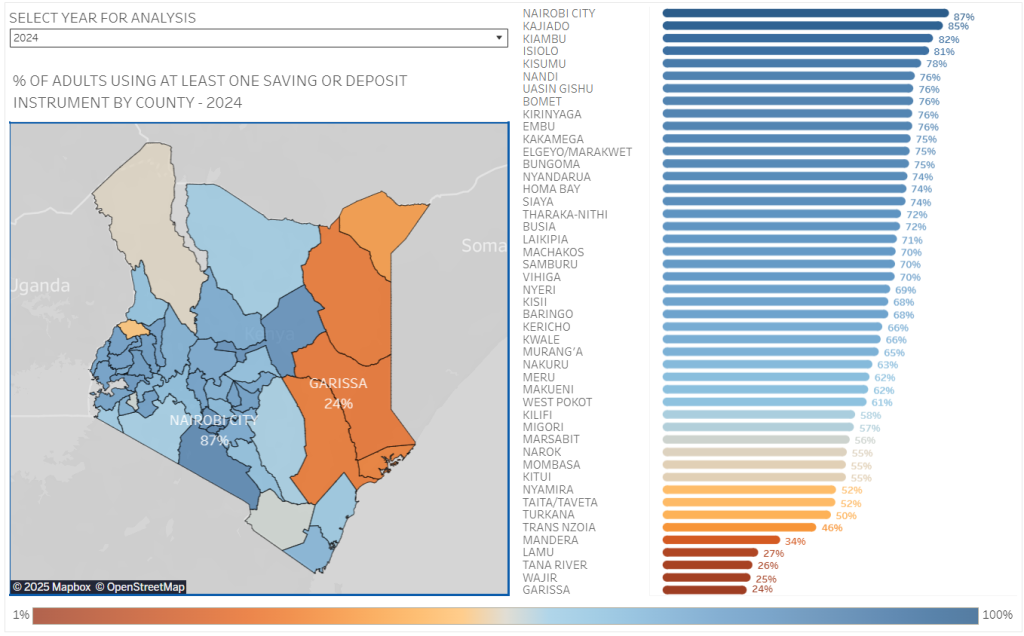

At regional level, some counties recorded impressive gains in formal savings adoption, while others experienced substantial setbacks.

- •Top Performers in 2024: Nairobi (87%), Kiambu (82%), Kajiado (85%) remain national leaders.

- •Counties with Sharpest Declines: Baringo dropped from 97% in 2021 to 68% in 2024; Trans Nzoia saw an even steeper fall from 90% to 46%.

- •Lowest Usage: Garissa (24%) alongside Wajir, Tana River, and Mandera (all under 30%) reflect persistently low engagement.