For several years, Kenya’s real estate sector has been definitely lucrative, attracting both investors and genuine buyers alike. Yet, a noticeable majority of kenyans are overly anxious when dealing with investment in this particular sector.

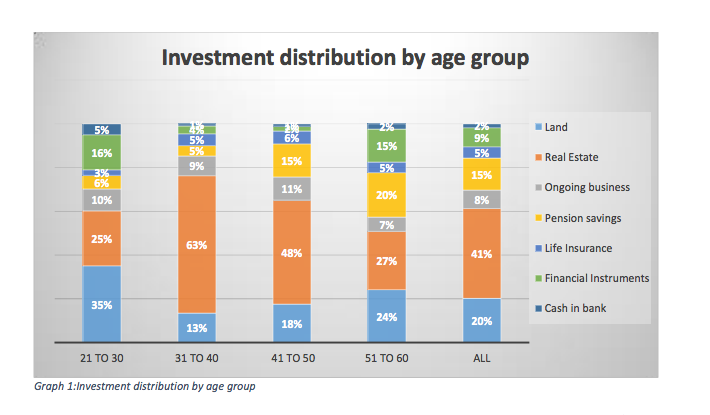

However, according to a survey conducted by a local pension administrator, Enwealth Financial Services in partnership with Strathmore University – 62.8 per cent of Kenyans opt for land and real estate when it comes to securing their investments. The report also states that 9.2 per cent of the population prefer investing in financial instruments while 9 per cent prefer investing in an ongoing business.

The survey covered average Kenyans from the top and middle slots of professionals and self-employed people who have savings and are planning to invest for future protection. Land and real estate makes up the largest assets Kenyans invest in across all age cohorts.

“Over the different age units there is a gradual change in the composition of investment assets, with land contributing the larger portion for those under 30 and real estate for those between 31 and 40 years.” said Enwealth CEO Simon Wafubwa while presenting the report to Industry stakeholders.

He said the decision by young people to invest in land and real estate is attributed to the perceived attractive returns, compared to returns from other asset classes like stocks which are viewed to be of high risk.

RELATED; 86% of Kenya’s working population uncertain of financial security in retirement – Report