First published on May 11th by Bob Ciura, David Morris, & Ben Reynolds for SureDividend

The dividend payment process may seem simple. You invest in a dividend paying stock, and then the dividends end up in your brokerage account when payments are made (typically quarterly).

There’s actually four steps to this process that often go unnoticed by dividend investors:

- •Declaration date

- •Ex-Dividend date dividend payment

- •Record date

- •Payment date

Investors should become familiar with all four terms before buying a dividend stock, as being able to identify these dates will help avoid any potential confusion.

This article will discuss each term in detail, and use two examples to show how these dates can be easily found for specific companies.

Table of Contents

- •Overview Of The 4 Step Dividend Payment Process

- •Declaration Date

- •Record Date vs Ex-Dividend Date

- •Payment Date

- •Two Real Life Examples

- •Final Thoughts

Overview Of The 4 Step Dividend Payment Process

Step #1: First, a company declares they are paying a dividend. This is the dividend declaration date.

Step #2: Then, a company decides which shareholders will receive a dividend. Shareholders who own shares before the ex-dividend date will receive the next dividend payment.

Important Note: The ex-dividend date is two days before the record date.

Step #3: The record date is the date when the corporation actually looks at its records to determine who will receive the dividend.

Step #4: Finally, the payment date is the payment date, when the dividend is actually paid to shareholders.

What really matters for shareholders is receiving the dividend in question. And three important dates determine who receives the dividend (and who doesn’t).

The first important date is your purchase (transaction) date. When shares trade hands, they actually do so on the actual purchase date, even though the formal settlement date is typically delayed by a few days time. For dividend purposes, the purchase date can make a difference. You must purchase one day in advance of the ex-dividend date to receive the dividend payment in question.

As discussed above, the ex-dividend date determines whether it is the buyer or the seller who receives the dividend. Investors who purchase shares on or after the ex-dividend date will not be paid that quarter’s dividend. Investors who purchase shares before the ex-dividend date will be paid that quarter’s dividend.

And finally, the payment date is the date the dividend payment is actually sent. Depending on the medium through which you own your shares, dividends may be mailed to you as a check, wired into your bank account, or deposited into your brokerage account as cash.

Dividend Declaration Date

The declaration date is the date on which the company’s Board of Directors announces the next dividend payment to shareholders. It is simply an announcement – no dividends are paid on the declaration date.

Generally, dividends are paid quarterly, so declaration dates are quarterly as well.

While dividends are in no way guaranteed, it is generally a goal of company management to grow their dividend payments over time. This is a shareholder-friendly activity that is seen as a sign of underlying business strength, and is certainly discussed in great detail at Board of Directors meetings.

Companies will generally make it very clear when their dividends are announced via a press release on their Investor Relations website.

Record Date Versus Ex-Dividend Date

The record date and the ex-dividend date determine which shareholders are eligible to receive company dividends.

If shares trade hands in the time leading up to a dividend payment, these two dates determine whether it is the buyer or the seller who receives the dividend.

The record date is the date on which company management looks at their shareholder records to see who is eligible to receive the company’s future dividend payment. However, this date is of little importance to investors. Buying the company’s stock on the record date does not mean that you will receive the company’s next dividend.

Practically speaking, the most important date for dividend investors to be aware of is the ex-dividend date. This date, which is two days before the record date, has much greater implications for portfolio management.

Investors who purchase shares on or after the ex-dividend date will not be paid that quarter’s dividend (although they will be entitled to future dividends, assuming they still hold the shares). Investors who purchase shares before the ex-dividend date will be paid that quarter’s dividend.

The reason why the ex-dividend date is two days earlier than the record date is because it takes three days for a trade to ‘settle’ – for cash and shares to legally trade hands.

This seems counterintuitive. Anyone who has placed trades before knows that cash is deposited to your account on the day that you sell shares. Often, this is simply because your broker is willing to front you the money in advance while they wait to receive money from the counter-party. The actual process takes three days to complete.

This is why you must purchase three days in advance of the record date (or one day in advance of the ex-dividend date) to receive the dividend payment in question.

The Payment Date

The payment date is the date on which corporate cash is actually paid to shareholder as a dividend. Depending on the medium through which you own your shares, dividends may be mailed to you as a check, wired into your bank account, or deposited into your brokerage account as cash.

Many companies also offer a Dividend ReInvestment Plan (or a DRIP, for short). These plans allow investors to use dividends to purchase morecompany shares.

You can view the 15 best DRIP stocks here (each of the stocks in that article charge no fees for their DRIPs).

Two Real-Life Examples of the Dividend Payment Process

Suppose an investor is looking to initiate a position in high-quality dividend growth stock AbbVie Inc. (ABBV), which is one of our top-ranked dividend stocks and a member of the Dividend Aristocrats.

You can download a full list of all 65 Dividend Aristocrats by clicking on the link below:

An investor purchasing the stock today would likely want to make sure he or she is eligible for the company’s next quarterly dividend payment. As such, investors need to purchase before the company’s ex-dividend date.

The easiest way to find this date is by looking directly on the company’s Investor Relations page, which can be easily found via a Google search.

AbbVie’s Investor Relations site reveals that the company’s next ex-dividend date is in mid-July.

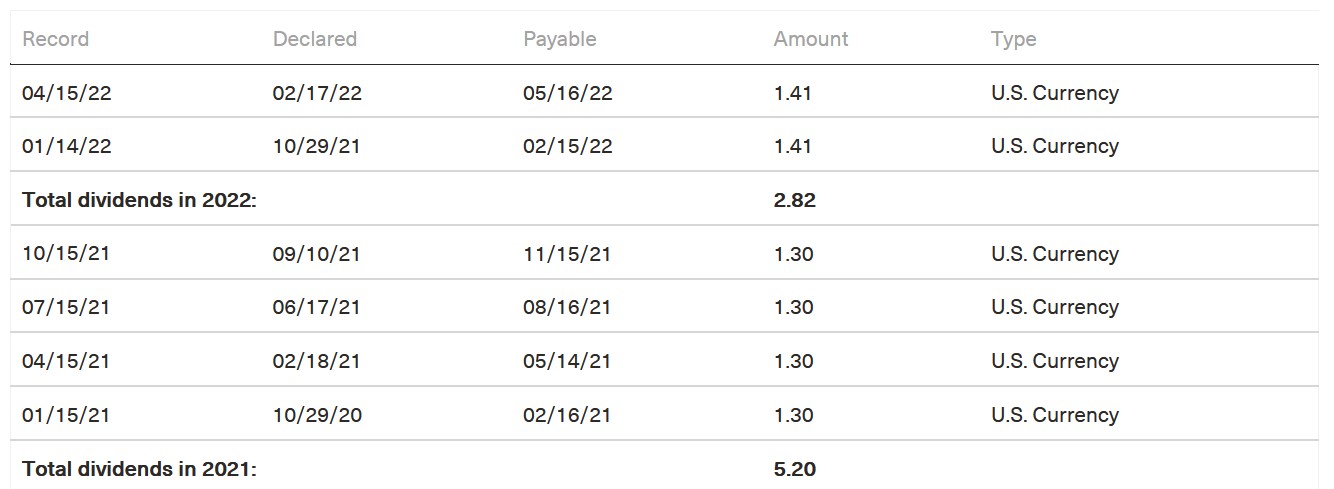

Or, investors can see AbbVie’s dividend history in the Stock Information portion of its Investor Relations page. There, investors will find that AbbVie has declared two dividend payouts of $1.41 per share so far this year, after paying out $5.20 per share in 2021.

Source: AbbVie Investor Relations

Applying the same methodology yields identical results for industrial giant 3M Company (MMM), which has an even longer dividend history than AbbVie.

3M has paid dividends for over a century, and has increased its dividend each year for the past 60 years in a row. 3M is a Dividend Aristocrat, and a Dividend King as well.

You can download a free list of all 44 Dividend Kings by clicking on the link below:

Click here to download my Dividend Kings Excel Spreadsheet now. Keep reading this article to learn more.

First, search for 3M’s dividend information on Google. While the company’s Investor Relations page might not be the first result, it is still on the first page of the search engine and thus very easy to find.

Once there, scrolling down leads to a table that is similar to AbbVie’s Investor Relations page.

In contrast to AbbVie, 3M has declared only one dividend so far in 2022, with three more to come. Its most recent dividend payment was made on March 12th. It is likely that 3M will announce its second quarterly dividend payout of the year over the coming days.

These two examples show precisely how easy it is to find information on record dates, ex-dividend dates, and pay dates for corporate dividends.

Final Thoughts

As investors, there are many other more important issues that we should be concerned with, instead of simply the timing that a specific company uses to pay its dividends.

On a company’s ex-dividend date, shares generally drop by an amount approximately equal to the company’s next dividend payment.

Investors wanting to ‘lock in’ the gain of that dividend, but who do not purchase before the ex-dividend date can still purchase shares on the ex-dividend date at a discount approximately equal to the dividend amount.

Because of this, there is no advantage to waiting to purchase shares.

Instead, focus on developing a long-term systematic investing plan that will be successful regardless of your timing of dividend payments.

Additionally, make sure a company’s dividend is sustainable for the long run. This requires a company to have durable competitive advantages, a steadily profitable business model even during recessions, and a positive growth outlook.

If you find a company that ranks favorably according to a proven system such as the Sure Analysis Research Database, buy some shares and focus on holding the stock over the long-term.

This article was first published by Bob Ciura, David Morris, Ben Reynolds for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

How To Live Off Dividends In Retirement

11 Best Stocks To Start Your Retirement Portfolio Now

The 4 Big U.S Bank Stocks Ranked | The Best Big Bank Stock Now

The 10 Best Retail Stocks To Buy Now For High Expected Returns