First published on June 15th, 2022 by Bob Ciura for SureDividend

Note: This article was originally titled ‘Bear Market Stocks: The Dividend Investors Guide’. It has been expanded and updated.

The S&P 500 has officially entered bear market territory. But for long-term investors, the decline in stock prices could be viewed as an opportunity to buy.

For this reason, we steer investors toward high-quality dividend growth stocks such as the Dividend Aristocrats.

The Dividend Aristocrats are a select group of 65 S&P 500 stocks with 25+ years of consecutive dividend increases.

There are currently 65 Dividend Aristocrats. You can download an Excel spreadsheet of all 65 (with metrics that matter such as dividend yields and price-to-earnings ratios) by clicking the link below:

Click here to download your Dividend Aristocrats Excel Spreadsheet List now.

Bear markets are uncomfortable, but can be much easier to tolerate by owning high-quality dividend growth stocks.

Table Of Contents

You can instantly jump to any particular section of the article by utilizing the links below:

- •What Is A Bear Market?

- •The S&P 500 Officially Enters A Bear Market

- •The Mindset Needed To Beat Bear Markets

- •Recession-Resistant Industries

- •Bear Market Stock #1: Walmart Inc. (WMT)

- •Bear Market Stock #2: Johnson & Johnson (JNJ)

- •Bear Market Stock #3: McDonald’s Corporation (MCD)

What Is A Bear Market?

The name ‘bear market’ invokes fear, and for good reason. Market-wide stock declines are called ‘bear markets’.

What is a bear market? Investopedia defines a bear market as (links added):

A market condition in which the prices of securities are falling, and widespread pessimism causes the negative sentiment to be self-sustaining. As investors anticipate losses in a bear market and selling continues, pessimism only grows. Although figures can vary, for many, a downturn of 20% or more in multiple broad market indexes, such as the Dow Jones Industrial Average or Standard & Poor’s 500 Index, over at least a two-month period, is considered an entry into a bear market.

The 20% decline threshold is what differentiates a bear market form a mere pullback or market correction.

- •Pullback: Market loss of 0% to 10%

- •Correction: Market loss of 10% to 20%

- •Bear Market: Market Loss of 20% or more

Bear markets send shivers down the spines of timid investors… And for good reason. Seeing the value of your stocks falling is unnerving.

There is however a silver-lining (silver fur?) to bear markets.

Bear Markets provide investors with opportunities to buy stocks at bargain prices.

Dividend investors in particular should be happy to see bear markets. The lower stock prices go, the greater dividend yield new purchases will have.

Higher dividend yields mean a shorter dividend payback period. Your investments will pay you more when purchased in a bear market.

What stocks you purchase before a bear market matters. If you invest in high quality businesses that are likely to pay rising dividends through the bear market, then you will feel confident in your portfolio. You can also reinvest those dividends into stocks that have seen their prices fall significantly.

Here’s an example of the type of bargains available during recessions…

Aflac (AFL) stock briefly traded for dividend yields over 7% during 2009. The stock currently has a 3% dividend yield. Click here for detailed Aflac analysis.

You can imagine how much of a steal the stock was when it yielded more than 7%.

This article examines bear markets in detail and provides 3 high-quality dividend growth investment ideas to recession-proof your portfolio.

The S&P 500 Officially Enters A Bear Market

On June 13th 2022, the S&P 500 Index officially entered a bear market.

Now, the big question is whether the U.S. economy will enter a recession.

When the next recession will occur is another question entirely. Nobody knows exactly when a recession will occur. The economy (and the stock market) is a complex dynamic system. It is not predictable.

While it is impossible to know exactly when a recession will occur, we can analyze history to see if we are in a time period that has a higher probability of a recession occurring in the near future.

The first sign we were due for a bear market was the high valuation of the stock market heading into the year. The historical average price-to-earnings (P/E) ratio of the S&P 500 is 16. It was trading for a price-to-earnings ratio above 35 recently.

There is one caveat to this simple price-to-earnings analysis: interest rates were near historical lows.

Low interest rates cause higher valuations. When savings accounts are yielding near 0%, the stock market looks like a comparatively favorable investment. This increases demand for stocks, and therefore the price-to-earnings multiple of the market.

Now that interest rates are rising to combat inflation, it makes sense that the SP 500’s price-to-earnings ratio has fallen to the current level of 19. However, if the valuation multiple of the S&P continues to drop towards its long-term average, this would imply ~16% further downside.

The good news is, investors can psychologically prepare themselves to handle bear markets.

The Mindset Needed To Beat Bear Markets

When the market falls, things get ugly in a hurry. Investors can recall the Great Recession and bear market of 2007-2009 as a good example.

You can see that from these 3 bear market stock charts from October of 2007 through March of 2009.

Here’s the S&P 500 (SPY)

And emerging markets (VWO)

And small cap stocks (VBR)

When markets fall, it is important to remember that stock price movements are not your enemy. In fact, you can benefit from a recession in the stock market.

It takes a self-assured investor to not panic during bear markets. The average individual investor sells during bear markets and buys during bull markets. This is completely backward – and it’s the primary reason why individual investors tend to do so poorly in the stock market.

I hope by reading this you will take action.

When the next bear market hits – and hits your portfolio (and everyone else’s) hard, DO NOT SELL.

Instead, either hold your stocks (which is okay), or buy while bargains are available (which is much better).

If you can adjust your psychology to be excited for the bargains that bear markets provide – or at least be ambivalent about bear markets – you will greatly outperform your investing peers.

Gene Walden of All Star Stocks has excellent advice on what to do in bear markets:

“So what should you do in a bear market? If you’re a long-term investor you do roughly the same thing in a bear market that you would in a bull market. You buy right through it. You make a continuing series of small bets. You select good quality companies and continue to build a position in those companies.”

For me, the key to being excited about bear markets is to invest in high quality dividend growth stocks with a long history of increasing dividends. These are stocks that have proven themselves in both bull and bear markets.

That doesn’t mean high quality dividend growth stocks don’t see price declines in bear markets… These stocks fall as well, but not as much, on average. Case-in-point, the Dividend Aristocrats Index fell 22% in 2008, while the S&P 500 fell 38%.

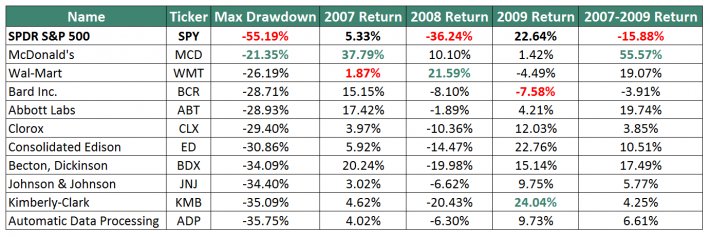

The image below shows the investing performance of the 10 most recession-proof Dividend Aristocrats:

As you can see, 2 Dividend Aristocrats (Walmart and McDonald’s) actually posted double-digit positive returns during the 2008, while the S&P 500 fell 36%.

Recession-Resistant Industries

Specific industries tend to perform better than others during recessions. Among the worst performers are airlines, hotels, and casino stocks. People simply spend less extravagantly when times get tough.

Six of the most recession-proof industries are shown below, along with a brief description of what makes them resistant to recessions.

- •Fast Food Stocks: People substitute fast food for more expensive restaurants during recessions.

- •Health Care Stocks: You cannot ‘put off’ important medical procedures

- •Discount Retail Stocks: People look for bargains when income falls

- •Waste Disposal Stocks: The garbage must be collected regardless of the overall economy

- •Alcohol Stocks & Tobacco Stocks: People look for an escape when times get tough

- •Essential Household Goods Stocks: Tissues, toilet paper, and other staples must be purchased

The 6 industries above have specific characteristics that help them to fight off the most severe effects of recessions. The 3 bear market stocks below are all worthy holds to protect your portfolio against recessions.

Bear Market Stock #1: Walmart (WMT)

From the beginning of 2007 to the end of 2009, the S&P 500 declined 15.9%. Walmart (WMT), on the other hand, gained 19.1%.

Walmart is an ideal bear market stock. The company is known to offer ‘everyday low prices’. When times get tough, consumers look for ways to get discounts on everyday household items. As a result, Walmart tends to do well during recessions.

Just how well? The company’s earnings-per-share each year through the Great Recession of 2007 to 2009 are shown below:

- •2007 earnings-per-share of $3.16

- •2008 earnings-per-share of $3.42

- •2009 earnings-per-share of $3.66

Thanks in large part to its recession-resistant business model, Walmart has increased its dividend each year for over 40 years. It is on the Dividend Aristocrats list.

Currently, the stock is offering investors a 1.9% dividend yield. The company currently has a payout ratio of around 35%. Despite its low payout ratio, Walmart will likely grow its dividend in line with earnings-per-share growth (instead of growing dividends faster) as the company is plowing money into future growth initiatives.

Walmart’s e-commerce segment is booming, leading to strong comparable sales growth in the United States.

If we do enter into another recession, Walmart will likely benefit from increased store traffic and greater sales – and earnings. Walmart is investing heavily in digital sales and better employee compensation. As a result, revenue and comparable store sales are up.

Earnings-per-share increased 8.2% from 2007 to 2008, and 7.0% from 2008 to 2009. While these are not amazing numbers during a solid economy, they are amazing when one considers the overall economic climate. 2007 through 2009 was a time when many businesses were absolutely struggling.

Bear Market Stock #2: Johnson & Johnson

Johnson & Johnson (JNJ) could have the best record of consistency of any publicly traded corporation. The company has paid increasing dividends for over 50 consecutive years. It is on the list of Dividend Kings.

As one would expect from such a stable business, Johnson & Johnson marched through the Great Recession of 2007 to 2009 without missing a beat. The company saw earnings-per-share grow each year of the Great Recession:

- •2007 earnings-per-share of $4.15

- •2008 earnings-per-share of $4.57

- •2009 earnings-per-share of $4.63

Additionally, the company’s stock realized total returns of 5.8% (versus -15.9% for the S&P 500) from 2007 through 2009.

Johnson & Johnson is a high quality dividend growth stock. The company has compounded earnings-per-share at 7.5% a year over the last decade. This is largely because of the company’s diversified business model and its leadership position across the three core markets in which it operates–pharmaceuticals, medical devices, and consumer health products.

Investors in Johnson & Johnson should expect reliable growth of around 6% a year combined with the company’s current 2.7% dividend yield.

Johnson & Johnson is currently trading at a forward price-to-earnings multiple of 16.5, a reasonable valuation against our fair value estimate of 17, equal to the stock’s 10-year average. Johnson & Johnson appears somewhat undervalued at this time. And, there is little doubt the company will be able to continue increasing its dividend each year, even during a recession.

Bear Market Stock #3: McDonald’s Corporation (MCD)

McDonald’s is the world’s leading global foodservice retailer with about 40,000 locations in over 100 countries. Approximately 93% of the stores are independently owned and operated. The company has raised its dividend each and every year since paying its first dividend in 1976, qualifying the company as a Dividend Aristocrat.

McDonald’s has a long and successful growth history when it comes to both earnings-per-share and dividends. From 2008-2019 earnings-per-share compounded at an average rate of 7.1% per year.

Like Walmart and J&J, McDonald’s is one of the few businesses to grow earnings-per-share each year through the Great Recession of 2007 to 2009. The company’s earnings-per-share through the Great Recession are shown below:

- •2007 earnings-per-share of $2.91

- •2008 earnings-per-share of $3.67

- •2009 earnings-per-share of $3.98

The company’s well-branded restaurants see demand increase during recessions. That’s because consumers tend to scale down their budgets when dining out during an economic downturn. McDonald’s dividend payout ratio has been oscillating in a range of ~50% to ~70% throughout the last decade. Due to the stability of McDonald’s during past recessions, coupled with a payout ratio that is not overly high, we view McDonald’s dividend as safe.

McDonald’s is currently trading for an adjusted price-to-earnings ratio of 23.6. The company appears to be trading significantly above fair value. However, shares currently yield 2.3%, and the company is very likely to keep increasing its dividend each year, even during recessions.

Take Action Today

All 3 of the stocks listed in this article perform exceptionally well during recessions. And all 3 have long histories of dividend growth. As a result, investors looking to improve the performance of their portfolio during recessions should consider Walmart, Johnson & Johnson, and McDonald’s.

Whether or not you buy these stocks today (or in the near future), it is critical that you take action by preparing yourself for the bear market.

Some investors will panic. Others know their portfolios are invested in high quality dividend growth stocks with a long history of paying steady or rising dividends through recessions.

These well-prepared investors will reinvest their dividends at very favorable prices during a bear market. If they are still saving money, they will add to their portfolios rather than sell in fear.

Be mentally prepared for the next recession to realize stock market success when others are panicking.

Other Dividend Lists

The Dividend Aristocrats list is not the only way to quickly screen for stocks that regularly pay rising dividends.

- •The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- •The Dividend Achievers List is comprised of ~350 stocks with 10+ years of consecutive dividend increases.

- •The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- •The Blue Chip Stocks List: stocks that qualify as Dividend Achievers, Dividend Aristocrats, and/or Dividend Kings

- •The High Dividend Stocks List: stocks that appeal to investors interested in the highest yields of 5% or more.

- •The Monthly Dividend Stocks List: stocks that pay dividends every month, for 12 dividend payments per year.

- •The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - •The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- •The Dividend Challengers List: 5-9 consecutive years of dividend increases.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

How To Live Off Dividends In Retirement

11 Best Stocks To Start Your Retirement Portfolio Now

The 4 Big U.S Bank Stocks Ranked | The Best Big Bank Stock Now

The 10 Best Retail Stocks To Buy Now For High Expected Returns