First Published on February 18th, 2023 by Samuel Smith for SureDividend. Spreadsheet data updated daily; Top 10 list is updated when the article is updated.

Return on invested capital, or ROIC, is a valuable financial ratio that investors can add to their research process.

Understanding ROIC and using it to screen for high ROIC stocks is a good way to focus on the highest-quality businesses.

With this in mind, we ran a stock screen to focus on the highest ROIC stocks in the S&P 500.

You can download a free copy of the top 100 stocks with the highest ROIC (along with important financial metrics like dividend yields and price-to-earnings ratio) by clicking on the link below:

Using ROIC allows investors to filter out the highest-quality businesses that are effectively generating a return on capital.

This article will explain ROIC and its usefulness for investors. It will also list the top 10 highest ROIC stocks right now.

Table Of Contents

You can use the links below to instantly jump to an individual section of the article:

What Is ROIC?

Put simply, return on invested capital (ROIC) is a financial ratio that shows a company’s ability to allocate capital. The common formula to calculate ROIC is to divide a company’s after-tax net operating profit, by the sum of its debt and equity capital.

Once the ROIC is calculated, it is evaluated against a company’s weighted average cost of capital, commonly referred to as WACC. If a company’s WACC is not immediately available, it can be calculated by taking a weighted average of the cost of a company’s debt and equity.

Cost of debt is calculated by averaging the yield to maturity for a company’s outstanding debt. This is fairly easy to find, as a publicly-traded company must report its debt obligations.

Cost of equity is typically calculated by using the capital asset pricing model, otherwise known as CAPM.

Once the WACC is calculated, it can be compared with the ROIC. Investors want to see a company’s ROIC exceed its WACC. This indicates the underlying business is successfully investing its capital to generate a profitable return. In this way, the company is creating economic value.

Generally, stocks generating the highest ROIC are doing the best job of allocating their investors’ capital. With this in mind, the following section ranks the 10 stocks with the highest ROIC.

The Top 10 Highest ROIC Stocks

The following 10 stocks have the highest ROIC. Stocks are listed in order from lowest to highest.

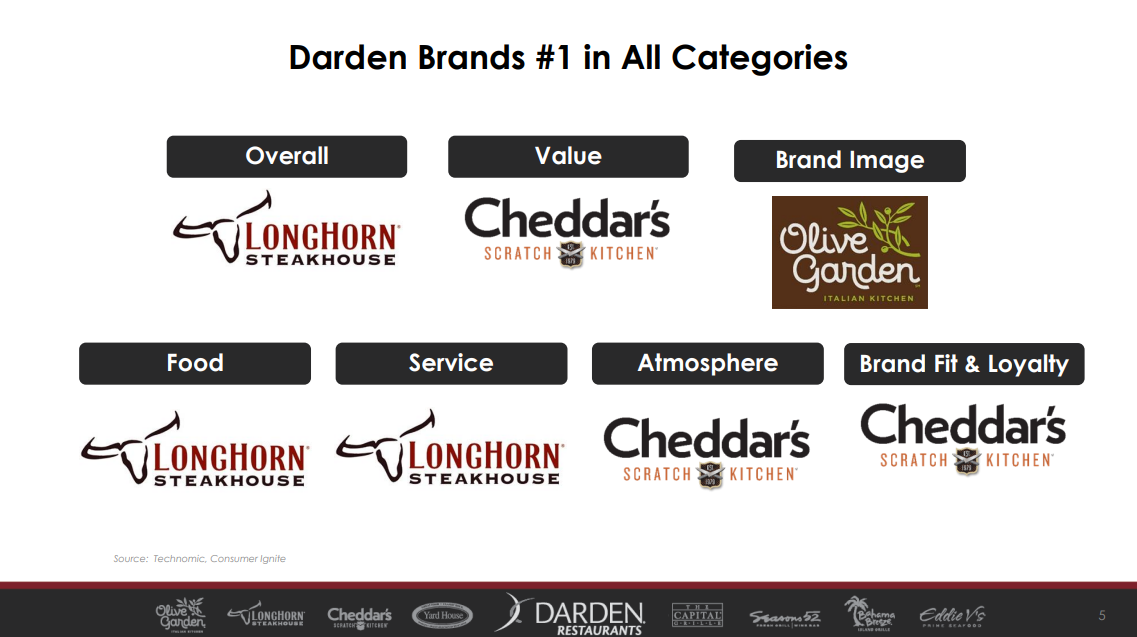

High ROIC Stock #10: Darden Restaurants Inc. (DRI)

- •Return on invested capital: 30.8%

Darden Restaurants Inc. is a restaurant company with a portfolio of brands including Olive Garden, LongHorn Steakhouse, Cheddar’s Scratch Kitchen, Yard House, The Capital Grille, Seasons 52, Bahama Breeze, and Eddie V’s. The company employs 165,000 team members, and as of the fiscal year ending May 31, 2022, it owns and operates over 1,800 restaurants in the United States and Canada, and 71 franchisees serve restaurants. Darden Restaurants Inc. has a $16.9 billion market capitalization and a 10-year dividend CAGR of 15.0% before the COVID-19 pandemic. However, recently the company has been very aggressive in increasing its dividend.

Darden Restaurants, Inc. has grown operating margins for the past five years. 2014 operating margin was 4.6%, which increased to 9.9% at the end of 2022. This performance was attributable to revenue growth, outpacing selling, general, and administrative expenses. However, the operating margin is currently sitting at a 12.1% rate. After FY2022, we forecast 4% earnings-per-share growth annually over the next five years, which will give the company expected earnings of $9.50 per share for 2028. Net margin has also been increasing over the past few years, which will help with earnings growth.

Click here to download our most recent Sure Analysis report on Darden Restaurants Inc. (preview of page 1 of 3 shown below):

High ROIC Stock #9: Best Buy Co. Inc. (BBY)

- •Return on invested capital: 35.5%

Best Buy Co. Inc. is one of North America’s largest consumer electronics retailers, with operations in the U.S. and Canada. Best Buy sells consumer electronics, personal computers, software, mobile devices, and appliances and provides services. At the end of Q3 FY2023, Best Buy operated 925 Best Buy stores and 19 Best Buy Outlet Centers in the U.S., 21 Pacific Sales Stores, 14 Yardbird Stores, 127 Best Buy stores in Canada, and 33 Best Buy Mobile Stand-Alone Stores in Canada. Best Buy exited its Mexico operations in fiscal 2021. The company continues to lower total store count continuing a long-term trend. The company’s annual sales exceeded $51.7B in fiscal 2022.

Best Buy’s diluted non-GAAP EPS growth is volatile because of the Great Recession and the transition to online shopping. In fact, sales growth was flat-to-negative from fiscal 2012 to 2017. However, the company’s efforts to prioritize online sales growth, optimize store count and extract cost efficiencies led to organic sales growth and higher earnings accelerated by the COVID-19 pandemic. But now sales are declining rapidly as consumers return to more normal buying habits and federal stimulus dollars expire. Additionally, inflation and supply chain disruptions are impacting margins. We are forecasting, on average, 4% EPS and lowered DPS growth to 6% out to fiscal 2028, but growth will be uneven.

Click here to download our most recent Sure Analysis report on Best Buy Co. Inc. (preview of page 1 of 3 shown below):

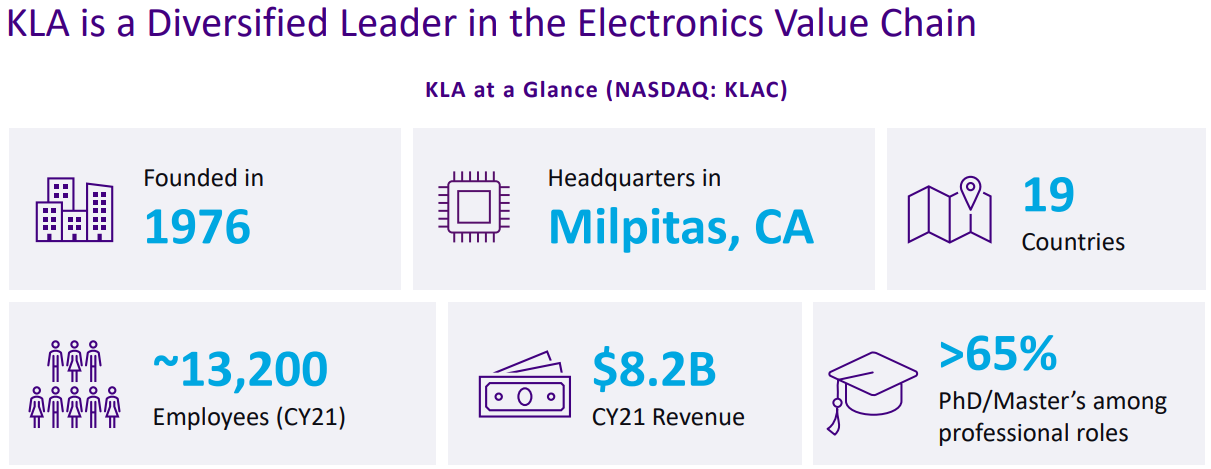

High ROIC Stock #8: KLA Corporation (KLAC)

- •Return on invested capital: 39.4%

KLA Corporation is a supplier to the semiconductor industry. The company supplies process control and yield

management systems for semiconductor producers such as TSMC, Samsung and Micron. KLA was created in 1997,

through a merger between KLA Instruments and Tencor Instruments, and has grown through a range of acquisitions

since then. The company is headquartered in Milpitas, CA.

KLA Corporation’s earnings-per-share growth has historically come from a mix of revenue growth, margin improvements, and share repurchases. The revenue growth outlook remains strong, as KLA has been able to grow its sales considerably during the last couple of quarters. The majority of KLA’s revenues come from product sales, but service revenues are becoming increasingly important. This is a positive in the long run, as a higher rate of recurring service revenues should help KLA’s top line become less cyclical.

Click here to download our most recent Sure Analysis report on KLA Corporation. (preview of page 1 of 3 shown below):

High ROIC Stock #7: Ulta Beauty, Inc. (ULTA)

- •Return on invested capital: 45.0%

Ulta has significantly impacted the American beauty retail industry with its strong brand power. Currently operating exclusively in the US, the company had planned a Canadian expansion, which was later cancelled before the pandemic outbreak. Ulta’s loyalty program is highly regarded and among the best in the retail sector, a common attribute of the leading retailers that I cover.

As of the latest update, the program had 39 million members, which represents a 9% YoY increase and accounts for roughly a quarter of all women in the US. This group generates 95% of sales and averages $200 of spend per year. The marketing and data advantages provided by this program are immensely valuable and offer a competitive edge for the company.

In the beauty product sales industry, top brands hold significant power and determine the locations where their products are sold. These high-end brands are highly selective, and the long-standing relationships developed over time prevent newcomers and some e-commerce companies from accessing their products. Initially, this may not seem economically feasible. However, the image of luxury products is crucial. This gives Ulta a nearly impenetrable advantage that few retailers can match.

High ROIC Stock #6: Gen Digital (GEN)

- •Return on invested capital: 49.1%

Gen Digital was formed after the merger of NortonLifeLock and Avast. The company provides security solutions for consumers around the world. It offers Norton 360, an integrated platform providing security with a subscription model for personal computers and mobile devices.

It also offers Norton and LifeLock identity theft protection solution that offers monitoring, alerts, and restoration services to its customers. The company also provides Norton Secure VPN solutions.

GEN stock has a market capitalization above $13 billion. Shares have a current dividend yield of 2.3%.

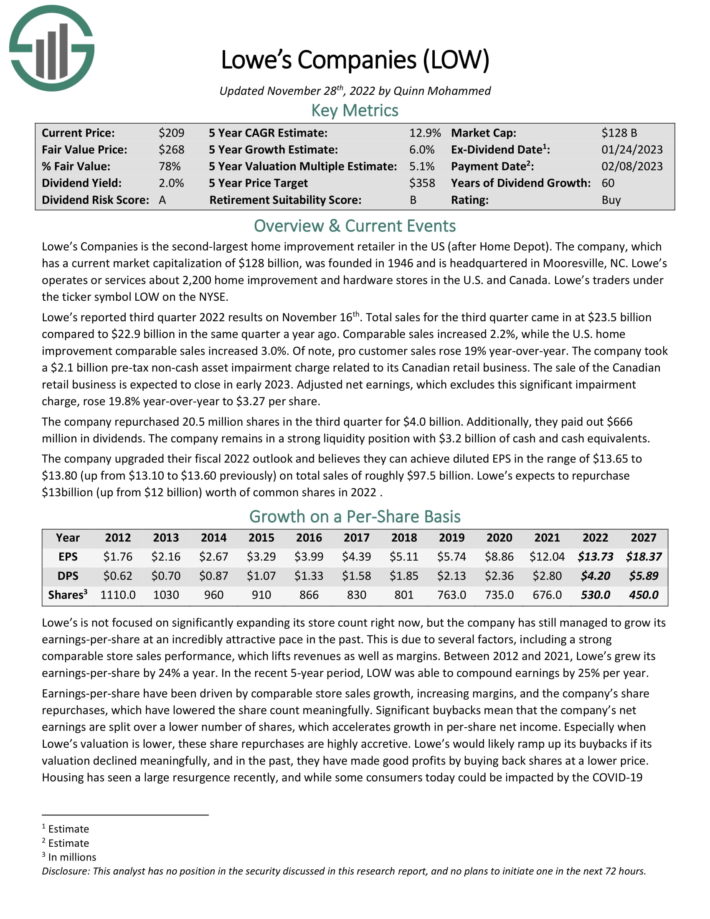

High ROIC Stock #5: Lowe’s Companies (LOW)

- •Return on invested capital: 56.8%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). Lowe’s operates or services more than 2,200 home improvement and hardware stores in the U.S. and Canada.

Lowe’s reported third quarter 2022 results on November 16th. Total sales for the third quarter came in at $23.5 billion compared to $22.9 billion in the same quarter a year ago. Comparable sales increased 2.2%, while the U.S. home improvement comparable sales increased 3.0%. Of note, pro customer sales rose 19% year-over-year.

The company took a $2.1 billion pre-tax non-cash asset impairment charge related to its Canadian retail business. The sale of the Canadian retail business is expected to close in early 2023. Adjusted net earnings, which excludes this significant impairment charge, rose 19.8% year-over-year to $3.27 per share.

The combination of multiple expansion, 6% expected EPS growth and the 2.2% dividend yield lead to total expected returns of 12.6% per year.

Click here to download our most recent Sure Analysis report on Lowe’s (preview of page 1 of 3 shown below):

High ROIC Stock #4: Apple, Inc. (AAPL)

- •Return on invested capital: 59.5%

Apple revolutionized personal technology with the introduction of the Macintosh in 1984. Today the technology company designs, manufactures and sells products such as iPhones, iPads, Mac, Apple Watch and Apple TV.Apple also has a services business that sells music, apps, and subscriptions.

Apple is the #1 holding of Berkshire Hathaway (BRK.B), making the technology giant one of the top Warren Buffett stocks. Apple is also a top holding of other influential investors, such as Kevin O’Leary.

On February 2nd, 2023, Apple reported Q1 fiscal year 2023 results for the period ending December 31st, 2022 (Apple’s fiscal year ends the last Saturday in September). For the quarter, Apple generated revenue of $117.154 billion, a -5.5% decline compared to Q1 2022. Product sales were down -7.7%, driven by an -8.2% decline in iPhones (56% of total sales). Service sales increased 6.4% to $20.8 billion and made up 17.7% of all sales in the quarter. Net income equaled $29.998 billion or $1.88 per share compared to $34.630 billion or $2.10 per share in Q1 2022.

Click here to download our most recent Sure Analysis report on AAPL (preview of page 1 of 3 shown below):

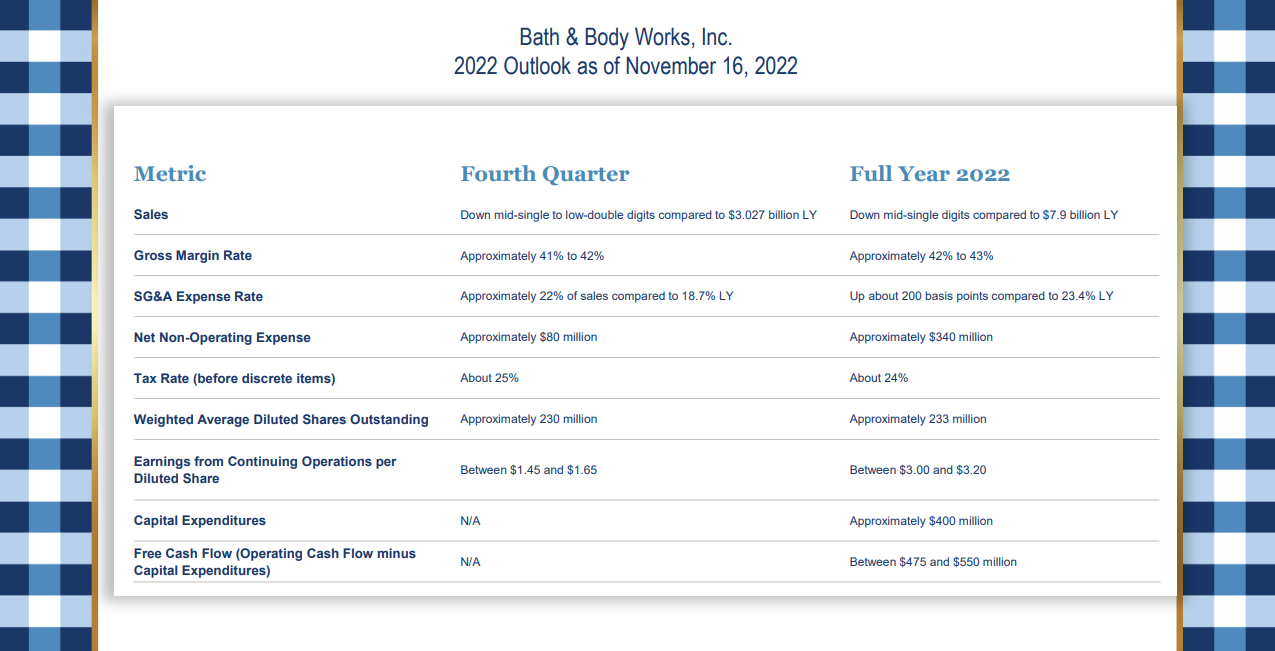

High ROIC Stock #3: Bath & Body Works (BBWI)

- •Return on invested capital: 87.0%

Bath & Body Works is a specialty retailer of home fragrance, body care, and soaps and sanitizer products. Its brands include Bath & Body Works, White Barn, and more.

The company operates over 1,700 company-operated retail stores and another 300+ international partner-operated stores. The company was formerly known as L Brands, Inc. and changed its name to Bath & Body Works, Inc. in August 2021.

High ROIC Stock #2: HP Inc. (HPQ)

- •Return on invested capital: 87.0%

Hewlett-Packard’s origins can be traced back to 1935 when two men started a business in a one-car garage. Over the past eight decades, the company has made significant contributions in electronic test equipment, computing, data storage, networking, software, and services.

On November 1st, 2015, Hewlett-Packard spun off its enterprise technology infrastructure, software, and services business, known as Hewlett Packard Enterprise Company (HPE), and rebranded itself as HP Inc. (HPQ). Today, HP Inc. primarily focuses on two main segments: its product line of printers and its personal systems, which include computers and mobile devices.

Click here to download our most recent Sure Analysis report on HP Inc. (preview of page 1 of 3 shown below):

High ROIC Stock #1: AutoZone Inc. (AZO)

- •Return on invested capital: 180.5%

After opening its first store on July 4th, 1979, AutoZone has grown into the leading retailer and distributor of automotive replacement parts and accessories, with more than 6,000 stores in the U.S., Puerto Rico, Mexico, and Brazil. AutoZone carries new and re-manufactured parts, maintenance items, and accessories for cars, SUVs, vans, and light trucks.

AutoZone has proven to be recession–resistant thanks to the nature of its business. During rough economic periods, the sales of new cars fall significantly, causing the average age of cars to increase. This favors AutoZone’s business. In the Great Recession, when most companies saw their earnings plunge, AutoZone grew its EPS by 18% in 2008 and another 17% in 2009.

Final Thoughts

There are many different ways for investors to value stocks. One popular valuation method is to calculate a company’s return on invested capital. By doing so, investors can get a better gauge of companies that do the best job of investing their capital.

ROIC is by no means the only metric that investors should use to buy stocks. There are many other worthwhile valuation methods that investors should consider. That said, the top 10 ROIC stocks on this list have proven the ability to create economic value for shareholders.

This article was first published by Samuel Smith for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

2023 High Beta Stocks List | The 100 Highest Beta S&P 500 Stocks

2023 Low Beta Stocks List | The 100 Lowest Beta S&P 500 Stocks