First Published on February 1st, 2023 by Bob Ciura for SureDividend. Spreadsheet data updated daily

The Dividend Kings are the best-of-the-best in dividend longevity.

What is a Dividend King? A stock with 50 or more consecutive years of dividend increases.

The downloadable Dividend Kings Spreadsheet List below contains the following for each stock in the index among other important investing metrics:

- •Payout ratio

- •Dividend yield

- •Price-to-earnings ratio

You can see the full downloadable spreadsheet of all 48 Dividend Kings (along with important financial metrics such as dividend yields, payout ratios, and price-to-earnings ratios) by clicking on the link below:

The Dividend Kings list includes recent additions such as Nucor Corp. (NUE), V.F. Corp. (VFC), Gorman-Rupp (GRC), Middlesex Water Company (MSEX), Canadian Utilities (CDUAF), and Tennant Company (TNC).

Each Dividend King satisfies the primary requirement to be a Dividend Aristocrat (25 years of consecutive dividend increases) twice over.

Not all Dividend Kings are Dividend Aristocrats.

This unexpected result is because the ‘only’ requirement to be a Dividend Kings is 50+ years of rising dividends.

On the other hand, Dividend Aristocrats must have 25+ years of rising dividends, be a member of the S&P 500 Index, and meet certain minimum size and liquidity requirements.

Table of Contents

- •How To Use The Dividend Kings List To Find Dividend Stock Ideas

- •The 5 Best Dividend Kings Today

#5: Target Corporation (TGT)

#4: ABM Industries (ABM)

#3: Lowe’s Companies (LOW)

#2: 3M Company (MMM)

#1: V.F. Corp. (VFC) - •Analysis Reports On All 48 Dividend Kings

- •Performance Of The Dividend Kings

- •Sector & Market Capitalization Overview

- •Final Thoughts

How To Use The Dividend Kings List to Find Dividend Stock Ideas

The Dividend Kings list is a great place to find dividend stock ideas. However, not all the stocks in the Dividend Kings list make a great investment at any given time.

Some stocks might be overvalued. Conversely, some might be undervalued – making great long-term holdings for dividend growth investors.

For those unfamiliar with Microsoft Excel, the following walk-through shows how to filter the Dividend Kings list for the stocks with the most attractive valuation based on the price-to-earnings ratio.

Step 1: Download the Dividend Kings Excel Spreadsheet.

Step 2: Follow the steps in the instructional video below. Note that we screen for price-to-earnings ratios of 15 or below in the video. You can choose any threshold that best defines ‘value’ for you.

Alternatively, following the instructions above and filtering for higher dividend yield Dividend Kings (yields of 2% or 3% or higher) will show stocks with 50+ years of rising dividends and above-average dividend yields.

Looking for businesses that have a long history of dividend increases isn’t a perfect way to identify stocks that will increase their dividends every year in the future, but there is considerable consistency in the Dividend Kings.

The 5 Best Dividend Kings Today

The following 5 stocks are our top-ranked Dividend Kings today, based on expected annual returns over the next 5 years. Stocks are ranked in order of lowest to highest expected annual returns.

Total returns include a combination of future earnings-per-share growth, dividends, and any changes in the P/E multiple.

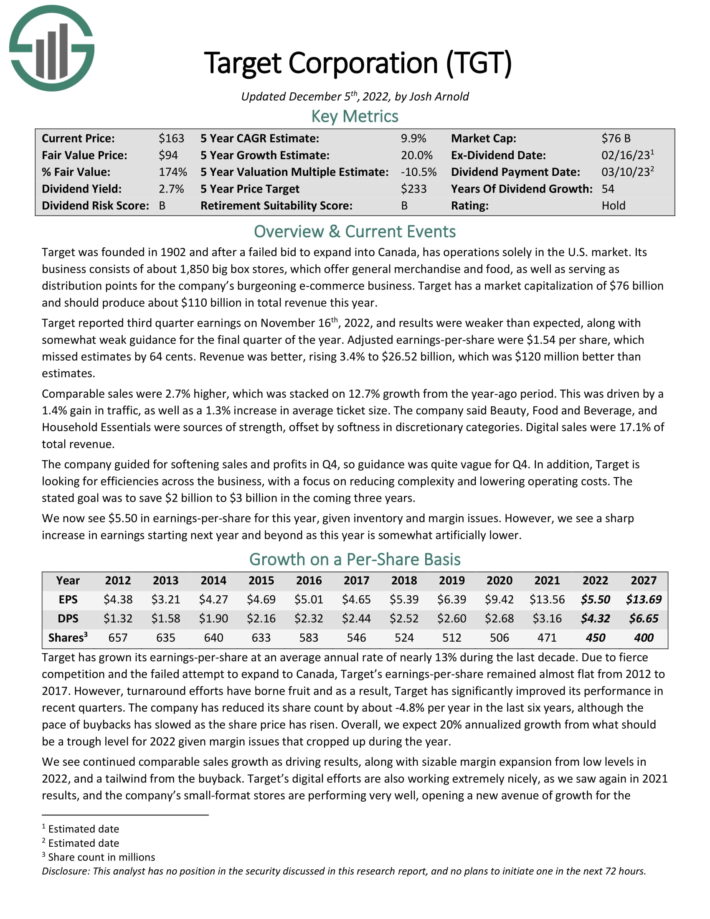

Dividend King #5: Target Corporation (TGT)

- •5-Year Annual Expected Returns: 11.6%

Target is a discount retailer with about 1,850 big box stores which offer general merchandise and food, and serve as distribution points for the company’s burgeoning e-commerce business. Target should produce about $110 billion in total revenue this year.

Target reported third quarter earnings on November 16th, 2022, and results were weaker than expected, along with somewhat weak guidance for the final quarter of the year. Adjusted earnings-per-share were $1.54 per share, which missed estimates by 64 cents. Revenue was better, rising 3.4% to $26.52 billion, which was $120 million better than estimates.

Comparable sales were 2.7% higher, which was stacked on 12.7% growth from the year-ago period. This was driven by a 1.4% gain in traffic, as well as a 1.3% increase in average ticket size. The company said Beauty, Food and Beverage, and Household Essentials were sources of strength, offset by softness in discretionary categories. Digital sales were 17.1% of total revenue.

The company guided for softening sales and profits in Q4, so guidance was quite vague for Q4. In addition, Target is looking for efficiencies across the business, with a focus on reducing complexity and lowering operating costs. The stated goal was to save $2 billion to $3 billion in the coming three years.

Click here to download our most recent Sure Analysis report on TGT (preview of page 1 of 3 shown below):

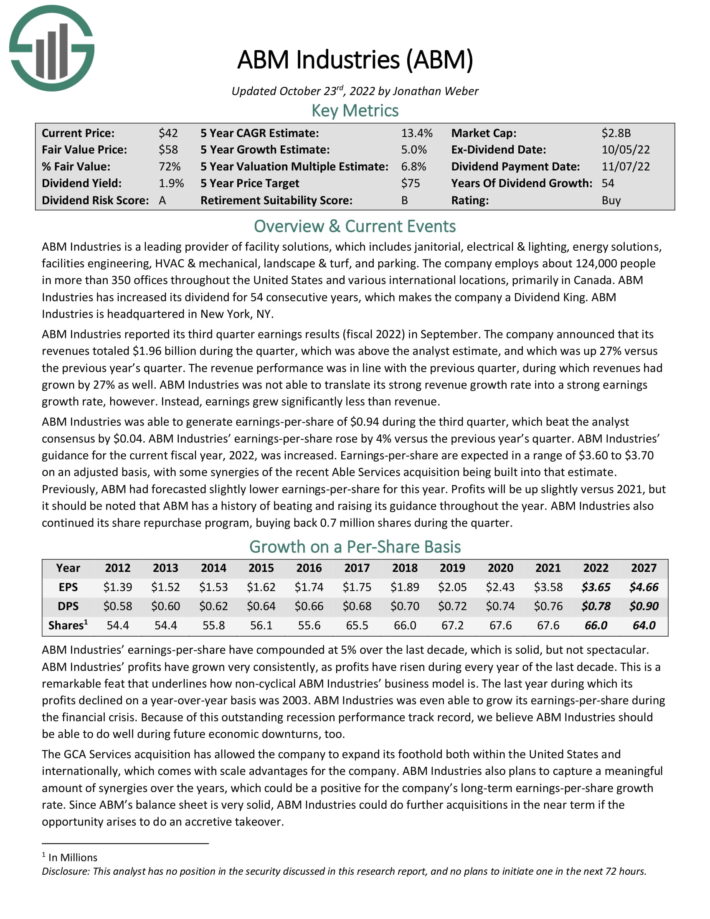

Dividend King #4: ABM Industries (ABM)

- •5-Year Annual Expected Returns: 11.8%

ABM Industries is a leading provider of facility solutions, which includes janitorial, electrical & lighting, energy solutions, facilities engineering, HVAC & mechanical, landscape & turf, and parking. The company employs about 124,000 people in more than 350 offices throughout the United States and various international locations, primarily in Canada.

ABM Industries reported its third quarter earnings results (fiscal 2022) in September. Revenues totaled $1.96 billion, which was above the analyst estimate, and up 27% versus the previous year’s quarter. Earnings-per-share of $0.94 beat the analyst consensus by $0.04. ABM Industries’ earnings-per-share rose by 4% versus the previous year’s quarter.

Guidance for the current fiscal year was increased. Earnings-per-share are expected in a range of $3.60 to $3.70 on an adjusted basis, with some synergies of the recent Able Services acquisition being built into that estimate.

We expect 5% annual earnings-per-share growth over the next five years for ABM. In addition to an expanding valuation multiple and the 2.0% dividend yield, total returns are expected to reach 11.8% per year over the next five years.

Click here to download our most recent Sure Analysis report on ABM (preview of page 1 of 3 shown below):

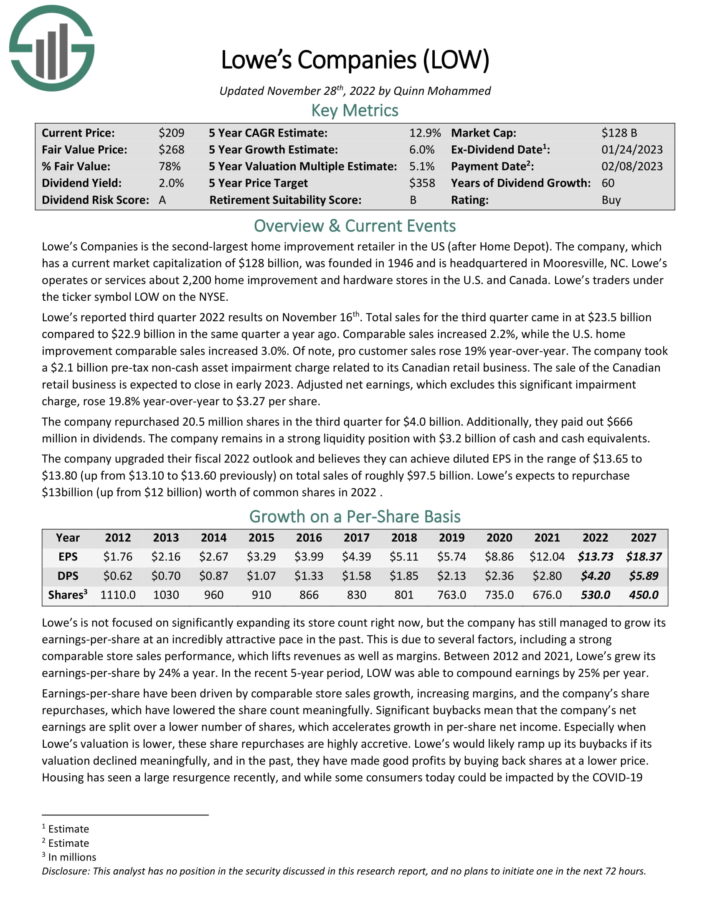

Dividend King #3: Lowe’s Companies (LOW)

- •5-Year Annual Expected Returns: 14.1%

Lowe’s Companies is the second-largest home improvement retailer in the US (after Home Depot). Lowe’s operates or services more than 2,200 home improvement and hardware stores in the U.S. and Canada.

Lowe’s reported third quarter 2022 results on November 16th. Total sales for the third quarter came in at $23.5 billion compared to $22.9 billion in the same quarter a year ago. Comparable sales increased 2.2%, while the U.S. home improvement comparable sales increased 3.0%. Of note, pro customer sales rose 19% year-over-year.

The company took a $2.1 billion pre-tax non-cash asset impairment charge related to its Canadian retail business. The sale of the Canadian retail business is expected to close in early 2023. Adjusted net earnings, which excludes this significant impairment charge, rose 19.8% year-over-year to $3.27 per share.

The combination of multiple expansion, 6% expected EPS growth and the 2.1% dividend yield lead to total expected returns of 14.1% per year.

Click here to download our most recent Sure Analysis report on Lowe’s (preview of page 1 of 3 shown below):

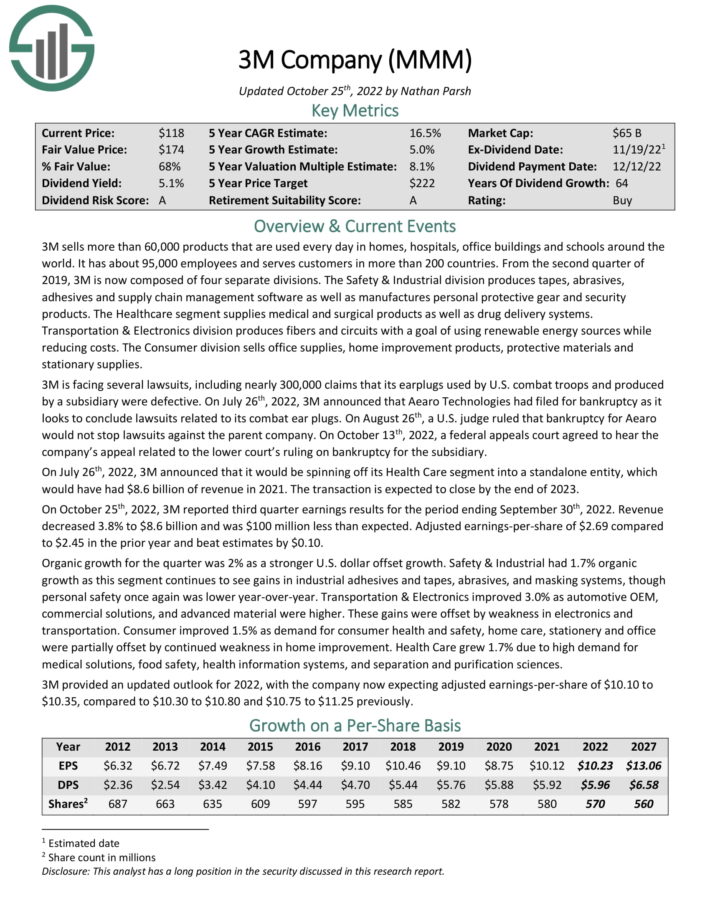

Dividend King #2: 3M Company (MMM)

- •5-Year Annual Expected Returns: 15.7%

3M sells more than 60,000 products that are used every day in homes, hospitals, office buildings and schools around the world. It has about 95,000employees and serves customers in more than 200 countries.

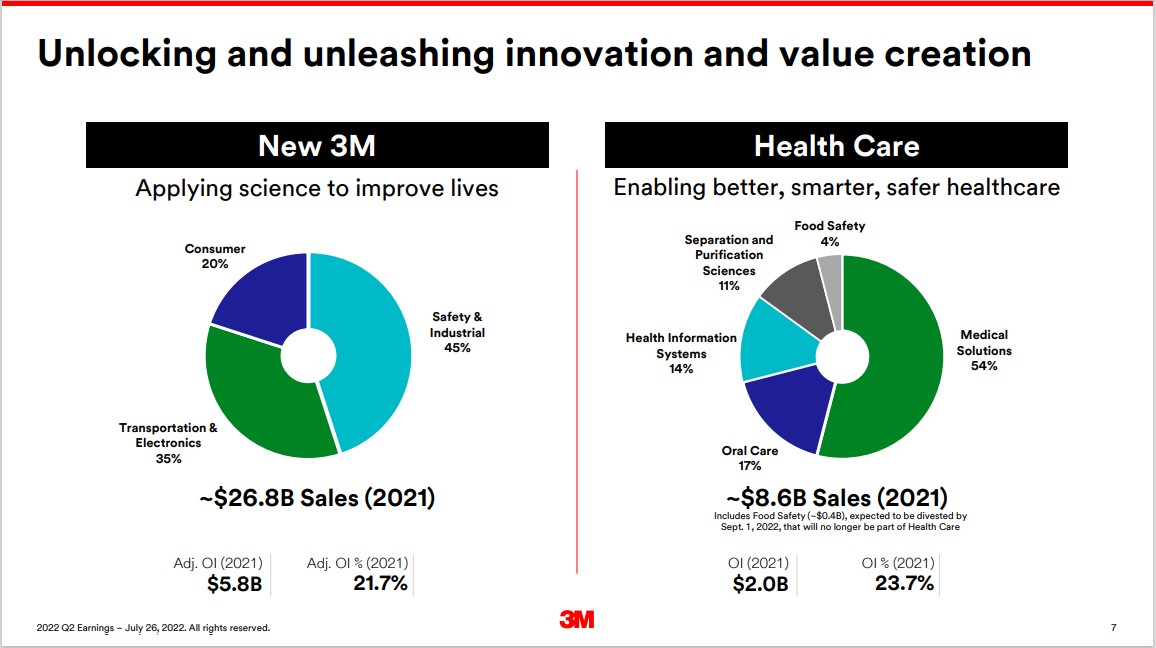

3M is now composed of four separate divisions. The Safety & Industrial division produces tapes, abrasives, adhesives, and supply chain management software as well as manufactures personal protective gear and security products.

The Healthcare segment supplies medical and surgical products as well as drug delivery systems. The Transportation & Electronics division produces fibers and circuits with a goal of using renewable energy sources while reducing costs. The Consumer division sells office supplies, home improvement products, protective materials, and stationary supplies.

Source: Investor Presentation

The company also announced that it would be spinning off its Health Care segment, which would have had $8.6 billion of revenue in 2021. The transaction is expected to close by the end of 2023.

We expect 15.7% annual returns for 3M stock, driven by 5% expected EPS growth, the 4.9% dividend yield, and a significant boost from an expanding P/E multiple.

Click here to download our most recent Sure Analysis report on 3M (preview of page 1 of 3 shown below):

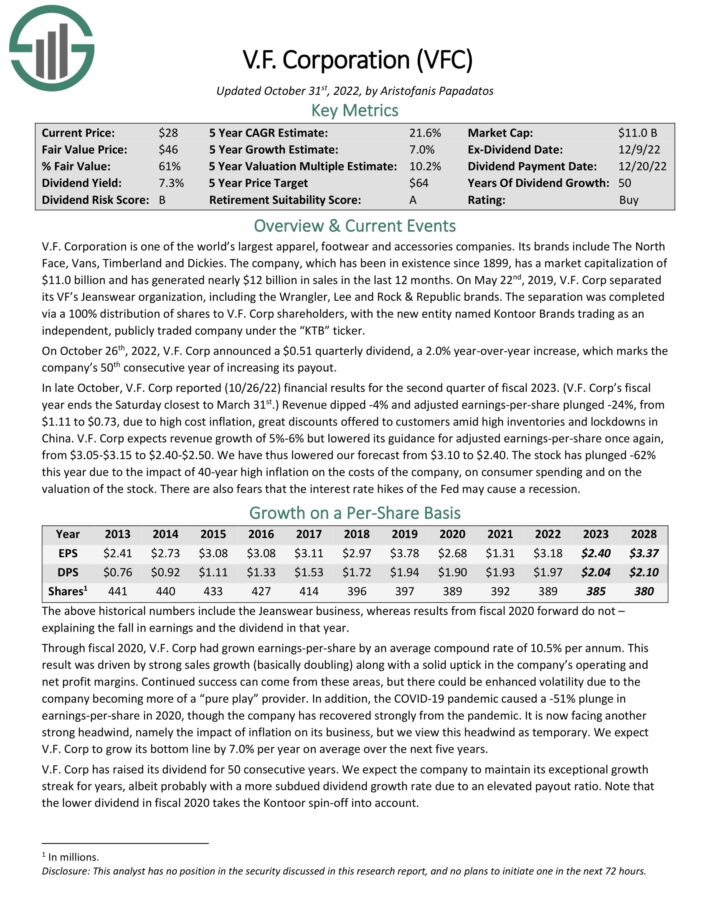

Dividend King #1: V.F. Corp. (VFC)

- •5-Year Annual Expected Returns: 20.9%

V.F. Corporation is one of the world’s largest apparel, footwear and accessories companies. The company’s brands include The North Face, Vans, Timberland and Dickies. The company, which has been in existence since 1899, generated over $11 billion in sales in the last year.

On October 26th, 2022, V.F. Corp announced a $0.51 quarterly dividend, a 2.0% year-over-year increase, which marks the company’s 50th consecutive year of increasing its payout.

In late October, V.F. Corp reported (10/26/22) financial results for the second quarter of fiscal 2023. (V.F. Corp’s fiscal year ends the Saturday closest to March 31st.) Revenue dipped -4% and adjusted earnings-per-share plunged -24%, from $1.11 to $0.73, due to high cost inflation, great discounts offered to customers amid high inventories and lockdowns in China. V.F. Corp expects revenue growth of 5%-6% but lowered its guidance for adjusted earnings-per-share once again, from $3.05-$3.15 to $2.40-$2.50.

We expect 7% annual EPS growth over the next five years. VFC stock also has a dividend yield of 7.0%. Annual returns from an expanding P/E multiple are estimated at ~6.9%, equaling total expected annual returns of 20.9% through 2027.

Click here to download our most recent Sure Analysis report on V.F. Corp. (preview of page 1 of 3 shown below):

Analysis Reports On All 48 Dividend Kings

All 48 Dividend Kings are listed below by sector. You can access detailed coverage of each by clicking on the name of each Dividend King.

Additionally, you can download our newest Sure Analysis Research Database report for each Dividend King as well.

Basic Materials

- •Stepan (SCL) – [See newest Sure Analysis report]

- •H.B. Fuller (FUL) – [See newest Sure Analysis report]

- •PPG Industries (PPG) – [See newest Sure Analysis report]

- •Nucor Corp. (NUE) – [See newest Sure Analysis report]

Consumer Discretionary

- •Genuine Parts Company (GPC) – [See newest Sure Analysis report]

- •Leggett & Platt (LEG) – [See newest Sure Analysis report]

- •Lowe’s Companies (LOW) – [See newest Sure Analysis report]

- •Target Corporation (TGT) – [See newest Sure Analysis report]

Consumer Staples

- •The Colgate-Palmolive Company (CL) – [See newest Sure Analysis report]

- •Hormel Foods Corporation (HRL) – [See newest Sure Analysis report]

- •Kimberly-Clark Corporation (KMB) – [See newest Sure Analysis report]

- •The Coca-Cola Company (KO) – [See newest Sure Analysis report]

- •Lancaster Colony (LANC) – [See newest Sure Analysis report]

- •Altria Group (MO) – [See newest Sure Analysis report]

- •PepsiCo (PEP) – [See newest Sure Analysis report]

- •Procter & Gamble (PG) – [See newest Sure Analysis report]

- •Sysco Corporation (SYY) – [See newest Sure Analysis report]

- •Tootsie Roll Industries (TR) – [See newest Sure Analysis report]

- •Universal Corporation (UVV) – [See newest Sure Analysis report]

Energy

Financial Services

- •Cincinnati Financial (CINF) – [See newest Sure Analysis report]

- •Farmers & Merchants Bancorp (FMCB) – [See newest Sure Analysis report]

- •Commerce Bancshares (CBSH) – [See newest Sure Analysis report]

- •S&P Global Inc. (SPGI) – [See newest Sure Analysis report]

Healthcare

- •AbbVie (ABBV) – [See newest Sure Analysis report]

- •Abbott Laboratories (ABT) – [See newest Sure Analysis report]

- •Becton, Dickinson & Company (BDX) – [See newest Sure Analysis report]

- •Johnson & Johnson (JNJ) – [See newest Sure Analysis report]

Industrial

- •ABM Industries (ABM) – [See newest Sure Analysis report]

- •Dover Corporation (DOV) – [See newest Sure Analysis report]

- •Emerson Electric (EMR) – [See newest Sure Analysis report]

- •Gorman-Rupp Company (GRC) – [See newest Sure Analysis report]

- •W.W. Grainger (GWW) – [See newest Sure Analysis report]

- •Illinois Tool Works (ITW) – [See newest Sure Analysis report]

- •3M Company (MMM) – [See newest Sure Analysis report]

- •MSA Safety (MSA) – [See newest Sure Analysis report]

- •Nordson (NDSN) – [See newest Sure Analysis report]

- •Parker Hannifin (PH) – [See newest Sure Analysis report]

- •Stanley Black & Decker (SWK) – [See newest Sure Analysis report]

- •Tennant Company (TNC) – [See newest Sure Analysis report]

Real Estate

Utilities

- •American States Water (AWR) – [See newest Sure Analysis report]

- •Black Hills Corp. (BKH) – [See newest Sure Analysis report]

- •California Water Service (CWT) – [See newest Sure Analysis report]

- •Canadian Utilities (CDUAF) – [See newest Sure Analysis report]

- •Middlesex Water Company (MSEX) – [See newest Sure Analysis report]

- •Northwest Natural Gas Holding Co. (NWN) – [See newest Sure Analysis report]

- •SJW Group (SJW) – [See newest Sure Analysis report]

Performance Of The Dividend Kings

The Dividend Kings under-performed the S&P 500 ETF (SPY) in January 2023. Return data for the month is shown below:

- •Dividend Kings January 2023 total return: 1.7%

- •SPY January 2023 total return: 6.3%

Stable dividend growers like the Dividend Kings tend to underperform in bull markets and outperform on a relative basis during bear markets.

The Dividend Kings are not officially regulated and monitored by any one company. There’s no Dividend King ETF. This means that tracking the historical performance of the Dividend Kings can be difficult. More specifically, performance tracking of the Dividend Kings often introduces significant survivorship bias.

Survivorship bias occurs when one looks at only the companies that ‘survived’ the time period in question. In the case of Dividend Kings, this means that the performance study does not include ex-Kings that reduced their dividend, were acquired, etc.

But with that said, there is something to be gained from investigating the historical performance of the Dividend Kings. Specifically, the performance of the Dividend Kings shows that ‘boring’ established blue-chip stocks that increase their dividend year-after-year can significantly outperform over long periods of time.

Notes: S&P 500 performance is measured using the S&P 500 ETF (SPY). The Dividend Kings performance is calculated using an equal weighted portfolio of today’s Dividend Kings, rebalanced annually. Due to insufficient data, Farmers & Merchants Bancorp (FMCB) returns are from 2000 onward. Performance excludes previous Dividend Kings that ended their streak of dividend increases which creates notable lookback/survivorship bias. The data for this study is from Ycharts.

In the next section of this article, we will provide an overview of the sector and market capitalization characteristics of the Dividend Kings.

Sector & Market Capitalization Overview

The sector and market capitalization characteristics of the Dividend Kings are very different from the characteristics of the broader stock market.

The following bullet points show the number of Dividend Kings in each sector of the stock market.

- •Consumer Staples: 11

- •Industrials: 12

- •Utilities: 7

- •Consumer Discretionary: 4

- •Health Care: 4

- •Financials: 4

- •Materials: 4

- •Real Estate: 1

- •Energy: 1

The Dividend Kings are overweight in the Industrials, Consumer Staples, and Utilities sectors. Interestingly, The Dividend Kings have just one stock from the Information Technology sector, which is the largest component of the S&P 500 index.

The Dividend Kings also have some interesting characteristics with respect to market capitalization. These trends are illustrated below.

- •5 Mega caps ($200 billion+ market cap; ABBV, JNJ, PEP, PG, and KO)

- •21 Large caps ($10 billion to $200 billion market cap)

- •14 Mid caps ($2 billion to $10 billion)

- •8 Small caps ($300 million to $2 billion)

Interestingly, 22 out of the 48 Dividend Kings have market capitalizations below $10 billion. This shows that corporate longevity doesn’t have to be accompanied by massive size.

Final Thoughts

Screening to find the best Dividend Kings is not the only way to find high-quality dividend growth stock ideas.

Sure Dividend maintains similar databases on the following useful universes of stocks:

- •The High Yield Dividend Kings List is comprised of the 20 Dividend Kings with the highest current yields.

- •The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- •The High Yield Dividend Aristocrats List is comprised of the 20 Dividend Aristocrats with the highest current yields.

- •The Dividend Champions: stocks with 25+ years of dividend increases, including stocks which may not otherwise qualify as Dividend Aristocrats.

- •The Dividend Contenders: 10-24 consecutive years of dividend increases.

- •The Dividend Challengers: 5-9 consecutive years of dividend increases.

- •The Dividend Achievers: dividend stocks with 10+ years of consecutive dividend increases.

- •The Complete List of High Dividend Stocks: Stocks with 5%+ dividend yields.

- •The Complete List of Monthly Dividend Stocks: our database currently contains more than 30 stocks that pay dividends every month.

- •The Blue-Chip Stocks List: our list of “blue-chip stocks” is a combination of our Dividend Kings, Dividend Aristocrats, and Dividend Achievers lists.

There is nothing magical about investing in the Dividend Kings. They are simply a group of high-quality businesses with shareholder-friendly management teams that have strong competitive advantages.

Related:

All 151 Dividend Champions In February 2023 | Updated Daily

2023 REITs List | See All 208 Now | Yields Up To 18.7%

What is in a Startup? Time to Support Local Startup Builders