Spreadsheet & table updated daily. Updated on May 24th, 2022 by Jonathan Weber for SureDividend

The marijuana industry continues to experience a lot of growth. Multiple countries around the world have already moved to legalized recreational marijuana. In the U.S., 18 states plus DC have legalized recreational marijuana already, with many more having legalized medicinal use – 39 in total. It is likely that more states will follow suit in the coming years, and eventually, there might be federal legalization of marijuana in the US.

While this naturally leads to a potentially significant investment opportunity, investors would do well to remember some of the industry bubbles of the past. For example, the tech bubble of the late 1990’s is a constant reminder that rapid industry growth alone does not guarantee investing success. Choosing the highest-quality companies (or least risky stocks) in a growing industry can make a world of difference for returns.

This article takes a deep dive into the marijuana industry, in search of the best marijuana stocks today. Surprisingly, there are over 100 to choose from with full or partial exposure to the marijuana industry.

Click the link below to download our free Excel spreadsheet of more than 100 marijuana stocks.

Click here to download your Marijuana Stocks List Excel Spreadsheet now, which has the names and tickers of more than 100 marijuana industry stocks. Keep reading this article to learn more.

Table of Contents

- •Industry Overview

- •Investing In The Marijuana Industry

- •‘Pure Play’ Marijuana Stocks

- •Indirect Exposure Marijuana Stocks

- •The Best Marijuana Stocks

- •Final Thoughts

Industry Overview

The cannabis plant can be divided into 2 broad categories based on tetrahydrocannabinol [THC] content:

- •High THC – what we often refer to as marijuana

- •Nearly no THC – what we often refer to as hemp

Marijuana has recreational and pharmaceutical uses while hemp has primarily industrial uses.

Interestingly, THC is one of more than 480 known substances in the plant, with more than 60 of those being cannabinoids.

Marijuana can be used either by smoking, by vaporizing, as content in food or beverages, or as an extract.

Marijuana Use & Legality Around The Globe

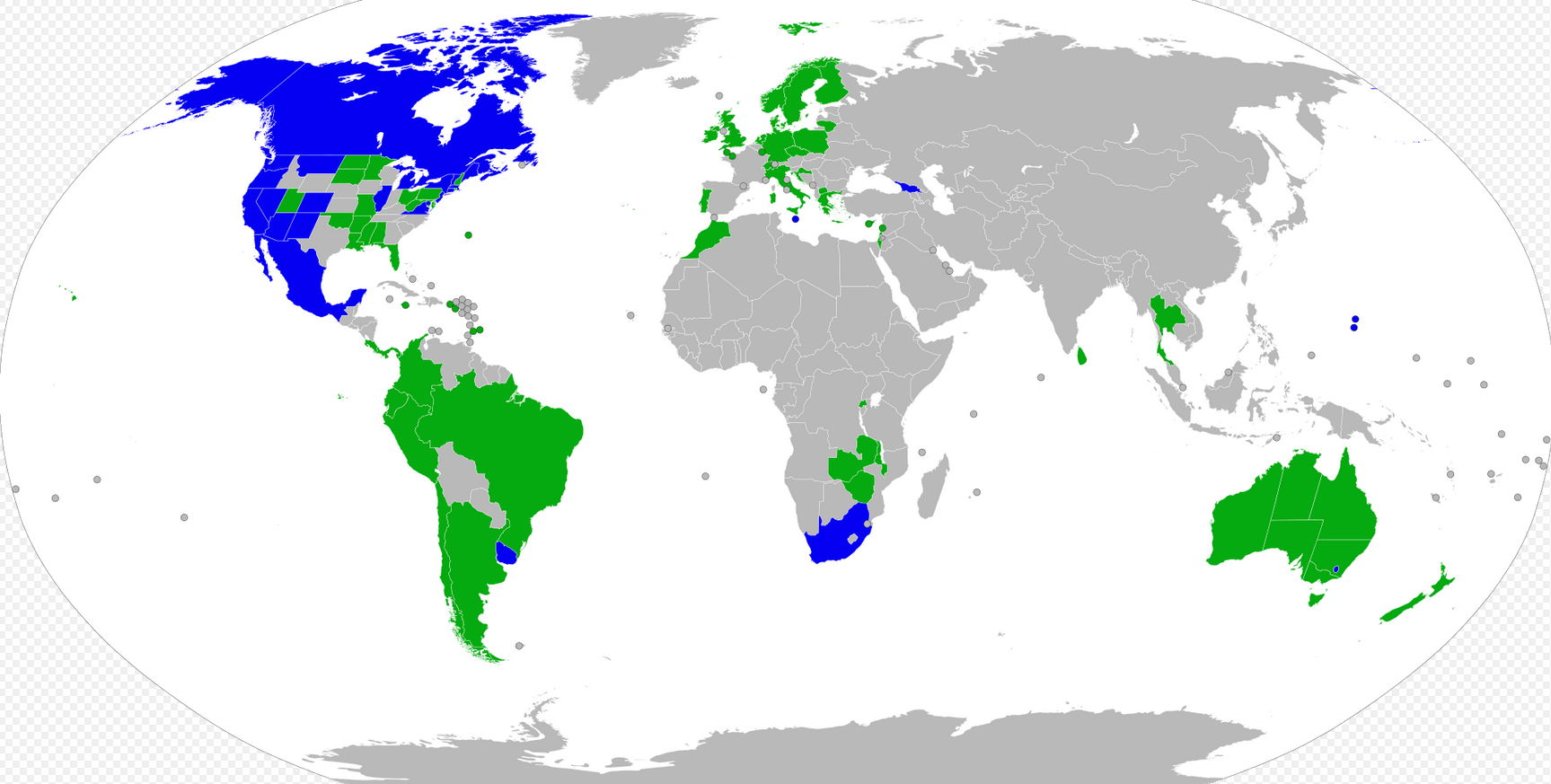

Over the last couple of years, marijuana laws around the globe have been relaxed in many cases, an increasing number of countries (and US states) have legalized the medical, and in some cases the recreational, use of marijuana. The drug has so far not been legalized on the federal level in the US, though. The image below shows legalization by country/state, blue countries and states allow recreational cannabis use, while green countries and states allow the medical use of cannabis.

Marijuana has been partially or fully legalized in around 50 countries as of May 2022. In most cases, medical marijuana has been legalized while the recreational use of marijuana has not (yet) been legalized.

In Canada, marijuana was fully legalized on the federal level in 2018. Several other countries, such as Germany and Mexico, have decriminalized the use and possession of small amounts of marijuana.

In the majority of US states marijuana has been at least partially legalized, and the number of those states has grown steadily in recent years.

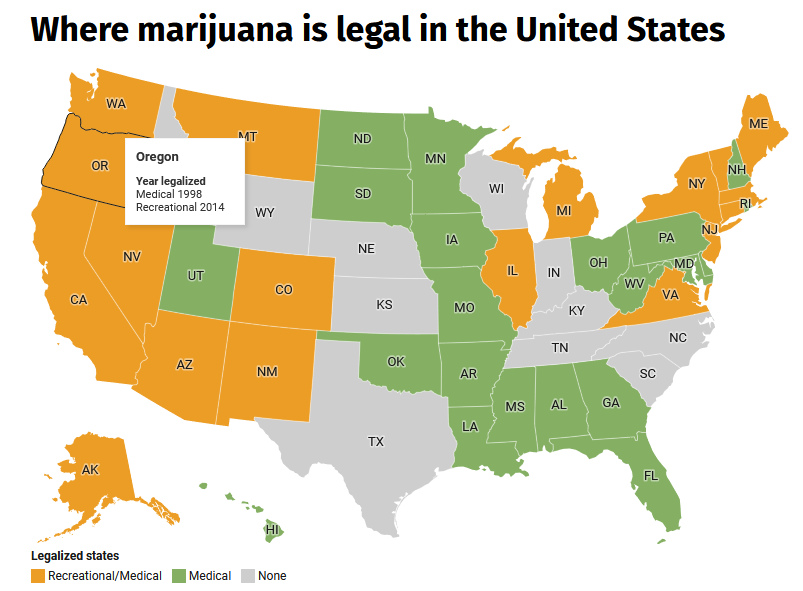

18 states, as well as the District of Columbia, allow the recreational use of marijuana by adults, with age restrictions ranging from 18 to 21.

In those countries and US states where marijuana has not been legalized, marijuana is still used regularly. It is the most commonly used illegal drug in both the world, as well as in the United States, where a 2021 study found that 49% of Americans had used the drug at least once. Globally, around 190 million people use marijuana for recreational purposes every year, according to UN estimates.

Medical Use Of Marijuana

Medical marijuana, also called medical cannabis, refers to marijuana that has been prescribed by doctors to their patients as a form of treatment for a variety of symptoms. Evidence suggests that the consumption of marijuana (or marijuana-based products) can have positive impacts on patients with certain conditions that are not explained by the placebo effect.

The use cases for medical marijuana include:

- •The treatment of nausea and vomiting for patients undergoing chemotherapy

- •Increasing appetite for patients with an HIV/AIDS infection

- •The treatment of chronic pain (e.g. caused by peripheral neuropathy) and muscle spasms

- •The treatment of neurological issues, such as multiple sclerosis (MS), epilepsy, and movement problems.

- •Sleep improvement

- •the reduction of tics for patients with Tourette syndrome

- •the treatment of post-traumatic stress disorder

In those countries where medical marijuana has been legalized, it oftentimes has only been allowed for a couple of years. The medical marijuana market thus is still in a relatively early phase of growth.

Potential growth catalysts for the industry include:

- •Rising usage in countries that have legalized the use of cannabis

- •More countries legalizing the use of cannabis

A study from 2022 suggest that the US legal marijuana market (medical and recreational) will grow to as much as $80 billion by 2030. The report that was published by Grand View Research sees an annual market growth rate in excess of 25% in that time frame.

For doctors to increasingly prescribe medical marijuana instead of opioid narcotics (which can cause addiction and serious side effects and are thus not necessarily harmless) is seen as another long-term growth driver for the use of medical marijuana as a form of pain relief.

The most important geographic markets will be those where healthcare budgets are meaningful and where marijuana has been (partially) legalized. This includes the United States (states where the use of medical marijuana has been legalized), Canada, Israel, Australia, parts of Europe (Germany, Italy, France, The Netherlands), and parts of South America (Chile, Argentina).

Recreational Use Of Marijuana

Marijuana, the world’s most commonly used illegal drug, has a potentially very wide (and growing) legal recreational market.

In the US, the recreational cannabis market is forecasted to grow to $25 billion by 2025, although growth is forecasted to slow down meaningfully over time – to just 5%-10% a year by the middle of the current decade.

According to this 2022 report, the recreational cannabis market in Canada is generating sales of $11 billion a year, while also sustaining more than 90,000 jobs across manufacturing, retail, and so on. More Canadians have started using the drug in recent years since it has been legalized, while some users who consumed illicit marijuana have shifted towards consuming regulated, legal cannabis instead.

Even though marijuana has not been legalized in the United States on a federal level, the US still has become the most important market for recreational marijuana over the years. In the 18 states where marijuana has been legalized, a number that will likely continue to grow over the coming years, recreational marijuana sales outpaced medical marijuana sales.

Forbes has forecasted that medical marijuana will make up just 35% of global legal marijuana sales in 2022, down from almost 100% one decade earlier. We do believe that it is likely that recreational marijuana could continue to gain market share versus medical marijuana, especially if recreational marijuana gets legalized in additional countries and states.

The global peer market is projected to be worth $685 billion by 2025. The global tobacco market, for reference, is worth about $700 billion annually, with a low-single-digit growth rate. Compared to those two markets, the recreational marijuana market still is rather small, which could indicate a lot of future upside. On the other hand, investors should consider that beer and tobacco are legal in more markets around the world compared to marijuana, which is still restricted in many parts of the world.

Analysts have been projecting significant market growth for the global marijuana markets for years. In recent years, the market has indeed grown meaningfully. But if the current growth projections for 2025-2030 do not materialize, e.g. due to legalization changes or shifts in consumer behavior, or because these projections were wrong in the first place, these market size estimates could turn out to be way too optimistic, thus investors should take these projections with a grain of salt.

Investors should also keep the following statement by Benjamin Graham in mind:

“Obvious prospects for physical growth in a business do not translate into obvious profits for investors.”

Market growth rates do not necessarily go hand in hand with high profits for the corporations that are active in this respective market, and they especially do not go hand in hand with meaningful shareholder payouts.

Growth stocks that are priced for perfection can disappoint investors and produce underwhelming total returns, even if the original thesis about strong underlying growth rates for the industry proves true.

There are credible arguments to be made against high-profit margins in the marijuana industry. These include the fact that market entry barriers are not overly high — there are no substantial network effects, entry costs are not overly large, and there are no big technological advantages — and the fact that marijuana is an agricultural good.

Margins in the agricultural industry are notoriously low. Half of all agricultural businesses generate operating profit margins (before interest expenses and before taxes) of less than 5%. It is in no way guaranteed that the same will apply to the marijuana market, but it is possible that industry-wide profits in the marijuana industry could be relatively meager, despite a large market size.

In recent years, we have already seen this play out to some degree. Despite further legalization of marijuana in additional countries and states, the stocks of many cannabis companies have underwhelmed, as profit margins are slim for many of these companies, and since valuations were too high, which caused multiple compression headwinds over the years.

Investing In The Marijuana Industry

There are a large number of publicly traded marijuana companies, with the biggest ones being located in Canada, which is not surprising, as Canada is one of the largest markets where marijuana has been fully legalized. Companies in this segment have different strategies, such as focusing on the medical marijuana market, or certain geographic markets.

There are several ETFs which investors can choose if they are bullish on the industry as a whole and if they do not want to choose among single companies. The largest one of these ETFs is the Horizons Marijuana Life Sciences Index ETF (HMLSF), which has a current net asset value of CAD4.45 per share (May 2022).

The Horizons Marijuana Life Sciences Index ETF has moved down since our last update. Share price declines in a range of cannabis stocks have caused its net asset value to decline, and rising interest rates and high inflation lead to lower interest from investors when it comes to investing in oftentimes barely profitable growth stocks.

This ETF made two distributions in 2021, according to its fact sheet, but its estimated annualized yield of 0.81% is not attractive for income investors and does not add meaningfully to the ETF’s total return potential. The Horizons Marijuana Life Science ETF has a relatively high expense ratio of 0.86% annually.

‘Pure Play’ Marijuana Stocks

Investors who are interested in this space can choose from a large list of publicly traded companies with direct exposure to the marijuana market, i.e. marijuana pure plays. These are companies which derive all, or a vast majority of, their revenues from the sale of marijuana and marijuana products, for medical use and/or for recreational use.

Many large players in this segment are Canada-based, but US-based companies with meaningful market capitalizations exist as well. Outside of North America, there are no large players in this space, since other countries where (medical) marijuana has been legalized do oftentimes import marijuana from North American companies instead of producing marijuana “at home”.

Most marijuana companies do not have a long history of revenues or earnings because the legal marijuana industry is still relatively young. It seems likely that those marijuana companies with the highest sales base and the largest production capacity have the greatest chance of generating above-average margins in the future. Reasons for this include economics of scale, operating leverage, and the fact that those with the most experience are likely the best at bringing down costs of production.

On the other hand, investors should be careful not to overpay for stocks – which is why the price for a stock should always be looked at relative to metrics such as the earnings or the cash flows that the company generates (on a per-share basis).

This is the list of 10 of the largest pureplay marijuana companies by revenue generation:

- •Aurora Cannabis (ACB)

- •Canopy Growth (CGC)

- •Tilray (TLRY)

- •Cronos (CRON)

- •Organigram (OGRMF)

- •Cresco Labs (CRLBF)

- •Curaleaf Holdings (CURLF)

- •Green Thumb Industries (GTBIF)

- •Trulieve Cannabis (TCNNF)

- •Columbia Care (CCHWF)

Aphria, which was one of the largest marijuana companies originally, got taken over by Tilray since our last update. Of these, our top three picks are the following ones:

Marijuana Pure Play Stock: Trulieve Cannabis Corp

Trulieve Cannabis Corp isn’t the largest marijuana pureplay company by far. But its profitability is, compared to most of its peers, outstanding, which makes it interesting for investors. Trulieve Cannabis operates as a medical cannabis company that cultivates, produces, and distributes its products itself, through dispensaries in its home market Florida, but over the years, Trulieve Cannabis has also ventured into other markets, including California, Arizona, Nevada, and a couple more.

According to its own data, Trulieve sells roughly half of the medical marijuana that is sold in Florida, despite operating only one-fourth of the dispensaries in the state. Its scale and large market share, especially in its most important market, allows Trulieve Cannabis to operate with margins that are stronger than what we see from most of its peers.

For the current fiscal year, 2022, Trulieve Cannabis is forecasting revenue of $1.3 billion to $1.4 billion, and adjusted EBITDA of $450 to $500 million. This does not only point to a pretty solid EBITDA margin in the 30% range, but the $450+ million EBITDA generation that is expected for the current year also results in a valuation that doesn’t seem high at all. The company’s market capitalization stands at $2.7 billion, which means that it is valued at around 6x this year’s expected adjusted EBITDA. Of course, net profits are considerably smaller due to depreciation, taxes, etc. But still, Trulieve Cannabis is one of the more profitable cannabis companies, and surprisingly inexpensive at the same time.

Marijuana Pure Play Stock: Canopy Growth

Canopy Growth is, by market capitalization, one of the largest cannabis companies in Canada. One of the poster children of the cannabis investing boom (or bubble) a couple of years ago, its price and market capitalization have pulled back considerably over the last couple of years. That has made its valuation improve, which is why it seems like a significantly better investment today.

Canopy Growth isn’t profitable, unlike Trulieve, but is generating solid revenue of around $400 to $500 million per year, and the company has recently announced new cost-cutting measures. Combined with some organic revenue growth, that should improve profitability over the years, all else equal.

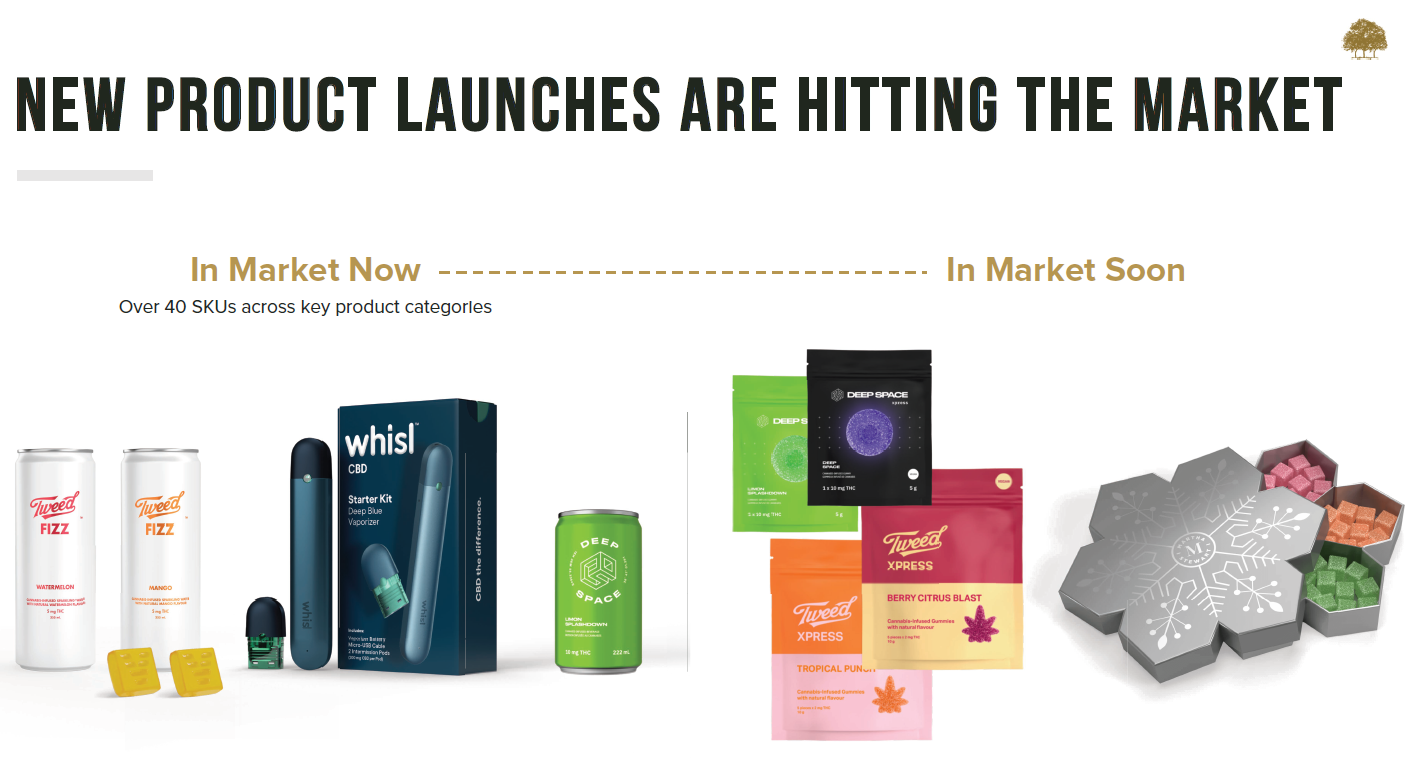

Canopy Growth has also been shifting its product portfolio towards branded consumer goods such as its sports nutrition products under the BioSteel label:

BioSteel and some of Canopy Growth’s other branded products had a record quarter in Q1, which indicates that its shift towards this products could help improve Canopy’s business growth over time. This strategy could help differentiate Canopy Growth from its peers over the years, and as long as its brands are attractive, they could also help Canopy Growth generate improving margins over time, compared to the relatively commoditized pure cannabis production business.

Marijuana Pure Play Stock: Cresco Labs

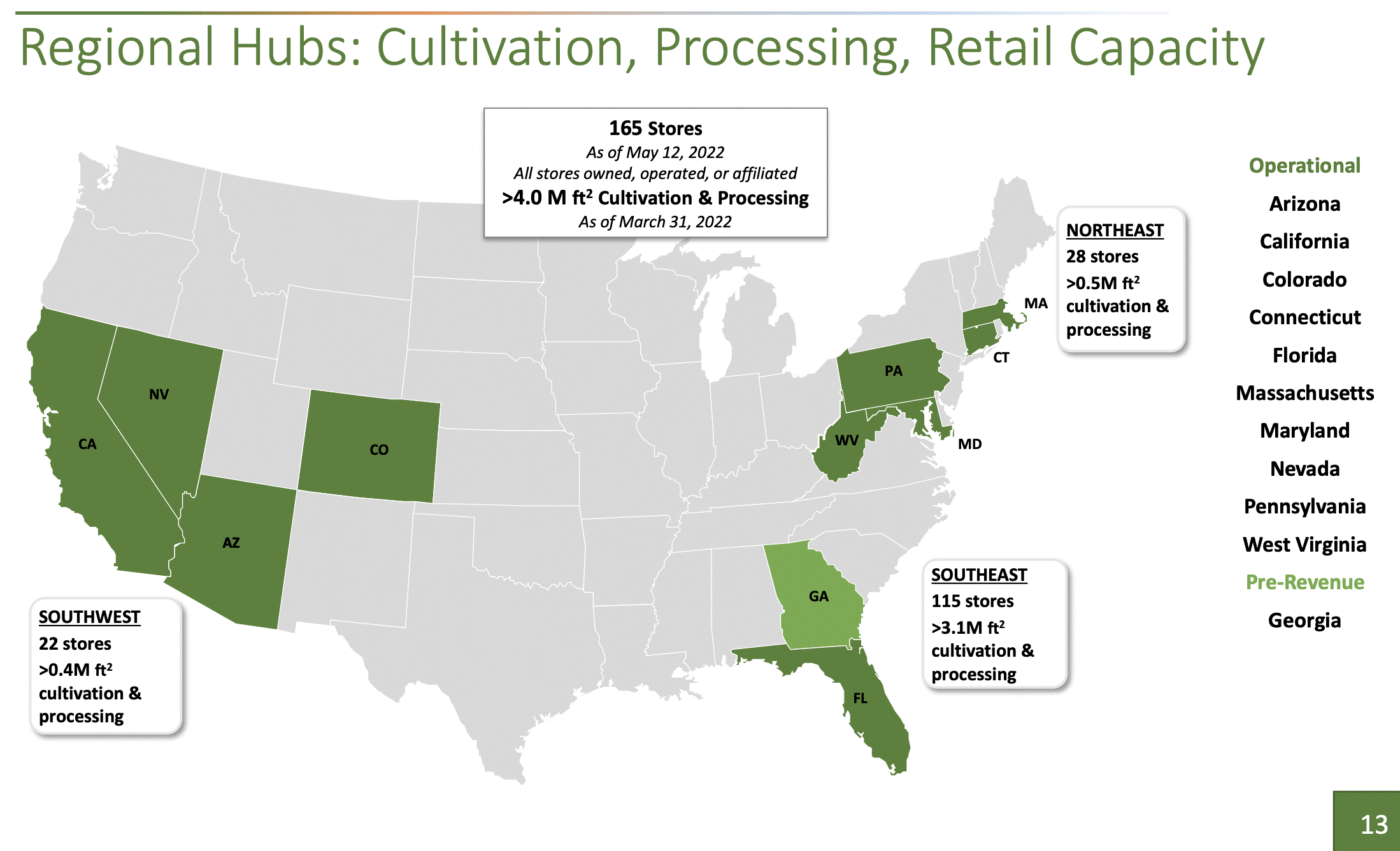

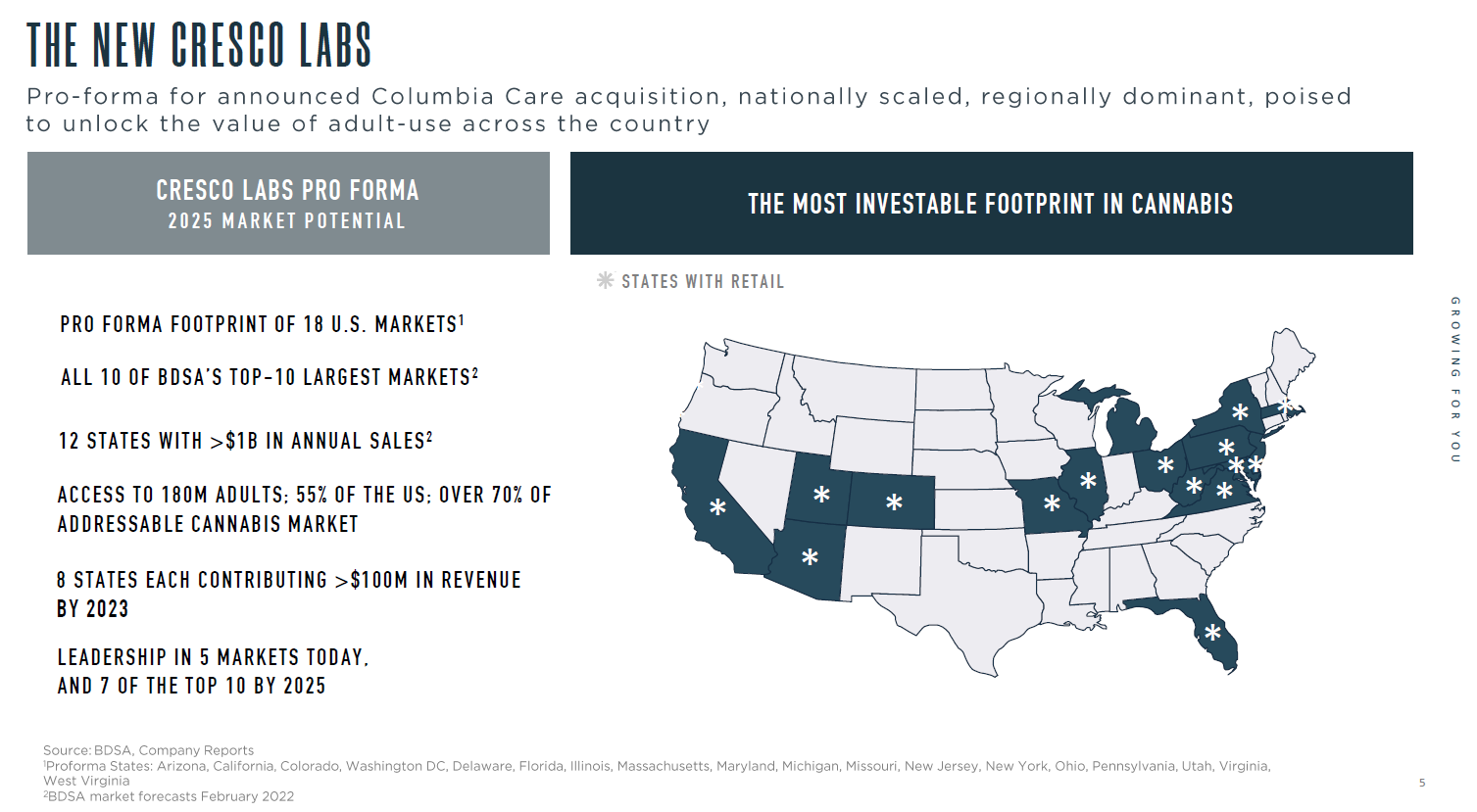

Cresco Labs Inc. cultivates, manufactures, and sells both medical and retail cannabis products in US states where it is allowed to do so. Its products include flowers, vape pens, extracts, concentrates, but also shakes and popcorn. Not surprisingly, the company is active in a wide range of US markets, including in important ones such as Florida or California:

The company generates compelling business growth, as its revenue rose by 20% during the most recent quarter. EBITDA, meanwhile, was up by 45% year over year, climbing to $51 million. That makes for a 24% EBITDA margin, which is a little less than that of Trulieve, but which is still far from bad.

Based on its current EBITDA run rate, Cresco Labs is valued at around 6x EBITDA, which is more or less in line with Trulieve’s valuation. It should be noted that Cresco Labs is not expected to be profitable on a GAAP net profit basis this year, due to depreciation, taxes, interest expenses, etc. That’s to be expected and holds true for almost all cannabis companies, however. Thanks to its encouraging growth and solid EBITDA margins, Cresco Labs should be able to reach GAAP profitability in the not too distant future, we believe.

Indirect-Exposure Marijuana Stocks

Marijuana pure play stocks have the problem that their valuations are not low at all, and that most of these companies are not profitable yet. It is also not guaranteed that they will (all) become profitable (due to possible margin pressures for the industry). Last but not least investors don’t get any meaningful dividend yields from marijuana pure play stocks.

For investors that don’t want to invest in marijuana pure play stocks due to the reasons outlined above, and that seek exposure to the growing marijuana industry nevertheless, one possibility is to invest in stocks that are not marijuana pure plays, but that have some exposure to the industry nevertheless.

This primarily includes consumer goods companies (beverage stocks, tobacco stocks) that have ventured into the marijuana space, but that continue to generate the majority of their revenues and earnings in another industry. Our top five picks among these companies are analyzed below.

Indirect Marijuana Exposure Stock: AbbVie

AbbVie (ABBV) is a biotech company that is active in oncology and immunology primarily. AbbVie generates revenues of more than $50 billion annually and is highly profitable, with its biggest drug Humira playing an important role in both revenue and earnings generation.

AbbVie is seen by some as one of the first medical marijuana companies, as its drug Marinol was the first FDA-approved cannabis drug. Marinol is used for the treatment of nausea and vomiting in patients enduring chemotherapy. Marinol is also used for increasing appetite in patients with HIV/AIDS or certain cancers.

Marinol was not a large revenue driver for AbbVie in the past, as other drugs were larger in terms of their addressable market and when it comes to the prices the company could demand for them. AbbVie also sold Marinol to Alkem Labs a while ago. One can argue whether AbbVie should be seen as a marijuana stock, but the company has been interested in the space and had FDA-approved products on the market. It seems possible that AbbVie develops new products that utilize marijuana in the future, although there is no guarantee of that.

Investors don’t have the high risks that are associated with an investment into a marijuana pure play, but might still benefit from growth of the medical marijuana industry. AbbVie trades at an inexpensive valuation of just 11 times 2022’s profits right now. AbbVie also offers a sizeable dividend yield of 3.7% right here. Due to its yield, its low valuation, and its share price upside potential AbbVie is one of our favorite Dividend Aristocrat buys today.

Indirect Marijuana Exposure Stock: Altria

Altria (MO) is one of the largest tobacco companies in the world. Altria produces and sells cigarettes under the Marlboro brand in the US. The company also sells several other cigarette brands, cigar brands, and non-smokeable tobacco products to round out the company’s product portfolio. In addition, Altria owns a 10% stake in Anheuser-Busch InBev (BUD), which is one of the world’s largest beer companies.

As a tobacco company Altria is primed for an expansion into the marijuana space, which is why the company has taken a stake in Canadian marijuana company Cronos. In December 2018 Altria agreed to pay $1.8 billion for a 45% stake in Cronos. Additionally Altria has an option to acquire another 10% at a fixed price. Since then, there has been speculation that Altria might make a bid to take over Cronos entirely, with these rumors boiling up again in 2021. So far, no deal to acquire all of Cronos has been announced, however, and it is far from certain that such a deal will be crafted in the future.

Compared to Altria’s market capitalization of $96 billion its Cronos stake is not overly large, but it provides an entry into this potentially large market. In case marijuana gets legalized in the US on a federal level, Altria could likely expand into this space very fast thanks to the know-how that the company acquires through its stake in Cronos and through Altria’s established (tobacco) sales channels across all of the United States.

Altria is highly profitable, trades at just 11 times 2022’s earnings, and offers a hefty dividend yield of 7.1% which makes it a high dividend stock. We believe that Altria is a compelling pick for investors that seek an income investment with some potential upside through a side-venture in the marijuana space.

Indirect Marijuana Exposure Stock: Associated British Foods

Associated British Foods (ASBFY) is a London, UK, based company that is active in several industries. The company operates in the sugar production and agricultural industries, but it also produces beverages, cereals, and other food products. Last but not least, Associated British Foods has established itself as a low-cost apparel retailer with its Primark brand.

Associated British Foods has ventured into the marijuana industry by becoming a marijuana cultivator and supplier to the medical industry. Unlike many marijuana pure plays, Associated British Foods is highly profitable and produces sizeable cash flows thanks to its other businesses, which means that this is a lower-risk stock, that could potentially grow its marijuana business at a fast pace through organic investments thanks to its cash generation from other business units.

As Associated British Foods is experienced in growing farm products and producing snacks and beverages, which gives the company the potential to introduce marijuana-containing products snacks and beverages, the expansion into the marijuana industry seems like a reasonable move.

Associated British Foods, which is valued at $16 billion today, trades at 13 times this year’s earnings, which is not a high valuation at all. Associated British Foods offers a dividend yielding 2.7%, which is more than what investors can get from the broad market. The company has raised its dividend regularly and at an ample pace in the past.

Indirect Marijuana Exposure Stock: Constellation Brands

Constellation Brands (STZ) is one of the largest alcoholic beverages companies in the world. Constellation Brands is focused on the wine and spirits markets, but it owns a small beer segment as well.

Constellation Brands made news when the company announced a $4 billion investment in Canadian marijuana company Canopy Growth. This deal diluted Canopy Growth’s existing shareholders, but it gave Constellation Brands a substantial position in the marijuana industry.

Constellation Brands sees significant potential for marijuana-infused beverages, and due to its experience in the beverages industry and its existing sales networks Constellation Brands will likely become one of the biggest players in this (potentially large) market.

Even if this venture does not work out, Constellation Brands would remain a profitable company, and investors would likely not suffer too much from a failure in this space. Today, Constellation Brands trades at 21 times this year’s earnings, which isn’t cheap, but which also isn’t especially expensive compared to how many other alcoholic beverages companies are valued.

Investors get a dividend that yields 1.4% from Constellation Brands, which is not really a lot, but better than what one receives from pure-play cannabis stocks, as those generally make no dividend payments at all. At the same time, the stake in Canopy Growth allows for substantial upside potential in case things go well.

Indirect Marijuana Exposure Stock: Molson Coors

Molson Coors (TAP) is a beverage company as well, but unlike Constellation Brands, it is focused on the global beer market. Molson Coors, which is based in Denver, CO, has moved into the marijuana industry through a joint venture with Hydropothecary, a Canada-based marijuana producer. The joint venture focuses on producing marijuana-containing, but alcohol-free beverages.

The join venture first moved into the Canadian market when it was legal to do so, but international expansion was only natural, and additional market should get added over time as cannabis gets legalized in more and more countries and states. Due to Molson Coors’ existing global sales networks it is likely that the venture between Molson Coors and Hydropothecary would be able to capture significant market share in overseas markets if the opportunity arises, e.g. when additional countries in Europe or South America legalize marijuana/marijuana products.

Molson Coors is trading at a relatively inexpensive valuation of just 13 times 2022’s earnings, and investors get paid a dividend yield of 2.1% at current prices.

The Best Marijuana Stocks

The marijuana industry is still young, which means that both risks and potential rewards are elevated.

In the pure play space, Trulieve Cannabis looks inexpensive relative to other marijuana pure plays, while at the same time, it is operating with above-average profitability, which reduces financial risks to some degree. Legal and regulatory risks remain, of course.

Marijuana pure play companies are mostly not profitable and do not pay dividends. More risk-averse investors with a goal of steady income generation should rather look at companies with some indirect marijuana exposure.

This list includes established companies with long and steady dividend growth records that will be more suitable for many investors compared to the higher-risk pure plays.

Among those stocks with indirect exposure, there are several ones that are reasonably to attractively priced and that offer an above-average dividend yield on top of that. These companies give investors the ability to benefit from future growth opportunities in the marijuana industry without taking on a lot of risk.

Of these, Altria is our favorite indirect exposure marijuana stock in May 2022, thanks to its low valuation and strong total return outlook, driven by its outstanding dividend yield of more than 7%. Its marijuana exposure is not as large as that of pure plays, of course, but in case marijuana gets legalized on a federal level in the US, Altria still could be a major beneficiary. The fact that it is a Dividend Aristocrats that has raised the dividend like clockwork for several decades is also a highly attractive trait for many income investors.

Final Thoughts

When it comes to marijuana, there is a clear trend of decriminalization and outright legalization, for both medicinal and recreational purposes, in the U.S. and across the globe. This means that the potential market for legal marijuana continues to grow.

That said, investors should not blindly jump into this industry based solely on the market potential. Many of the companies in this industry are not profitable, and may never reach profitability. As a result, investing in marijuana stocks is fraught with risk. It is not guaranteed that all major marijuana companies (some of which are valued at several billion dollars) will grow into their valuations in a reasonable amount of time.

Investors should take a close look at all relevant data points before making any decisions, especially in a higher-risk environment such as the marijuana industry. Choosing lower-risk stocks which allow for some indirect exposure to the industry could be an opportune move for investors, especially for those that desire regular and reliable dividend income from their stock holdings.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

2022 Dividend Kings List | Updated Daily | All 44 Analysed

These 2 Dividend Stocks Will Work During Inflation Or Recession

Bill Gates Portfolio List | All 18 Stock Investments Now

2022 Best Monthly Dividend Stocks List | See All 49 Now | Yields Up To 19.0%