First published on August 10th, 2022 by Bob Ciura for SureDividend. Spreadsheet data updated daily

Real estate investment trusts – or REITs, for short – can be fantastic securities for generating meaningful portfolio income. REITs widely offer higher dividend yields than the average stock.

While the S&P 500 Index on average yields less than 1.5% right now, it is relatively easy to find REITs with dividend yields of 5% or higher.

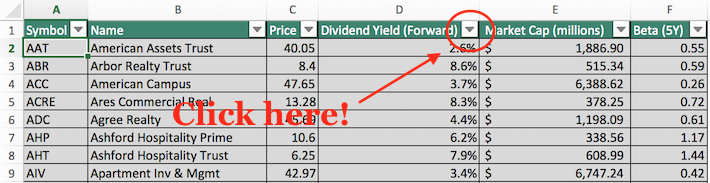

The following downloadable REIT list contains a comprehensive list of U.S. Real Estate Investment Trusts, along with metrics that matter including:

- •Stock price

- •Dividend yield

- •Market capitalization

- •5-year beta

You can download your free 200+ REIT list (along with important financial metrics like dividend yields and payout ratios) by clicking on the link below:

Click here to download your Complete REIT Excel Spreadsheet List now. Keep reading this article to learn more.

In addition to the downloadable Excel sheet of all REITs, this article discusses why income investors should pay particularly close attention to this asset class. And, we also include our top 7 REITs today based on expected total returns.

Table Of Contents

In addition to the full downloadable Excel spreadsheet, this article covers our top 7 REITs today, as ranked using expected total returns from The Sure Analysis Research Database.

The table of contents below allows for easy navigation.

- •How To Use The REIT List

- •Why Invest In REITs?

- •REIT Financial Metrics

- •The Top 7 REITs Today

#7: Chimera Inv. Corp. (CIM)

#6: AGNC Investment Corporation (AGNC)

#5: The Macerich Company (MAC)

#4: Medical Properties Trust (MPW)

#3: Douglas Emmett (DEI)

#2: Brandywine Real Estate (BDN)

#1: SL Green Realty (SLG)

How To Use The REIT List To Find Dividend Stock Ideas

REITs give investors the ability to experience the economic benefits associated with real estate ownership without the hassle of being a landlord in the traditional sense.

Because of the monthly rental cashflows generated by REITs, these securities are well-suited to investors that aim to generate income from their investment portfolios. Accordingly, dividend yield will be the primary metric of interest for many REIT investors.

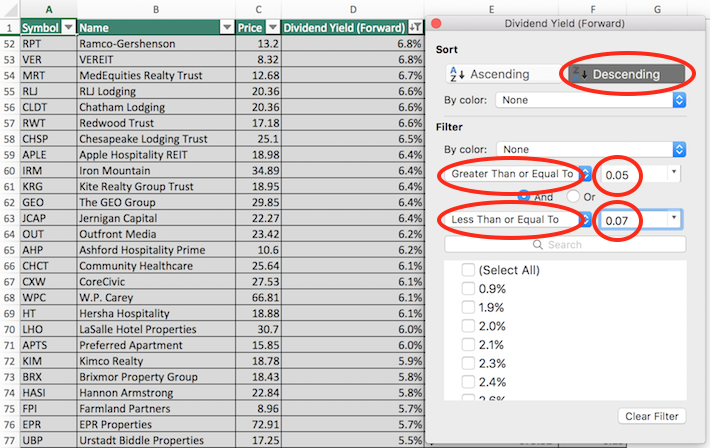

For those unfamiliar with Microsoft Excel, the following images show how to filter for REITs with dividend yields between 5% and 7% using the ‘filter’ function of Excel.

Click here to download your Complete REIT Excel Spreadsheet List now. Keep reading this article to learn more.

Step 1: Download the Complete REIT Excel Spreadsheet List at the link above.

Step 2: Click on the filter icon at the top of the ‘Dividend Yield’ column in the Complete REIT Excel Spreadsheet List.

Step 3: Use the filter functions ‘Greater Than or Equal To’ and ‘Less Than or Equal To’ along with the numbers 0.05 ad 0.07 to display REITs with dividend yields between 5% and 7%.

This will help to eliminate any REITs with exceptionally high (and perhaps unsustainable) dividend yields.

Also, click on ‘Descending’ at the top of the filter window to list the REITs with the highest dividend yields at the top of the spreadsheet.

Now that you have the tools to identify high-quality REITs, the next section will show some of the benefits of owning this asset class in a diversified investment portfolio.

Why Invest in REITs?

REITs are, by design, a fantastic asset class for investors looking to generate income.

Thus, one of the primary benefits of investing in these securities is their high dividend yields.

The currently high dividend yields of REITs is not an isolated occurrence. In fact, this asset class has traded at a higher dividend yield than the S&P 500 for decades.

Related: Dividend investing versus real estate investing.

The high dividend yields of REITs are due to the regulatory implications of doing business as a real estate investment trust.

In exchange for listing as a REIT, these trusts must pay out at least 90% of their net income as dividend payments to their unitholders (REITs trade as units, not shares).

Sometimes you will see a payout ratio of less than 90% for a REIT, and that is likely because they are using funds from operations, not net income, in the denominator for REIT payout ratios (more on that later).

REIT Financial Metrics

REITs run unique business models. More than the vast majority of other business types, they are primarily involved in the ownership of long-lived assets.

From an accounting perspective, this means that REITs incur significantnon-cash depreciation and amortization expenses.

How does this affect the bottom line of REITs?

Depreciation and amortization expenses reduce a company’s net income, which means that sometimes a REIT’s dividend will be higher than its net income, even though its dividends are safe based on cash flow.

Related: How To Value REITs

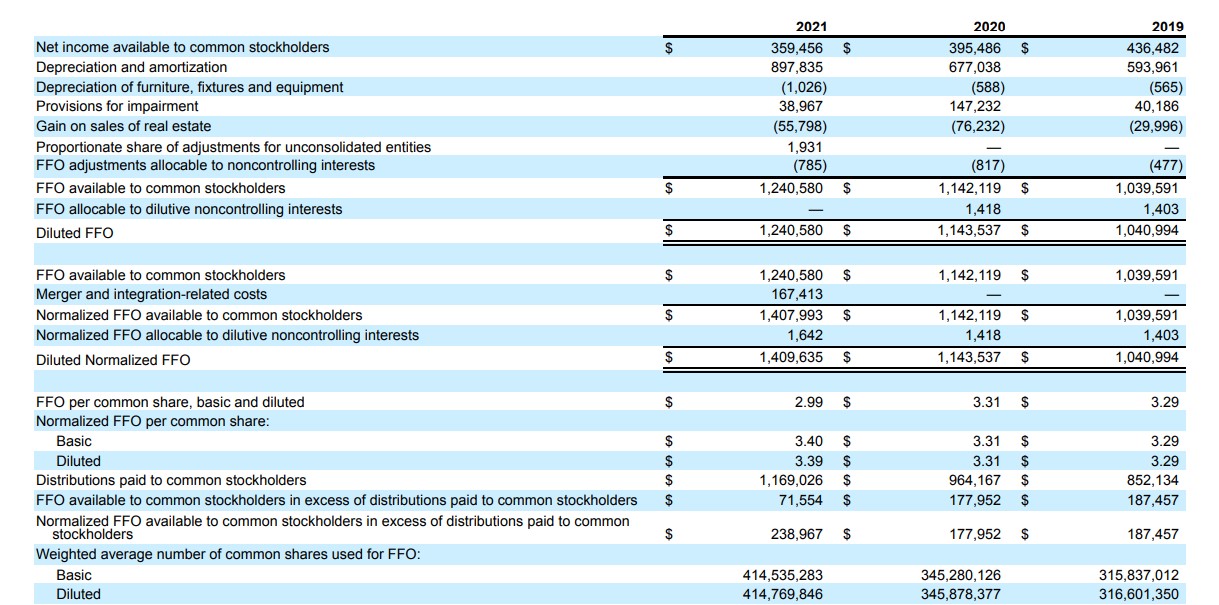

To give a better sense of financial performance and dividend safety, REITs eventually developed the financial metric funds from operations, or FFO.

Just like earnings, FFO can be reported on a per-unit basis, giving FFO/unit – the rough equivalent of earnings-per-share for a REIT.

FFO is determined by taking net income and adding back various non-cash charges that are seen to artificially impair a REIT’s perceived ability to pay its dividend.

For an example of how FFO is calculated, consider the following net income-to-FFO reconciliation from Realty Income (O), one of the largest and most popular REIT securities.

Source: Realty Income Annual Report

In 2021, net income was $359 million while FFO available to stockholders was above $1.4 billion, a sizable difference between the two metrics. This shows the profound effect that depreciation and amortization can have on the GAAP financial performance of real estate investment trusts.

The Top 7 REITs Today

Below we have ranked our top 7 REITs today based on expected total returns.

Expected total returns are in turn made up from dividend yield, expected growth on a per unit basis, and valuation multiple changes. Expected total return investing takes into account income (dividend yield), growth, andvalue.

Note: The REITs below have not been vetted for safety. These are high expected total return securities, but they may come with elevated risks.

We encourage investors to fully consider the risk/reward profile of these investments.

For the Top 10 REITs each month with 4%+ dividend yields, based on expected total returns and safety, see our Top 10 REITs service.

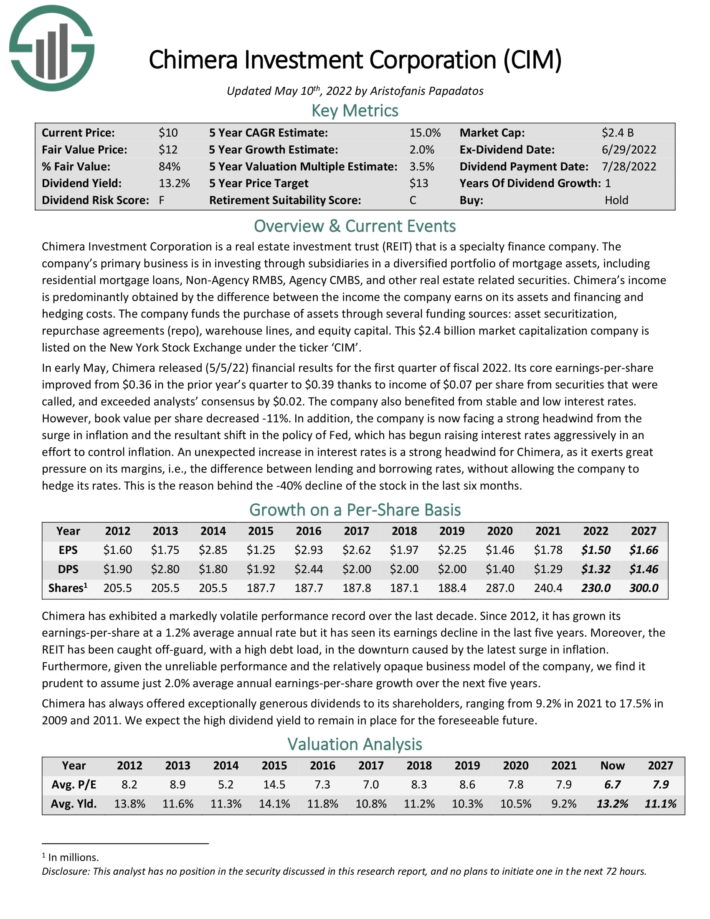

Top REIT #7: Chimera Inv. Corp. (CIM)

- •Expected Total Return: 16.7%

- •Dividend Yield: 14.1%

Chimera Investment Corporation is a real estate investment trust (REIT) that is a specialty finance company. The company’s primary business is in investing through subsidiaries in a diversified portfolio of mortgage assets, including residential mortgage loans, Non-Agency RMBS, Agency CMBS, and other real estate related securities.

Chimera’s income is predominantly obtained by the difference between the income the company earns on its assets and financing and hedging costs. The company funds the purchase of assets through several funding sources: asset securitization, repurchase agreements (repo), warehouse lines, and equity capital.

Chimera has exhibited a markedly volatile performance record over the last decade. Since 2012, it has grown its earnings-per-share at a 1.2% average annual rate but it has seen its earnings decline in the last five years. Moreover, the REIT has been caught off-guard, with a high debt load, in the downturn caused by the latest surge in inflation.

Click here to download our most recent Sure Analysis report on CIM (preview of page 1 of 3 shown below):

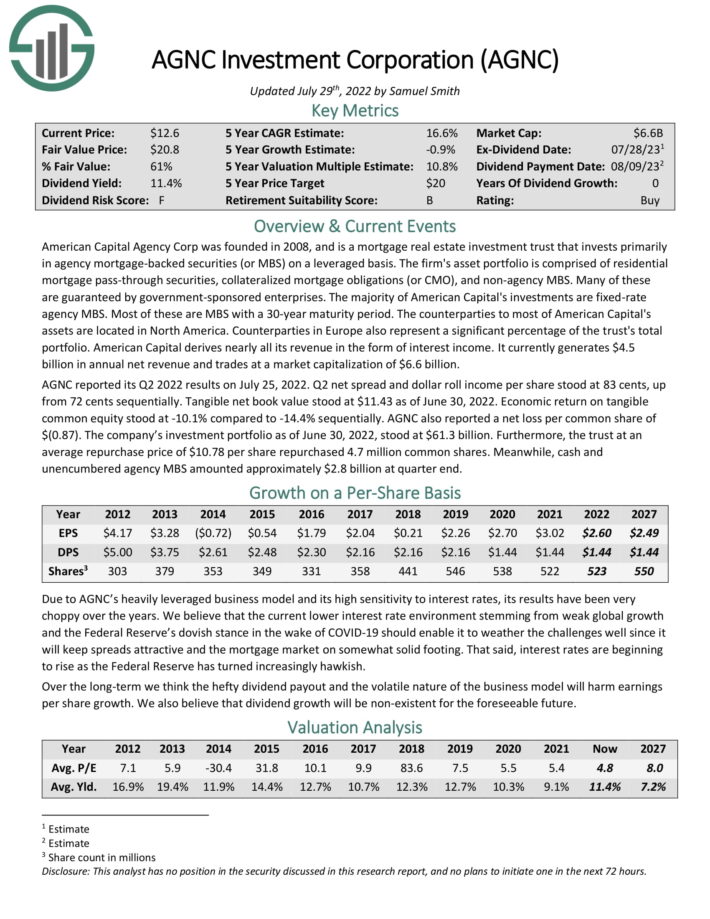

Top REIT #6: AGNC Investment Corporation (AGNC)

- •Expected Total Return: 16.8%

- •Dividend Yield: 11.6%

American Capital Agency Corp was founded in 2008, and is a mortgage real estate investment trust that invests primarily in agency mortgage-backedsecurities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass-throughsecurities, collateralized mortgage obligations (or CMO), and non-agencyMBS. Many of these are guaranteed by government sponsored enterprises.

The majority of American Capital’s investments are fixed rate agency MBS. Most of these are MBS with a 30-year maturity period. AGNC derives nearly all its revenue in the form of interest income. It currently generates $1.2 billion in annual net revenue.

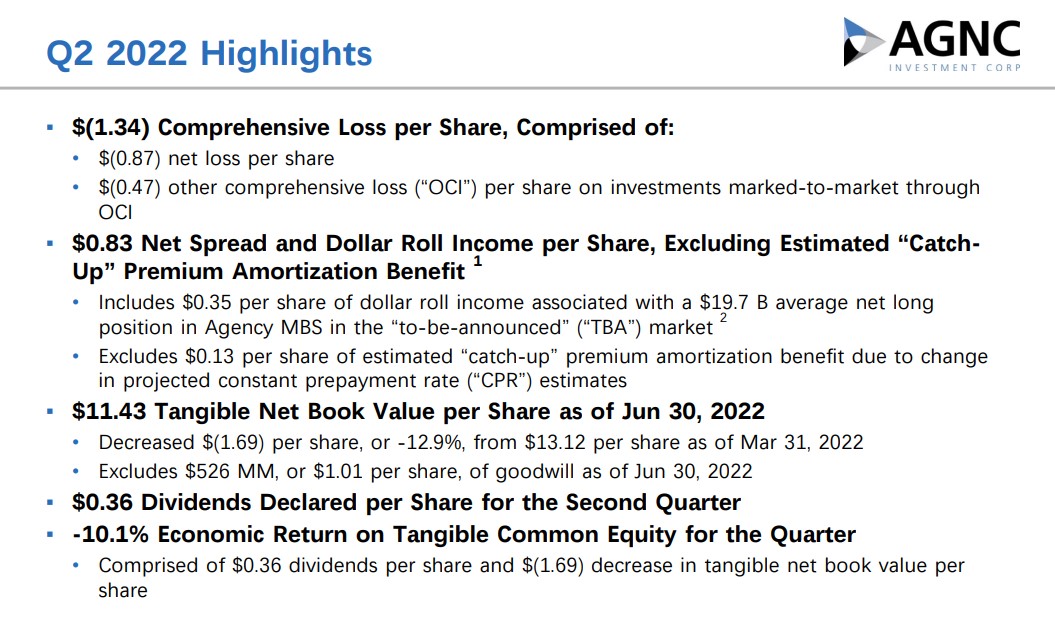

You can see an overview of the company’s second-quarter report in the image below:

Source: Investor Presentation

AGNC reported its Q2 2022 results on July 25, 2022. Q2 net spread and dollar roll income per share stood at 83 cents, up from 72 cents sequentially. Tangible net book value stood at $11.43 as of June 30, 2022. Economic return on tangible common equity stood at -10.1% compared to -14.4% sequentially. AGNC also reported a net loss per common share of $(0.87). The company’s investment portfolio as of June 30, 2022, stood at $61.3 billion.

Furthermore, the trust at an average repurchase price of $10.78 per share repurchased 4.7 million common shares. Meanwhile, cash and unencumbered agency MBS amounted approximately $2.8 billion at quarter end.

We expect 16.8% annual returns for AGNC, made up of the 11.6% dividend yield, negative growth of -0.9%, and a ~6.1% boost from a rising P/FFO multiple.

Click here to download our most recent Sure Analysis report on AGNC (preview of page 1 of 3 shown below):

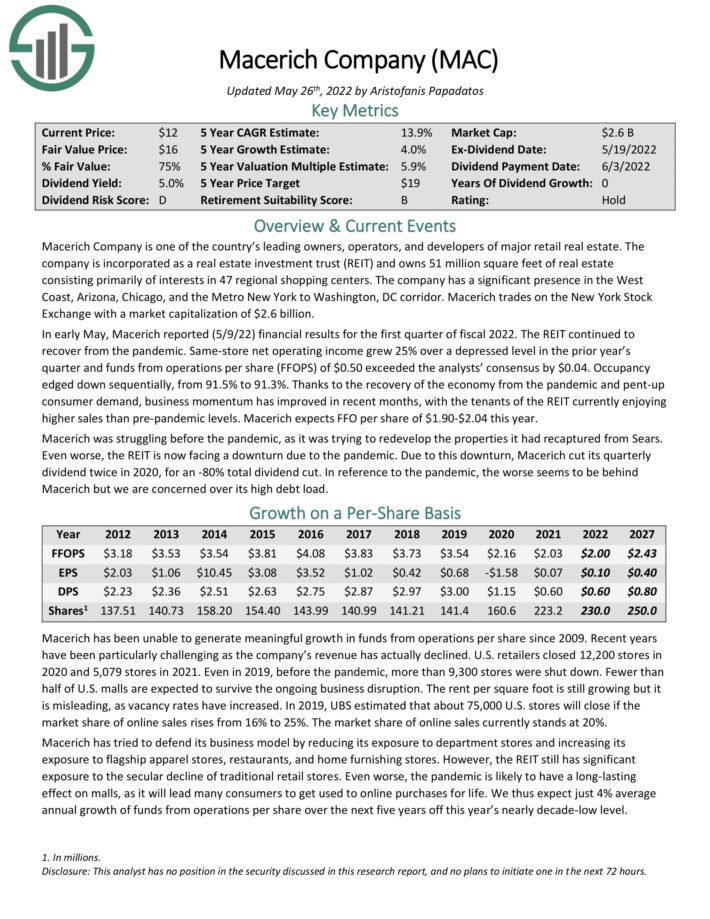

Top REIT #5: The Macerich Company (MAC)

- •Expected Total Return: 16.8%

- •Dividend Yield: 5.7%

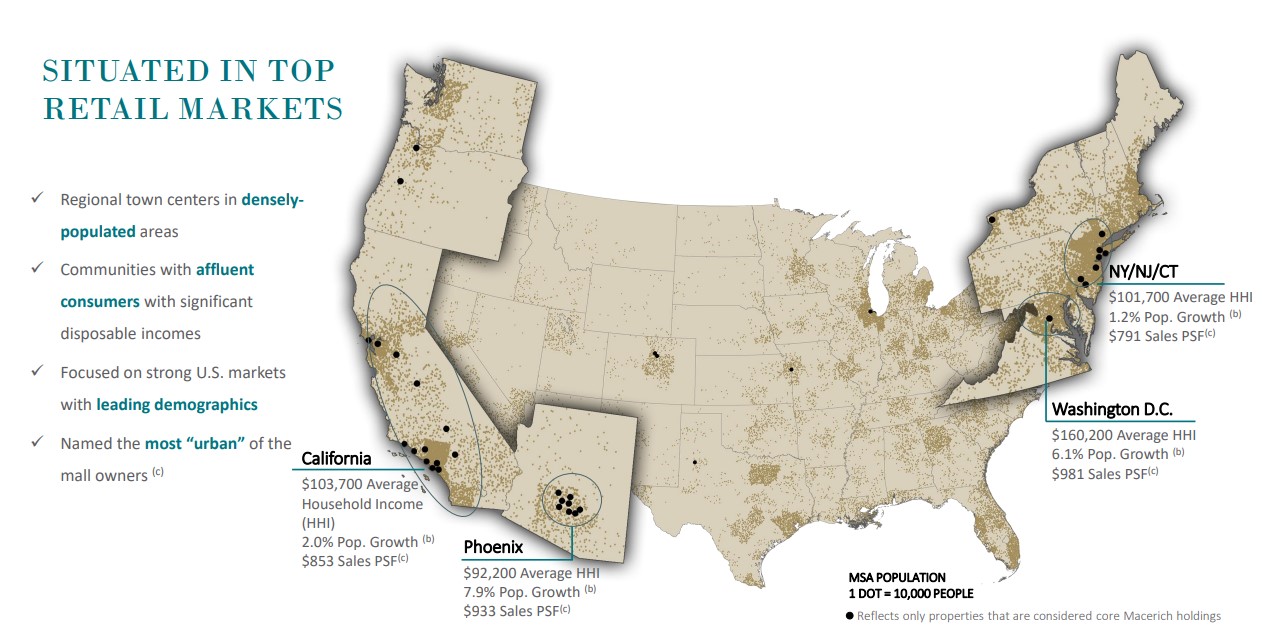

Macerich Company is one of the country’s leading owners, operators, and developers of major retail real estate. The

company owns 51 million square feet of real estate consisting primarily of interests in 47 regional shopping centers.

The company has a significant presence in the West Coast, Arizona, Chicago, and the Metro New York to Washington, DC corridor.

Source: Investor Presentation

Thanks to the recovery of the economy from the pandemic and pent-up consumer demand, business momentum has improved in recent months, with the tenants of the REIT currently enjoying higher sales than pre-pandemic levels. Macerich expects FFO per share of $1.90-$2.04 this year.

Macerich has properties in densely populated areas, with high barriers to entry. However, its poor performance record does not indicate the existence of a meaningful competitive advantage.

Moreover, Macerich has a high debt load, as its interest expense currently exceeds its operating income and its net debt stands at $4.8 billion, which is 185% its current market cap. The high debt load is a major concern, particularly given the secular decline of this business.

Click here to download our most recent Sure Analysis report on MAC (preview of page 1 of 3 shown below):

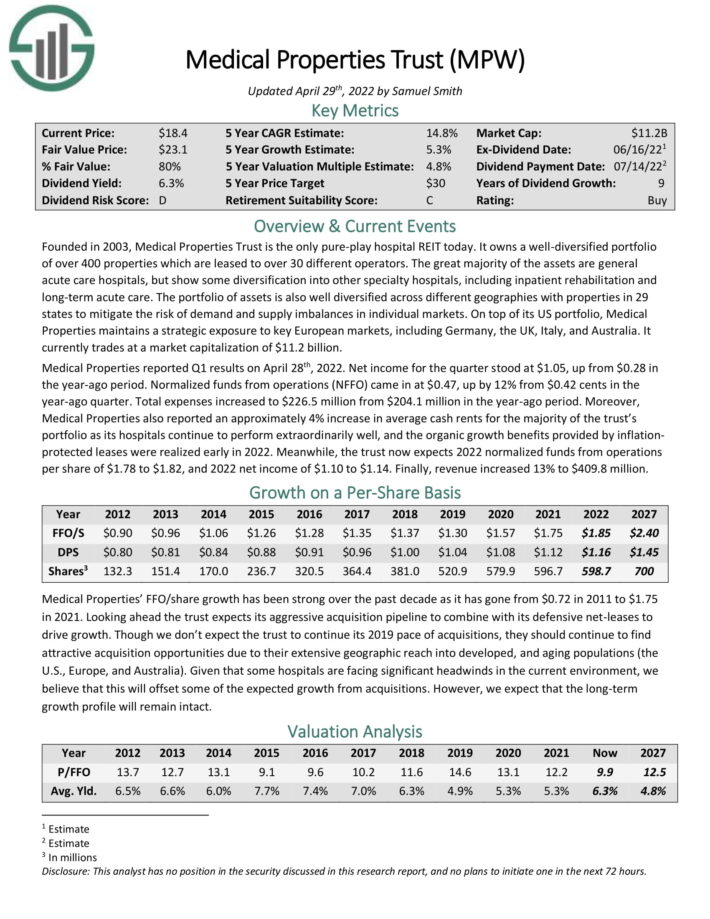

Top REIT #4: Medical Properties Trust (MPW)

- •Expected Total Return: 17.6%

- •Dividend Yield: 7.2%

Medical Properties Trust is the only pure-play hospital REIT today. It owns a well-diversified portfolio of over 400 properties which are leased to over 30 different operators. The great majority of the assets are general acute care hospitals, but show some diversification into other specialty hospitals, including inpatient rehabilitation and long-term acute care.

The portfolio of assets is also well diversified across different geographies with properties in 29 states to mitigate the risk of demand and supply imbalances in individual markets. On top of its US portfolio, Medical Properties maintains a strategic exposure to key European markets, including Germany, the UK, Italy, and Australia.

Medical Properties’ FFO/share growth has been strong over the past decade as it has gone from $0.72 in 2011 to $1.75 in 2021. Looking ahead the trust expects its aggressive acquisition pipeline to combine with its defensive net-leases to drive growth.

We expect annual returns of 17.6% per year, driven by 5.3% AFFO-per-share growth, the 7.2% dividend yield, and a 5.1% annual boost from an expanding P/FFO multiple.

Click here to download our most recent Sure Analysis report on MPW (preview of page 1 of 3 shown below):

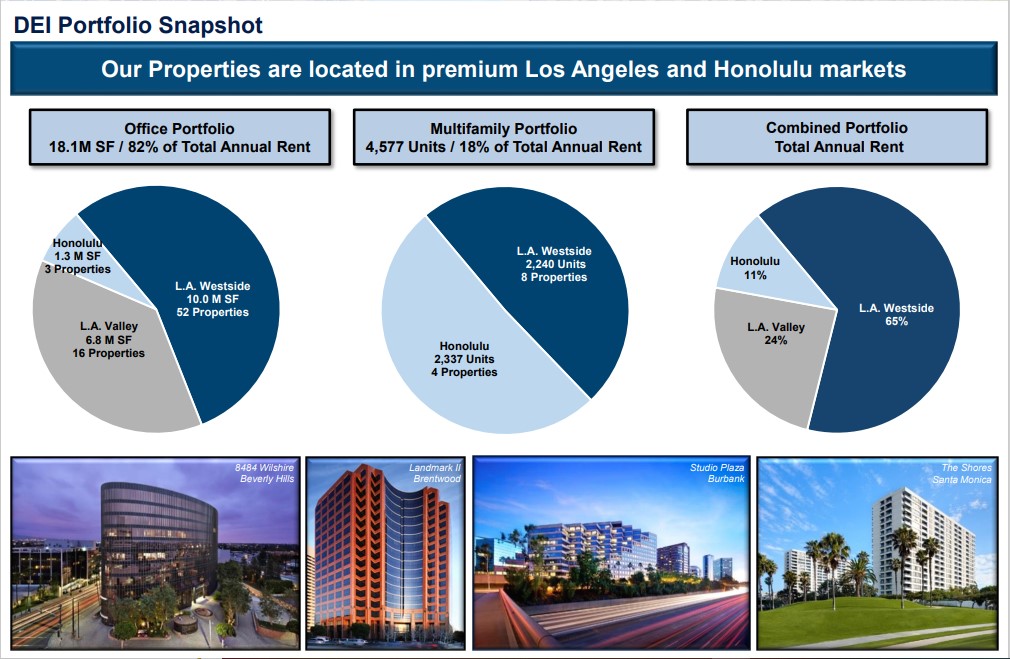

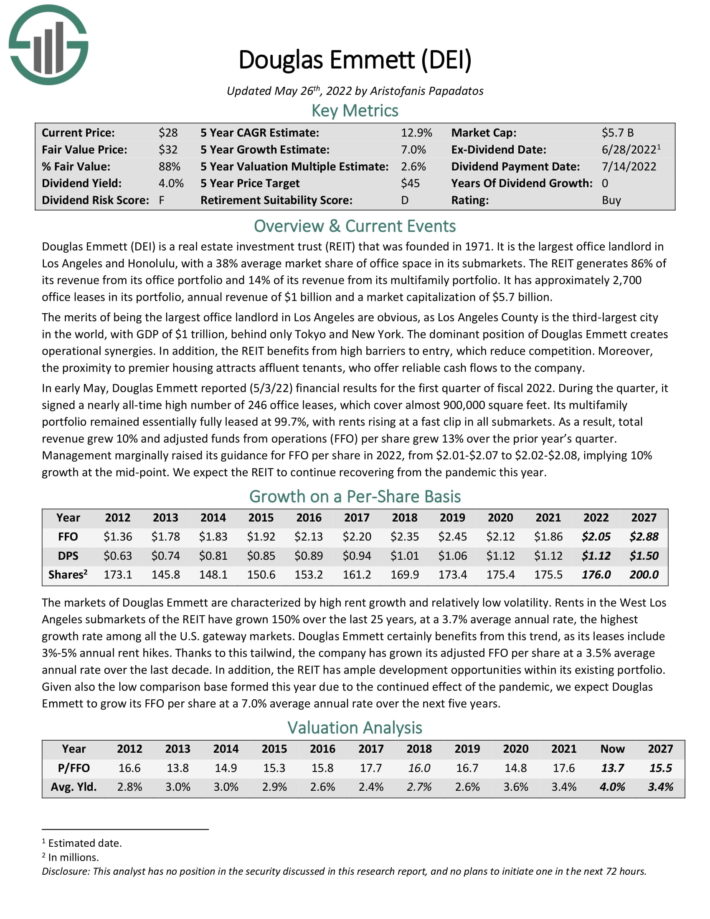

Top REIT #3: Douglas Emmett (DEI)

- •Expected Total Return: 19.1%

- •Dividend Yield: 5.2%

Douglas Emmett is the largest office landlord in Los Angeles and Honolulu, with a 38% average market share of office space in its sub-markets. The REIT generates 86% of its revenue from its office portfolio and 14% of its revenue from its multifamily portfolio. It has approximately 2,700 office leases in its portfolio, annual revenue of $1 billion and a market capitalization of $4.5 billion.

Source: Investor Presentation

The merits of being the largest office landlord in Los Angeles are obvious, as Los Angeles County is the third-largest city in the world, with GDP of $1 trillion, behind only Tokyo and New York. The dominant position of Douglas Emmett creates operational synergies. In addition, the REIT benefits from high barriers to entry, which reduce competition. Moreover, the proximity to premier housing attracts affluent tenants, who offer reliable cash flows to the company.

The markets of Douglas Emmett are characterized by high rent growth and relatively low volatility. Rents in the West Los Angeles submarkets of the REIT have grown 150% over the last 25 years, at a 3.7% average annual rate, the highest growth rate among all the U.S. gateway markets.

Douglas Emmett certainly benefits from this trend, as its leases include 3%-5% annual rent hikes. Thanks to this tailwind, the company has grown its adjusted FFO per share at a 3.5% average annual rate over the last decade.

Click here to download our most recent Sure Analysis report on DEI (preview of page 1 of 3 shown below).

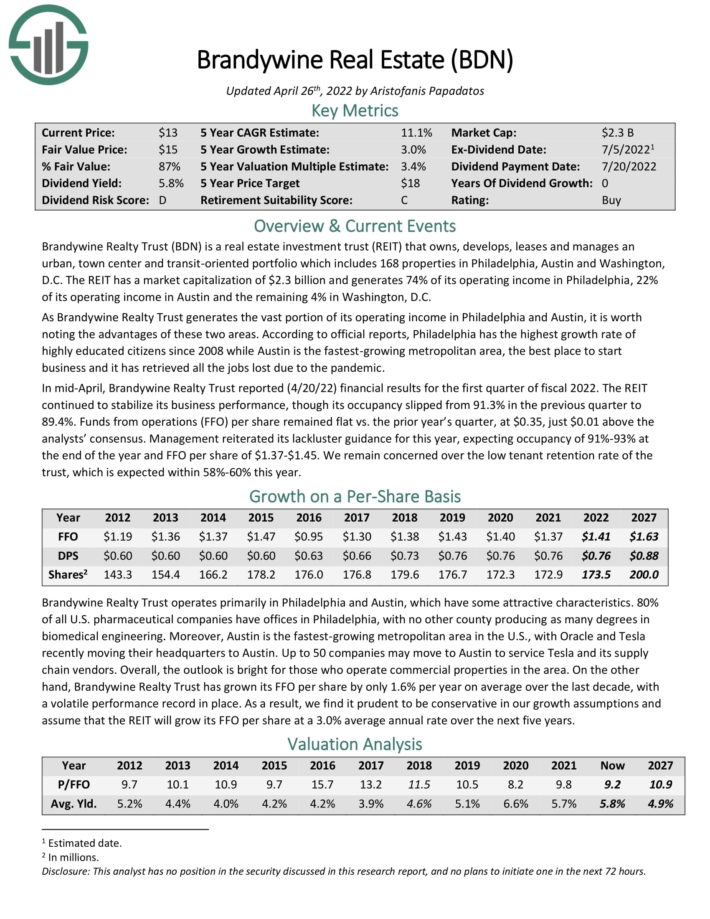

Top REIT #2: Brandywine Real Estate (BDN)

- •Expected Total Return: 20.7%

- •Dividend Yield: 9.0%

Brandywine Realty Trust owns, develops, leases and manages an urban, town center and transit-oriented portfolio which includes 168 properties in Philadelphia, Austin and Washington, D.C. The REIT generates 74% of its operating income in Philadelphia, 22% of its operating income in Austin and the remaining 4% in Washington, D.C.

As Brandywine Realty Trust generates the vast portion of its operating income in Philadelphia and Austin, it is worth noting the advantages of these two areas. According to official reports, Philadelphia has the highest growth rate of highly educated citizens since 2008 while Austin is the fastest-growing metropolitan area, the best place to start business and it has retrieved all the jobs lost due to the pandemic.

Brandywine Realty Trust is offering an above-average 9.0% dividend yield. Given the solid payout ratio of 54%, the dividend looks enticing on the surface. However, it is important to note that the REIT operates with a nosebleed leverage ratio (Net Debt to EBITDA) of 7.0. It also has a heavy schedule of debt maturities until the end of 2024. As a result, the dividend is likely to come under pressure in the event of an unforeseen downturn.

The high debt load is probably the primary reason behind the freeze of the dividend for 14 consecutive quarters. Moreover, Brandywine Realty Trust is sensitive to recessions due to its weak balance sheet and the sensitivity of its tenants to recessions.

Still, we expect annual returns above 20%, driven by the 9% dividend yield, expected FFO-per-share growth of 3%, and a sizable boost from an expanding valuation multiple.

Click here to download our most recent Sure Analysis report on BDN (preview of page 1 of 3 shown below):

Top REIT #1: SL Green Realty (SLG)

- •Expected Total Return: 21.4%

- •Dividend Yield: 7.9%

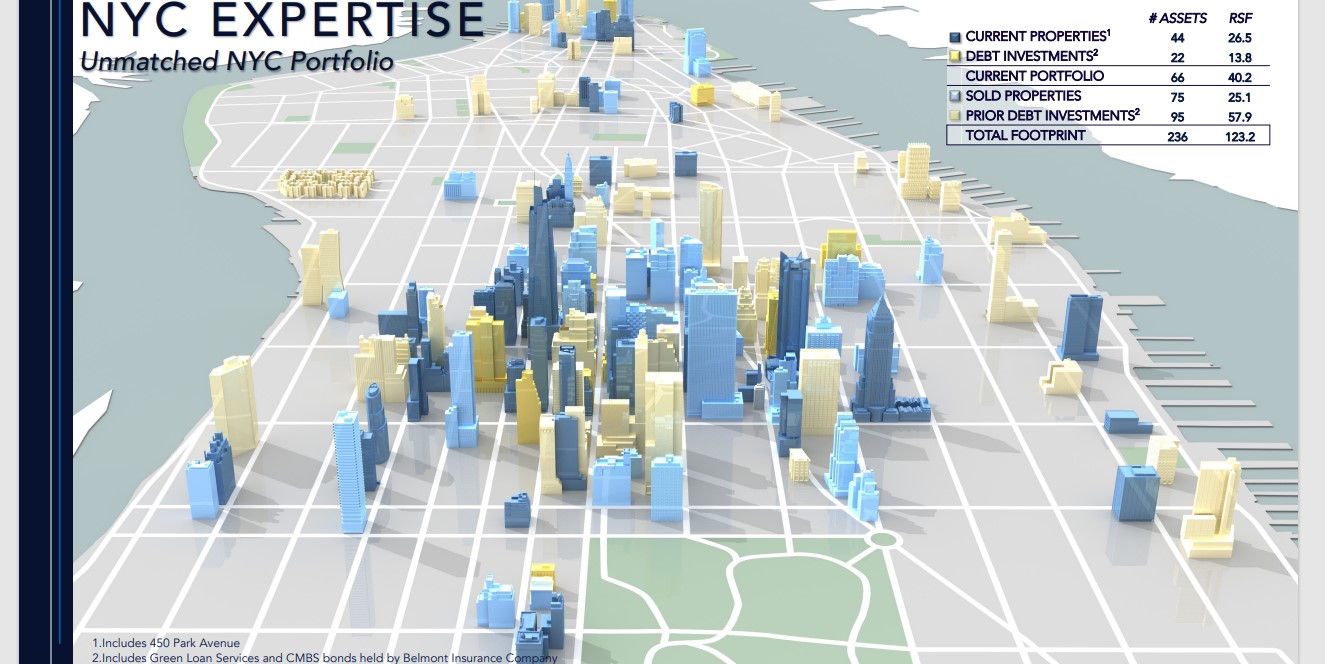

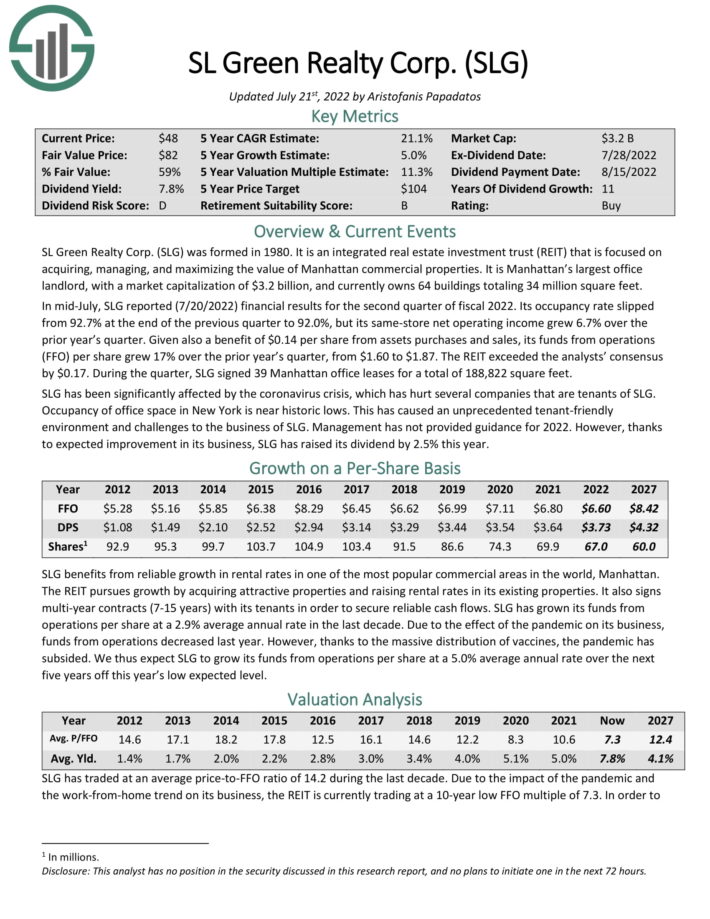

SL Green Realty Corp was formed in 1980. It is an integrated real estate investment trust (REIT) that is focused on acquiring, managing, and maximizing the value of Manhattan commercial properties. It is Manhattan’s largest office landlord, and currently owns 73 buildings totaling 35 million square feet.

It is Manhattan’s largest office landlord, and currently owns 73 buildings totaling 35 million square feet.

Source: Investor Presentation

In mid-July, SLG reported (7/20/2022) financial results for the second quarter of fiscal 2022. Its occupancy rate slipped from 92.7% at the end of the previous quarter to 92.0%, but its same-store net operating income grew 6.7% over the prior year’s quarter.

Given also a benefit of $0.14 per share from assets purchases and sales, its funds from operations (FFO) per share grew 17% over the prior year’s quarter, from $1.60 to $1.87. The REIT exceeded the analysts’ consensus by $0.17. During the quarter, SLG signed 39 Manhattan office leases for a total of 188,822 square feet.

We expect annual returns of 21.4% going forward, comprised of 5% expected earnings growth, the 7.9% dividend yield, and a ~8.5% annual boost from an expanding P/FFO multiple.

Click here to download our most recent Sure Analysis report on SLG (preview of page 1 of 3 shown below):

Final Thoughts

The REIT Spreadsheet list in this article contains a list of publicly-traded Real Estate Investment Trusts.

However, this database is certainly not the only place to find high-quality dividend stocks trading at fair or better prices.

In fact, one of the best methods to find high-quality dividend stocks is looking for stocks with long histories of steadily rising dividend payments. Companies that have increased their payouts through many market cycles are highly likely to continue doing so for a long time to come.

You can see more high-quality dividend stocks in the following Sure Dividend databases, each based on long streaks of steadily rising dividend payments:

- •Dividend Kings List: Dividend Stocks With 50+ Years of Rising Dividends

- •The Highest Yielding Dividend Kings List: The 20 Dividend Kings with the highest current yields.

- •Dividend Aristocrats List: 25+ Years of Rising Dividends

- •The Highest Yielding Dividend Aristocrats List: The 20 Dividend Aristocrats with the highest current yields.

- •Blue Chip Stocks List: Stocks that qualify as either Dividend Achievers, Dividend Aristocrats, or Dividend Kings.

- •Dividend Champions List: 25+ years of rising dividends, that do not qualify as Dividend Aristocrats

- •Dividend Achievers List: 10+ years of dividend increases

Alternatively, another great place to look for high-quality business is inside the portfolios of highly successful investors. By analyzing the portfolios of legendary investors running multi-billion dollar investment portfolios, we are able to indirectly benefit from their million-dollar research budgets and personal investing expertise.

To that end, Sure Dividend has created the following two articles:

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

2022 Blue-Chip Dividend Stocks | See All 357 | Yields Up To 8.3%