First Published on July 6th, 2022 by Bob Ciura for Sure Dividend

Spreadsheet data updated daily

Monthly dividend stocks are securities that pay a dividend every month instead of quarterly or annually. More frequent dividend payments mean a smoother income stream for investors.

This article includes:

- •A free spreadsheet on all 49 monthly dividend stocks

- •Links to detailed stand-alone analysis on all 49 monthly dividend stocks

- •Several other resources to help you invest in monthly dividend securities for steady income

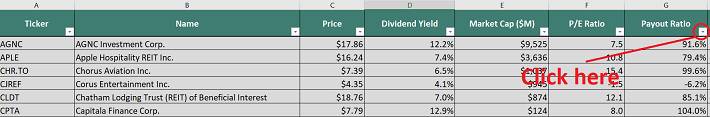

You can download our full Excel spreadsheet of all monthly dividend stocks (along with metrics that matter like dividend yield and payout ratio) by clicking on the link below:

Click here to download your free spreadsheet of all 49 monthly dividend stocks now.

The downloadable Monthly Dividend Stocks Spreadsheet above contains the following for each stock that pays monthly dividends:

- •Dividend yield

- •Name and ticker

- •Market cap

- •Payout ratio

- •Beta

Note: We strive to maintain an accurate list of all monthly dividend payers. There’s no universal source we are aware of for monthly dividend stocks; we curate this list manually. If you know of any stocks that pay monthly dividends that are not on our list, please email [email protected].

This article also includes our top 5 ranked monthly dividend stocks today, according to expected five-year annual returns.

We have excluded oil and gas royalty trusts due to their high risks. These high risks make them less attractive for income investors, in our view.

Table of Contents

- •How to Use the Monthly Dividend Stocks Spreadsheet to Find Dividend Investment Ideas

- •The 5 Best Monthly Dividend Stocks

#5: Itau Unibanco (ITUB)

#4: Broadmark Realty Capital (BRMK)

#3: Orchid Island Capital (ORC)

#2: AGNC Investment Corporation (AGNC)

#1: SL Green Realty (SLG) - •Detailed Analysis on All Monthly Dividend Stocks

- •Performance Through June 2022

- •Why Monthly Dividends Matter

- •The Dangers of Investing in Monthly Dividend Stocks

- •Final Thoughts

Having the list of monthly dividend stocks along with metrics that matter is a great way to begin creating a monthly passive income stream.

High-yielding monthly dividend payers have a unique mix of characteristics that make them especially suitable for investors seeking current income.

Keep reading this article to learn more about investing in monthly dividend stocks.

How to Use the Monthly Dividend Stocks Sheet to Find Dividend Investment Ideas

For investors that use their dividend stock portfolios to generate passive monthly income, one of the main concerns is the sustainability of the company’s dividend.

A dividend cut indicates one of two things:

- •The business isn’t performing well enough to sustain a dividend

- •Management is no longer interested in rewarding shareholders with dividends

Either of these should be considered an automatic sign to sell a dividend stock.

Of the two reasons listed above, #1 is more likely to happen. Thus, it is very important to continually monitor the financial feasibility of a company’s dividend.

This is best evaluated by using the payout ratio. The payout ratio is a mathematical expression that shows what percentage of a company’s earnings is distributed to shareholders as dividend payments. A very high payout ratio could indicate that a company’s dividend is in danger of being reduced or eliminated completely.

For readers unfamiliar with Microsoft Excel, this section will show you how to list the stocks in the spreadsheet in order of decreasing payout ratio.

Step 1: Download the monthly dividend stocks excel sheet at the link above.

Step 2: Highlight columns A through H, and go to “Data”, then “Filter”.

Step 3: Click on the ‘filter’ icon at the top of the payout ratio column.

Step 4: Filter the high dividend stocks spreadsheet in descending order by payout ratio. This will list the stocks with lower (safer) payout ratios at the top.

The 5 Best Monthly Dividend Stocks

The following companies represent our top 5 monthly dividend stocks right now. Stocks were selected based on their projected total annual returns over the next five years.

Monthly Dividend Stock #5: Itau Unibanco (ITUB)

- •5-year expected annual returns: 14.5%

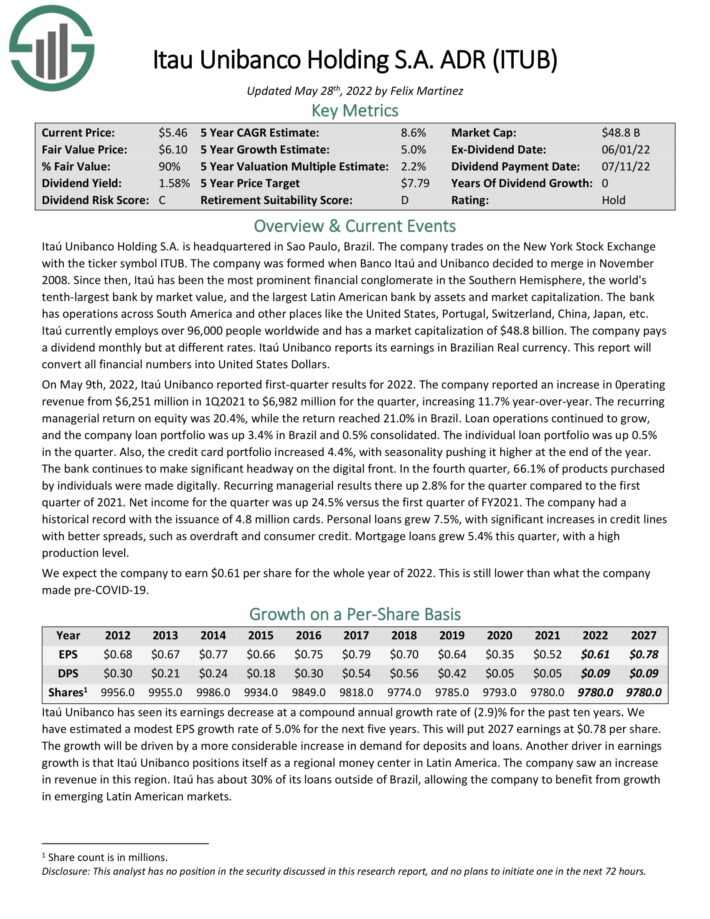

Itaú Unibanco Holding S.A. is headquartered in Sao Paulo, Brazil. The company trades on the New York Stock Exchange with the ticker symbol ITUB. The company was formed when Banco Itaú and Unibanco decided to merge in November 2008.

Since then, Itaú has been the most prominent financial conglomerate in the Southern Hemisphere, the world’s tenth-largest bank by market value, and the largest Latin American bank by assets and market capitalization. The bank has operations across South America and other places like the United States, Portugal, Switzerland, China, Japan, etc.

Itaú currently employs over 96,000 people worldwide and has a market capitalization of $48.8 billion. The company pays a dividend monthly but at different rates. Itaú Unibanco reports its earnings in Brazilian Real currency. This report will convert all financial numbers into United States Dollars.

On May 9th, 2022, Itaú Unibanco reported first-quarter results for 2022. The company reported an increase in 0perating revenue from $6,251 million in 1Q2021 to $6,982 million for the quarter, increasing 11.7% year-over-year. The recurring managerial return on equity was 20.4%, while the return reached 21.0% in Brazil.

Loan operations continued to grow, and the company loan portfolio was up 3.4% in Brazil and 0.5% consolidated. The individual loan portfolio was up 0.5% in the quarter. Also, the credit card portfolio increased 4.4%, with seasonality pushing it higher at the end of the year.

The bank continues to make significant headway on the digital front. In the fourth quarter, 66.1% of products purchased by individuals were made digitally. Recurring managerial results there up 2.8% for the quarter compared to the first quarter of 2021. Net income for the quarter was up 24.5% versus the first quarter of FY2021. The company had a historical record with the issuance of 4.8 million cards.

Personal loans grew 7.5%, with significant increases in credit lines with better spreads, such as overdraft and consumer credit. Mortgage loans grew 5.4% this quarter, with a high production level.

We expect annual returns of 14.5%, driven by the 2.1% dividend yield, 5% EPS growth, and a ~7.4% positive impact from an expanding valuation multiple.

Click here to download our most recent Sure Analysis report on ITUB (preview of page 1 of 3 shown below):

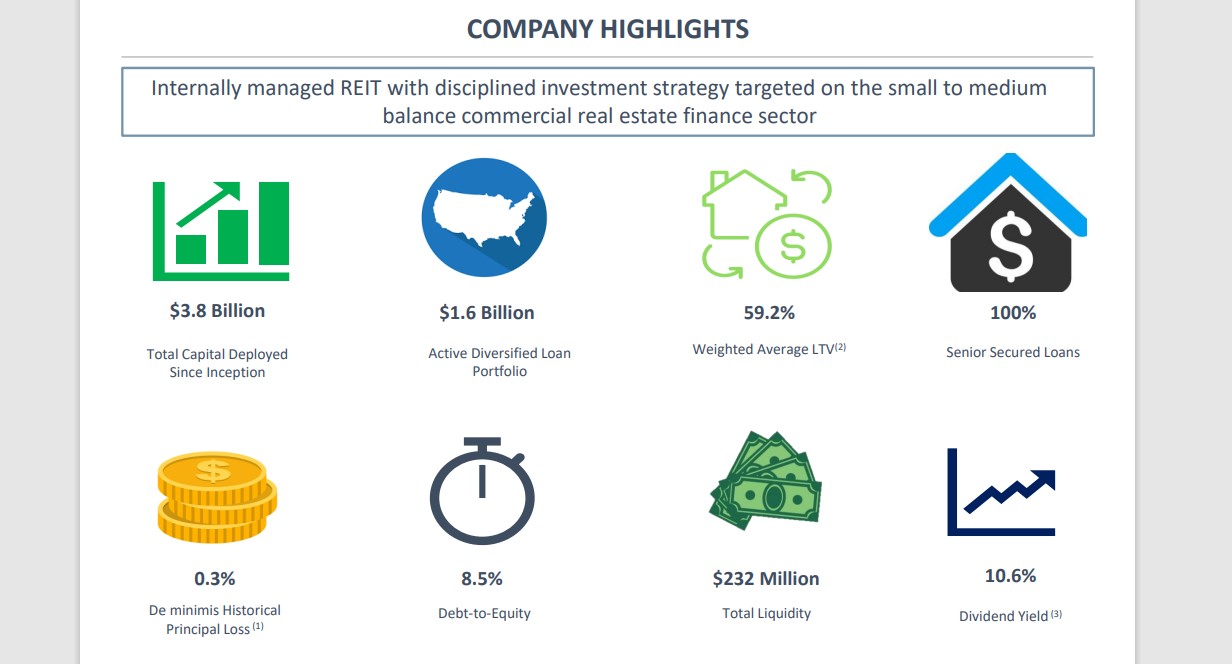

Monthly Dividend Stock #4: Broadmark Realty Capital (BRMK)

- •5-year expected annual returns: 14.7%

Broadmark Realty Capital Inc. is a real estate investment trust that provides short-term, first deed of trust loans that are secured by real estate. Customers use these loans to acquire, renovate, rehab and develop properties for both residential and commercial uses in the U.S. Broadmark Realty formed in 2010, but had its initial public offering in November 2019.

Source: Investor Presentation

On May 9th, 2022, Broadmark Realty reported first quarter results for the period ending March 31st, 2022. For the quarter, revenue grew 1.4% to $29.87 million, which was $2.2 million lower than expected. Adjusted earnings per share of $0.17 compared unfavorably to adjusted earnings per share of $0.18 in the prior period and was $0.02 below estimates.

Broadmark Realty originated $189.6 million of new loans and amendments for the quarter. First quarter origination was a 24% decrease sequentially and at a weighted average loan to value of 61.8%. Quarterly interest income totaled $24.1 million and fee income was $5.8 million. The total portfolio consisted of $1.6 billion of loans across 20 states and the District of Columbia.

As of March 31st, 2022, Broadmark Realty had a total of $187.8 million of loans in contractual default. The trust resolved $36 million of loans in contractual default during the quarter. Provisions for credit losses totaled $1.75 million compared to $2.71 million in the first quarter of 2021.

We expect 14.7% annual returns for Broadmark stock, representing 3% expected EPS growth, the 12.3% dividend yield, and a ~0.6% reduction from a declining valuation multiple.

Click here to download our most recent Sure Analysis report on BRMK (preview of page 1 of 3 shown below):

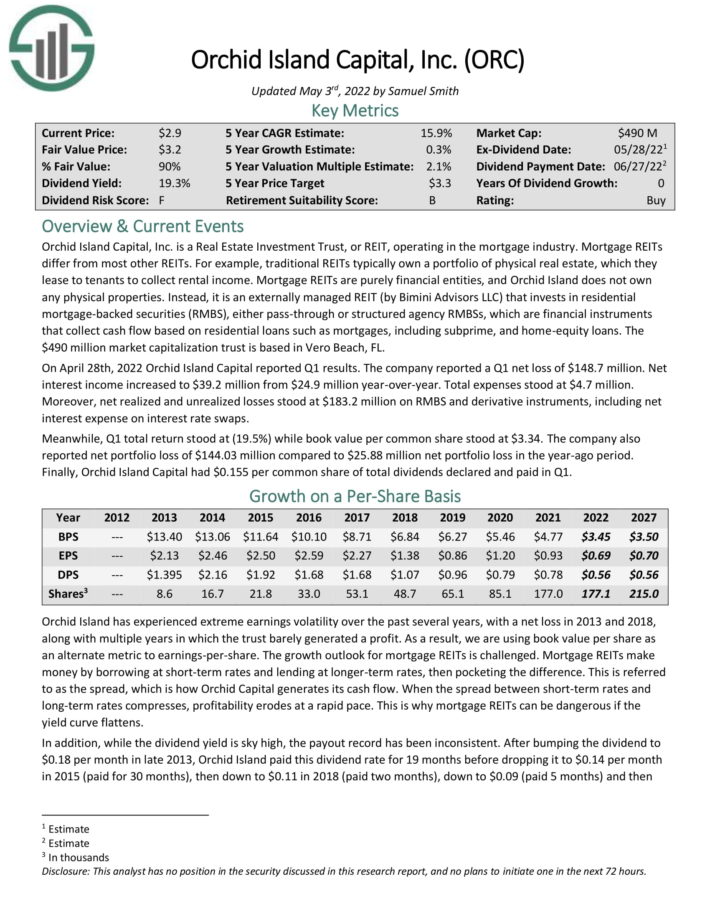

Monthly Dividend Stock #3: Orchid Island Capital (ORC)

- •5-year expected annual returns: 15.5%

Orchid Island Capital, Inc. is a REIT operating in the mortgage industry. Mortgage REITs differ from most other REITs.

For example, traditional REITs typically own a portfolio of physical real estate, which they lease to tenants to collect rental income. Mortgage REITs are purely financial entities, and Orchid Island does not own any physical properties.

Instead, it is an externally managed REIT (by Bimini Advisors LLC) that invests in residential mortgage–backed securities (RMBS), either pass-through or structured agency RMBSs, which are financial instruments that collect cash flow based on residential loans such as mortgages, including subprime, and home-equity loans.

ORC recently cut its dividend by 18%. We expect annual returns of 15.5% for ORC stock, driven by the 19% dividend yield partially offset by a declining valuation multiple.

Click here to download our most recent Sure Analysis report on ORC (preview of page 1 of 3 shown below):

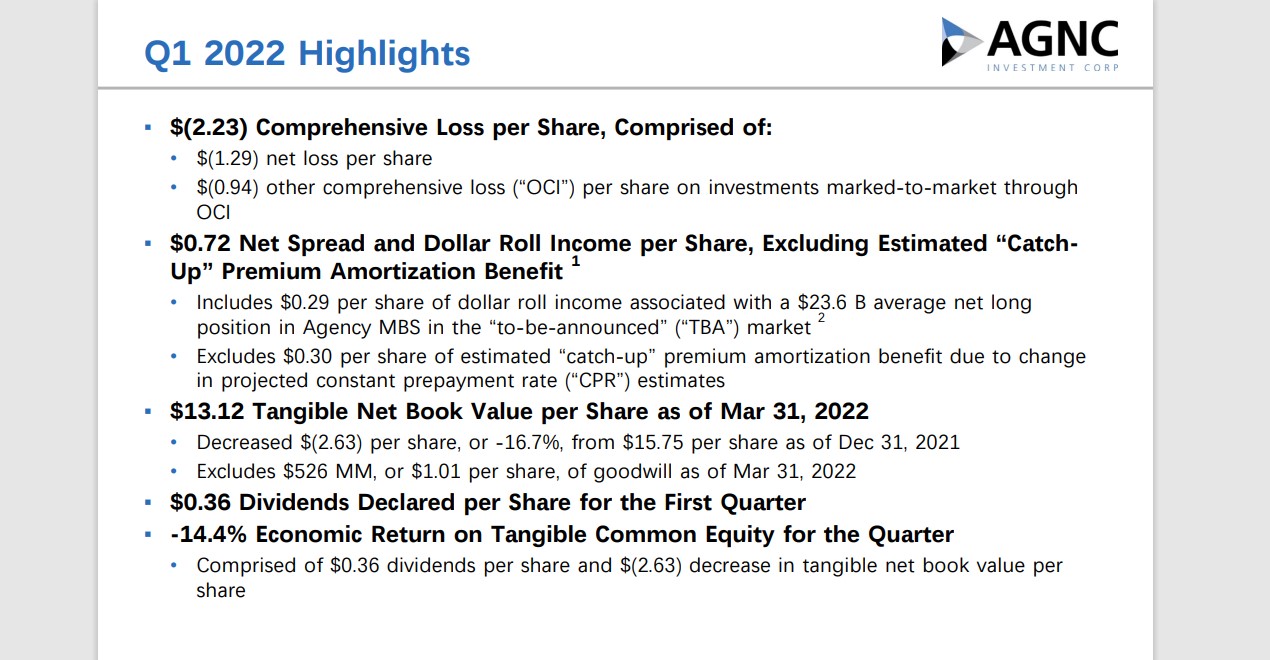

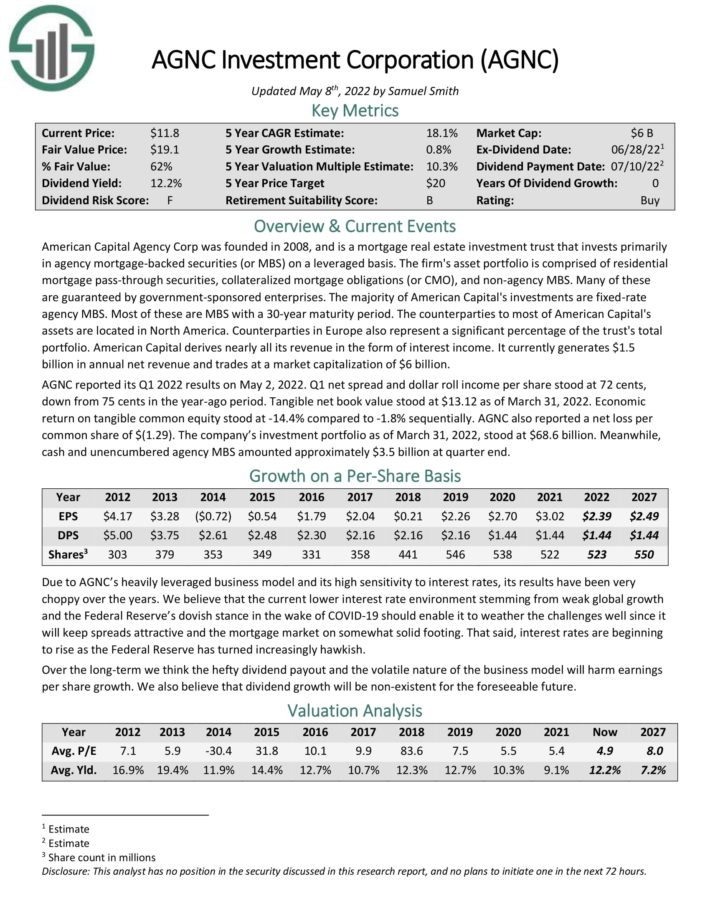

Monthly Dividend Stock #2: AGNC Investment Corporation (AGNC)

- •5-year expected annual returns: 18.5%

American Capital Agency Corp was founded in 2008, and is a mortgage real estate investment trust that invests primarily in agency mortgage-backedsecurities (or MBS) on a leveraged basis.

The firm’s asset portfolio is comprised of residential mortgage pass-throughsecurities, collateralized mortgage obligations (or CMO), and non-agencyMBS. Many of these are guaranteed by government sponsored enterprises.

The majority of American Capital’s investments are fixed rate agency MBS. Most of these are MBS with a 30-year maturity period. AGNC derives nearly all its revenue in the form of interest income. It currently generates $1.2 billion in annual net revenue.

You can see an overview of the company’s first-quarter report in the image below:

Source: Investor Presentation

We expect 18.5% annual returns for AGNC, made up of the 12.4% dividend yield, no growth, and a ~6.1% boost from a rising P/FFO multiple.

Click here to download our most recent Sure Analysis report on AGNC (preview of page 1 of 3 shown below):

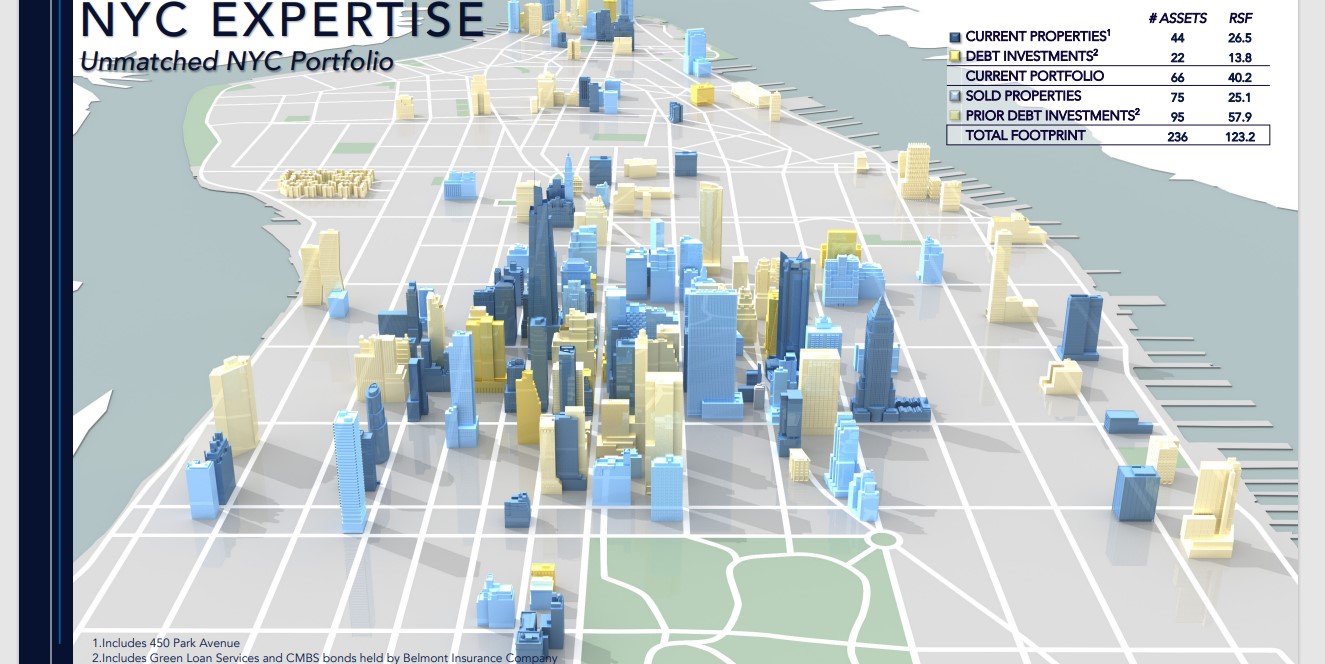

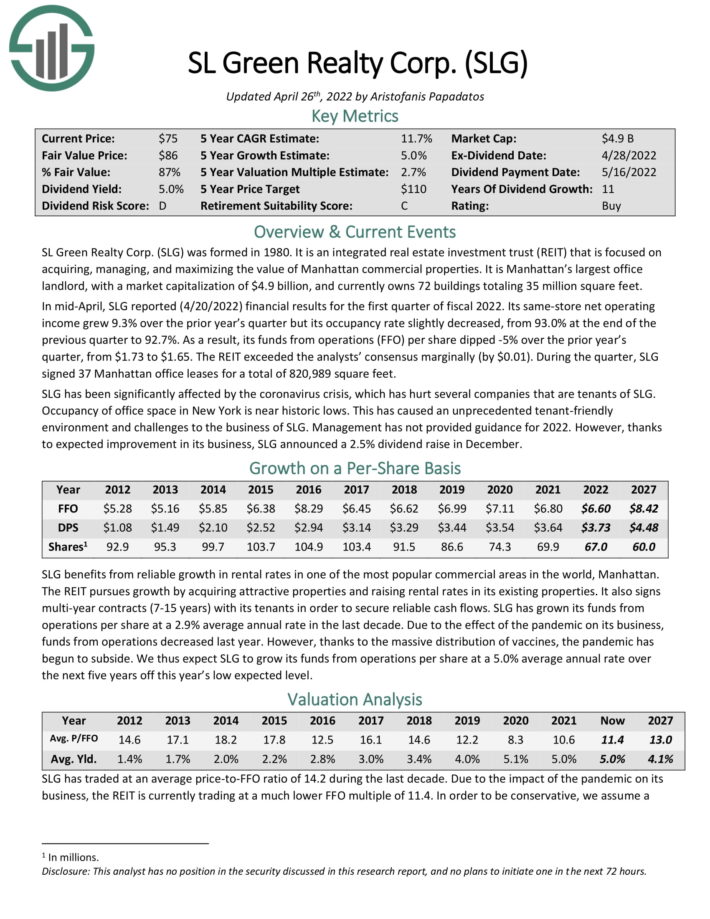

Monthly Dividend Stock #1: SL Green Realty (SLG)

- •5-year expected annual returns: 22.3%

SL Green Realty Corp was formed in 1980. It is an integrated real estate investment trust (REIT) that is focused on acquiring, managing, and maximizing the value of Manhattan commercial properties. It is Manhattan’s largest office landlord, and currently owns 73 buildings totaling 35 million square feet.

Source: Investor Presentation

In mid-April, SLG reported (4/20/2022) financial results for the first quarter of fiscal 2022. Its same-store net operating income grew 9.3% over the prior year’s quarter but its occupancy rate slightly decreased, from 93.0% at the end of the previous quarter to 92.7%.

As a result, its funds from operations (FFO) per share dipped -5% over the prior year’s quarter, from $1.73 to $1.65. The REIT exceeded the analysts’ consensus marginally (by $0.01). During the quarter, SLG signed 37 Manhattan office leases for a total of 820,989 square feet.

We forecast FFO-per-share of $6.60 in 2022. Therefore, the stock currently trades for a P/FFO ratio of 9.0.

We expect annual returns of 22.3% going forward, comprised of 5% expected earnings growth, the 7.9% dividend yield, and a ~9.4% annual boost from an expanding P/FFO multiple.

Click here to download our most recent Sure Analysis report on SLG (preview of page 1 of 3 shown below):

Detailed Analysis On All of The Monthly Dividend Stocks

You can see detailed analysis on monthly dividend securities we cover by clicking the links below. We’ve included our most recent Sure Analysis Research Database report update in brackets as well, where applicable.

- •Agree Realty (ADC) | [See Newest Sure Analysis Report]

- •AGNC Investment (AGNC) | [See Newest Sure Analysis Report]

- •Apple Hospitality REIT, Inc. (APLE) | See Newest Sure Analysis Report

- •ARMOUR Residential REIT (ARR) | [See Newest Sure Analysis Report]

- •Banco Bradesco S.A. (BBD) | [See Newest Sure Analysis Report]

- •Broadmark Realty Capital (BRMK) | [See Newest Sure Analysis Report]

- •Chatham Lodging (CLDT)* | [See Newest Sure Analysis Report]

- •Choice Properties REIT (PPRQF) | [See Newest Sure Analysis Report]

- •Cross Timbers Royalty Trust (CRT) | [See Newest Sure Analysis Report]

- •Dream Industrial REIT (DREUF) | [See Newest Sure Analysis Report]

- •Dream Office REIT (DRETF) | [See Newest Sure Analysis Report]

- •Dynex Capital (DX) | [See Newest Sure Analysis Report]

- •Ellington Residential Mortgage REIT (EARN) | [See Newest Sure Analysis Report]

- •Ellington Financial (EFC) | [See Newest Sure Analysis Report]

- •EPR Properties (EPR) | [See Newest Sure Analysis Report]

- •Exchange Income Corporation (EIFZF) | [See Newest Sure Analysis Report]

- •Fortitude Gold (FTCO) | [See Newest Sure Analysis Report]

- •Generation Income Properties (GIPR) | [See Newest Sure Analysis Report]

- •Gladstone Capital Corporation (GLAD) | [See Newest Sure Analysis Report]

- •Gladstone Commercial Corporation (GOOD) | [See Newest Sure Analysis Report]

- •Gladstone Investment Corporation (GAIN) | [See Newest Sure Analysis Report]

- •Gladstone Land Corporation (LAND) | [See Newest Sure Analysis Report]

- •Global Water Resources (GWRS) | [See Newest Sure Analysis Report]

- •Granite Real Estate Investment Trust (GRP.U)** | [Historical Reports]

- •Horizon Technology Finance (HRZN) | [See Newest Sure Analysis Report]

- •Itaú Unibanco (ITUB) | [See Newest Sure Analysis Report]

- •LTC Properties (LTC) | [See Newest Sure Analysis Report]

- •Main Street Capital (MAIN) | [See Newest Sure Analysis Report]

- •Orchid Island Capital (ORC) | [See Newest Sure Analysis Report]

- •Oxford Square Capital (OXSQ) | [See Newest Sure Analysis Report]

- •Pembina Pipeline (PBA) | [See Newest Sure Analysis Report]

- •Permian Basin Royalty Trust (PBT) | [See Newest Sure Analysis Report]

- •Phillips Edison & Company (PECO) | [See Newest Sure Analysis Report]

- •Pennant Park Floating Rate (PFLT) | [See Newest Sure Analysis Report]

- •PermRock Royalty Trust (PRT) | [See Newest Sure Analysis Report]

- •Prospect Capital Corporation (PSEC) | [See Newest Sure Analysis Report]

- •Permianville Royalty Trust (PVL)

- •Realty Income (O) | [See Newest Sure Analysis Report]

- •Sabine Royalty Trust (SBR) | [See Newest Sure Analysis Report]

- •Stellus Capital Investment Corp. (SCM) | [See Newest Sure Analysis Report]

- •San Juan Basin Royalty Trust (SJT)

- •Shaw Communications (SJR) | [See Newest Sure Analysis Report]

- •SL Green Realty Corp. (SLG) | [See Newest Sure Analysis Report]

- •SLR Investment Corp. (SLRC) | [See Newest Sure Analysis Report]

- •Stag Industrial (STAG) | [See Newest Sure Analysis Report]

- •Superior Plus (SUUIF) | [See Newest Sure Analysis Report]

- •TransAlta Renewables (TRSWF) | [See Newest Sure Analysis Report]

- •U.S. Global Investors (GROW) | [See Newest Sure Analysis Report]

- •Whitestone REIT (WSR) | [See Newest Sure Analysis Report]

Note 1: The asterisk (*) denotes a stock that has suspended its dividend. As a result, we have not included the stock in our annual Monthly Dividend Stock In Focus Series. We will resume coverage when and if the company in question resumes paying dividends.

Note 2: The double asterisk (**) denotes a security that is not included by our data provider and is therefore excluded from our Sure Analysis research database despite being a monthly paying dividend stock.

As we do not have coverage of every monthly dividend stock, they are not all included in the list above. Note that most of these businesses are either small or mid-cap companies.

You will not see any S&P 500 stocks in this list – it is predominantly populated by members of the Russell 2000 Index or various international stock market indices.

Based on the list above, the bulk of monthly dividend paying securities are REITs and BDCs.

Performance Through June 2022

In June 2022, a basket of the 49 monthly dividend stocks above (excluding SJT) generated negative total returns of 8.8%. For comparison, the Russell 2000 ETF (IWM) generated negative total returns of 9.1% for the month.

Notes: Data for performance is from Ycharts. Canadian company performance may be in the company’s home currency. Year-to-date performance does have survivorship bias as some securities have been excluded as they eliminated their dividends. Global Net Lease (GNL) was also eliminated as it changed its dividend to quarterly payments.

Monthly dividend stocks outperformed in June. We will update our performance section monthly to track future monthly dividend stock returns.

In June 2022, the 3 best-performing monthly dividend stocks (including dividends) were:

- •Eagle Point Income Co. (EIC), up 4.5%

- •Shaw Communications (SJR), up 4.4%

- •Agree Realty (ADC), up 4.0%

The 3 worst-performing monthly dividend stocks (including dividends) in June were:

- •Permianville Royalty Trust (PVL), down 29.8%

- •SL Green Realty (SLG), down 24.8%

- •Bank Bradesco SA (BBD), down 22.4%

Why Monthly Dividends Matter

Monthly dividend payments are beneficial for one group of investors in particular – retirees who rely on dividend stocks for income.

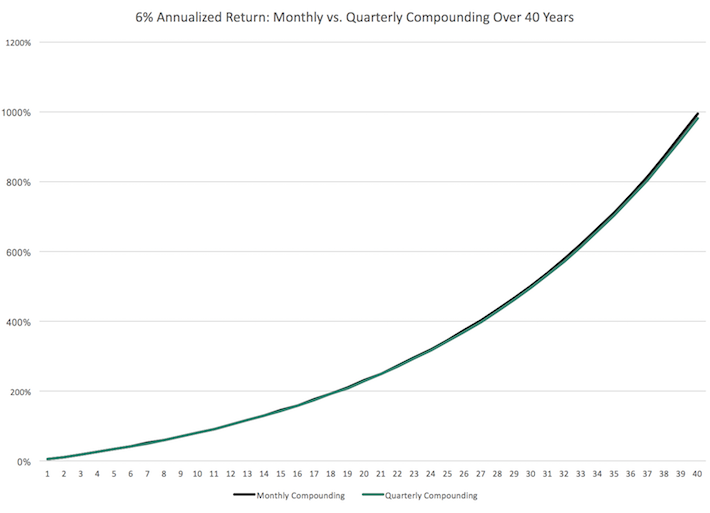

With that said, monthly dividend stocks are better under all circumstances (everything else being equal), because they allow for returns to be compounded on a more frequent basis. More frequent compounding results in better total returns, particularly over long periods of time.

Consider the following performance comparison:

Over the long run, monthly compounding generates slightly higher returns over quarterly compounding. Every little bit helps.

With that said, it might not be practical to manually re-invest dividend payments on a monthly basis. It is more feasible to combine monthly dividend stocks with a dividend reinvestment plan to dollar cost average into your favorite dividend stocks.

The last benefit of monthly dividend stocks is that they allow investors to have – on average – more cash on hand to make opportunistic purchases. A monthly dividend payment is more likely to put cash in your account when you need it versus a quarterly dividend.

Case-in-point: Investors who bought a broad basket of stocks at the bottom of the 2008-2009 financial crisis are likely sitting on triple-digit total returns from those purchases today.

The Dangers of Investing In Monthly Dividend Stocks

Monthly dividend stocks have characteristics that make them appealing to do-it-yourself investors looking for a steady stream of income. Typically, these are retirees and people planning for retirement.

Investors should note many monthly dividend stocks are highly speculative. On average, monthly dividend stocks tend to have elevated payout ratios. An elevated payout ratio means there’s less margin for error to continue paying the dividend if business results suffer a temporary (or permanent) decline.

As a result, we have real concerns that many monthly dividend payers will not be able to continue paying rising dividends in the event of a recession.

Additionally, a high payout ratio means that a company is retaining little money to invest for future growth. This can lead management teams to aggressively leverage their balance sheet, fueling growth with debt. High debt and a high payout ratio is perhaps the most dangerous combination around for a potential future dividend reduction.

With that said, there are a handful of high-quality monthly dividend payers around. Chief among them is Realty Income (O). Realty Income has paid increasing dividends (on an annual basis) every year since 1994.

The Realty Income example shows that there are high-quality monthly dividend payers around, but they are the exception rather than the norm. We suggest investors do ample due diligence before buying into any monthly dividend payer.

Final Thoughts

Financial freedom is achieved when your passive investment income exceeds your expenses. But the sequence and timing of your passive income investment payments can matter.

Monthly payments make matching portfolio income with expenses easier. Most personal expenses recur monthly whereas most dividend stocks pay quarterly. Investing in monthly dividend stocks matches the frequency of portfolio income payments with the normal frequency of personal expenses.

Additionally, many monthly dividend payers offer investors high yields. The combination of a monthly dividend payment and a high yield should be especially appealing to income investors.

But not all monthly dividend payers offer the safety that income investors need. A monthly dividend is better than a quarterly dividend, but not if that monthly dividend is reduced soon after you invest. The high payout ratios and shorter histories of most monthly dividend securities mean they tend to have elevated risk levels.

Because of this, we advise investors to look for high-quality monthly dividend payers with reasonable payout ratios, trading at fair or better prices.

Click here to download your free spreadsheet of all 49 monthly dividend stocks now.

If you are interested in finding more high-quality dividend growth stocks suitable for long-term investment, the following Sure Dividend databases will be useful:

- •The Dividend Aristocrats: S&P 500 stocks with 25+ years of consecutive dividend increases.

- •The 20 Highest Yielding Dividend Aristocrats

- •The Dividend Kings List is even more exclusive than the Dividend Aristocrats. It is comprised of 44 stocks with 50+ years of consecutive dividend increases.

- •The 20 Highest Yielding Dividend Kings

- •The Dividend Achievers List: a group of stocks with 10+ years of consecutive dividend increases.

- •The Dividend Champions List: stocks that have increased their dividends for 25+ consecutive years.

Note: Not all Dividend Champions are Dividend Aristocrats because Dividend Aristocrats have additional requirements like being in The S&P 500. - •The Dividend Contenders List: 10-24 consecutive years of dividend increases.

- •The Dividend Challengers List: 5-9 consecutive years of dividend increases.

- •The 20 Highest Yielding Monthly Dividend Stocks

- •The High Dividend Stocks List: high dividend stocks are suited for investors that need income now (as opposed to growth later) by listing stocks with 5%+ dividend yields.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

These 2 Dividend Stocks Will Work During Inflation Or Recession

Bill Gates Portfolio List | All 18 Stock Investments Now

2022 High ROIC Stocks List | Top 10 Highest Return On Invested Capital Stocks