First Published on July 13th, 2022 by Bob Ciura for SureDividend

Income investors might be tempted to buy stocks with the highest dividend yields. But this is often a mistake, as extreme high-yielding stocks are often in dubious financial condition. While high yields are important, we believe it is equally important to focus on quality.

One way to measure the quality of a dividend stock is by its dividend history. We believe stocks with established histories of dividend growth, are more likely to continue growing their dividends moving forward. This is why we focus on groups of stocks with long histories of increasing their dividends, such as the Dividend Aristocrats.

Meanwhile, investors should also look over the list of Dividend Contenders, which have raised their dividends for at least 10 years in a row.

With this in mind, we created a downloadable list of 348 Dividend Contenders. You can download your free copy of the Dividend Contenders list, along with relevant financial metrics like price-to-earnings ratios, dividend yields, and payout ratios, by clicking on the link below:

Click here to download your Dividend Contenders Excel Spreadsheet List now.

This article will discuss an overview of Dividend Contenders, and why investors should consider quality dividend growth stocks. Additional information regarding dividend stocks in our coverage universe can be found in the Sure Analysis Research Database.

Table of Contents

You can instantly jump to any specific section of the article by clicking on the links below:

- •Overview of Dividend Contenders

- •Example Of A High-Quality Dividend Contender: Bristol-Myers Squibb (BMY)

- •Final Thoughts

Overview of Dividend Contenders

The requirement to become a Dividend Contender is fairly straightforward: 10-24 consecutive years of dividend growth. While 10-24 years may not seem like the longest track record, and indeed there are stocks with much longer streaks of annual dividend hikes, it is nevertheless a positive indicator.

After all, there are a number of companies that have never paid a dividend. Or, even among companies that do pay dividends, many have not been able to raise their dividends consistently due to a lack of underlying business growth.

Many companies cannot pay dividends, or raise dividend payouts from year to year, because their business models do not generate enough profits or cash flow.

Cyclical companies also have trouble joining lists of long-running dividend growth stocks, because their profits collapse during recessions.

Automakers and oil stocks are good examples of highly cyclical companies that will often freeze or cut their dividends during recessions.

In recessions, corporate profits typically decline, particularly within industries that are closely tied to consumer spending. In 2020-2021, companies across multiple industries suspended or eliminated their dividend payouts due to the impact of the coronavirus pandemic on the global economy.

That said, there were many companies that maintained their dividends over the past two years, and even continued to raise them, despite the pandemic.

The highest-quality dividend growth stocks that continued to increase their dividends, once again proved the staying power and durable competitive advantages of their business models.

This is why income investors looking for safe dividends and reliable dividend growth, should focus on companies with established histories of successfully growing their dividends, even during recessions.

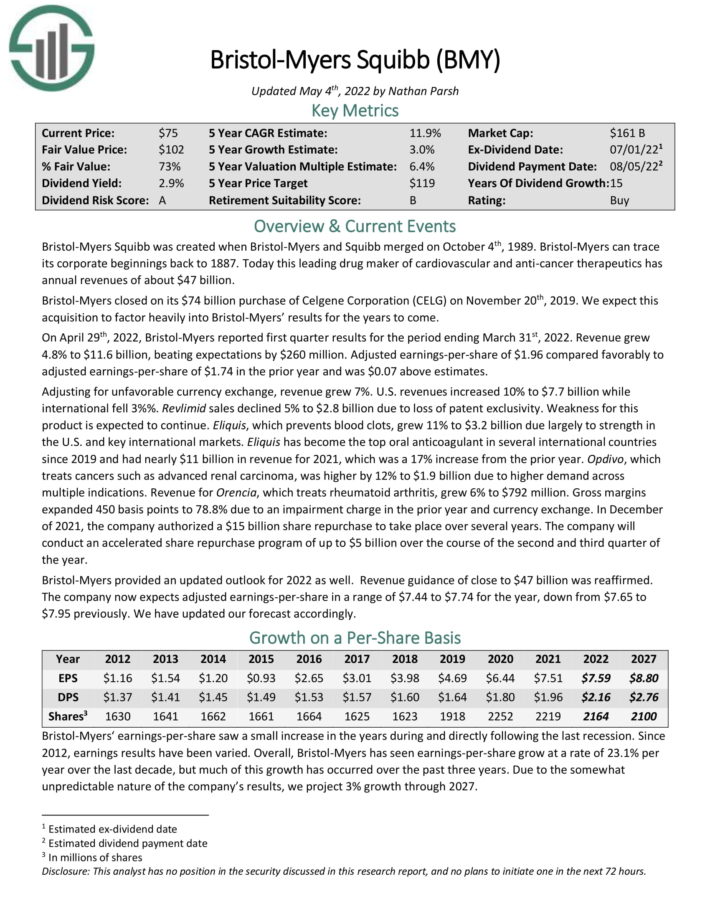

Example Of A High-Quality Dividend Contender: Bristol-Myers Squibb (BMY)

Bristol-Myers Squibb is a leading drug maker of cardiovascular and anti-cancer therapeutics. The company transformed itself due to the $74 billion acquisition of Celgene, a peer pharmaceutical giant which derived almost two-thirds of its revenue from Revlimid, which treats multiple myeloma and other cancers.

The company has increased its dividend for 15 consecutive years.

On April 29th, 2022, Bristol-Myers reported first quarter results for the period ending March 31st, 2022. Revenue grew 4.8% to $11.6 billion, beating expectations by $260 million. Adjusted earnings-per-share of $1.96 compared favorably to adjusted earnings-per-share of $1.74 in the prior year and was $0.07 above estimates.

Adjusting for unfavorable currency exchange, revenue grew 7%. U.S. revenues increased 10% to $7.7 billion while international fell 3%. Revlimid sales declined 5% to $2.8 billion due to loss of patent exclusivity. Weakness for this product is expected to continue.

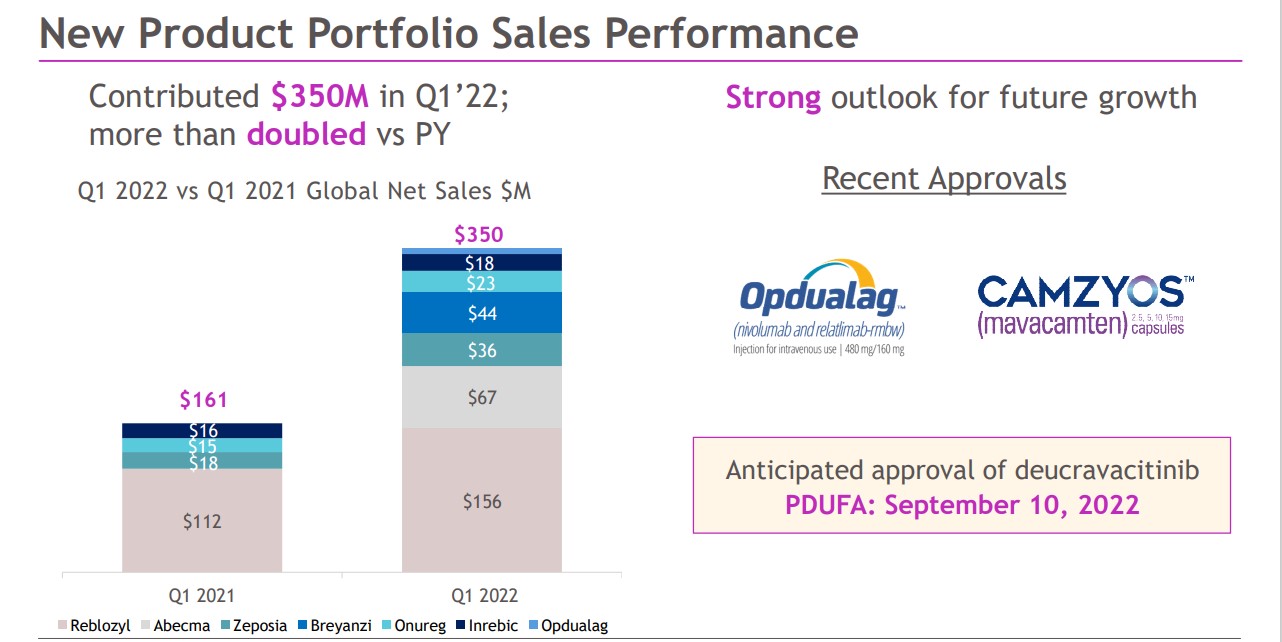

However, new products contributed significantly to the company’s growth last quarter.

Source: Investor Presentation

Eliquis, which prevents blood clots, grew 11% to $3.2 billion due largely to strength in the U.S. and key international markets. Opdivo, which treats cancers such as advanced renal carcinoma, was higher by 12% to $1.9 billion due to higher demand across multiple indications. Revenue for Orencia, which treats rheumatoid arthritis, grew 6% to $792 million.

Bristol-Myers provided an updated outlook for 2022 as well. Revenue guidance of close to $47 billion was reaffirmed. The company now expects adjusted earnings-per-share in a range of $7.44 to $7.74 for the year, down from $7.65 to $7.95 previously.

Shares of BMY trade for a forward P/E ratio below 10. Our fair value P/E estimate is 13.5, which is more in-line with the pharmaceutical peer group. Lastly, BMY has a 2.8% dividend yield, leading to total expected returns of 11.8% per year over the next five years.

Click here to download our most recent Sure Analysis report on Bristol-Myers Squibb (preview of page 1 of 3 shown below):

Final Thoughts

Investors on the hunt for stocks with a high likelihood of increasing their dividends each year reliably, should focus on stocks with the longest histories of dividend growth.

For a company to raise its dividend for at least 10 years, it must have durable competitive advantages, steady profitability even during times of economic downturns, and a positive future growth outlook.

This will provide them with the ability to raise their dividends going forward. As a result, high-quality Dividend Contenders like Bristol-Myers Squibb are attractive for long-term dividend growth investors.

This article was first published by Bob Ciura for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

Top 20 Highest-Yielding Dividend Aristocrats Now | Yields Up To 4.9%

2022 Best Monthly Dividend Stocks List | See All 49 Now | Yields Up To 19.0%

These 2 Dividend Stocks Will Work During Inflation Or Recession