According to a recent report by UNCTAD, FDI flows into Africa declined by 5% to US$ 51 billion in 2016. The decline was largely attributed to low level of commodity prices which has continued to have an impact on commodity dependent countries.

Angola was the most affected as flows to the country more than halved after surging in 2015. Mozambique on the other hand saw its FDI fall 11%, but the level was still significant at an estimated US$3 billion.

However, there was some uptick in flows to parts of Africa, centered on traditional FDI recipients such as Egypt (from US$6.9 billion to US$7.5 billion) and Nigeria (from US$3.1 billion to US$4 billion). Similarly South Africa saw a 38% increase in FDI inflows, though they remained at a relatively low level of US$2.4 billion.

Global FDI Update

Global FDI flows fell 13% in 2016, reaching an estimated US$1.52 trillion, in a context of weak global economic growth and a lacklustre increase in the volume of world trade. Equity investments at the global level were boosted by a 13% increase in the value of cross-border mergers and acquisitions (M&As), which rose to their highest level since 2007, reaching US$831 billion.

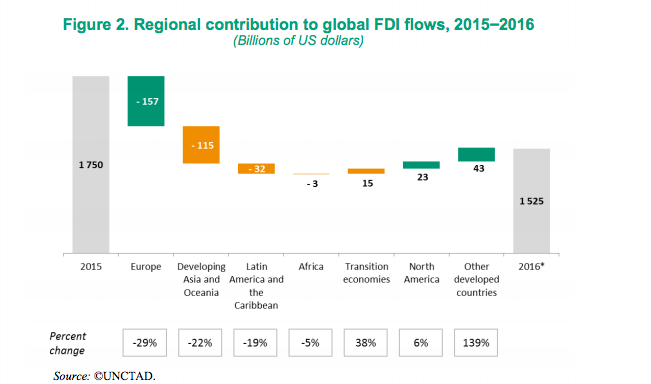

At the regional level, falling flows to Europe (-29%), Developing Asia and Oceania (-22%), Latin America and the Caribbean (-19%) and Africa (-5%) reduced the global total as shown in the table below.

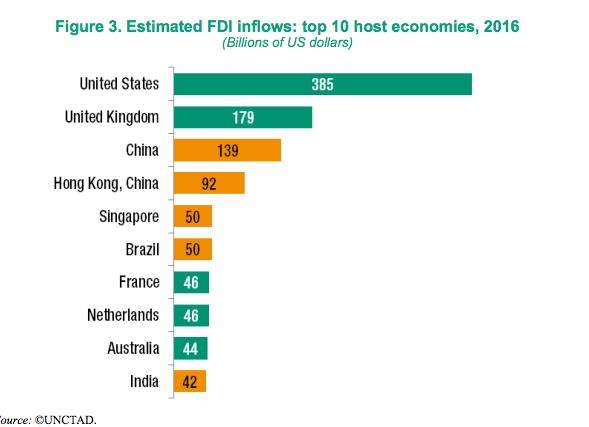

The United States remained the largest recipient of FDI, attracting an estimated US$385 billion in inflows, followed by the United Kingdom with flows of US$179 billion, vaulting up from 12th position in 2015. China remained in third position with a record inflow of US$139 billion.

Download the Report; UNCTAD Foreign direct investment survey