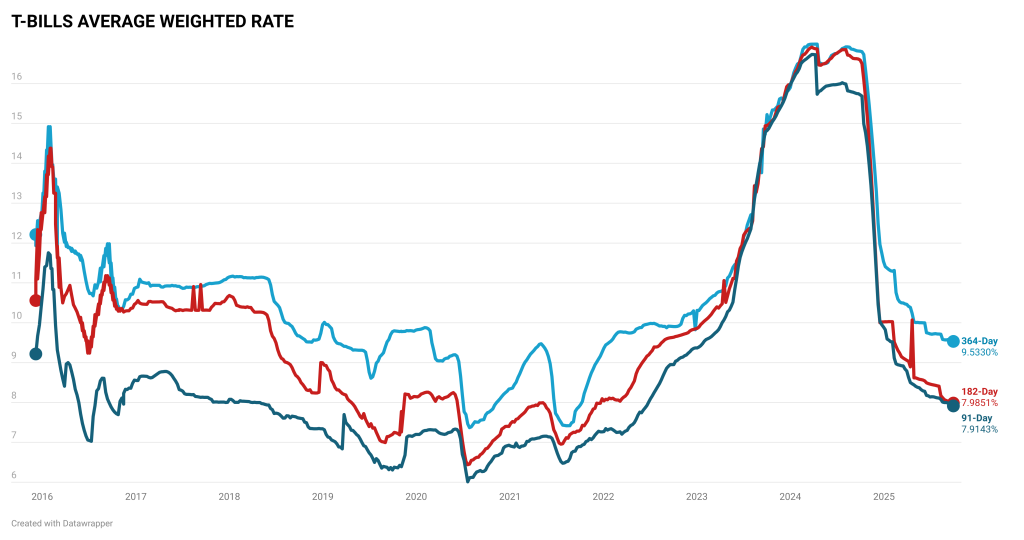

Kenya’s Treasury bills auction on September 29 delivered a key milestone as the 182-day paper averaged 7.9851%, slipping under 8% for the first time since December 27, 2021.

- •The 91-day bill cleared at 7.9143%, the lowest since June 13, 2022, while the 364-day paper came in at 9.5330%, its lowest since January 24, 2022.

- •The 182-day was the weakest, drawing KSh 1.9 billion against KSh 10 billion on offer (19.4% performance) and the 91-day fared a little better at 40.5%.

- •In contrast, the 364-day remained in strong demand, attracting KSh 11.5 billion against KSh 10 billion on offer (115.3%).

Auction Outcome

Drivers of the Rate Decline

Several factors explain the sustained fall in T-bill yields over the past 12 months:

- •Monetary easing: The Central Bank has lowered its policy rate by a cumulative 275 bps in 2025, now at 9.50%, anchoring lower returns at the short end.

- •Contained inflation: Annual inflation has remained within target, ranging between 3.3% and 4.5% this year, reinforcing lower nominal rates.

- •Easier liquidity: Interbank rates have stayed in the mid-9s, providing funding comfort to banks and investors.

- •Issuance strategy: Treasury has aimed to lengthen maturities and reduce reliance on short-dated bills, easing pressure on shorter tenors.

- •Reduced risk premium: Successful external financing and debt management steps have calmed investor concerns, compressing yields.

Demand Split by Tenor

Investor behavior has clearly shifted. Banks and funds are locking in nearly 10% returns on the 364-day to avoid reinvestment risk in a falling rate environment, driving oversubscription for over a month.

By contrast, the 91-day and 182-day, closely tied to the softening policy outlook, have consistently seen heavy undersubscription.

The September 29 auction reinforces the trend: investors prefer duration at current yields, even as short-tenor rates mark multi-year lows.