First Published January 11th, 2023 by Nathan Parsh for SureDividend

Many that follow the dividend growth investment strategy aim to live off the income their portfolio provides in retirement.

We believe that those that follow this strategy can have a more worry-free retirement experience as the investor’s portfolio can provide income regardless of the state of the economy.

This is why we believe that investors should focus on owning high-quality dividend-paying stocks such as the Dividend Aristocrats, which are those companies that have raised their dividends for at least 25 consecutive years.

Membership in this group is so exclusive that just 65 companies qualify as Dividend Aristocrat.

We have compiled a list of all 65 Dividend Aristocrats and relevant financial metrics like dividend yield and P/E ratios. You can download the full list of Dividend Aristocrats by clicking on the link below:

In a perfect world, investors would receive the same or similar amount of income from their portfolio every month as expenses are usually consistent.

But this is not the case as many companies typically distribute their dividends at the end of each quarter, which is usually in March, June, September, and December. This can make for uneven cash flows throughout the year, which presents some issues for investors that require similar income month-to-month.

Still, investors can construct a diversified portfolio with high-quality, dividend-paying stocks that can provide similar amounts of income every month of the year.

To that end, we have created a model portfolio of 15 stocks with $20,000 invested in each position. Each stock has at least nine years of dividend growth, with the average position having a dividend growth streak of 30 years.

Stocks were selected from various sectors, giving the investor a diversified portfolio that would provide at least $855 of income each month of the year. The portfolio has a yield of 3.5%, twice the average yield of the S&P 500 Index, and a five-year dividend compound annual growth rate of 9.1%.

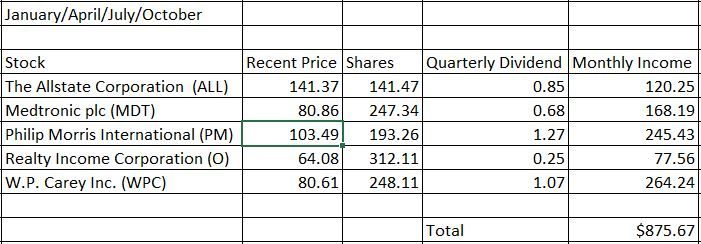

January, April, July, and October Payments

Source: Author’s Calculations

Allstate Corporation (ALL)

In business since 1931, Allstate provides property and casualty to its customers, along with an accident, life, and health insurance products. The company’s largest segments include Allstate Protection, Service Businesses, Allstate Life, and Allstate Benefits. Top brands include Allstate, Encompass, and Esurance. The company has more than 185 million total policies in place as of the most recent quarter.

Allstate has raised its dividend for ten consecutive years and has a five-year compound annual growth rate (CAGR) of more than 16%. We do note that growth will likely slow as the company is expected to see a slowdown in net income this year due to increased claims and severity and unfavorable prior year reserve reestimated. However, the stock’s 2.4% dividend yield is likely safe, given our projected payout ratio is 62% when using our earnings power estimate.

Click here to download our most recent Sure Analysis report on Allstate Corporation (ALL) (preview of page 1 of 3 shown below):

Medtronic plc (MDT)

Medtronic, which has operations in more than 150 countries, is the world’s largest manufacturer of biomedical devices and implantable technologies. The company consists of segments, including Cardiovascular, Medical Surgical, Neuroscience, and Diabetes.

Aging worldwide demographics should provide a tailwind to the company’s business as increased access to healthcare products and services becomes more necessary. There are nearly 70 million Baby Boomers in the U.S. alone that will need increasing amounts of medical care as they age.

With a dividend growth streak of 45 consecutive years, Medtronic is a member of the Dividend Aristocrats. The company nearly qualifies as a Dividend King, which is a name with at least 50 consecutive years of dividend growth.

Medtronic’s dividend has a five-year CAGR of 8.2%, a yield of 3.4%, and a projected payout ratio of 52% for the fiscal year 2023.

Click here to download our most recent Sure Analysis report on Medtronic plc (MDT) (preview of page 1 of 3 shown below):

Philip Morris International (PM)

After being spun off from parent company Altria Group (MO) in 2008, Philip Morris is one of the largest international marketers of tobacco products. The company offers many products, but Marlboro is its most well-known brand.

Tobacco usage is falling in the U.S., but Philip Morris is not exposed to this market after separating from its parent company. The company is experiencing some headwinds, namely the ongoing war between Ukraine and Russia, with the two markets combining for 8% of net revenues in 2021. Currency exchange has also been an issue, as all of the company’s revenues are sourced in currencies other than the U.S. dollar.

That said, Philip Morris has raised its dividend for 15 consecutive years and for more than 50 years when including the time the company was part of Altria. Shares yield 4.9%, which helps to compensate for the low growth rate of just 2.8% over the last five years. The projected payout ratio for 2022 is very high at 96%, but this is mainly due to currency exchange rates.

Click here to download our most recent Sure Analysis report on Philip Morris International (PM) (preview of page 1 of 3 shown below):

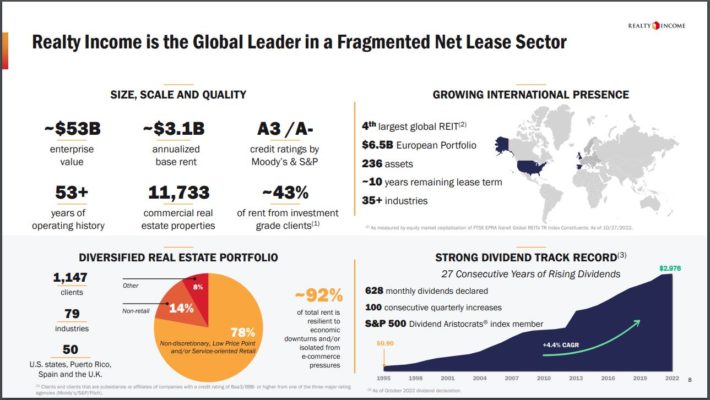

Realty Income (O)

Realty Income is a real estate investment trust, or REIT, that operates more than 11,100 properties. The trust’s properties are standalone, which makes Realty Income’s locations appealing to a wide variety of tenants, including government services, healthcare services, and entertainment.

Realty Income had long been focused primarily on the U.S., but the trust has recently expanded its operations internationally, with a presence now in both the U.K. and Spain. The trust’s tenants are spread out over more than 70 different industries. Realty Income has also strengthened its portfolio by spinning off its office properties, which were among the weakest performers during the worst of the Covid-19 pandemic in late 2021.

Unlike most companies, Realty Income pays a monthly dividend, including more than 600 payments since going public in 1994.

Source: Investor Presentation

The dividend growth streak stands at 26 years. The last five years have seen dividend growth at a rate of 3% annually, but the stock yields a generous 4.7%. The projected payout ratio for the year is 76%, which should be considered safe for REIT.

Click here to download our most recent Sure Analysis report on Realty Income (O) (preview of page 1 of 3 shown below):

W. P. Carey (WPC)

W.P. Carey is REIT with two segments: real estate ownership and investment management. The former is the much larger of the business, with more than 1,200 single-tenant properties across the U.S. and Northern and Western Europe.

The trust has spent more than $10 billion over the last decade acquiring properties to grow its portfolio. Much of this acquisition spree has been through the use of share issuance, as the share count has nearly tripled since 2012. That being the case, growth has been very steady for W.P. Carey even as the float has gotten larger.

W.P. Carey raises its dividend slightly every quarter, though the five-year CAGR is under 1%. Even so, the stock has a 5.3% yield and a dividend growth streak of 26 years. The forecasted payout ratio is 80%, a reasonable rate for a REIT.

Click here to download our most recent Sure Analysis report on W. P. Carey (WPC) (preview of page 1 of 3 shown below):

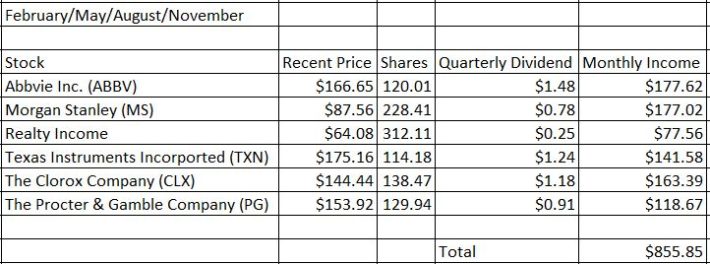

February, May, August, and November Payments

AbbVie (ABBV)

Following being spun off from parent company Abbott Laboratories (ABT) in early 2013, AbbVie has become one of the largest biotechnology companies in the world. The company’s portfolio treats ailments in the areas of immunology, oncology, and virology.

Many investors know the company for Humira, which was once the best-selling drug globally, but this product has lost most of its patent protection. Revenues from Humira will nearly disappear by the middle of this decade.

AbbVie does have other promising drugs, including Skyrizi and Rinvoq, that are expected to contribute meaningfully to top-line results. The addition of Allergan in 2020 has helped diversify the company’s product offerings.

This should enable the company to continue to grow its dividend, something AbbVie has done for 51 consecutive years, including the time it was part of Abbott Laboratories. With the payout likely to be 43% for the year, it appears that AbbVie’s dividend yield of 3.6% should be very safe. The five-year CAGR is almost 12%.

Click here to download our most recent Sure Analysis report on AbbVie (ABBV) (preview of page 1 of 3 shown below):

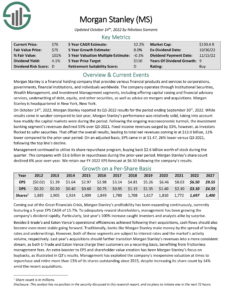

Morgan Stanley (MS)

Morgan Stanley is a financial holding company that provides various financial products and services to corporations, financial institutions, governments, and individuals around the world. The company’s business segments include Institutional Securities, Wealth Management, and Investment Management.

Morgan Stanley has used acquisitions, such as E-Trade in 2020 and Eaton Vance in 2021, that has further cemented the company’s leadership position. Rising interest rates have also had a material benefit on net interest income.

The global financial crisis in 2007 to 2009 time period caused Morgan Stanley, along with much of the financial sector, to cut its dividend. However, the company has seen impressive results over much of the last decade as the business appears to be on more sound footing than it was during this turbulent time.

As a result, Morgan Stanley has provided dividend increases for nine consecutive years, with a growth rate of 27% over the last half-decade. The expected payout ratio is 48%, and shares yield 3.6%.

Click here to download our most recent Sure Analysis report on Morgan Stanley (MS) (preview of page 1 of 3 shown below):

Texas Instruments (TXN)

Texas Instruments is a semiconductor company that operates two units: Analog and Embedded Processing. The company’s product portfolio includes semiconductors that measure sound, temperature, and other physical data and then convert them to digital signals. The semiconductors can be designed to handle specific tasks and applications.

Long-term, Texas Instruments benefits from very favorable tailwinds. First, the patent list is extensive, at more than 40,000. The company also has a product portfolio of over 100,000 and looks poised to benefit from the demand for semiconductors in multiple areas, such as automation.

This should provide shareholders with ongoing dividend increases, which Texas Instruments has done for 19 consecutive years. The payout is healthy at 53%, and shares yield 2.8%. The dividend has a five-year CAGR of just below 16%.

Click here to download our most recent Sure Analysis report on Texas Instruments (TXN)(preview of page 1 of 3 shown below):

Clorox Company (CLX)

Clorox is a leading manufacturer and marketer of consumer and professional products. The company has a wide variety of products, including cleaning supplies and food.

The company is so ingrained in its industry that it holds the number one or number two position in several categories, which derives the bulk of revenue for Clorox. Many of these products are staples for consumers, which helps to keep the business from suffering during a recession.

Clorox did very well during the worst of the Covid-19 pandemic as consumers stocked up on cleaning supplies and ate more meals at home. This demand has since normalized, which has caused the company to issue weak guidance for the year. This has caused the expected payout ratio for the dividend to jump to 115%.

Normally, this would be unsustainable, but we considered Clorox to be a very defensive company and expect the payout ratio to moderate in the coming years. The company has an extensive dividend growth streak of 45 years. The dividend has increased more than 8% annually over the past five years. The stock offers a yield of 3.3%.

Click here to download our most recent Sure Analysis report on Clorox Company (CLX) (preview of page 1 of 3 shown below):

Procter & Gamble Co. (PG)

Procter & Gamble is a consumer staple giant in its own right. The company has been in business since the 1830s and has built a stable of well-known brands, including Pampers, Charmin, Gillette, Old Spice, Oral-B, and Head & Shoulders.

Over the past few years, the company has been on an extensive thinning of its product lines, going from nearly 170 brands to just 65 core names. Revenue has declined as a result, but focusing on top brands with high margins has helped increase profitability.

A more focused product lineup will likely allow Procter & Gamble to continue growing its dividend, which the company has done for 66 consecutive years. Dividend growth has been decent over the medium term at 5.6% annually. Procter & Gamble yields 2.4%, and the forecasted payout ratio is 61% for the fiscal year.

Click here to download our most recent Sure Analysis report on Procter & Gamble Co. (PG) (preview of page 1 of 3 shown below):

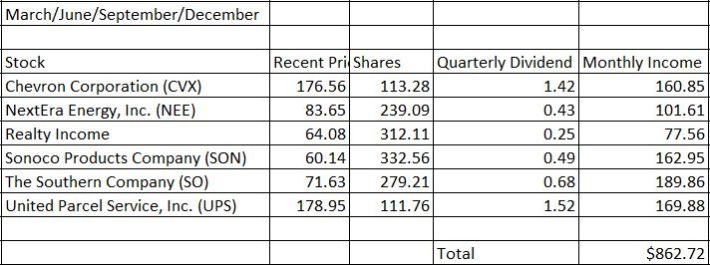

March, June, September, and December Payments

Chevron Corporation (CVX)

Chevron is one of the largest oil majors in the world. This gives the company a size and scale that many competitors aren’t able to match.

The company sees the bulk of its earnings from its upstream segment and has a higher crude oil and natural gas production ratio at 61/39 than most of its peers. Chevron also prices some natural gas volumes based on the oil price. In the end, the company is more leveraged to the oil price than the other oil majors.

This has caused Chevron to feel the brunt of downturns in energy markets. However, the company has invested heavily in its business over the years, leading to solid production growth. Chevron is focused on funding projects that deliver cash flows within two years, meaning the company isn’t waiting as long to see the benefit of its capital investments.

For these reasons, the dividend, which is now covered even at an average oil price of $40, is likely to see its 35-year dividend growth streak continue. Chevron’s dividend yield of 3.2% is well-covered, with a payout ratio estimate of 32% for the year. The dividend has had an annual growth rate of 5.6% since 2018.

Click here to download our most recent Sure Analysis report on Chevron Corporation (CVX) (preview of page 1 of 3 shown below):

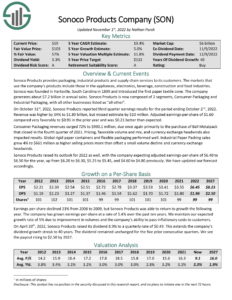

Sonoco Products Company (SON)

Sonoco Products provides its customer’s packaging, industrial products, and supply chain services. The company’s products are used in appliances, electronics, construction, and food and beverage containers. Sonoco Products operates two main segments: Consumer Packaging and Industrial Packaging.

The company has proven very successful at offsetting inflationary pressures by passing costs along to customers without seeing a weakening of demand. This illustrates the company’s pricing power. Sonoco Products has also augmented its core business with acquisitions, such as the addition of Ball Metalpack near the end of 2021.

These factors, along with a projected payout ratio of just 31%, should help Sonoco Products continue its dividend growth streak, which stands at 40 years. The dividend has increased by nearly 5% per year over the past five years, and the stock is trading with a yield of 3.3%.

Click here to download our most recent Sure Analysis report on Sonoco Products Company (SON) (preview of page 1 of 3 shown below):

Southern Company (SO)

Southern is one of the largest utility companies in the market, serving almost nine million customers in the U.S. As a regulated utility, the company benefits from limited competition and regularly receives approval for rate increases.

Southern has been in the process of building two nuclear plants, a process that delays and cost overruns have marked. However, both plants, which are the first nuclear units built in the U.S. in more than three decades, are expected to be operational in 2023. Upon completion, this will be the largest nuclear power station in the country.

Southern has raised its dividend for 21 consecutive years and at a rate of 3.2% per year since 2018. The dividend growth rate is on the low side, but this is likely due to the payout ratio of 76% that we forecast for the year. Shares do yield 3.8%.

Click here to download our most recent Sure Analysis report on Southern Company (SO) (preview of page 1 of 3 shown below):

United Parcel Service Inc. (UPS)

United Parcel Service, or UPS, is a logistics and package delivery company that offers services such as transportation, distribution, ground freight, ocean freight, insurance, and financing. The company has three segments: U.S. Domestic Package, International Package, and Supply Chain & Freight.

The rise of e-commerce has led to an overall increase in demand for shipping and distribution, which has benefited UPS greatly as it is one of the most significant players in the industry. Online shopping also aided the company during the Covid-19 pandemic, as results were robust both during and after the period.

UPS has raised its dividend for 13 consecutive years. The five-year CAGR is nearly 14%, and the payout ratio is very reasonable at 47%. UPS offers a 3.4% dividend yield.

Click here to download our most recent Sure Analysis report on United Parcel Service Inc. (UPS) (preview of page 1 of 3 shown below):

Final Thoughts

Investors seeking consistent monthly cash flows can construct a portfolio of high-quality names with long histories of raising dividends.

The stocks created to create this diversified model portfolio yield twice as much as the S&P 500 Index. These names have an average dividend growth streak of three decades and have had a high single-digit growth rate over the past five years.

Investors can scale this portfolio to meet their needs, but a modest portfolio of $300,000 would see at least $855 of income every month of the year, even before factoring in dividend increases that most, if not all, of these companies will surely provide. This can provide the investor in retirement with stable cash flows that can be used to meet their needs.

This article was first published by Nathan Parsh for Sure Dividend

Sure dividend helps individual investors build high-quality dividend growth portfolios for the long run. The goal is financial freedom through an investment portfolio that pays rising dividend income over time. To this end, Sure Dividend provides a great deal of free information.

Related:

Dividend Aristocrats In Focus: Chevron Corporation

10 Regional Banks To Buy After The Collapse Of Silicon Valley Bank