A new report released by Quantum Global’s independent research arm, Quantum Global Research Lab has revealed that Kenya has highest rate in the use of mobile financial services at 68%, ahead of Sudan at 52%, Gabon at 50% and Algeria at 44%.

According to the report, Kenya scores highly based on a range of factors that include mobile phone penetration, financial and conventional infrastructure development, regulation and the appetite of private players to pursue new initiatives that have driven the the variation in digital financial services, unlike Cameroon where only Banks are allowed to offer digital financial services directly.

“There are 203 Million registered mobile money accounts in the world, almost half of which are in Sub-Saharan Africa with East Africa accounting for the highest share. At least 19 African countries have more registered mobile money accounts than Bank accounts.” read part of the report.

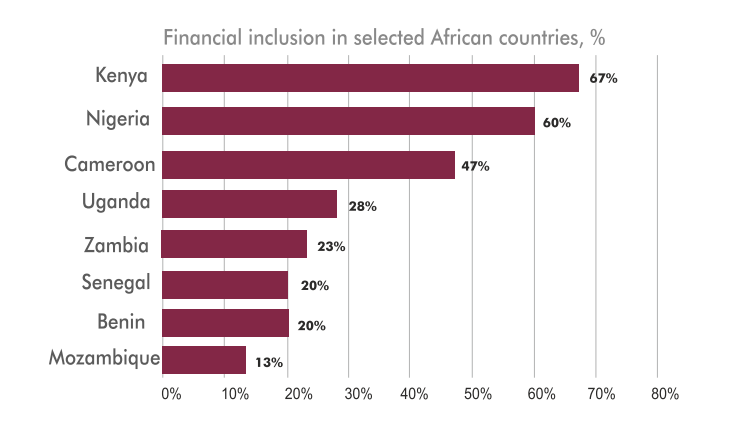

Kenya was also ranked number one in Financial inclusion in Sub-Saharan Africa, with 68% of the adult population using formal financial services. Nigeria, Africa’s most populous country and largest economy in Sub-Saharan Africa, was ranked second at 60 per cent as shown below.

Kenya’s high rate of financial inclusion is supported by having the highest percentage (at nearly 60%) of people who own a mobile banking account. Safaricom’s M-PESA mobile money platform is ranked highest with approximately 30 Million subscribers, making it the most successful digital financial services initiative globally.

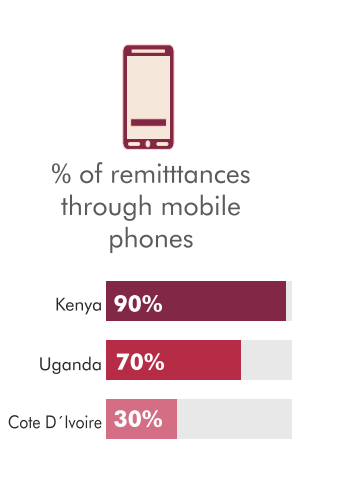

The report further notes that Kenyans receive nearly 90 per cent of their remittances through mobile phones, followed by Ugandans at nearly 70 percent, and Ivorians at 50%. This is well above the Sub-Saharan Africa average of 30 per cent, and a comparable markets including South Asia and Latin America each at 5 percent.

Related;

Report; Uganda has the Most Entrepreneurial Women in the World

Kenya Has the Fourth Fastest-Growing Ultra-Rich Population in the World