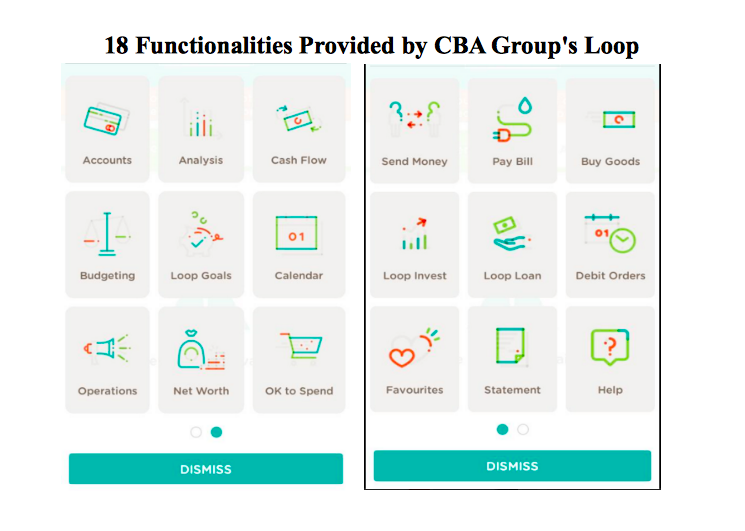

Unlike other banking apps which allow customers to save, borrow, pay bills and buy goods and services, Loop comes with a personal finance management tool that enables users to track, plan and analyse their income against their expenditure on a regular basis. This comes in the form of graphical tools that are designed to warn customers when they are living beyond their means or spending too much on consumption rather than investment, which is likely to come in hand for its target – millennial entrepreneurs seeking to grow their start-ups.

The graphical tools mean they will be able to interpret the data faster.

The budgeting tool generates three statuses:

• Safe (Green): The customer will be considered safe if the amount you have spent is within the proportional budget limit: e.g. 15 days into the month, only half of the budget should be spent to remain safe.

Related; CBA Group Launches Banking Service Targeting Millennial Entrepreneurs

CBA General Manager, New Business Ventures Eric Muriuki said during the launch that by monitoring their budget cycles, customers will also be able to plan for and finance their personal goals and aspirations for a given period.

For instance, if one intends to buy an asset, say a fridge, the app is able to determine how much one should save to achieve that goal by a specific date.

In addition, the app has the ability to determine how one is managing his finances comparative to his contemporaries.

Apart from millenials (those aged between 20 and 34 years), the new new service targets tech-savvy individuals who would love to have a relatable banking experience that eliminates the need to visit a physical branch or endure the pain associated with traditional banking.

CBA has also come with a new banking model that entails establishment of retail stores when customers can collect their Loop cards after registering online, share their banking experiences and engage with financial partners.

Six Loop Stores, which are equipped with Wi-Fi, have already been established in Nairobi and plans are afoot to set up more in other parts of the country.

Muriuki said with the launch of Loop, CBA has broken the bullet proof glass between the customer and the bank.

CBA Executive Director Martin Mugambi said the new service marks the transition to CBA 2.0.

It is a culmination of CBA’s dream to become a truly digital bank and builds on successes and experiences realised through M-Shwari, another CBA product powered by Safaricom’s M-Pesa that allows customers to save and borrow loans.