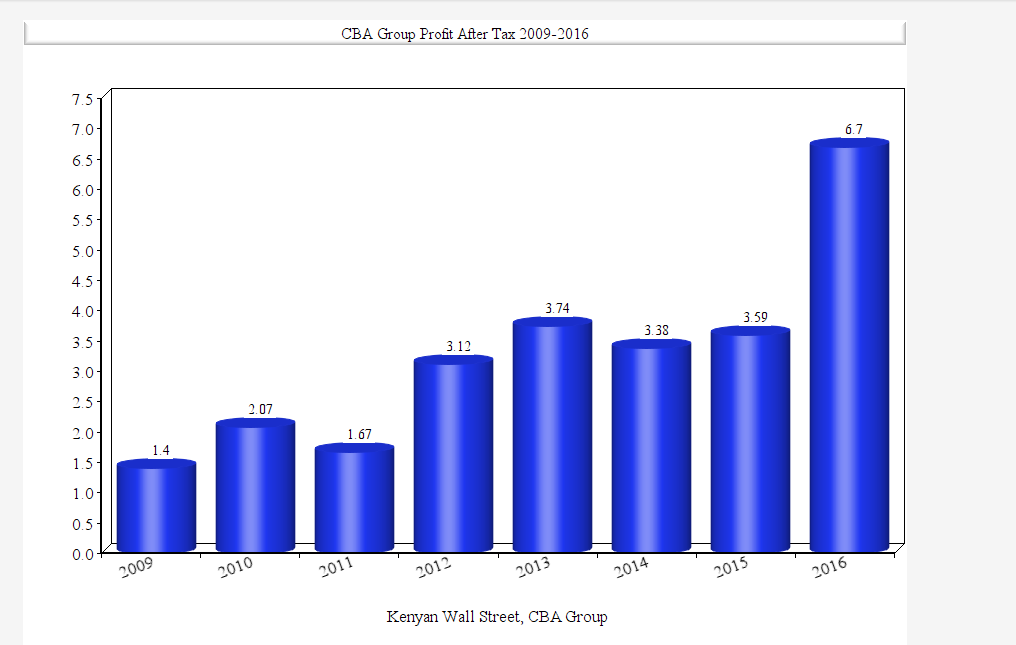

Kenya’s Largest Private Bank, Commercial Bank of Africa has released its financials for the full year period ended 31st December 2016 recording an increase of 87 per cent in profit after tax to Sh 6.72 Billion from Sh 3.59 Billion.

The Bank’s total non interest income rose by 53 per cent to Sh 10.272 Billion largely driven by “Fees and commissions on loans and advances” which grew by 51 per cent to Sh 5.73 Billion. Income from the Bank’s mobile lending product, popularly known as M-Shwari is classified under “Fees and commissions on loans and advances.”

CBA Group’s Total interest income rose by Sh 6.8 per cent to Sh 20.88 Billion with interest income from the conventional lending business increasing from Sh 12.5 Billion to Sh 13.330 Billion.

Loan Loss Provision was up by over 100 per cent to Sh 4.09 Billion from Sh 2.02 Billion recorded in 2015.

Forex income recorded a growth of 133% to Sh2.2 Billion while customer deposits also inceased to Sh 159 Billion from Sh 148 Billion in 2015.

Download; CBA Group FY 2016 Financial Results